| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-15-24 | |

| Add new links | Nisha | Apr-11-25 |

- Blog

- jio financial services case study

Jio Financial Services: Business Model And SWOT Analysis

Did you know there is a recently listed company that is the country’s third biggest NBFC after the Bajaj twins, i.e., Bajaj Finance and Bajaj Finserve? It is the new kid on the block with the backing of Reliance Industries Limited (RIL), as it is RIL’s newly carved out Entity. We are talking about Jio Financial Services Limited (JFSL).

In this blog, we will talk about its Jio business model and SWOT analysis.

Jio Financial Services – Introduction

Reliance Industries Limited (RIL) demerged its financial services company, Reliance Strategic Investments Ltd (incorporated in 1999), and renamed it as Jio Financial Services Limited (JFSL). The Jio Financial Services aims to provide simple, affordable, and innovative digital-first solutions.

JFSL is positioned uniquely to play a crucial role in transforming the landscape of digital finance in India. It is a non-banking financial company. As of 13 May 2024, the market capitalization of Jio Financial is almost INR 2.2 lakh crores. It is one of the top 40 Indian companies by market capitalization, in a list headed by Reliance at INR 19 lakh crores. The company debuted on the stock exchanges on August 21, 2023. The company’s initial listing price was INR 265 per share on the BSE and INR 262 per share on the NSE, and currently trading at INR 341 (as of 13 May 24)..

Jio Financial Services Business Model

The company is a holding company that operates its Jio financial services business model through its consumer-facing subsidiaries, Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), and Jio Payment Solutions Limited (JPSL), and joint venture namely Jio Payments Bank Limited (JPBL).

Products

Lending: The company offers personal loans for salaried and self-employed individuals through MyJio app. Further, the company has also launched consumer durable loans across 300 stores in India.

Insurance Broking: Established partnership with 24 insurance companies (Life – 5, General – 15, Health – 4) offering a wide range of products such as General, Life, Auto Insurance, Health Insurance, Embedded insurance, corporate solutions & employer-employee benefits.

Payments Bank: It provides services such as bill payments, money transfers, etc. It has an on-ground network of over 2,400 business correspondents.

Products in the pipeline: There are several products in the pipeline such as Business and merchant loans for self-employed individuals, sole proprietors, and small business entities; Auto loans, Home loans, and loans against shares.

Competitive Landscape

Non-Banking Financial Companies (NBFCs) in India are characterized by oligopoly competition. An oligopoly is an industry where a small group of large companies have a dominant position, giving them more market control and pricing power than the other companies.

Read Also: Reliance Industries Case Study: Marketing Strategy and SWOT Analysis

Jio Financial Services SWOT Analysis

Strengths

Jio Financial Services Limited (JFSL) has the potential to be a game changer in the Indian market for several reasons. It is a part of Reliance, which has a well-established brand presence that drives trust and recognition.

1) JFSL has the backing of Reliance Industries, one of the largest conglomerates in India. This gives JFSL access to a vast pool of resources, including capital, talent, and technology.

2) JFSL is focused on providing financial services to underserved segments of the population, such as small businesses and low-income households. This is a large and growing market that is ripe for disruption.

3) A 50:50 joint venture between Jio and Blackrock will combine BlackRock’s scale and investment expertise with Jio Financial Services’ knowledge and resources to deliver affordable, innovative investment solutions to millions of investors in India.

Weakness

- The company is relatively new; although they are backed by Reliance Industries Limited, it is still in the financial industry, so building trust can be challenging for them.

- Due to its extensive product portfolio, it may encounter difficulties in effectively managing and allocating resources to it.

Opportunities

Today’s India is adopting digital finance at a fast pace and the digitalization has penetrated every corner of the nation through Jan Dhan accounts, digital payments, usage of smartphones, and low-cost data. The growth opportunities presented by financial services are remarkable and provide strong directional support to the economy.

- Favorable demographics: 450 million working people and the 12th largest population of high-net-worth individuals (HNIs).

- Increasing user activity: Higher consumption and digitalization will fuel the growth. As per several estimates, India to become a USD 10 trillion economy by 2035.

Threats

- The business operates in an Oligopoly market where few big players have the controlling power to dictate price and the competition.

- Their margins may be impacted by regulatory changes made by the Indian government as it is highly regulated.

- Economic growth may affect consumers’ spending and saving patterns, which in turn will affect the company’s profitability.

Jio Financial Services Financials

Let’s have a look at the financials of Jio Financial Services Limited.

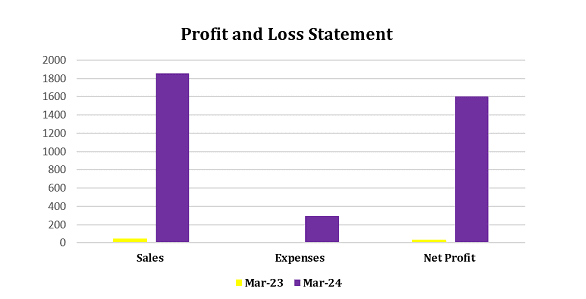

Profit and Loss Statement (INR crore)

| Particulars | Mar-23 | Mar-24 |

|---|---|---|

| Sales | 45 | 1,854 |

| Expenses | 6 | 296 |

| Operating Profit | 39 | 1,558 |

| OPM % | 88% | 84% |

| Other Income | 10 | 429 |

| Interest | – | 10 |

| Depreciation | – | 22 |

| Profit before tax | 49 | 1,956 |

| Tax % | 37% | 18% |

| Net Profit | 31 | 1,605 |

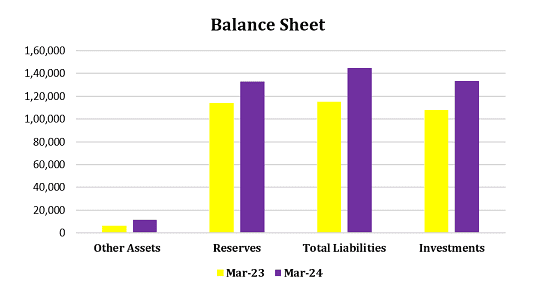

Balance Sheet.

| Particulars | Mar-23 | Mar-24 |

|---|---|---|

| Equity Capital | 2 | 6,353 |

| Reserves | 114,118 | 132,794 |

| Borrowings | 743 | – |

| Other Liabilities | 66 | 5,715 |

| Total Liabilities | 114,930 | 144,863 |

| Fixed Assets | 158 | 175 |

| CWIP | 38 | – |

| Investments | 108,141 | 133,292 |

| Other Assets | 6,593 | 11,396 |

| Total Assets | 114,930 | 144,863 |

Shareholding pattern

| Particulars | Sep-23 | Dec-23 | Mar-24 |

|---|---|---|---|

| Promoters | 46.77% | 47.12% | 47.12% |

| FIIs | 21.58% | 19.83% | 19.45% |

| DIIs | 13.64% | 12.99% | 12.50% |

| Government | 0.13% | 0.14% | 0.14% |

| Public | 17.86% | 19.92% | 20.77% |

From the above table, we can observe that FIIs and DIIs have reduced their shareholding over the last three quarters. In contrast, retailers have increased their shareholding.

Read Also: Reliance Power Case Study: Business Model, Financial Statements, And SWOT Analysis

Conclusion

In summary, JFSL’s stock price performance has been impressive and has shown an upward trajectory in recent months, reaching new record highs. The stock hit INR 394.70 in April 2024, an all-time high. Further, the company also reported stellar performance in FY 2024.

But it is important to note that the market and most of the stocks are at all-time highs, and there are major events lined up like Indian Elections, Budgets, and then US Elections. So, always consider your risk tolerance and time horizon before making any investing decision.

Frequently Asked Questions (FAQs)

What is the old name of Jio Financial Services Limited (JFSL)?

JFSL was initially incorporated as Reliance Strategic Investments Private Limited in 1999.

What products do Jio Financial Services offer?

The company is a holding company that operates its financial services business through its consumer-facing subsidiaries, Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), and Jio Payment Solutions Limited (JPSL), and joint venture namely Jio Payments Bank Limited (JPBL). These subsidiaries offer services such as lending, insurance broking, payments bank, etc. Further, JFSL has multiple products in the pipeline.

What are the challenges for Jio Financial Services in the coming future?

JFS operates in a highly regulated sector; along with that, it will be affected by economic, interest rate fluctuations, repo rates, inflation rates, etc.

Is Jio Financial Services (JFS) a NBFC?

Yes, the JFS is a Non-Banking Financial Company (NBFC). NBFCs in India are highly regulated by the Reserve Bank of India (RBI).

Is Jio Financial Services a good investment?

The company’s future looks promising, but it is crucial to do thorough research before investing.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.