| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-22-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- jm financials case study rbi ban segments and the road ahead

JM Financials Case Study: RBI Ban, Segments, and the Road Ahead

JM Financial, a recognized name in Indian financial services, has recently made headlines. The RBI’s restrictions on their loan offerings have sparked questions and concerns.

Whether you are a customer, investor or simply curious about the financial landscape, in today’s blog, we will delve deeper into the situation and uncover the company overview, key issues, consequences and the road ahead.

JM Financials Overview

JM Financial is a prominent integrated financial services group in India. They provide various services and cater to institutional, corporate, government, and ultra-high-net-worth clients.

The company commenced its operations in 1973 by Mahendra Kampani and Nimesh Kampani as a consultancy practice spun off from Jamnadas Morarjee Securities’ investment banking arm. The company was incorporated as a private limited company named JM Share and Stock Brokers Private Limited, venturing into stock broking.

In 1999, JM formed a joint venture with Morgan Stanley named JM Morgan Stanley, and it later separated in 2007.

JM Financial Segments

Business Segments of the company are as follows:

- Investment Banking

This segment serves many clients, including institutional, corporate, government and ultra-high-net-worth individuals. With expertise in investment banking, institutional equities, research, private equity funds, fixed income, and debt syndication, the company offers comprehensive financial solutions.

- Alternative and Distressed Credit

JM Financial has a strong reputation for handling non-performing loans and distressed assets, which allows it to acquire these debts and work with borrowers to find feasible solutions.

- Mortgage Lending

The company also offers both wholesale and retail mortgage lending, including affordable housing finance business and secured MSME lending.

- Asset Management / Wealth Management / Securities Business

It also offers an integrated investment platform called AWS, which provides a comprehensive suite of services, including wealth management, broking, portfolio management services (PMS) and mutual fund offerings.

Other Products and Services

Apart from the above segments, the company also offers the following range of products and services.

- Bondskart – Launched in November 2021, it is a digital investment platform that allows investors to trade or invest in Fixed Income Securities, including Corporate Bonds.

- Dwello – It is a tech-based real estate consulting division functioning within the primary residential real estate space that supports customers in making the right decisions during their home-buying journey.

- Capital Market Lending Group – It offers loans against shares and other securities to meet the fund requirements of various categories of clients.

Read Also: IIFL Case Study: RBI Ban, Implications for Investors, Financials, and Road Ahead

JM Financial Highlights

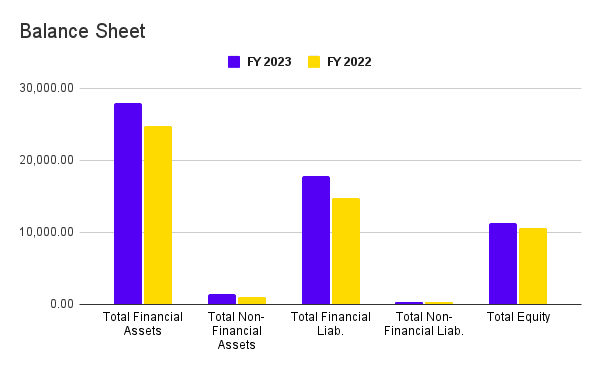

Balance Sheet

| Key Metrics | FY 2023 | FY 2022 |

|---|---|---|

| Total Financial Assets | 27,910.93 | 24,785.95 |

| Total Non-Financial Assets | 1,459.51 | 1,028.55 |

| Total Financial Liab. | 17,805.15 | 14,790.55 |

| Total Non-Financial Liab. | 295.44 | 398.31 |

| Total Equity | 11,269.85 | 10,625.64 |

The Balance Sheet clearly shows a growth in total financial assets and total financial liabilities. The same trend does not seem to persist in total non financial assets and liabilities.

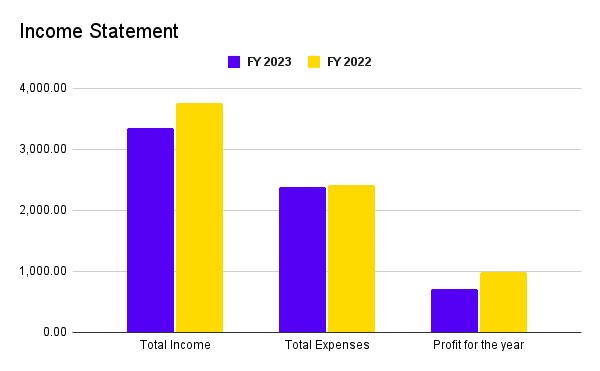

Income Statement

| Key Metrics | FY 2023 | FY 2022 |

|---|---|---|

| Total Income | 3,343.07 | 3,763.28 |

| Total Expenses | 2,390.46 | 2,415.24 |

| Profit for the year | 708.76 | 992.37 |

The basic EPS of the company stands at 6.26 and 8.11 for the FY 2023 & 2022 respectively.

The income statement KPIs show a decline in total income, which led to a decline in profit for the year as there was no major reduction in total expenses.

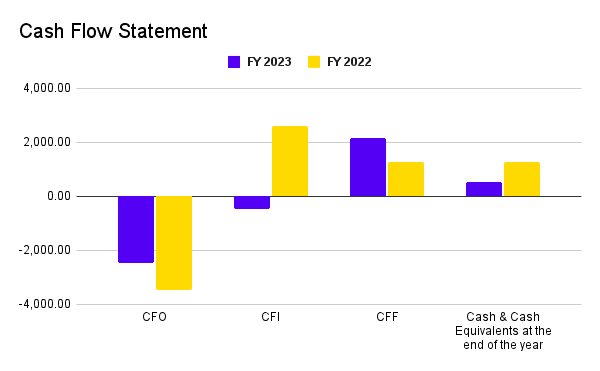

Cash Flow Statement

| Cash Flows | FY 2023 | FY 2022 |

|---|---|---|

| Net Cash generated from operating activities | (2,448.73) | (3,458.08) |

| Net Cash generated from Investing activities | (450.84) | 2,613.92 |

| Net Cash Generated from Financing Activities | 2,153.26 | 1,280.72 |

| Cash & Cash Equivalents at the end of the year | 524.02 | 1,262.94 |

The cash flow statement reflects severe issues as a major portion of the cash inflow comes from investing and financing activities and not from core operations. This could prove fatal for the company in the long run.

RBI Ban

Despite having decent financials and fundamentals, JM Financials crashed by more than 27% in the past month. Let’s analyze what happened.

On March 7, 2024, the RBI banned JM Financial Products Limited, a subsidiary of JM Financials and an NBFC from giving loans against shares and debentures.

Restrictions imposed by the RBI were due to several alleged irregularities which were as follows

- During the review, RBI found that the company provided financing to a specific group of customers, allowing them to participate in IPO and NCD offerings with borrowed money.

- The review also found that the company’s process for evaluating borrowers (credit underwriting) was superficial. They provided loans even when the borrowers did not have enough valuable assets to assure repayment.

- The company allegedly took control of customers’ subscription applications, demat accounts, and bank accounts through a Master Agreement and a Power of Attorney (POA) essentially excluding the customers from any further decision-making or oversight of these financial activities.

- Also, the company was able to effectively act as both a lender as well a borrower.

- The POA was allegedly used by the company to both setup and manage bank accounts for customers.

- In addition to the identified regulatory violations, the company’s governance structure is a significant area of concern and these practices create a situation where customer rights and financial security are compromised.

- The RBI will conduct a special audit to examine the practices of JM Financials. The restrictions will remain in place until the company fixes the issues to the RBI’s satisfaction.

Read Also: Gillette India Case Study: Business Model, SWOT Analysis, and Financial Overview

The Road Ahead

The road ahead for the company is uncertain and hinges on how they address the recent regulatory issues with the RBI. The allegations can affect customer trust and investor confidence. However, the company has expressed commitment to resolving the issues with the RBI. The next few months will be crucial for JM Financials. Their ability to navigate the regulatory hurdles and regain trust will determine their future success. However, the outcome of the legal battle with the RBI could impact the timeline and severity of the restrictions. It is important to keep yourself updated as the story develops to get a clearer picture of the road ahead.

Conclusion

On a parting note, JM Financials finds itself at a crossroads. The restrictions and allegations of regulatory breaches imposed by the RBI cast a shadow over the company’s future. Successfully navigating the special audit, addressing deficiencies and rebuilding the trust will be paramount.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Elcid Investments – India’s Costliest Stock |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | Zara Case Study |

Frequently Asked Questions (FAQs)

What is the full form of JM?

The full form of JM in JM Financial is Jayshree and Nimesh, representing the founder Nimesh Kampani and his wife Jayshree Kampani.

What does the JM Financial logo mean?

The JM Financial logo reflects the company’s commitment to delivering financial expertise and fostering trust with clients. Its design signifies growth, stability, and a forward-thinking approach to financial services.

What does this mean for investors?

It is too early to answer this question. The restrictions will impact the company’s business but it is trying to contest the RBI’s decision.

Who is the owner of JM Financial?

JM Financial is owned by the Nimesh Kampani family, with Nimesh Kampani being the founder and key figure behind the company.

What happened to JM Financial?

JM Financial remains a prominent financial services group in India, offering investment banking, wealth management, and lending services. It continues to grow and diversify its business portfolio while navigating competitive and market challenges.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.