| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-14-24 | |

| Add new links | Nisha | Feb-27-25 | |

| Add new links | Nisha | Feb-27-25 |

- Blog

- jsw steel case study

JSW Steel Case Study: Business Model, Product Portfolio, and SWOT Analysis

Since its independence, India has developed an amazing infrastructure, including its buildings, ports, and railroads, at a remarkable pace. One of the main requirements to construct these engineering marvels is steel.

In this blog, we will take a close look at JSW Steel Limited, look at their financials and do a SWOT analysis.

JSW Steel Company Overview

In 1982, Sajjan Jindal established JSW Steel when the Jindal group acquired Piramal Steel Limited. The company was previously known as Jindal Iron and Steel Company (JISCO) and started operations by setting up a steel plant near Mumbai. Jindal Vijaynagar Steel Ltd. (JVSL) commenced operations in 1994 by establishing a manufacturing facility in Karnataka. The company changed its name to JSW Steel Ltd. in 2005 after the merger of JISCO and JVSL. The organization’s head office is in Mumbai.

Business Model of JSW Steel

Due to the company’s acquisition of numerous iron mines throughout the nation, it is now able to obtain its raw materials domestically, thereby decreasing its reliance on outside suppliers and raising profit margins. The company has built the world’s largest conveyor system, which has a length of 24 km, which helps it transport raw materials from mines to the Vijayanagar plant more efficiently. The company’s primary activity is the production of steel. The corporation is broadening its horizons through strategic alliances and the acquisition of other steel companies across the globe.

Product Portfolio of JSW Steel

The company provides its customers with a wide range of steel goods, catering to various industries such as automotive, construction, infrastructure engineering, and energy. These products include hot rolled coils, cold rolled coils, roofing steel products, wire rods, round bars, and electrical steel products. In addition, they provide personalized solutions and alloy steel goods. Additionally, they have a robust distribution network to ensure quick delivery of steel products to clients.

Market Details of JSW Steel

| Current Market Price | INR 937 |

| Market Capitalization (In INR Crores) | 2,29,237 |

| 52 Week High | INR 969 |

| 52 Week Low | INR 723 |

| Book Value | INR 318 |

| P/E Ratio (x) | 32.9 |

Financial Statements of JSW Steel

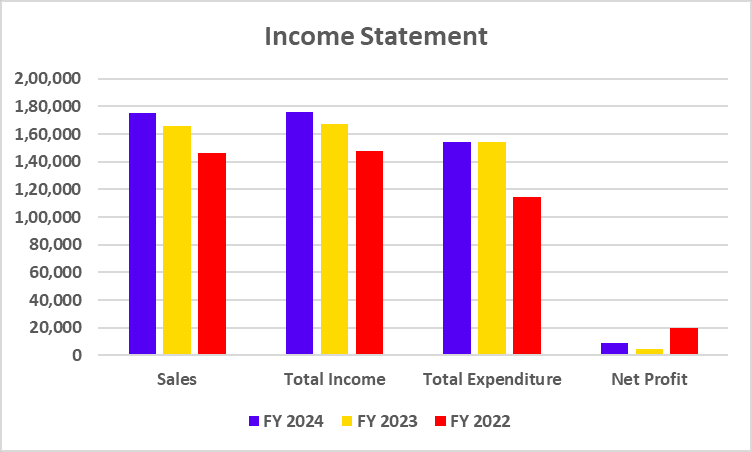

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 1,75,006 | 1,65,960 | 1,46,371 |

| Total Income | 1,76,010 | 1,66,990 | 1,47,902 |

| Total Expenditure | 1,54,353 | 1,54,296 | 1,14,106 |

| Net Profit | 9,145 | 4,276 | 20,021 |

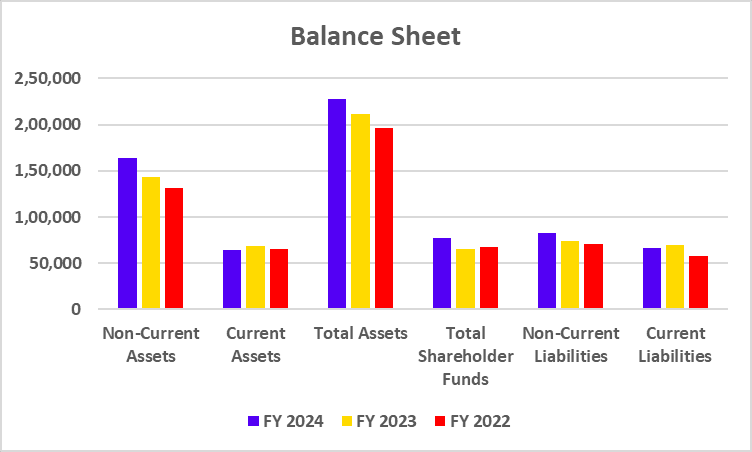

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Non-Current Assets | 1,63,664 | 1,42,928 | 1,31,111 |

| Current Assets | 64,534 | 68,150 | 65,374 |

| Total Assets | 2,28,198 | 2,11,078 | 1,96,485 |

| Total Shareholder Funds | 77,705 | 65,728 | 67,297 |

| Non-Current Liabilities | 82,321 | 74,043 | 70,399 |

| Current Liabilities | 66,065 | 69,963 | 57,551 |

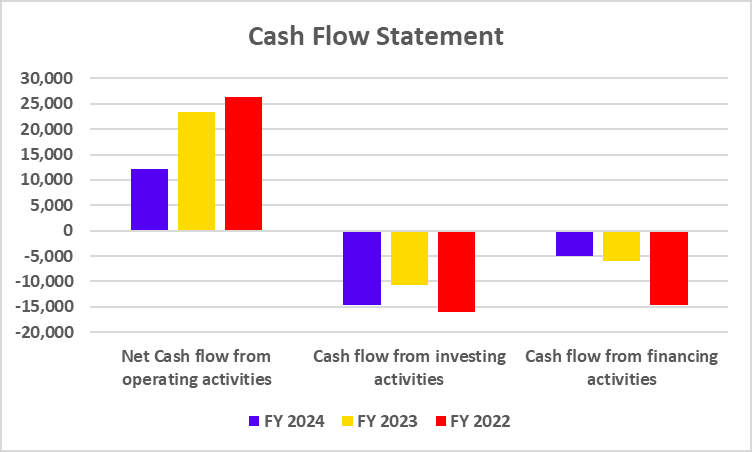

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Net Cash flow from operating activities | 12,078 | 23,323 | 26,270 |

| Cash flow from investing activities | -14,638 | -10,711 | -15,987 |

| Cash flow from financing activities | -5,005 | -5,977 | -14,657 |

Key Performance Indicators (KPIs)

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Operating Profit Margin (%) | 12.03 | 7.29 | 23.59 |

| Net Profit Margin (%) | 5.22 | 2.57 | 13.67 |

| Return on Net Worth/Equity (%) | 11.34 | 6.30 | 30.70 |

| Return on Capital Employed (%) | 12.99 | 8.57 | 24.85 |

| Current Ratio | 0.98 | 0.97 | 1.14 |

| Debt to Equity Ratio | 1.10 | 1.20 | 1.04 |

Read Also: Tata Steel vs. JSW Steel: A Comparative Analysis Of Two Steel Giants

SWOT Analysis of JSW Steel

Strength

- Brand Image – JSW Steel is one of the most valued and well-known brands in the country, which helps it attract new clients.

- Diversification – The company manufactures a wide variety of products for various industries, providing them with a steady stream of income.

- Geographical Reach – The company’s international operations allow it to maintain a consistent revenue stream.

Weaknesses

- High Debt – The business has taken on a lot of debt to grow by acquiring other businesses, which eventually strains their financial standing.

- Business Cycle – Because the steel sector is cyclical, there can be an occasional drop in the demand for steel.

- Prices of Commodities – Changes in commodity prices will directly impact the financial performance of the company.

Opportunities

- Technological Advancement – Using the latest technologies in the manufacturing processes will enable the organization to reduce production expenses.

- Strategic Partnership – The company can grow and develop better manufacturing facilities by forming partnerships with other businesses,

- Government Schemes – The National Steel Policy and “Made in India” initiatives are a few government initiatives that help the steel industry grow, and JSW Steel can benefit from such initiatives.

Threat

- Competition – An increase in domestic and foreign competitors may negatively impact the market share of the company.

- Global Demand – Any downturn in the economy will lead to a decrease in the demand for steel products, which will have an immediate impact on sales and revenue for the company.

- Changes in Currency – Since the business has operations outside India, changes in exchange rates may impact the company’s profit margins.

Read Also: Tata Steel Case Study: Business Model, Financial Statements, SWOT Analysis

Conclusion

In conclusion, JSW Steel is one of the major steel producers in India, and it has operations across the globe. Substantial long-term borrowings and environmental issues regarding the carbon footprint are a few issues the company faces. The company has declared net profit over the last three fiscal years, although the metric has been volatile. It is important that you speak with your financial advisor before investing in this company.

Frequently Asked Questions (FAQs)

Who is the CEO of JSW Steel Limited?

Mr Jayant Acharya is the current CEO of JSW Steel as of 11 September 2024.

Where are JSW Steel’s major plants located in India?

JSW Steel has 14 steel plants at Vijayanagar, Dolvi, Vasind, Tarapur, Salem, etc.

Where is JSW Steel headquartered?

The headquarters of JSW Steel is situated in Mumbai.

Is JSW Steel a profitable company?

JSW Steel is a profitable company as it has reported a net profit of 9,145 crores for FY 2024 and 4,276 crores in FY 2023.

Is JSW Steel a large-cap or mid-cap company?

As of 11th September 2024, JSW Steel is a large-cap company with a market capitalization of 2,29,237 crores.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.