| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-27-24 | |

| Add new links | Nisha | Feb-27-25 | |

| Add new links | Nisha | Feb-27-25 |

- Blog

- kp green engineering ipo business model and swot analysis

KP Green Engineering: IPO, Business Model, And SWOT Analysis

The Indian steel industry is brimming with potential, and steel plays a crucial role in construction, whether it is a cell phone tower or a mega sea bridge. KP Green Engineering Limited is not just a steel manufacturer; they are poised to take centre stage which is making strides towards exciting growth.

Our blog explores KP Green’s promising opportunities, background, financials, and key IPO details.

KP Green Engineering Overview

KP Green Engineering Limited, formerly known as (KP Buildcon Private Limited) is an Indian company based in Vadodara, Gujarat. It was established by Dr. Farukhbhai Gulambhai Patel in 2001. The company initially focused on manufacturing hot-dip galvanized steel products.

However, KP Green Engineering expanded its offerings over time to include a wider range of fabricated steel products. The company has experienced significant growth in recent years. With rising revenue and profits, it is a leading provider of steel structure manufacturing in India.

Did you know?

As of March 2024, KP Green Engineering IPO is the biggest SME issue in the history of Indian Stock Markets; the company raised app. INR 189.50 crore via this issue.

Business Model

The company generates revenue from the two major business verticals, i.e., Manufacturing and Services. Have a look at the detailed portfolio:

Manufacturing Portfolio

Under this vertical, the company offers fabrication and Hot-dip galvanised steel products to customers by their needs and requirements.

- Lattice Towers – These are a free-standing structure made of steel characterized by a web of intersecting metal bars that create a stable, geometric lattice pattern. These towers are used in various industries, including power transmission, telecommunications, and even as support structures for wind turbines.

- Substation Structure – This refers to a specialized infrastructure that manages electricity, which includes equipment for transforming voltage levels, distributing power, and controlling its flow. The company manufactures substation and switchyard structure which includes Gantries and Equipment support structure as per customer’s needs.

- Solar MMS Structures and Solar Tracker – Solar module mounting structures are the essential framework that secures solar panels and optimises their exposure to sunlight for efficient energy generation. These structures can be either ground-mounted or roof-mounted.

- Metal Beam Crash Barrier Structure – Crash Barriers act as a physical barrier, redirecting vehicles back onto the roadway and minimising the risk of dangerous run-off road incidents. The company manufactures crash barriers and vital safety features along highways, and bridges and offers high-risk roads.

- HV Disconnector Structure – High Voltage Disconnectors are essential components in power systems. They are used to isolate and disconnect sections of an electrical circuit for maintenance, repairs, or to ensure safety during equipment servicing.

- Cable Trays – Cable trays function as a support system specifically designed for managing and organising electrical cables and wires. They facilitate organised routing, act as overhead shelves and are used in places like offices, factories, and data centres.

- Roofing Channels – The company manufactures both types of C&Z purlins, which are also known as roll-formed structural steel sections, and are used for Pre-engineered Buildings as they provide structural support in the construction.

Services Portfolio

Under this vertical, the company provides Fault Rectification Services w.r.t Optical Fiber Cables to various telecom service providers. Optical Fiber cables are crucial in ensuring telecommunication networks’ reliability and optimal performance.

- Fault Rectification Services – The company provides Fault rectification services concerning Optical Fibre Cables to various telecom service providers.

- Galvanizing Job Work – The company provides galvanising job work services to its clients.

- Comprehensive Repair Solutions – The skilled technicians of the company implement effective and durable repair solutions, which include splicing broken fibres, replacing damaged components, and addressing signal degradation.

- Solar Rooftop Installation Services – The company offers Solar Installation services and procures solar panels from manufacturers. Once installed, the company tests the entire solar system to ensure proper functionality and electrical connections.

Key Customers

The company boasts a diversified set of customers. Some of its key customers are:

Siemens, SRF, Vodafone, Torrent Pharma, Wipro, ABB, Airtel, GMR, BSNL, etc.

IPO Details

| IPO Date | March 15, 2024 to March 19, 2024 |

| Price Band | INR137 to INR144 per share |

| Lot Size | 1000 Shares |

| Total Issue Size | 13,160,000 shares |

| Issue Type | Book Built Issue IPO |

| IPO Type | SME IPO |

| Basis of Allotment | Wednesday, March 20, 2024 |

| Initiation of Refunds | Thursday, March 21, 2024 |

| Listing Date | Friday, March 22, 2024 |

Objectives of the Issue

The following are the key reasons to raise capital via this IPO:

1. To finance the capital expenditure towards setting up a new manufacturing unit to expand its current production capabilities.

2. To expand the current product portfolio.

3. General Corporate Purposes.

Read Also: Pune E-Stock Broking Limited IPO: Key Details, Business Model, Financials, Strengths, and Weaknesses

Financial Statement Analysis

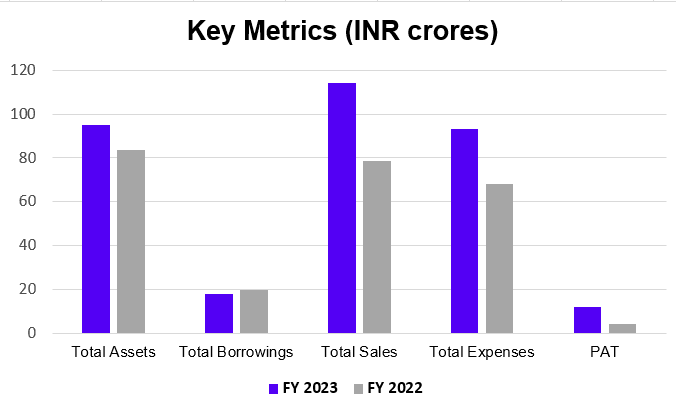

Have a look at the key metrics of the company (in INR crore):

| Particulars | FY 2023 | FY 2022 |

|---|---|---|

| Total Assets | 95.06 | 83.48 |

| Total Borrowings | 18.00 | 20.09 |

| Total Sales | 114.02 | 78.42 |

| Total Expenses | 93.17 | 68.08 |

| PAT | 12.39 | 4.46 |

Cash Flow Statements

| Particulars | FY 2023 | FY 2022 |

|---|---|---|

| Net Cash from Operating Activities | 12.40 | 3.96 |

| Net Cash from Investing Activities | (5.08) | (1.63) |

| Net Cash Flow in Financing Activities | (5.56) | (2.79) |

| Cash & Cash Equivalent | 3.54 | 3.20 |

SWOT Analysis of KP Green Engineering

Strengths

- KP Green Engineering benefits from the combined strengths of a passionate founder and a team of industry leaders, who deliver innovative solutions and exceptional customer service.

- The company can efficiently translate plans into actions. This execution advantage sets the company apart from its competitors. KP’s manufacturing facility in Dabhasa boasts an impressive annual production capacity of over 53,000 MT, which leads to smooth completion of projects and high-volume production.

- With a strong track record of financial success, KP Engineering has witnessed remarkable growth in Revenue, experiencing a CAGR of a staggering 71.98% over the past 3 years.

Weakness

- The company’s market presence is limited outside the region of Gujarat, and this dependence on a single geographical area could pose a risk if economic conditions or industry trends in Gujarat take a negative turn.

- The observation of negative cash flows from operating activities in recent years showcases challenges in managing working capital or inefficient collection of payments from customers, which can limit their ability to invest in growth.

- The company’s significant portion of its revenue comes from just a handful of clients, and if they lose a major contract, it could lead to financial difficulties.

Opportunities

- The rising demand for solar energy solutions aligns perfectly with KP Green’s expertise in solar module mounting structures. They can leverage this trend to expand their market share and develop innovative new solar-related products.

- Government investment in infrastructure projects creates a demand for steel structures used in transmission lines, substations, and other infrastructure projects. The company can position itself as a reliable supplier for these projects.

- Moving beyond their current base to cater to a wider national market and exploring export opportunities for their products and services in other countries with growing infrastructure and renewable energy sectors can be lucrative avenues for expansion.

Threats

- The company is currently involved in some ongoing legal disputes. The outcome of these is uncertain but can impact the business operations.

- Any changes in the Infrastructure Industry could adversely affect the business and financial conditions.

- Any kind of failure in the quality control processes can adversely affect the business and its further expansion.

Read Also: AVP Infracon IPO: Overview, Key Details, Financials, Strengths, and Weaknesses

Conclusion

KP Green Engineering has established itself as a strong player in the steel infrastructure and fabrication industry. They boast a history of a history of innovation, a commitment to quality, and a proven track record of sound financial success.

The company’s listing on the BSE SME platform signals an exciting new chapter for growth. The stock closed at INR 210 on the day of listing as opposed to the issue price of INR 144 (up almost 46%).

Frequently Asked Questions (FAQs)

What does KP Green Engineering do?

KP Green manufactures steel structures, provides hot-dip galvanisation services and offers fault detection for OFC networks.

When was KP Green Engineering founded?

The company was founded in the year 2001.

Is KP Green Engineering IPO a mainboard or SME IPO?

The KP Green Engineering IPO was an SME IPO. The stock is listed on the BSE SME platform.

How is KP Green performing financially?

The company has experienced significant growth in recent years with rising revenue and profits.

How did the company perform on the listing date?

On the listing date, i.e., 22 March 2024, the company’s stock was listed at INR 200, almost 39% premium to its issue price of INR 144. The share opened at INR 200 and closed at INR 210, rising 5% further from the open price.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.