| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-27-24 | |

| Add new links | Nisha | Feb-27-25 | |

| Add new links | Nisha | Feb-27-25 |

- Blog

- krystal integrated services ipo business model and swot analysis

Krystal Integrated Services: IPO, Business Model and SWOT Analysis

Did you know there is an Indian company recently listed on NSE and BSE, which provides integrated facility management services (FMS) such as housekeeping, sanitation, gardening, plumbing services, pest control, etc?

The company is a nationwide provider of such services and offers a powerful combination of extensive geographic reach, exceptional service quality and unwavering expertise.

But what truly sets Krystal Integrated Services Limited apart? Let’s dive deep into the key IPO details, company overview, financial statements, and SWOT analysis.

Krystal Integrated Services Overview

Krystal Integrated Services Limited is a prominent player in India’s facility management segment with a major focus on sectors like healthcare, education, public administration, railways, airports, etc. offering a range of services across various industries. The company was established in the year 2000 and has grown into a leader with a strong track record of success. The national footprint allows them to cater for the diverse needs of customers.

Business Model

Krystal Integrated Limited offerings include soft services such as housekeeping, sanitation, landscaping and gardening, hard services such as mechanical, electrical and plumbing services, solid, liquid and biomedical waste management, pest control and façade cleaning and other services such as production support, warehouse management and airport management services (including multi-level parking and airport traffic management).

The company also provides staffing solutions and payroll management to its customers, as well as private security and manned guarding services and catering services.

Additionally, Krystal also offers solutions to the government sector has a track record of executing large contracts and is among select companies in India to qualify for and service large, multi-location government projects. Some of the company’s government customers include Maha Mumbai Metro Operation Corporation Limited and the Education Department, Brihanmumbai Municipal Corporation.

Furthermore, the company offers services in 14 states and operates 21 branch offices across India.

Key IPO Details

| IPO Date | March 14, 2024 to March 18, 2024 |

| Price Band | INR 680 to INR 715 per share |

| Lot Size | 20 Shares |

| Total Issue Size | 4,197,552 shares |

| Issue Type | Book Built Issue IPO |

| IPO Type | Mainboard IPO |

| Basis of Allotment | Tuesday, March 19, 2024 |

| Initiation of Refunds | Wednesday, March 20, 2024 |

| Listing Date | Thursday, March 21, 2024 |

Objectives of the Issue

There are three key objectives of the issue:

1. Repayment/prepayment, in full or part, of certain borrowings availed of by the company.

2. Funding working capital requirements and capital expenditure for the purchase of new machinery.

3. General corporate purposes.

The promoters of the Company are Prasad Minesh Lad, Neeta Prasad Lad, Saily Prasad Lad, Shubham Prasad Lad and Krystal Family Holdings Private Limited. The pre-issue shareholding of the promoters was at 99.99%. Currently, i.e., after listing, the shareholding of promoters stands at 69.96%.

Financial Statements Analysis

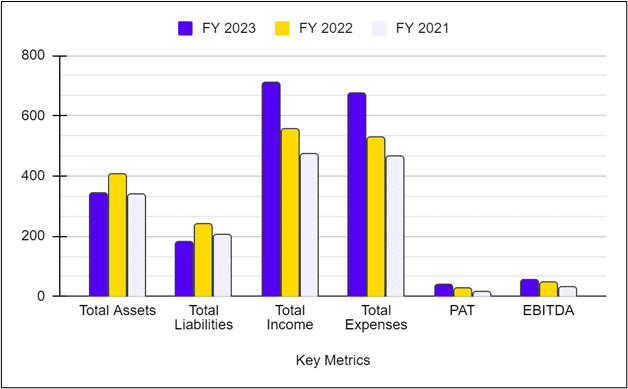

Have a look at the key metrics of the company (in INR crores):

| Key Metrics | FY 2023 | FY 2022 | FY 2021 |

| Total Assets | 343.46 | 404.38 | 338.47 |

| Total Borrowings | 51.05 | 74.53 | 68.39 |

| Total Revenue | 703.96 | 550.85 | 468.30 |

| Total Expenses | 641.94 | 510.75 | 447.88 |

| PAT | 38.44 | 26.27 | 16.82 |

| EBITDA | 66.50 | 47.45 | 31.10 |

Basic EPS of the company for the FY 2023, 2022, and 2021 stands at 33.33, 22.69, and 14.45, respectively.

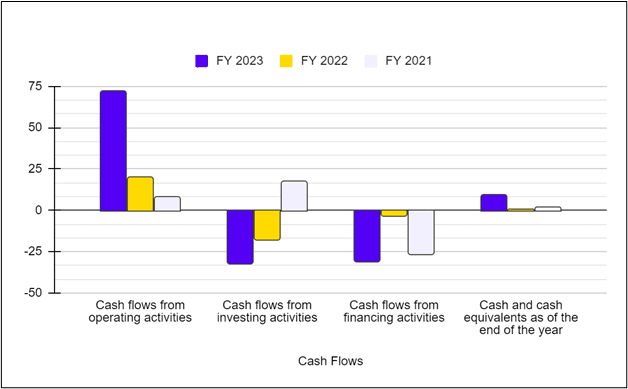

Cash Flow Statements

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Cash flows from operating activities | 71.78 | 19.98 | 7.95 |

| Cash flows from investing activities | (32.00) | (17.89) | 17.60 |

| Cash flows from financing activities | (30.89) | (3.05) | (26.77) |

| Cash and cash equivalents as of the end of the year | 9.37 | 0.49 | 1.45 |

Inferences from the above figures:

- The revenue of the company has shown steady growth over the past few years, showcasing an increase in its market presence and operational scalability.

- The PAT has also seen impressive growth, i.e., roughly a two-fold jump in the past three years which suggests effective management of expenses.

- Positive operating cash flows signify the company’s ability to generate cash from its core operations, which is important for the financial health of the company.

Read Also: Gillette India Case Study: Business Model, SWOT Analysis, and Financial Overview

SWOT Analysis of Krystal Integrated Services

Strengths

- With a diverse portfolio and extensive reach, Krystal Integrated Services stands out as a top pan-India facility manager.

- The company is a trusted partner for complex government projects, with a proven ability to handle large-scale contracts across multiple locations.

- By combining unwavering quality with cutting-edge services, Krystal fosters strong and lasting partnerships with its key customers.

- The company’s PAN India reach combined with expertly trained team, allows the company to tackle projects of any size.

Weaknesses

- A significant portion of the company’s revenue comes from a limited number of clients, which makes them vulnerable and increases the concentration risk.

- While government contracts offer stability, securing them can be unpredictable. Additionally, changes in government regulations could negatively impact the company.

- The company relies heavily on a large workforce, which can be expensive and complex to maintain and any kind of labour shortages could hinder their ability to fulfil existing contracts.

- Delivering services across diverse environments needs constant adaptation to local needs. This can lead to inefficiency in maintaining quality control across different project locations.

Opportunities

- The Indian facility management sector is poised for growth which will eventually create a fertile ground for KIS Limited to expand their service offerings and client base.

- By seeking new clients in several industries beyond government contracts, the company can reduce their dependence on a few customers. This would help them mitigate risks and open doors to new revenue streams.

- Embracing technological advancements like automation and data analytics can improve the company’s efficiency and streamline business operations.

- As environmental awareness grows, Krystal can develop eco-friendly facility management solutions that cater to businesses seeking sustainable practices.

Threats

- The dependence on government contracts exposes the company to the volatility of the public bidding process, with no guarantee of future success.

- The company’s revenue from operations is highly dependent upon a limited number of customers.

- The diverse nature of the services across various segments requires constant adjustments, which can be disruptive and cause inefficiencies.

- The manpower-intensive nature of the business can create a significant risk of stagnation and it will become difficult for the company to attract and retain enough qualified personnel to keep pace with evolving industry demands.

Read Also: AVP Infracon IPO: Overview, Key Details, Financials, Strengths, and Weaknesses

Conclusion

Krystal Integrated Services is well-positioned to capitalise on the burgeoning Indian facility management market. With their commitment to quality, adaptability, and a skilled workforce, they are poised for continued success.

As they recently navigated through their IPO in an increasingly competitive landscape, their focus on client diversification and innovative service offerings will be important to watch.

Frequently Asked Questions (FAQs)

What does Krystal’s integrated services do?

The company is a leading Indian management company offering a wide range of services like housekeeping, security, waste management, staffing, etc.

Does Krystal Integrated Services only work with the government?

No, while they have a strong presence in government contracts, the company also serves clients in several industries.

What are some key challenges that the company can face?

Retaining skilled workers and dependence on a limited number of clients are the challenges that the company may encounter.

When was Krystal Integrated Services established?

The company was established in the year 2000.

What was the performance of the company’s share on the listing date?

On the listing date, i.e., 21 March 2024, the stock was opened at INR 785 (almost 10% up). However, stock is closed at INR 713, slightly below its issue price.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.