| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-25-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- ltimindtree case study

LTIMindtree Case Study: Products, Services, Financials, KPIs, and SWOT Analysis

LTIMindtree stands out as a major player in the Indian landscape. It provides exceptional services and is known for its critical contributions to India’s people and economy. Today’s blog will provide the company overview, business segment, financials, KPIs, and SWOT Analysis.

LTIMindtree Case Study Overview

In the fast-evolving world of technology, LTIMindtree Ltd. has made its name in the game. But that’s not how the company began its operations. LTIMindtree is a merged entity of LTI and Mindtree. The merger happened in 2022 and had its record date as 24th November 2022. As part of the merger, all shareholders of Mindtree were issued shares of LTI in the ratio of 73 shares of LTI for every 100 shares of Mindtree.

Currently, the company holds an important position in the competitive IT services industry. This company specializes in data analytics, cloud computing, and Artificial Intelligence, and also helps its clients overcome complex business challenges and achieve faster growth. The company assists its clients with customized end-to-end solutions tailored to meet specific requirements.

| Company Type | Public |

|---|---|

| Industry | Information technology |

| Founded | 1997 |

| Headquarters | Mumbai, Maharashtra, India |

| Area served | Worldwide |

LTIMindtree Case Study Products and Services

LTIMindtree has a diverse portfolio of products and services. Let’s have a look at some of them:

Data Analytics

The company emphasizes innovation and contemporary technology stacks. It helps accelerate growth and achieve remarkable business results on a large scale. LTIMindtree Products enhances the client’s capabilities and delivers cutting-edge data and analytics services to its clients by utilizing accelerators and platforms to navigate their digital transformation journeys.

Cybersecurity

Cybersecurity helps clients protect their computer servers, networks, and data from malicious attacks. LTIMindtree cybersecurity service is a well-defined cybersecurity model powered by technology-enabled progression towards intelligent and autonomous cyber defense.

Digital Engineering

This service helps customers design and conceive cutting-edge digital

products that offer a seamless customer experience. It helps to gain insights and stores customer data.

Quality Engineering Testing

It helps to improve the client’s software by implementing manual and automated testing processes throughout the entire SDLC (Software Development Lifecycle). The company uses DevOps, Performance, Cloud, and Automation enabling firms in their digital transformation journey.

Canvas

It helps to provide a hassle-free and modern interface platform designed to meet the needs of the remote and hybrid workforce.

Market Data

| Market Cap | ₹ 139,829 Cr. |

|---|---|

| TTM P/E | 30.42 |

| ROCE | 37.7 % |

| ROE | 29.2 % |

Read Also: Larsen & Toubro Ltd Case Study: Business Model, Financials, KPIs, and SWOT Analysis

LTIMindtree Case Study Financial Highlights

Income Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Operating Revenue | 33,183.00 | 26,108.70 | 12,369.80 | 10,878.60 |

| Total Income | 33,752.90 | 26,894.60 | 12,657.30 | 11,216.70 |

| Total Expenditure | 27,088.30 | 20,880.20 | 9,657.80 | 8,858.30 |

| Profit before Tax | 5,791.50 | 5,293.90 | 2,588.20 | 2,002.90 |

| Consolidated Profit | 4,408.30 | 3,948.30 | 1,936.10 | 1,520.10 |

The income statement shows trending levels of growth at all major lines. Though expenditure increased substantially in the past 3 years, the revenue surge helped continue profit growth.

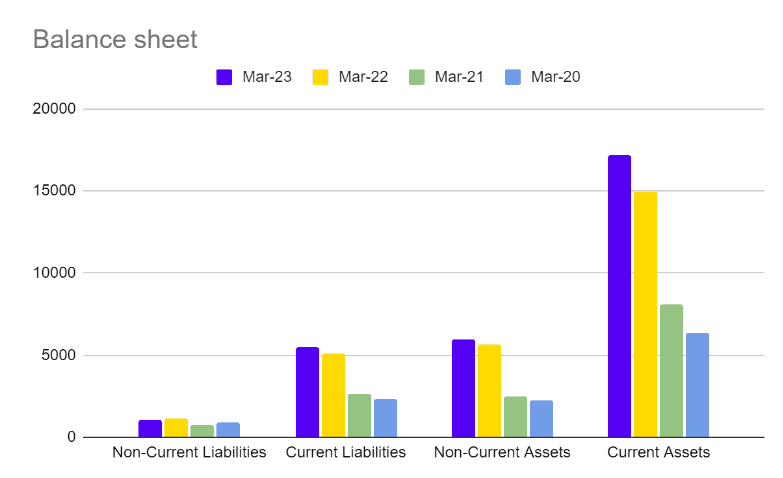

Balance Sheet

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Non-Current Liabilities | 1,033.40 | 1,158.50 | 715.10 | 866.40 |

| Current Liabilities | 5,482.60 | 5,092.30 | 2,632.30 | 2,331.20 |

| Non-Current Assets | 5,929.40 | 5,605.10 | 2,523.20 | 2,273.70 |

| Current Assets | 17,185.80 | 14,938.60 | 8,131.30 | 6,329.00 |

The company showcases a healthy state of balance sheet as non-current liabilities have been kept at a minimum in the past 4 years while showing a consistent trend in increasing assets.

Cash Flow Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Cash From Operating Activities | 3,094.60 | 3,250.70 | 2,399.60 | 1,643.50 |

| Cash Flow from Investing Activities | -330.90 | -1,645.30 | -1,656.00 | -652.00 |

| Cash from Financing Activities | -1,931.70 | -1,680.40 | -508.80 | -890.00 |

The cash flow statement indicates a healthy state due to a consistent level of cash from operations. The financing and investing activities show potential as continuous outflow in these fields will yield returns in the long term.

Profitability Ratios

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| ROCE (%) | 38.27 | 49.97 | 41.73 | 40.38 |

| ROE (%) | 29.20 | 37.05 | 30.86 | 29.92 |

| ROA (%) | 20.20 | 25.32 | 20.13 | 20.12 |

| EBIT Margin (%) | 16.19 | 17.74 | 19.24 | 16.06 |

| Net Margin (%) | 13.07 | 14.69 | 15.31 | 13.56 |

The business enjoys a consistent margin of profits at both net income level and operating income level.

LTIMindtree Case Study SWOT Analysis

This case study analysis highlights LTIMindtree Ltd’s strengths in brand recall and market diversification, weaknesses like FX risk, opportunities in untapped markets and Generative AI, and threats such as high attrition rates:

Strengths

- LTIMindtree Ltd enjoys the position of 5th largest IT service provider in the country.

- LTI has a strong brand recall because of its affiliation with the L&T group.

- Due to the company’s broad network, it is not heavily dependent on just 1 geography.

- The company has a history of providing client satisfaction and creating a culture shift that is guided by the management.

Weaknesses

- The company majorly operates in foreign markets. This opens the company to FX risk.

- The client base of the company is concentrated in the BFSI market.

- The company faces tough competition from larger established companies.

Opportunities

- Due to globalization, newer markets are emerging, which opens the possibility of operating in untapped European markets.

- The company enjoys a competitive advantage while participating in large deals because it is scaling up cross-sell and up-sell opportunities in the market.

- The company made significant investments in R&D and has made significant progress in the segment of Generative AI. This could open up new doors for the company.

Threats

- The company currently faces high attrition rates. This can cause long term issues in the company.

- Further increase in interest rates can put additional pressure on the clients, thus leading to reduced revenues.

Read Also: Varun Beverages Case Study: Business Model, Financials, and SWOT Analysis

Conclusion

LTIMindtree Ltd., a technology consulting and digital solutions company, has shown steady growth and profitability over the years. With a diverse range of services and a strong client base, the company focuses on innovation and client satisfaction while positioning itself well in the competitive landscape.

However, it is important to perform extensive analysis before investing your hard-earned money.

Also, give this a read – HCL Technologies Case Study

Frequently Asked Questions (FAQs)

What type of company is LTIMindtree?

LTIMindtree is a global company that has expertise in information technology services and consulting.

Where is the headquarters of LTIMindtree?

The headquarters of LTIMindtree is based in Mumbai, Maharashtra, India.

Who is the CEO of LTI Mindtree?

Mr. Deabshis Chatterjee is the CEO of LTIMindtree.

What are the types of products and services LTIMindtree offers?

The products and services offered are: consulting, cybersecurity, data analytics, cloud computing, iNXT, canvas, and many more.

What is the biggest weakness of LTIMindtree?

The company receives a significant portion of its revenue from global companies. This opens the company to FX risks.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.