| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-10-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- mahindra mahindra case study products financials kpis and swot analysis

Mahindra & Mahindra Case Study: Products, Financials, KPIs, and SWOT Analysis

Mahindra & Mahindra Ltd is one of the largest vehicle manufacturers in India. It is a multinational automotive manufacturing company headquartered in Mumbai, Maharashtra. In this Mahindra & Mahindra Case Study, we will understand how Mahindra & Mahindra Ltd grabbed a major chunk of the automobile industry along with the business segments, financials, and SWOT analysis.

Mahindra & Mahindra Overview

As one of the largest automotive manufacturers in India, Mahindra & Mahindra has established itself as a key player in the automobile industry. It was established by Kailash Chandra Mahindra and Jagdish Chandra Mahindra, with Malik Ghulam Muhammad in Ludhiana in 1945. It is one of the largest vehicle manufacturers by production in India and the largest manufacturer of tractors throughout the globe.

| Founder | JC Mahindra, KC Mahindra, and Malik Ghulam Mohammed |

| Founded Year | 1945 |

| Industry Type | Automotive, Agribusiness, Aerospace, Defence, Energy, Finance, Hospitality, Information, Two Wheelers, Construction, Technology, Leisure, and Hospitality |

| Headquarters | Mumbai, Maharashtra, India |

| Chairperson | Anand Mahindra |

| Parent Company | Mahindra Group |

Major Acquisitions

- Peugeot Motorcycles

Mahindra & Mahindra Ltd made a great move in 2015 by acquiring Peugeot Motorcycles, a subsidiary of the PSA Group and a reputed entity in European scooter manufacturing. This acquisition helped M&M increase the number of two-wheeler variants with modern elements and technologically superior scooters like the Django and Metropolis, known for their contemporary aesthetics and innovative features.

- Sampo Rosenlew

Mahindra & Mahindra Ltd. purchased a 35% share in the Finnish firm Sampo Rosenlew in 2016, an agri-machinery industry. Sampo Rosenlew, recognized for its superior combine harvesters and forest machinery, has played an important role in the improvement and efficiency of agricultural and forestry management.

Awards and Recognition

- 2006- Bombay Chamber Good Corporate Citizen Award

- 2007- Businessworld FICCI-SEDF Corporate Social Responsibility Award

- 2016 – Corporate Governance and CSR awards at Asiamoney

- 2017 – Manufacturing Innovator of the Year by TIME India.

- 2019 – India’s Best Brand by Interbrand

- 2021 – Most Trusted Brands of India by Team Marksmen and CNBC TV18.

Key Highlights

- In FY23, Consolidated PAT after EI stood at INR 10,282 crores, rising by 56%.

- In FY23, Consolidated Revenue stood at INR 1,21,269 crores, rising by 34%.

- #1 in LCVs: market share (<3.5T) stood at 45.5%, up 520 bps

- #1 in electric 3-wheelers: market share stood at 67.6%

Mahindra & Mahindra Products

Mahindra & Mahindra Ltd. has a wide range of products, including farm equipment, utility vehicles, and commercial vehicles. Some of them are:

- Heavy trucks

- Two-wheelers

- SUVs

- Tractors

- School buses

Popular Products

Let’s elaborate on some of the company’s major products that ruled the market. These are some of the top Mahindra and Mahindra products that have made a significant impact in their respective sectors:

Mahindra Thar

Mahindra Thar was launched in 2010 with its bold, rugged design and unmatched all-terrain capability. Again, they relaunched it in 2020 with a more refined and feature-rich design, receiving fantastic reviews for its timeless design and perfect blend of modernity.

Mahindra Scorpio

With its bold design and affordable pricing, the Mahindra Scorpio revolutionized the SUV market in India. It quickly became one of the most popular vehicles in its segment. The Scorpio has seen multiple updates over the years, improving its appeal with modern technology and upgraded performance.

Mahindra XUV 700

The XUV 700, launched in 2021, is a powerhouse SUV known for its high-end technology, robust performance, and world-class safety. The XUV 700 has solidified Mahindra’s position as a manufacturer that focuses not only on design and performance but also on ensuring maximum safety and cutting-edge technology for its customers.

Market Data

| Market Cap | ₹ 2,60,034 Cr |

| TTM P/E | 23.32 |

| ROCE | 14.9 % |

| Book Value | ₹ 451 |

| ROE | 22.09 % |

| 52 Week High / Low | ₹ 2,098.65 / 1,171.25 |

| Dividend Yield | 0.78 % |

| Face Value | ₹ 5.00 |

Read Also: Coal India Case Study: Products, Subsidiaries, Financials, KPIs, and SWOT Analysis

Mahindra & Mahindra Financial Highlights

Income Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

| Operating Revenue | 1,21,268.55 | 90,170.57 | 74,277.78 | 75,381.93 |

| Total Income | 1,22,475.04 | 91,208.21 | 75,376.24 | 76,410.62 |

| Total Expenditure | 1,00,983.26 | 75,590.85 | 60,666.58 | 62,190.36 |

| Profit before Tax | 14,060.23 | 9,361.77 | 5,347.73 | 4,688.43 |

| Consolidated Profit | 10,281.50 | 6,577.32 | 3,347.41 | 127.04 |

The table above shows that the company has grown periodically, even during economic strain. The company has been able to grow its revenue each year while keeping its expenditures minimal, resulting in continuous profitability growth.

Balance Sheet

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Non-Current Assets | 1,12,950.87 | 97,240.49 | 92,607.26 | 1,01,670.70 |

| Current Assets | 91,268.84 | 75,148.00 | 72,137.91 | 63,948.93 |

| Non-Current Liabilities | 66,614.79 | 59,274.90 | 62,646.93 | 64,045.56 |

| Current Liabilities | 70,579.41 | 56,288.33 | 51,446.01 | 54,009.52 |

The company’s balance sheet depicts a growing trend of both current and non-current assets. These assets are financed equally by both the current and non-current liabilities. Thus, indicating a steady business position.

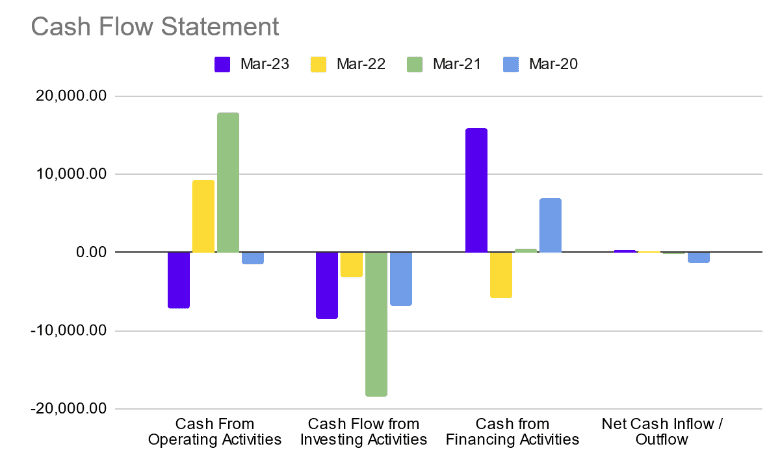

Cash Flow Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Cash From Operating Activities | -7,074.02 | 9,247.55 | 17,908.83 | -1,456.93 |

| Cash Flow from Investing Activities | -8,547.26 | -3,225.82 | -18,446.76 | -6,894.83 |

| Cash from Financing Activities | 15,946.11 | -5,882.60 | 406.23 | 6,932.75 |

| Net Cash Inflow / Outflow | 324.83 | 139.13 | -131.70 | -1,419.01 |

The cash flow position does not align with the growing trend in the balance sheet and income statement. This misalignment can be concluded from the excessive turbulence seen in the chart.

KPIs

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| ROCE (%) | 14.90 | 11.92 | 9.46 | 9.18 |

| ROE (%) | 22.09 | 16.44 | 9.14 | 6.83 |

| ROA (%) | 6.04 | 4.30 | 2.24 | 1.66 |

| EBIT Margin (%) | 13.13 | 12.28 | 13.78 | 13.03 |

| Net Margin (%) | 9.29 | 7.95 | 4.91 | 3.55 |

| Cash Profit Margin (%) | 12.45 | 11.53 | 9.20 | 7.69 |

The KPIs show a growing trend in the company’s profitability. ROCE, ROE, and Net Margin have all seen an uptrend in the last few years.

Read Also: HCL Technologies Case Study: Financials, KPIs, And SWOT Analysis

Mahindra & Mahindra SWOT Analysis

The SWOT analysis of Mahindra and Mahindra reveals the company’s strong market position in tractors and utility vehicles, alongside its focus on innovation and customer loyalty.

Strengths

- Mahindra & Mahindra Ltd. has a strong and leading market segment in tractors and utility vehicles.

- The company is highly focused on its Research & Development and developing new technologies.

- The company provides excellent products like SUVs and Scorpios that align with Indian tastes and preferences.

- The company has built a reputation for providing reliable after-sales services, which increases customer trust and loyalty.

Weaknesses

- Mahindra & Mahindra is facing stiff competition from domestic and international players in the automotive sector. The high competition hampers its market share growth and challenges its overall success.

- Although the company has expanded globally, much of its revenue still comes from India, which may cause economic downturns in that market.

Opportunities

- Mahindra & Mahindra can explore more market opportunities for its range of products, especially in the automotive and tractor segments. The company creates a strong footprint for emerging markets.

- Partnering with global players can help the company to access new technologies, markets, and customer segments, increasing its product quality and offerings.

Threats

- Global automotive giants are continuously developing and launching new products. This reason may create robust competition from both Indian and international players.

- Continuously changing consumer tastes and preferences can also pose challenges to the firm.

Conclusion

In conclusion, the Mahindra & Mahindra Case Study highlights the company’s strong market presence in tractors and utility vehicles, its focus on research and development, and its potential for growth in emerging markets. However, operating in a dynamic industry means any major changes can significantly impact its growth.

FAQs

What was Mahindra & Mahindra originally known as?

Mahindra & Mahindra was originally known as Mahindra & Mohammed when it was established in 1945.

Which was Mahindra’s first car?

The Jeep CJ3 was the first-ever automobile produced by Mahindra & Mahindra.

Who owns Mahindra & Mahindra Ltd?

Mahindra Group is the parent company of Mahindra & Mahindra Ltd.

What are the subsidiaries of Mahindra Group?

The Mahindra group has many subsidiaries, some of which are Mahindra & Mahindra Limited, Mahindra Lifespace Developers Limited, Mahindra Logistics Limited, Mahindra Electric Mobility Limited, Tech Mahindra, Mahindra Holiday and Resorts India Limited, Mahindra Aerospace, and Mahindra Financial Services Limited.

When was Mahindra & Mahindra Ltd. established?

Mahindra & Mahindra Ltd. was established in 1945 in Ludhiana.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.