| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-12-24 |

- Blog

- mahindra mahindra vs tata motors

Mahindra & Mahindra vs Tata Motors: Which is Better?

India’s automotive sector is a major contributor to the country’s economy. The demand for vehicles continues to create opportunities for growth and innovation within the auto industry.

In today’s blog, we will deeply analyze the two auto giants of the Indian auto sector: Tata Motors and M&M.

Mahindra & Mahindra – An Overview

The Mahindra and Mohammed firm was founded in 1945 by Malik Ghulam Muhammad and the Mahindra brothers (JC and KC Mahindra). The business was first involved in the trading of steel. The Mahindra brothers took over the company’s administration after India gained independence from Britain in 1947, and Mohammed went into politics in Pakistan.

The company started making cars in 1947 after obtaining the license to manufacture Willys Jeep. After that, in 1956, it went public on the Bombay Stock Exchange. The company’s decision to manufacture tractors in 1981 marked a significant turning point. Mahindra Reva is the company’s first electric car. M&M continues to invest in new product development and technological upgrades to deliver customer-centric products. The company’s headquarters is located in Mumbai.

Tata Motors – An Overview

Tata Motors is India’s largest automobile company and is a leading global manufacturer of cars, utility vehicles, buses, trucks, and defense vehicles. Tata Motors was incorporated in 1945 and was a part of the Tata Group, which was founded by Jamshedji Tata in 1868. Tata Motors was founded as Tata Engineering and Locomotive Company (TELCO), initially focusing on manufacturing locomotives.

The company entered the commercial world market in 1954 through a joint venture with Daimler-Benz, establishing India’s first heavy vehicle manufacturing facility. Gradually, it expanded the commercial vehicle portfolio with trucks and buses, becoming a dominant player in the market. Some of the world’s most iconic brands, including Jaguar Land Rover in the UK and Tata Daewoo in South Korea, are a part of the group’s automotive operations.

Tata Motors is committed to developing innovative and sustainable vehicles for the future of mobility. The company operates on a philosophy of ‘giving back to society.’ 2008 marked a bold move with the acquisition of Jaguar and Land Rover, which propelled Tata Motors onto a global stage.

Comparative Analysis

| Particular | Mahindra & Mahindra | Tata Motors |

|---|---|---|

| Current Share Price | INR 2,805 | INR 1,111 |

| Market Capitalisation (in INR crores) | 3,48,860 | 4,09,045 |

| 52-Week High | INR 3,014 | INR 1,179 |

| 52-Week Low | INR 1,450 | INR 606 |

| FII Holdings (%) | 41.90 | 18.18 |

| DIIs Holdings (%) | 26.25 | 16.07 |

| Book Value per Share | INR 532 | INR 255 |

| PE Ratio (x) | 31.6 | 12 |

Read Also: Mahindra & Mahindra Case Study: Products, Financials, KPIs, and SWOT Analysis

Financial Statements Analysis

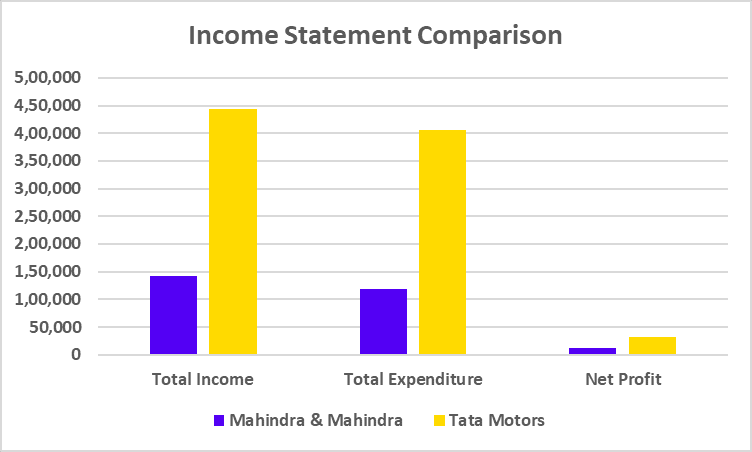

Income Statement (FY 2024)

| Particulars | Mahindra & Mahindra | Tata Motors |

|---|---|---|

| Total Income | 1,41,231 | 4,43,877 |

| Total Expenditure | 1,18,887 | 4,06,636 |

| Net Profit | 11,148 | 31,106 |

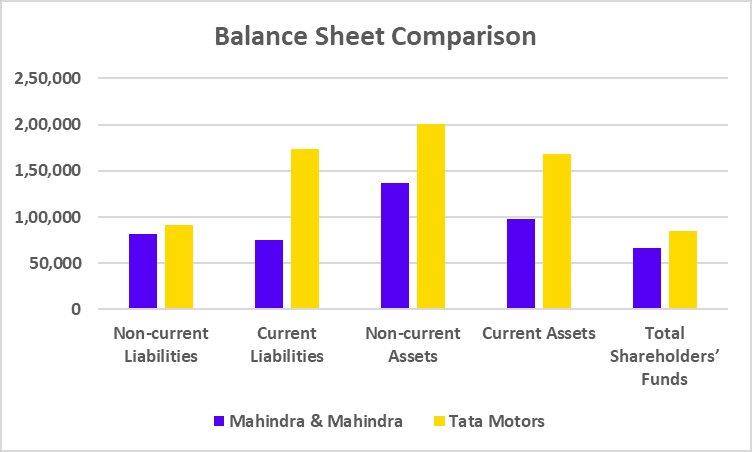

Balance Sheet (FY 2024)

| Particulars | Mahindra & Mahindra | Tata Motors |

|---|---|---|

| Non-current Liabilities | 81,667 | 90,854 |

| Current Liabilities | 75,546 | 1,73,617 |

| Non-current Assets | 1,36,263 | 2,01,128 |

| Current Assets | 98,240 | 1,67,718 |

| Total Shareholders Funds | 66,191 | 84,918 |

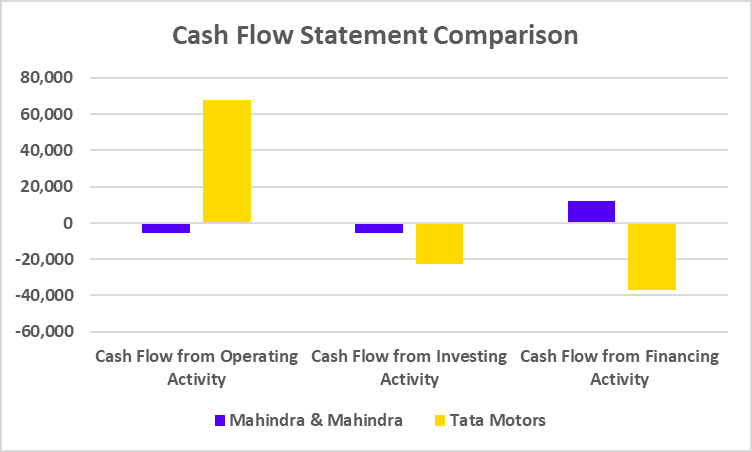

Cash Flow Statement (FY 2024)

| Particulars | Mahindra & Mahindra | Tata Motors |

|---|---|---|

| Cash Flow from Operating Activity | -5,629 | 67,915 |

| Cash Flow from Investing Activity | -5,597 | -22,828 |

| Cash Flow from Financing Activity | 12,281 | -37,005 |

Key Performance Indicators

| Particulars | Mahindra & Mahindra | Tata Motors |

|---|---|---|

| Net Profit Margin (%) | 8.06 | 7.10 |

| ROE (%) | 17.02 | 36.97 |

| ROCE (%) | 13.89 | 19.39 |

| Current Ratio | 1.3 | 0.97 |

| Debt-to-Equity | 1.56 | 1.16 |

Conclusion

Mahindra & Mahindra and Tata Motors have played important roles in the development of India’’s automotive sector. Both companies have their unique strengths and weaknesses, and their strategies have evolved to adapt to changing market dynamics. As the Indian automotive market grows, it will be interesting to see how these two giants adapt to and innovate in the prevailing competition in the Indian automotive industry.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Bharat Petroleum vs Hindustan Petroleum |

| 2 | Mahindra & Mahindra vs Tata Motors |

| 3 | Tata Motors vs Maruti Suzuki |

| 4 | Apollo Hospitals vs Fortis Healthcare: |

| 5 | Tata Power Vs Adani Power |

Frequently Asked Questions (FAQs)

Which company, Mahindra & Mahindra and Tata Motors, has a larger market share in India?

Both M&M and Tata Motors have a good market share in India. However, M&M Motors is generally considered a dominant player in the SUV segment, while Tata Motors has a strong presence in both passenger cars and commercial vehicles.

What is the most popular SUV of Mahindra & Mahindra and Tata Motors?

The most popular SUVs of Mahindra & Mahindra are Scorpio and Nexon for Tata Motors.

Which company, Mahindra & Mahindra and Tata Motors, has been more involved in the electric vehicles segment?

Tata Motors has been more active in the electric vehicles segment, launching several electric models in recent years.

Which company, Mahindra & Mahindra and Tata Motors, has a stronger brand image for off-road capabilities?

M&M is known for its off-road capable SUVs compared to Tata Motors.

Who are Mahindra & Mahindra and Tata Motors’ primary competitors in India?

Maruti Suzuki, Hyundai, and Kia are the major competitors of Mahindra & Mahindra and Tata Motors in the Indian automotive industry.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.