| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-31-24 | |

| Add new links | Nisha | Feb-27-25 | |

| Add new links | Nisha | Feb-27-25 |

Read Next

- SEBI Action on Jane Street: Impact on Indian Markets

- What is Personal Finance?

- Military Wealth Management: Strategies for Growing and Preserving Your Assets

- India’s Republic Day 2025: Honoring the Nation’s Defense Achievements

- 10 Essential Financial Planning Tips for Military Members

- How Do You Apply for PAN 2.0 Online and Get It on Your Email ID?

- 10 Best YouTube Channels for Stock Market in India

- LTP in Stock Market: Meaning, Full Form, Strategy and Calculation

- 15 Best Stock Market Movies & Web Series to Watch

- Why Do We Pay Taxes to the Government?

- What is Profit After Tax & How to Calculate It?

- Budget 2024: Explainer On Changes In SIP Taxation

- Budget 2024: F&O Trading Gets More Expensive?

- Budget 2024-25: How Will New Tax Slabs Benefit The Middle Class?

- Semiconductor Industry in India

- What is National Company Law Tribunal?

- What is Capital Gains Tax in India?

- KYC Regulations Update: Comprehensive Guide

- National Pension System (NPS): Should You Invest?

- Sources of Revenue and Expenditures of the Government of India

- Blog

- mastering your finances beginners guide to tax savings

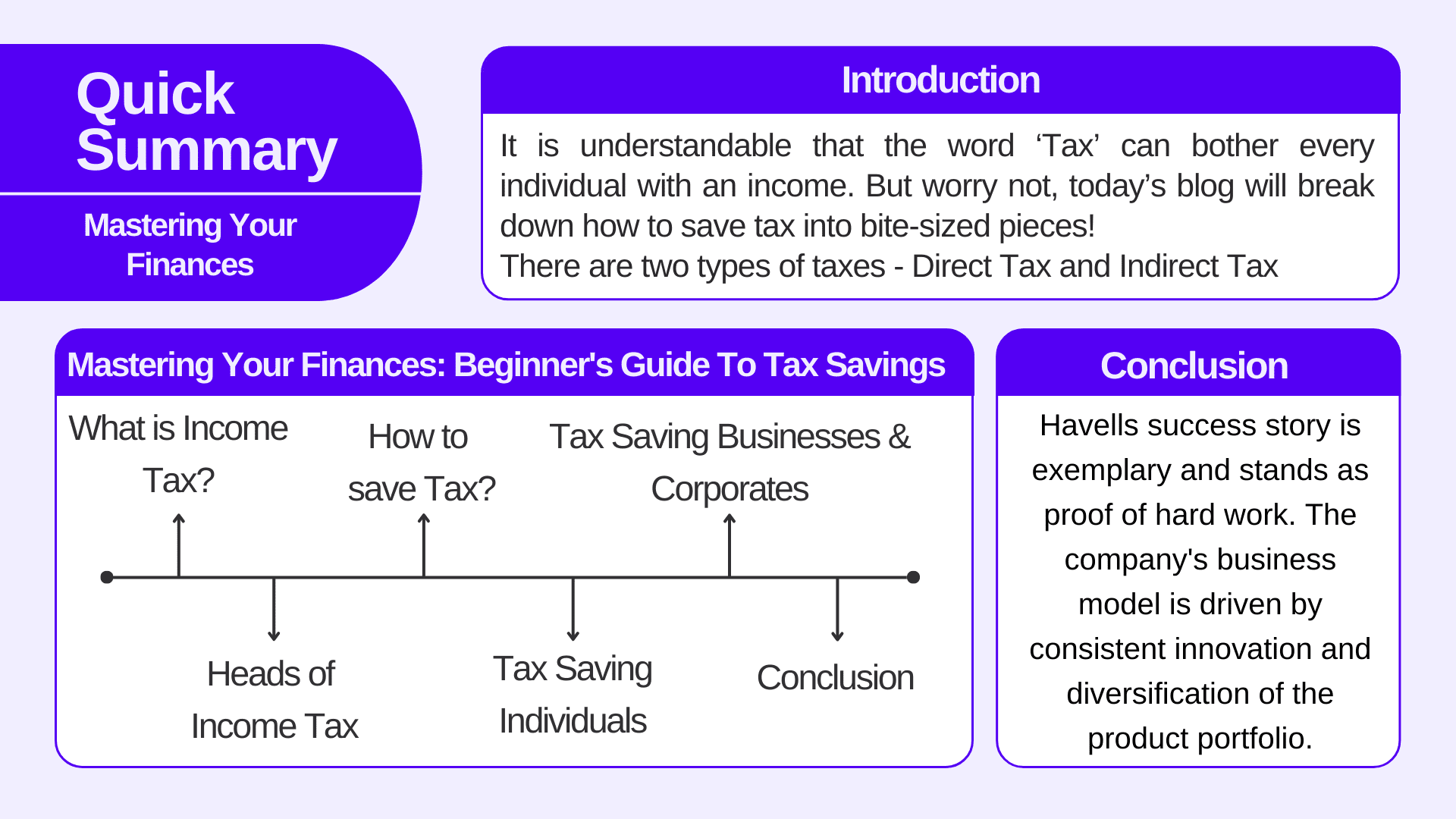

Mastering Your Finances: Beginner’s Guide To Tax Savings

It is understandable that the word ‘Tax’ can bother every individual with an income. But worry not, today’s blog will break down how to save tax into bite-sized pieces!

Generally, there are two types of taxes:

- Direct Tax – A tax which is levied on individuals / businesses and cannot be transferred to anyone. For example, income tax and property tax.

- Indirect Tax – A tax which is levied on goods and services and is charged from the final consumer. Businesses collect these taxes from consumers and give it to the Government. For example, GST, Excise duty, Customs duty, etc.

Learning how to save on income tax is an important part of personal finance. Here are some basics of income tax and a beginner’s guide on how you can reduce it.

What is Income Tax?

Income tax is the tax imposed by the government on the income of individuals and businesses. It is a mandatory financial contribution in most countries.

The Income Tax Act in India was enacted in 1961 and outlines the rules and regulations for calculating and collecting income tax from individuals. The objective of the act was to limit tax disparities and foster economic growth.

Below listed are some key features to know about income tax:

- In the case of individuals, salary, wages, interest income, rental income, and capital gains are taxed, whereas businesses are taxed on profits earned from business operations.

- Your taxable income is calculated by subtracting certain deductions and exemptions from your total income, and then individuals or corporations are taxed as per their income tax slab.

- Income tax is structured in a progressive manner, i.e., the higher income is subject to the higher taxes.

- Income tax is one of the primary sources of revenue for the government and is utilised to fund public services such as education, infrastructure, etc.

- Individuals are required to file income tax returns with the government annually. The filing procedure involves reporting income, deductions, and other financial information. There are various Income Tax Return (ITR) forms such as ITR-1, ITR-2, etc. We will learn about these forms in another blog.

Heads of Income Tax

Now, let us delve deeper and learn about the heads under which your income is taxable. Heads are categories into which your income is classified for tax purposes. There are five main heads of income:

1. Income from Salary

This head includes wages, bonuses, allowances, gratuity and other employment income. The employer generally deducts tax deducted at source or TDS from the employee’s salary. Under this head, exemptions that can be availed include:

HRA (house rent allowance), conveyance allowance, leave travel allowance (LTA), and medical allowance.

Do remember that salary income is taxable on a due basis or receipt basis, whichever is earlier.

2. Income from House Property

The rental income that an individual earns from letting out a property they own is taxable under the head income from house property. The property can either be a self-occupied property or deemed-to-be-let-out property. That is, if you own two properties the second one is considered as deemed-to-be-let-out, and if you have taken a loan to purchase or construct the property, you can claim a deduction for the interest paid on the loan.

3. Income from Profits & Gains of Business or Profession

This head comprises the profits earned from the business’s operations that involve the sale of goods, manufacturing, etc. and the income earned by professionals such as doctors, lawyers, etc. All expenses that include rent, salaries, and office expenses for business are deductible.

4. Income from Capital Gains

Income from capital gains refers to the profits earned from selling capital assets such as real estate, stocks, bonds, etc.

There are two types of capital gains:

- Long-term capital gains (LTCG) – LTCG is subject to change as per the asset class. For example, gains from the sale of equity shares held for more than one year are taxed at a rate of 10% above INR 1 lakh.

- Short-term Capital Gain (STCG) – Similar to LTCG, these are also subject to change as per the asset class. For example – gains from the sale of debt held for a short duration of less than a year are taxed at the rate of 15%.

5. Income from other sources

Income from other sources, also known as the residuary head of the income, includes all income that does not fall in the other four main heads. Any income you receive that is not covered in the above-mentioned heads fits into ‘Income from other sources’. This generally includes interest income, dividends income, gifts, lottery, etc.

Read Also: What is Non-Tax Revenue – Sources and Components

How to save Tax?

Knowing the heads, let us discuss some strategies individuals and businesses can implement to save tax.

Tax Saving – Individuals

- Know your tax basics and understand the tax brackets as applicable to your income.

- Be careful about the tax implications of your investments because long-term capital gains often have lower tax rates as compared to short-term capital gains.

- Utilise deductions under Section 80(C) of the Income Tax Act and invest up to INR 1.5 lakh in financial instruments like PPF, ELSS funds, NPS, ULIPs, etc. These investments not only offer you fascinating returns but also tax benefits.

- Utilise the exemption provided for HRA (house rent allowance) if you receive HRA as a part of your salary. For example, if you live in a rented house, you can claim HRA to reduce your taxable income.

- Consider investing in tax-saving bonds that are issued by the government.

- You can also claim deductions for expenses like tuition fees for the education of your child, principal repayment on home loans, and contributions to certain retirement funds.

- Donate to charitable institutions since these donations qualify for deductions under section 80(G).

- Premiums paid for health insurance policies for your spouse, children, or oneself are eligible for deductions under section 80(D).

- Keep in mind to maintain all the essential documents, receipts, and proofs of your investments and expenses that you claim for deductions.

Tax Saving – Businesses & Corporates

- Choosing a business structure (sole proprietorship, partnership, or LLC) can significantly affect the tax treatment.

- Businesses need to recognise the deductible expenses such as rent, utilities, office supplies, employee salaries, advertising, and other business-related expenses.

- Businesses can also claim deductions under Section 179 to expense the property purchase cost.

- It is suggested to provide employee benefits such as health insurance, retirement plans, etc. since these benefits provide tax advantages and aid in employees’ well-being and retention.

- Suppose the businesses have incurred losses in a given financial year. In that case, the net operating loss can be carried forward to offset the taxable income in other years, thereby providing the tax benefits.

- Deductible expenses for research and development (R&D) can reduce the taxable capital gains for businesses.

- Investing in tax-free infrastructure bonds issued by the government, such as REC & NHAI Bonds are qualified for deduction under section 54 EC of the Income Tax Act. Individuals can also claim deductions under section 54 EC by investing in tax-saving infrastructure bonds.

- Businesses can also claim tax deductions for machinery depreciation of up to 20% if acquiring new machinery in a year.

Read Also: 5 Must-Read Best Swing Trading Books for Trader

Conclusion

Tax saving is not just about keeping your tax bill low; it is about making clever financial decisions to safeguard your present and future. Tax laws are complex to understand and are subject to changes. Do not forget to seek guidance from tax professionals for better understanding.

Frequently Asked Questions (FAQs)

When was the Income Tax Act of India was enacted?

Income Tax Act of India was enacted in the year 1961.

What are the 5 heads of the income tax in India?

Income from Salary, Income from house property, Income from Profits and gains of Business or Profession, Income from capital gain, and Income from other sources.

How can I reduce my taxable income?

You can claim deductions for eligible expenses such as insurance premiums, home loan principal amount repayment, and investment in tax-saving financial instruments. Remember to consult with tax expert at the time of filing your tax return.

Are there penalties for non-compliance with tax laws?

Yes, there are certain penalties for non-compliance with tax laws. We will cover this topic in a separate blog.

What is the maximum deduction limit in Section 80C?

As of January 2023, you can claim deduction in Section 80C up to INR 1.5 lakh.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle