| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-16-24 | |

| internal linking | Nisha | Feb-17-25 | |

| internal linking | Nisha | Feb-17-25 |

- Blog

- mcx exchange case study

MCX Exchange Case Study: Evolution, Products, And Financials

Did you know an Indian exchange known as Multi Commodity Exchange, or MCX, allows you to trade in commodities such as gold, silver, crude, etc?

Read the blog to learn about the company’s history and evolution, as well as the products currently trading on it.

Company Overview

Multi Commodity Exchange, or MCX, is India’s first and largest commodity derivative exchange, allowing online commodity trading. The company’s headquarters are located in Mumbai, Maharashtra. It was founded in 2002 and began operations in November 2003. Gradually, the company expanded its product portfolio to encompass various commodities, such as metals, energy, and agriculture. Throughout its journey, the company has spent time in its research department, ensuring technological advancements in its trading platform.

The Securities Exchange Board of India regulates the MCX’s operations.

MCX in Numbers

- MCX is the 5th largest commodity option exchange in the world.

- It is also the world’s 7th largest commodity future exchange.

- They account for about 96.7% of India’s market share in commodity trading.

- In 2022-23, the average daily turnover in options was about INR 33,998 crores, whereas the average daily turnover of futures contracts was INR 23,514 crores.

- As of 15 May 2024, the company has a market capitalization of app. INR 19,900 crores.

- As of June 2023, the MCX has 556 members and 47,573 authorized persons in 706 cities of India.

Evolution of MCX Exchange

- 2002 – 2005 – The company began its operations and signed a licensing agreement with London Metal Exchange.

- 2006 – 2008 – The company established a product licensing agreement with New York Mercantile Exchange (NYMEX), and became a member of the International Organization of Securities Commissions (IOSCO).

- 2012 – 2015 – The company signed an MOU with Chicago Mercantile Exchange (CME) Group, and became India’s Listed exchange.

- 2017 – 2019 – MCXs launched its first-ever options on gold futures in India and launched a new series of iComdex commodities indices.

- 2020 – 2023 — The company launched its new trading software version, enabling investors to trade at hostile prices.

Read Also : What is Commodity Market in India?

Products Offered

The company has positioned its products according to the growing demand for commodity trading in India and abroad. The products offered by MCX are as follows:

- Metals

a) Gold – One can trade in gold futures and option contracts based on the price movement of gold.

b) Silver – Through silver contracts, investors can take a position on the silver price. - Energy Metals

a) Crude Oil – MCX provides crude oil derivative contracts, available in different variants that track the price of Brent crude oil.

b) Natural Gas – It allows investors to speculate on the price movement of natural gas.

c) Base Metals – MCX also allows investors to trade in commodities like copper, nickel, aluminium, zinc, lead, steel rebar, etc. - Agricultural Commodities

a) Agri Futures – It offers contracts of various agricultural commodities such as palm oil, cotton, menthe oil, kapas, etc.

Financial Highlights

Let’s have a look at the financials of the MCX Exchange:

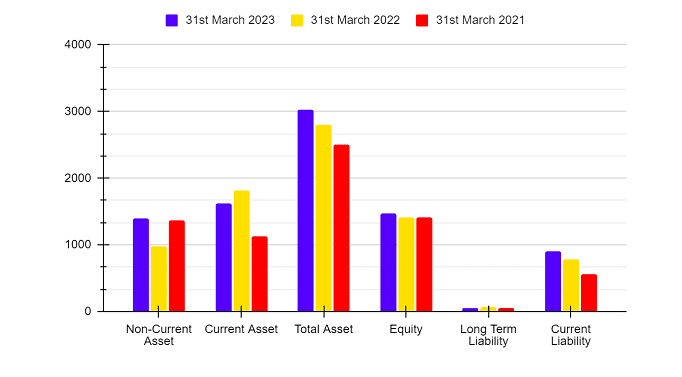

Balance Sheet (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Non-Current Asset | 1,396.81 | 978.06 | 1,374.18 |

| Current Asset | 1,625.94 | 1,822.48 | 1,128.33 |

| Total Asset | 3,022.75 | 2,800.54 | 2,502.51 |

| Equity | 1,479.30 | 1,418.11 | 1,418.23 |

| Long Term Liability | 56.09 | 65.78 | 57.27 |

| Current Liability | 897.6 | 791.06 | 557.78 |

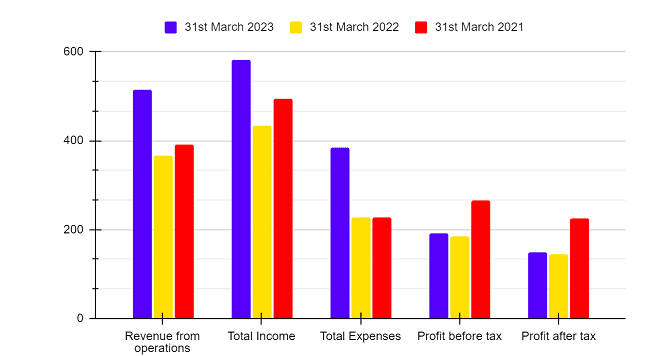

Income Statement (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Revenue from operations | 513.51 | 366.81 | 390.56 |

| Total Income | 581.17 | 433.31 | 494.34 |

| Total Expenses | 385.62 | 227.57 | 227.68 |

| Profit before tax | 190.57 | 184.05 | 266.75 |

| Profit after tax | 148.97 | 143.45 | 225.22 |

The company’s income for FY 2023 climbed by 34% compared to FY 2022, although its profit after tax increased by only 3% in FY 2023.

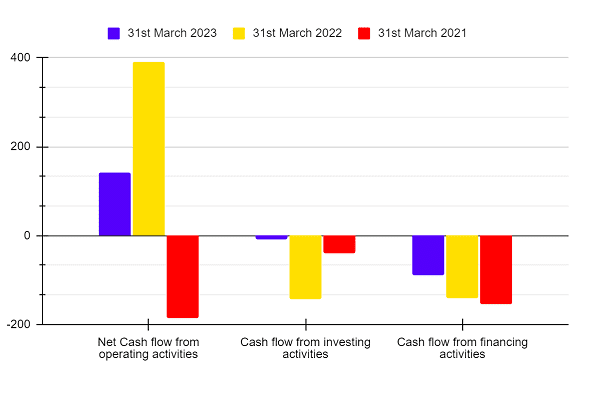

Cash Flow Statement (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Net Cash flow from operating activities | 141.42 | 391.3 | -184.43 |

| Cash flow from investing activities | -8.08 | -142.22 | -38.78 |

| Cash flow from financing activities | -89.48 | -141.65 | -153.89 |

The above graph illustrates that the company’s cash flow from operating operations has declined compared to FY 2022, but its cash flow from investment activities has improved in FY 2023, albeit with a negative value.

Ratio Analysis

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Operating Profit Margin (%) | 38.12 | 56.15 | 68.32 |

| Net Profit Margin (%) | 29.97 | 39.45 | 57.64 |

| Return on Capital Employed (%) | 9.21 | 10.25 | 13.71 |

| Current Ratio | 1.81 | 2.3 | 2.02 |

| Return on Net Worth (%) | 10.07 | 10.11 | 15.88 |

SWOT Analysis

Strengths

- MCX is the largest commodity exchange in India and has a strong market presence across the industry.

- The company has a wide product portfolio consisting of metal, energy, agriculture commodities, currencies, etc.

Weakness

- The performance of the company depends on various factors such as geopolitical situations, supply and demand, market sentiments, commodity prices, etc.

- MCX faces competition from various other players in the industry (NCDEX, IEX, etc.) which can limit its market share.

Opportunities

- The company can collaborate with international exchanges, to help them with technical expertise and increase brand visibility.

- MCX can introduce more innovative products to attract a new set of traders.

Threats

- Any changes made by the regulatory body, i.e., SEBI, could impact their operation and profit margins.

- Any economic turndown in the economy can decrease the trading activities, which significantly hampers the revenue of the company.

Read Also : List of Stock Exchanges in India

Conclusion

In summation, the Multi Commodity Exchange provides investors with a diverse product range; as the population of traders grows, so will the trading volume and profit. The company nearly has a monopoly in the market when it comes to commodity trading. However, you need to examine your risk tolerance and undertake a thorough investigation of the company if you’re looking to invest in it.

Frequently Asked Questions (FAQs)

Can we trade currencies on MCX?

No, as of May 2024, currency derivative contracts are not available on MCX.

Who are the competitors of MCX?

There are multiple competitors of MCX who facilitate trading in commodity derivatives, such as the National Commodity and Derivates Exchange (NCDEX), Indian Commodity Exchange (ICEX), etc.

Who is the founder of Multi Commodity Exchange?

The MCX was incorporated in the year 2002 and began its operation in 2003 under the leadership of Mr. Jignesh Shah.

What is the trading time of MCX?

Investors can trade in the commodities derivatives segment at MCX in two parts:⦁ Morning Session: 9:00 a.m. – 5:00 p.m.⦁ Evening Session: 5:00 p.m. – 11:30/11:55 p.m.Further, except for Saturdays and Sundays, trading occurs every day of the week.

What is the difference between MCX, NSE, and BSE?

The National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) allows participants to trade primarily in stocks of the publicly listed companies, whereas the Multi Commodity Exchange allows trading in commodities such as Gold, Silver, Copper, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.