| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-11-23 | |

| Add new links | Nisha | Feb-28-25 |

Read Next

- What is the 15*15*15 Rule of Mutual Fund Investing?

- Mutual Fund Factsheet: Definition And Importance

- XIRR Vs CAGR: Investment Return Metrics

- Arbitrage Mutual Funds – What are Arbitrage Funds India | Basics, Taxation & Benefits

- Hybrid Mutual Funds – Definition, Types and Taxation

- Top AMCs in India

- Active or Passive Mutual Funds: Which Is Better?

- Liquid Funds Vs Ultra Short Fund: Which One Should You Choose?

- Debt Mutual Funds: Meaning, Types and Features

- Equity Mutual Funds: Meaning, Types & Features

- What are Small Cap Mutual Funds? Definition, Advantages, and Risks Explained

- What is PSU Index? Performance, Comparison, Benefits, and Risks Explained

- Bandhan Long Duration Fund NFO: Objective, Benefits, Risks, and Suitability Explained

- Smart Beta Funds: Characteristics, Factors, Benefits, and Limitations

- The Rise of ESG Funds: Overview, Growth, Pros, Cons, and Suitability

- Mutual Funds vs Direct Investing: Differences, Pros, Cons, and Suitability

- A Comprehensive Guide on Mutual Fund Analysis: Quantitative and Qualitative Factors Explained

- NFO Alert: PGIM India Large & Mid Cap Fund

- ELSS Funds: 3 Years Lock-In Worth It?

- Regular vs Direct Mutual Funds: Make The Right Investment Decision

- Blog

- multi cap vs flexi cap mutual funds which is better for you

Multi-Cap Vs Flexi-Cap Mutual Funds? Which Is Better For You?

You are a well-versed investor and recently stumbled upon multi-cap and flexi-cap mutual funds and asked yourself, what exactly is the difference. We will unfold your question in today’s blog.

Firstly, if you are new to the world of mutual funds, check out our blog: Mutual Funds: Meaning, Types, Features, Benefits and How They Work.

Mutual funds are classified according to asset class, financial goals, and structure. Multi-cap and Flexi-cap are both similar to other equity mutual funds, which are pooled investments, and they aim to provide capital growth to investors in the long term. Both funds fall under the umbrella of active mutual funds.

Read Also: Equity Mutual Funds: Meaning, Types & Features

Multi-Cap Funds

Multi-cap funds are active equity mutual funds that invest in large-cap, mid-cap, and small-cap stocks. As per the latest circular released by SEBI, at least 75% of the investments made by multi-cap mutual funds are in equity and equity-related instruments. The investments should be made in the following manner:

- Investments in large-cap companies: at least 25% of the total assets.

- Investments in mid-cap companies: at least 25% of the total assets.

- Investments in small-cap companies: at least 25% of the total assets.

The advantage of multi-cap funds is that your capital is invested in all three caps (at least 25%), with mid and small caps being more volatile than large caps, which can yield an ample return in the long run. However, keep in mind that there is no guarantee that multi-cap funds will outperform other mutual fund classes; in fact, multi-cap funds can be more volatile in the short run.

Flexi-Cap Funds

The Securities and Exchange Board of India (SEBI) and the Association of Mutual Funds in India (AMFI) have launched a number of initiatives in India to raise public awareness and confidence in the financial sector.

SEBI introduced this category of mutual funds in November 2020 after receiving recommendations from the Mutual Fund Advisory Committee (MFAC). As per the circular released by SEBI, it is an open-ended, dynamic equity scheme investing across large-cap, mid-cap, and small-cap stocks.

In the flexi-cap fund, at least 65% of the investments should be invested in equity and equity-related instruments. However, as compared to multi-cap funds, there is no minimum criterion to invest this 65% across large, small, or mid-cap stocks. The advantage of flexi-cap funds is that fund managers have more investment flexibility to invest money across large, mid, and small caps.

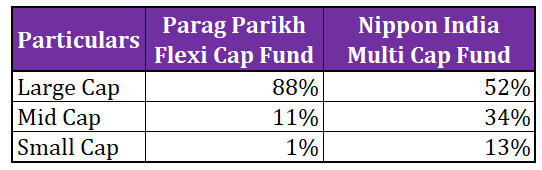

Let’s look at the below comparison. We have selected one mutual fund from each category:

- Parag Parikh Flexi Cap Fund

- Nippon India Multi Cap Fund

As you can observe, the Parag Parikh flexi-cap fund has more investment in large-cap funds than the Nippon India multi-cap fund. Further, the Parag Parikh flexi-cap fund has only a 1% investment in small-cap stocks. Flexi-cap funds provide more flexibility for investments as compared to multi-cap funds, as there is no regulatory requirement for flexi-cap funds.

Choosing Between Multi-Cap and Flexi-Cap:

| Particulars | Flexi-cap fund | Multi-cap fund |

|---|---|---|

| Equity Exposure | At-least 65% investment in equity and equity-related instruments | At-least 75% investment in equity and equity-related instruments |

| Asset Allocation | Fund managers have flexibility in asset allocation | At-least 25% in each of the cap: large, mid and small |

| Risk | Very High | Very high |

| Volatility | Low as compared to multi-cap | High as compared to flexi-cap |

| Tax | Subject to both STCG and LTCG | Subject to both STCG and LTCG |

Read Also: What are Small Cap Mutual Funds? Definition, Advantages, and Risks Explained

Conclusion

We have discussed the similarities and differences between flexi-cap and multi-cap mutual funds. Both are equity mutual funds and provide diversification to your mutual fund portfolio. However, the key difference in both is the equity exposure and the asset allocation. The minimum percentage of equity and equity-related instruments that flexi-cap funds and multi-cap funds can invest in is 65% and 75%, respectively. Further, multi-cap funds must invest at least 25% in each class: large, mid, and small-cap, whereas flexi-cap funds have greater flexibility.

The best mutual fund strategy is to select mutual funds based on your risk appetite and time horizon after consulting with your financial advisor.

Frequently Asked Questions (FAQs)

Are multi-cap and flexi-cap active or passive funds?

Both multi-cap and flexi-cap are active mutual funds means they are actively managed by a professional fund manager.

Can flexi-cap funds invest in debt securities?

Yes, as long as a fund has at least 65% of its investments in equity.

What is the risk profile of flexi-cap and multi-cap funds?

The risk profile for both funds is very high, as both are equity mutual funds.

Are multi-cap funds more volatile than flexi-cap funds?

In general, the answer is yes, because multi-cap funds must invest at least 25% in small-cap and mid-cap funds due to regulatory requirements, whereas no such requirement for flexi-cap funds.

When did flexi-cap funds launch?

In November 2020, SEBI introduced flexi-cap funds.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle