| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-30-23 | |

| Add new links | Nisha | Feb-28-25 |

- Blog

- mutual fund vs etf are they same or different

Mutual Fund vs ETF. Are They Same Or Different?

Mutual Funds and Exchange Trade Funds (ETFs) are both pooled investments that take money from multiple investors and then invest in several instruments: Equity, Bonds, Commodities, etc. However, there are a few differences between them. Let’s find out those differences!

What are Mutual Funds?

Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. These funds are managed and curated by professional fund managers and hence become suitable for investors who have less time and expertise to manage their portfolios. When you invest in mutual funds, NAV (Net asset value) is allotted to you which reflects the net value of the assets that the fund manager chooses to invest your money.

Mutual funds in India are established in the form of a trust under the Indian Trust Act of 1882, in accordance with SEBI (Mutual Funds) Regulations, 1996.

Mutual funds are considered ideal for investors who do not have sufficient knowledge of investing in stock markets and wish to start their financial journey with a small amount since these funds offer investors a wide variety of investment options like shares, bonds, debentures, real estate, and money market instruments.

Check out our blog on Mutual Funds!

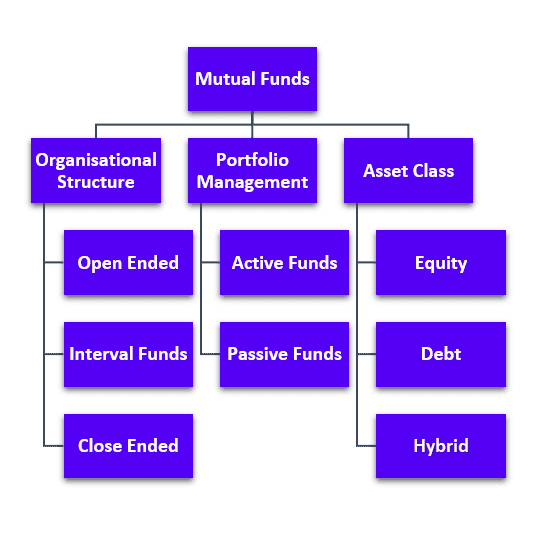

Types of Mutual Funds

1. On the basis of organizational structure

- Open-ended funds

These funds issue shares and redeem existing shares on a daily basis. The NAV of the underlying assets determines the price of this fund.

- Closed-ended Funds

These funds have a fixed number of shares that are issued only once and then are traded on the exchange until maturity. Close-ended funds have a fixed maturity date.

- Interval Funds

These funds are a mixture of open-ended and closed-ended funds that allow investors to purchase & redeem their shares at certain intervals. The transaction period in interval funds has to be a minimum of 2 days, and there should be at least a 15-day gap between the two transaction periods.

2. On the basis of portfolio management

- Active Funds

An active fund is a fund where the fund manager manages the portfolio, i.e., he decides what needs to be sold, bought, and held in the portfolio.

- Passive Funds

Passive funds, also known as index funds, are investment funds that are designed to replicate the performance of a specific index. They keep track of the benchmark returns.

3. On the basis of asset class

- Equity funds

These funds invest primarily in stocks or equities and come with higher volatility. For example, large-cap funds, mid-cap funds, and small-cap funds.

- Debt Funds

These funds invest in fixed-income securities such as government bonds and carry lower risk when compared to regular equity funds.

Check out our blog on Debt Mutual Funds

- Hybrid funds

In these funds, the capital of the investor is allocated both in equity and debt funds and the fund manager tries to create a balance between risk and return.

Advantages of investing in Mutual fund

Investing in mutual funds comes with certain risks and advantages. Below are some key advantages that mutual funds offer:

- Mutual funds offer investors a diversified portfolio of different asset classes – Large cap, Small Cap, Flexi Cap, etc.

- Active Mutual funds are professionally managed funds with skills and expertise.

- Mutual funds are an affordable way to start an investment journey because the initial investment amount is relatively low.

- Liquidity – The lock-in period is generally low to none in Mutual funds.

- Tax benefits are also available to the investors investing in ELSS funds.

Risk of Investing in Mutual Funds

- Mutual funds are subject to market risks, and returns are not guaranteed.

- The value of your investments may fluctuate depending upon the market movements.

- Market-related risk: The inability of a mutual fund to sell securities held in the portfolio could result in potential losses to the scheme.

- Changes in interest rates and economic conditions can significantly affect the prices of securities held by Mutual Funds.

Read Also: SIP in Stocks vs SIP in Mutual funds?

What is ETF?

ETF stands for Exchange-traded funds. It is a type of investment option similar to Mutual Funds. ETFs invest in a basket of securities such as stocks, bonds, and other assets. Unlike mutual funds, ETFs are traded on stock exchanges just like any individual stock, and an investor can buy or sell them during market hours at certain prices. These funds track indices such as CNX NIFTY. ETFs generally carry a low expense ratio because of lower administrative costs. (Read more about expense ratios in our blog Asset Under Management).

To trade in ETFs, a de-mat account is required, and usual brokerage charges and STT would apply. When investing in ETFs, dividends from a stock that is in the ETF basket are also reinvested.

ETF shares are created or redeemed through a unique in-kind process. Authorized participants or Market Makers (typically large institutional investors) can exchange a basket of securities for ETF shares or vice versa, helping to keep the ETF’s market price close to its Net Asset Value (NAV).

Merits of investing in ETFs

- ETFs offer diversification because they invest in a basket of securities. Investors can customize their portfolios as per their choice.

- ETFs usually carry a lower expense ratio than mutual funds.

- ETFs are tax-efficient. They are designed and structured to minimize capital gains distributions so that your tax liability is reduced to an extent.

- ETFs can be easily bought and sold.

Demerits of investing in ETFs

- ETFs may have tracking error which is the difference between the ETFs performance and the performance of the underlying asset. Various factors such as expense ratio, brokerage, and liquidity of the underlying securities can cause this.

- ETFs offer less diversification as compared to Mutual Funds.

- ETFs with low trading volume can be more volatile because of high bid-ask spreads, which is the difference between the price at which you can buy an ETF and the price at which you can sell it.

Pro Tip: Always check the NAV of the ETFs before investing because ETFs generally trade at a premium.

Read Also: Types of Mutual Funds in India

Mutual fund vs. ETF: Which one is right for you?

Confused! Explore this table to have a better understanding.

| Basis | Mutual Funds | ETFs |

|---|---|---|

| Structure | Managed by investment firms and are priced once per day at the NAV | ETFs are tracked by index sector or asset class. |

| Trading | Bought and sold through the fund company | Traded on stock exchanges just like any other individual stock. |

| Management | Mutual Funds can either be actively managed or passively managed. | Most of the ETFs are passively managed, but there are actively managed ETFs as well. |

| Fees | Mutual funds carry management fees, sales loads, and expense ratios | ETFs do not carry any sales load, but you need to pay STT, brokerage, and expense ratios while trading in ETFs. |

Conclusion

To wrap it up, ETFs and Mutual Funds are both pooled investments. Eventually, the choice between a mutual fund and an ETF depends on the preferences of the investor, his investment strategy, and risk tolerance. Some investors may prefer the ease of trading and lower costs associated with ETFs, while others may value the professional management and simplicity of mutual funds.

Frequently Answered Questions (FAQs)

Which mutual fund offers investors with tax benefits?

ELSS (Equity Linked Savings Scheme) funds provide investors with tax benefits under Section 80 (C) of the Income Tax Act.

What does ETF stand for?

ETF stands for Exchange Traded Funds.

Are ETF and mutual Funds the same?

ETFs are traded like individual stocks, and mutual funds can be bought and sold through fund houses.

ETFs are actively managed or passively managed?

Most of the ETFs are passively managed, but there are actively managed ETFs as well.

Where do money-market funds invest?

Money market funds invest in highly liquid instruments like T-bills and commercial papers.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.