| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-14-23 | |

| Add internal link | Nisha | Feb-19-25 |

Read Next

- What is the 15*15*15 Rule of Mutual Fund Investing?

- Mutual Fund Factsheet: Definition And Importance

- XIRR Vs CAGR: Investment Return Metrics

- Arbitrage Mutual Funds – What are Arbitrage Funds India | Basics, Taxation & Benefits

- Hybrid Mutual Funds – Definition, Types and Taxation

- Top AMCs in India

- Active or Passive Mutual Funds: Which Is Better?

- Liquid Funds Vs Ultra Short Fund: Which One Should You Choose?

- Debt Mutual Funds: Meaning, Types and Features

- Equity Mutual Funds: Meaning, Types & Features

- What are Small Cap Mutual Funds? Definition, Advantages, and Risks Explained

- What is PSU Index? Performance, Comparison, Benefits, and Risks Explained

- Bandhan Long Duration Fund NFO: Objective, Benefits, Risks, and Suitability Explained

- Smart Beta Funds: Characteristics, Factors, Benefits, and Limitations

- The Rise of ESG Funds: Overview, Growth, Pros, Cons, and Suitability

- Mutual Funds vs Direct Investing: Differences, Pros, Cons, and Suitability

- A Comprehensive Guide on Mutual Fund Analysis: Quantitative and Qualitative Factors Explained

- NFO Alert: PGIM India Large & Mid Cap Fund

- ELSS Funds: 3 Years Lock-In Worth It?

- Regular vs Direct Mutual Funds: Make The Right Investment Decision

- Blog

- mutual funds

- taxation

Mutual Fund Taxation – How Mutual Funds Are Taxed?

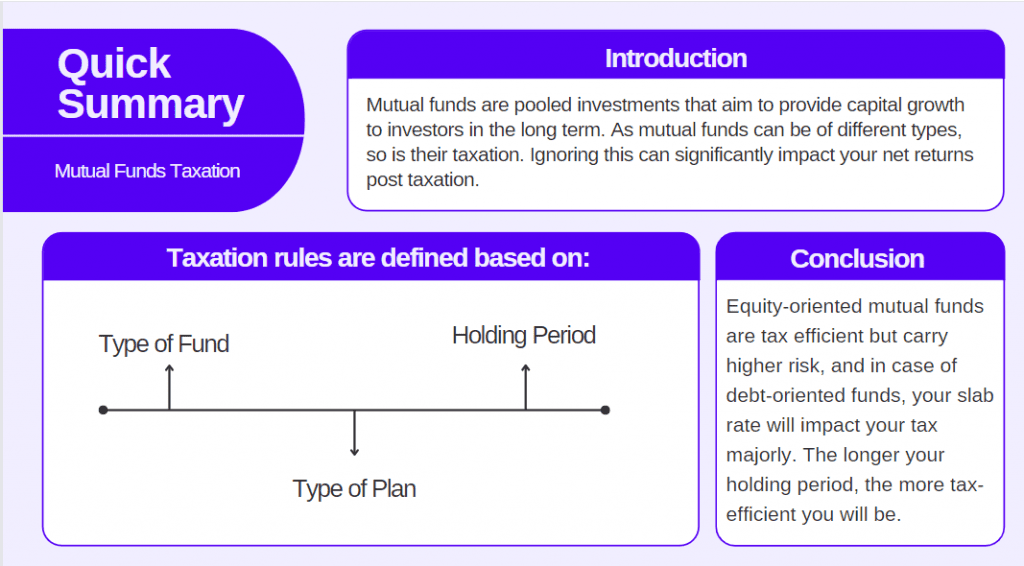

Mutual funds are pooled investments that aim to provide capital growth to investors in the long term. They are classified according to asset class, financial goals, and structure. There’s an entire universe of mutual funds.

As mutual funds can be of different types, so is their taxation. Now, you must be guessing, that is okay, but why should I care? Taxation on mutual funds varies due to various factors. Ignoring this can significantly impact your net returns post taxation. In this blog, we will learn how taxation impacts your returns on mutual funds investment.

In India, after the budget of 2023 and finance bill, the benefit of indexation is no longer available on debt mutual funds. Hold on; things will be clarified by the end of the blog.

Taxation rules are defined based on certain factors:

- Type of Fund: Equity-oriented or Debt-oriented.

- Type of Plan: Growth or IDCW (Income distribution cum capital withdrawal).

- Holding Period: Short term capital gain tax or Long term capital gain tax.

Earnings from Mutual Funds Investment

There are two ways you can earn from investing in mutual funds:

- Capital Gains: When you sell an asset at a price higher than initial buying price, you earn capital gains. In case of mutual funds, allotment is done based on NAV.

For example – You bought ten units of mutual funds having NAV of 100. Your total buying was 10*100 = INR 1,000. Now, after some time, you sold these ten units at 120. So, you earned 20*10= INR 200, i.e., capital gains. - Dividends: Mutual funds invest money in several companies, and when mutual funds receive dividends from those companies, the fund manager adjusts this dividend in two ways:

- Growth Option: In this, the fund manager will re-invest the dividend received in the portfolio, and you won’t get any pay check.

- IDCW: Income distribution cum capital withdrawal, the Fund manager will transfer the dividend received to you and will not re-invest the money.

Taxation

Now, for taxation purposes, both capital gains and dividends are taxed separately, we will uncover them one by one. Let’s start with dividends then we will move to capital gains tax.

Dividends Taxation

As discussed above, in the case of dividends, there are two options available to the investors:

Growth: In case of growth, all your returns are classified as capital gains tax. So, no need to worry about separate taxation on dividends.

IDCW: In this method, you will receive the dividends directly in your account. In India, dividends are taxed at your tax slab. For example, you fall in a 30% tax slab and receive dividends worth INR 50,000 in a year. So, out of total dividends, 30% of 50,000, i.e., INR 15,000 will go to the tax authorities.

IDCW is only suggested to investors looking for a regular source of income. However, the growth option is more tax-efficient and ideal for long-term investors.

Capital Gains Taxation

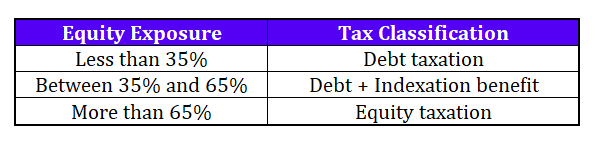

For capital gains, mutual funds are broadly classified as Equity-oriented or debt-oriented. After the fiscal budget of 2023, there are three categories of taxation: Equity, Debt and Debt with indexation benefit. The exposure of a mutual fund’s equity component determines which category the fund is in. Have a look at the table below:

So, funds investing more than 65% in equity and equity-related instruments, are taxed as per Equity taxation. Fun Fact: Arbitrage funds come under equity taxation.

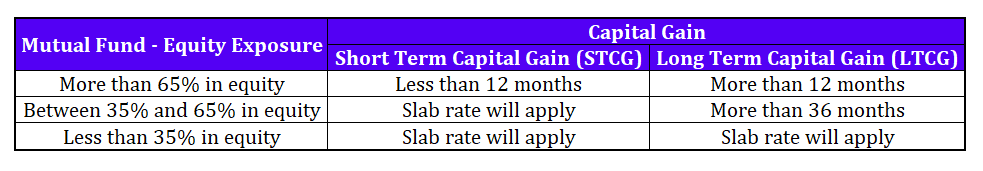

Now, coming to the holding period. Your holding period also affects taxation. The holding period is different for all three categories. Check the table below:

As you can observe, for equity-oriented funds, STCG will apply if the holding period is less than a year and LTCG if the holding period exceeds one year. In case of less than 35% exposure in equity, neither STCG nor LTCG will apply. Your gains are taxed at your income tax slab rate.

There are hybrid funds in the market, these are the combination of equity and debt funds. They can be either equity-focused or debt-focused. If equity-focused (at least 65% in equity), then equity taxation will apply else debt taxation.

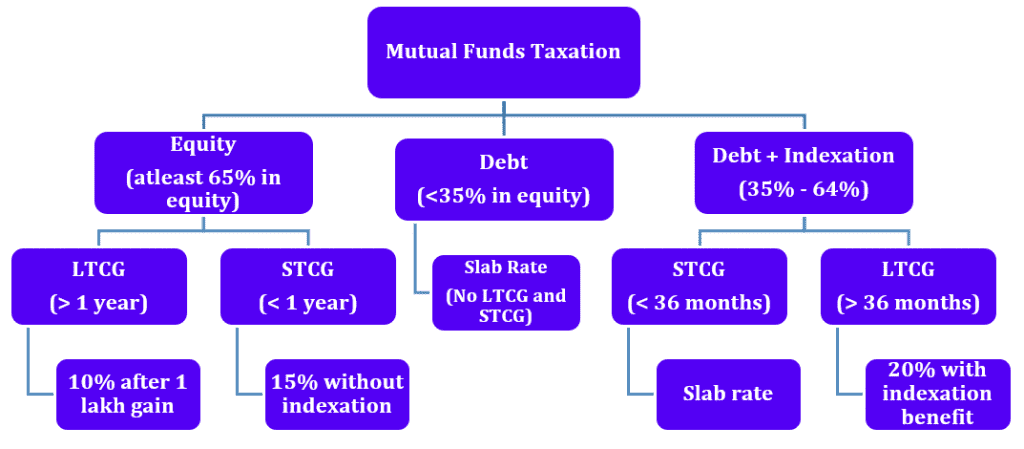

Now again, tax rates are different for STCG and LTCG. At this point, you must be scratching your head; so many rules. Don’t worry, we have created a cheat sheet for you. Have a look at the chart below:

Note that, in the case of LTCG in equity, there is no tax till the income of one lakh; post this limit a 10% tax is applicable without indexation benefit. In case of STCG in equity, there is flat 15% tax on gains without indexation benefit.

Indexation benefit on debt funds – In this, your buying value will be inflation-adjusted so that your taxable income is reduced. Longer the holding period, higher the benefit of indexation.

Now, which has the lowest taxation? Generally, there is no straight answer. It will depend on the type of mutual fund you are invested in and your holding period. However, between debt and debt with indexation, latter is the clear winner.

Read Also: Long-Term Capital Gain (LTCG) Tax on Mutual Funds

Conclusion

We have covered all the aspects of mutual funds taxation in India. In summation, it broadly depends on the type of mutual fund you invest in and your holding period.

Equity-oriented mutual funds are tax efficient but carry higher risk, and in case of debt-oriented funds, your slab rate will impact your tax majorly. If you fall in “no-tax” bracket, then small gains in a short holding period will carry no tax. Further, the longer your holding period, the more tax-efficient you will be.

Based on this, one can analyses their portfolio and plan their entry and exit. For example, you have an unrealized profit of INR 80,000 in an equity mutual fund and want to take out this profit. Here, a better approach would be to analyses your holding period and act accordingly. If you have been invested for 11 months, then probably waiting for one more month is ideal, where LTCG will apply on your 80,000 gains. Do remember that in case of equity, no tax is there till one lakh.

Read Also: Arbitrage Mutual Funds – What are Arbitrage Funds India | Basics, Taxation & Benefits

Frequently Asked Questions (FAQs)

What are slab rates in taxation?

These are brackets based on the age and income of an individual; each bracket will carry different taxation.

Do I need to pay any tax if my realized profit is INR 95,000 from selling an equity mutual fund after 14 months?

No, in this case, LTCG will apply, and in equity LTCG, no tax is there till one lakh.

What is IDCW?

IDCW (Income Distribution Cum Capital Withdrawal) means dividends received from mutual funds will be transferred to you.

What is Indexation benefit?

Your buying value will be inflation-adjusted so that your taxable income is reduced.

For long term investing, which is better, growth plan or IDCW?

For the long-term, a growth plan is preferred.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle