| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-22-24 | |

| Add new links | Nisha | Mar-01-25 |

- Blog

- nestle india case study

Nestle India Case Study: Business Model, Financial Statement, SWOT Analysis

On a Sunday, you decide to relax at home with a cup of coffee and some Maggie. You probably won’t believe it when you learn that Nestle India Limited, a single FMCG company, makes the ingredients you’ll be using.

In today’s blog post, we’ll talk about Nestle India, one of the biggest FMCG Companies in India.

Nestle India Company Overview

Nestle, the world’s biggest food and beverage company, has a long and illustrious history that began in the 1860s. The narrative begins with the formation of the Anglo-Swiss Condensed Milk Company in 1866, which produced ground-breaking milk products. Simultaneously, a German pharmacist, Henri Nestle, invented “Farine Lactee” to lower the newborn death rates. These businesses were successful because of their creative milk products, which catered to urban consumers with shifting lifestyles. The two businesses merged in 1905 to form Nestle.

The company’s main goal is to offer food and beverage items to clients of all ages and backgrounds. Its main offerings include frozen foods, baby formula, nutritious bars, instant coffee, and more.

Business Model of Nestle India

Nestle’s business strategy is built around utilizing its well-known brand and widespread reach. It operates in 191 nations and has a research department in nearly all major nations. It has formed strategic alliances with many global brands and acquired many businesses. An effective supply chain can guarantee prompt product delivery to clients, and maintaining quality standards encourages brand loyalty.

Product Portfolio

Nestle provides a large selection of products to its customers. In addition to boosting the nutritional value of its products while retaining the same level of flavor, Nestle is dedicated to innovation to fulfill the evolving demands of its customers. The company offers its products to customers through partnerships with dairy farms and various retail locations. Nestle owns numerous brands such as Nespresso, Nescafe, Kit Kat, Maggi, etc., and its 29 brands have annual sales of over $1.1 billion.

Read Also: Asian Paints Case Study: Business Segments, KPIs, Financials, and SWOT Analysis

Market Details of Nestle India Limited

| Current Market Price | INR 2,518 |

| Market Capitalization (In INR Crores) | 2,42,745 |

| 52 Week High | INR 2,771 |

| 52 Week Low | INR 2,163 |

| P/E Ratio (x) | 75 |

Financial Highlights of Nestle India Limited

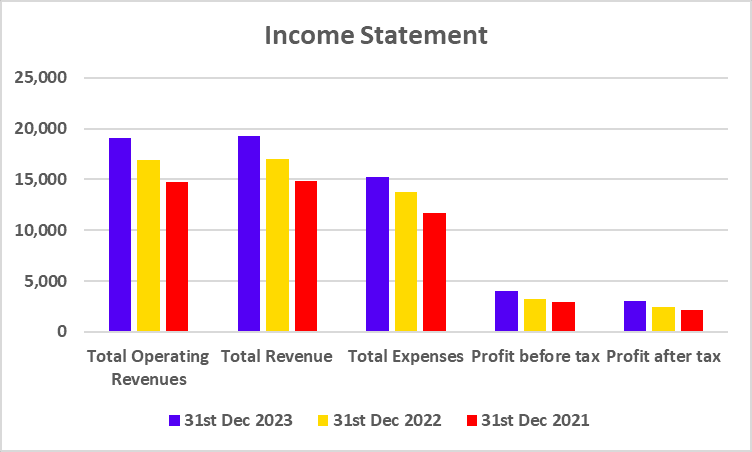

Income Statement

| Particulars | 31st Dec 2023 | 31st Dec 2022 | 31st Dec 2021 |

|---|---|---|---|

| Total Operating Revenues | 19,126 | 16,897 | 14,709 |

| Total Revenue | 19,248 | 16,998 | 14,830 |

| Total Expenses | 15,204 | 13,742 | 11,709 |

| Profit before tax | 4,038 | 3,256 | 2,884 |

| Profit after tax | 2,999 | 2,391 | 2,145 |

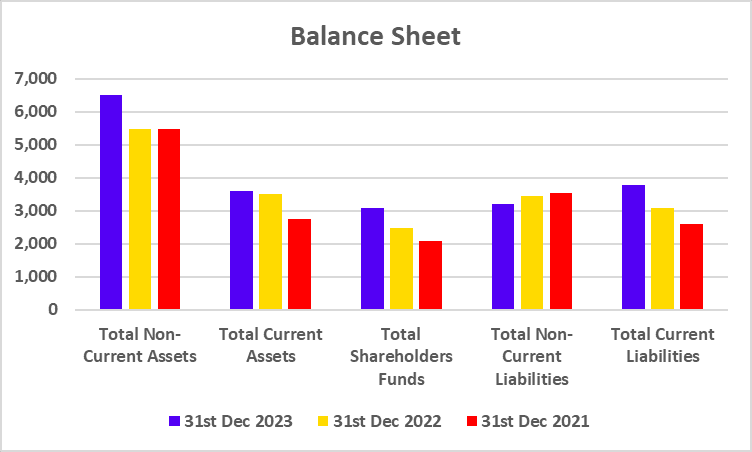

Balance Sheet

| Particulars | 31st Dec 2023 | 31st Dec 2022 | 31st Dec 2021 |

|---|---|---|---|

| Total Non-Current Assets | 6,500 | 5,489 | 5,471 |

| Total Current Assets | 3,594 | 3,490 | 2,739 |

| Total Shareholders Funds | 3,093 | 2,459 | 2,084 |

| Total Non-Current Liabilities | 3,211 | 3,440 | 3,522 |

| Total Current Liabilities | 3,791 | 3,080 | 2,603 |

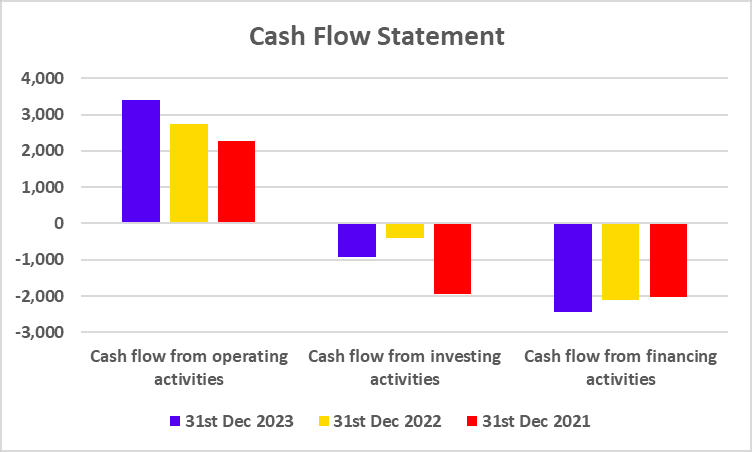

Cash Flow Statement

| Particulars | 31st Dec 2023 | 31st Dec 2022 | 31st Dec 2021 |

|---|---|---|---|

| Cash flow from operating activities | 3,392 | 2,737 | 2,271 |

| Cash flow from investing activities | -926 | -391 | -1,957 |

| Cash flow from financing activities | -2,436 | -2,122 | -2,018 |

Key Performance Indicators (KPIs)

| Particulars | 31st Dec 2023 | 31st Dec 2022 | 31st Dec 2021 |

|---|---|---|---|

| Operating Profit Margin (%) | 21.76 | 20.18 | 22.58 |

| Net Profit Margin (%) | 15.67 | 14.14 | 14.58 |

| Return on Net Worth/Equity (%) | 96.95 | 97.20 | 102.89 |

| Return on Capital Employed (%) | 66.04 | 57.81 | 59.24 |

| Current Ratio | 0.95 | 1.13 | 1.05 |

| Debt to Equity Ratio | 0.01 | 0.01 | 0.02 |

Read Also: Britannia Industries Ltd Case Study: Business Segments, KPIs, Financials, and SWOT Analysis

SWOT Analysis of Nestle India Limited

Strength

- Global Presence – With a significant presence in more than 190 countries, the company is regarded as the most well-known firm in the FMCG sector.

- Variety:- Nestle is not dependent on one product as it has numerous brands with billions of dollars in annual sales.

- Research – The business makes significant investments in product R&D, enabling it to adjust to the shifting customer preferences.

Weaknesses

- Product Pricing – The company could lose market share because it caters to a higher-end consumer base.

- Supply Chain – Due to the intricate nature of the company’s distribution system, any disruption in the supply chain may affect the company’s earnings.

- Product Criticism – The company’s product has been criticized for quality issues recently.

Opportunities

- Technological Advancement – The corporation will be able to lower production costs by integrating digital technologies into the business processes.

- Product Diversification – Since consumers are becoming health conscious, the corporation can add healthier products to its lineup.

- E-Commerce – E-commerce platforms allow the business to boost digital or online sales.

Threat

- Competition – The price war between businesses can lower the company’s profit margin.

- Economic Downturn – Any downturn in the economy will result in less demand for their products, which will immediately affect the company’s sales and earnings.

- Changing Consumer Preferences – Consumer preferences are ever-evolving; therefore, if a business cannot adapt, it will lose customers.

Conclusion

In summary, Nestle India is a leading fast-moving consumer goods (FMCG) company in India that provides a wide range of products to meet the demands of its clients. The business is present in more than 190 countries worldwide. NESTLE is working to enhance its product line, but it has already experienced some negative feedback from customers regarding the quality of its products. Even if the company has a bright future, you should speak with your investment advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Elcid Investments – India’s Costliest Stock |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | Zara Case Study |

Frequently Asked Questions (FAQs)

Who is the Chairman and Managing Director of Nestle India Ltd.?

Suresh Narayanan is the company’s current Chairman and Managing Director (CMD).

Is Nestle India a good stock to buy?

Nestle India’s global presence and diverse product range give it a competitive edge, but investing in this stock involves a number of other risks, including changing customer preferences, price competition, etc. Investors should carefully assess their risk tolerance and speak to a financial advisor before making any decisions.

Where is Nestle India headquartered?

The headquarters of Nestle India is situated in Gurgaon.

Is Nestle India a profitable company?

The business has been consistently profitable for the previous three years, and its profits are consistently rising.

In what ratio is the share of Nestle India split?

In 2024, the management of Nestle India approved a stock split in a 1:10 ratio, meaning that one share with a face value of INR 10 would be divided into ten shares with a face value of INR 1 for each equity share.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.