| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-05-24 | |

| Update Content | Nisha | Mar-21-25 | |

| Infographic Update | Ranjeet Kumar | Apr-03-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Blog

- ola case study business model financials and swot analysis

Ola Electric Case Study: Business Model, Financials, and SWOT Analysis

India is witnessing a silent revolution on its streets. Electric two-wheelers (E2Ws) are zooming past conventional scooters, driven by a surge in eco-consciousness and government incentives. At the forefront of this change is Ola Electric, a young company with a bold vision.

In today’s blog, we will dive deep into the story of Ola Electric and explore the company’s business model, challenges, strengths, etc.

Buckle up and read how Ola Electric is paving the way for a greener tomorrow.

Ola Overview

Ola is a ride-hailing company that connects customers with drivers and vehicles. It is India’s largest mobility platform and serves over 250 cities across India, Australia, and New Zealand. Ola was founded in 2010 by IIT graduates Bhavish Aggarwal and Ankit Bhati. They both previously started an online trip-planning company called Olatrip.com. They aimed to bridge the gap between cab owners and commuters and make hailing cabs a smooth experience. In January 2011, recognising the growing demand for cab services, Ola was launched as a taxi aggregation firm. Initially, bookings were made via phone calls. However, in 2012, Ola introduced its mobile app, making it even more convenient for users to book rides.

Currently, the company has the biggest market share in the Indian ride-hailing space. Over the years, Ola has expanded its services beyond car booking. Today, Ola has also ventured into the electric vehicle market with Ola Electric, a subsidiary focused on sustainable transportation solutions.

Ola Electric

The products offered by Ola Electric include Ola S1 scooter models—Ola S1 Pro, Ola S1 Air, Ola S1 X+, Ola S1 X (2 kWh), and Ola S1 X (3 kWh), which are built on the current EV scooter Generation 3 platform. Compared to the Generation 2 platform, the Generation 3 platform improves several important aspects of the EV scooters, including motor power, battery performance, range, acceleration, and speed.

The current line of third-generation EV scooters includes,

- Ola S1 Pro+ – flagship premium EV scooter offers an extended driving range of up to 320 km, a top speed of 141 km/h.

- Ola S1 Air – second premium EV scooter offering a driving range of 151 km with a 6 kW peak motor power.

- Ola S1 X+ – sold at a lower price than the Ola S1 Pro+, the Ola S1 X+ features a driving range of 242 km and a top speed of 125 km/h.

The company also intends to apply the same platform strategy to its recently unveiled motorbike lineup, which consists of Roadster X+, Roadster X and Roadster. Moreover, the company plans to launch new bikes based on Diamondhead, Adventure, and Cruiser models in 2025 and 2026.

Furthermore, with the help of the Ola Electric website and the company’s digitally enabled pan-Indian sales and service network, the products are sold through a D2C omnichannel strategy. Consumers have two options for buying the Ola EV scooters – they can order them via the Ola Electric website or visit one of the nearest centres, where staff members will let them view and test drive the EV scooters before placing an order. The company guarantees a seamless ownership and post-purchase servicing experience through the widespread network.

Read Also: Ather Energy Case Study: Business Model, Financials, and SWOT Analysis

Business Model of Ola Electric

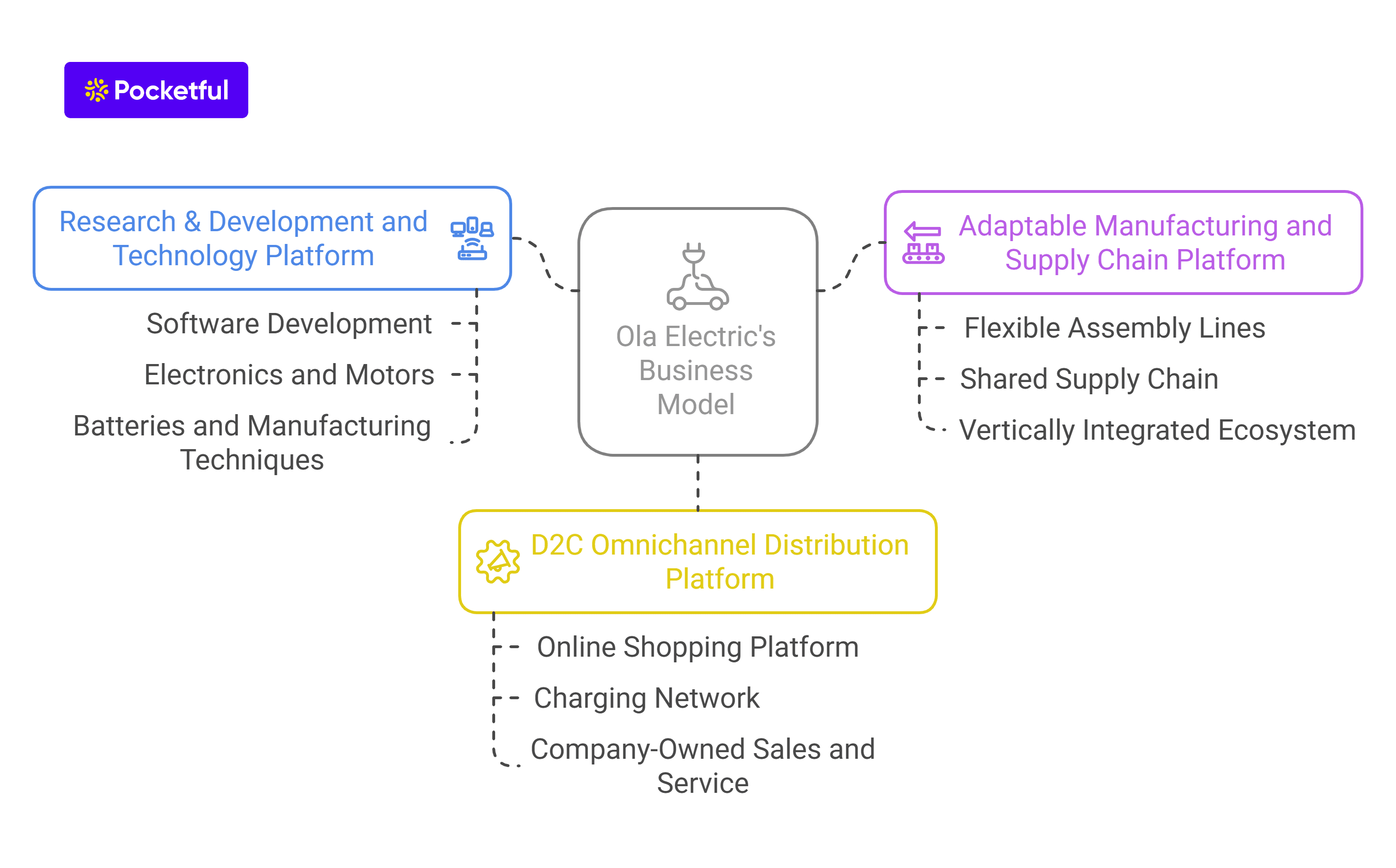

The Ola Electric Business Model is based on three key scalable platforms:

- Research & Development and Technology Platform – This encompasses Ola Electric’s in-house development of core technologies like software (MoveOS), electronics, motors, batteries and even manufacturing techniques. This gives them greater control over the entire process, including products and costs, which eventually helps develop different EV models.

- Adaptable manufacturing and supply chain platform – This comprises flexible assembly lines, a robust and shared supply chain emphasising co-location and localisation, and a vertically integrated manufacturing ecosystem across fundamental EV components, including battery packs, motors, and vehicle chassis. This platform also helps the company reduce costs, maximize capital expenditure on developing its EVs, and increase its manufacturing capacity.

- D2C omnichannel distribution platform – consists of an online shopping platform, a charging network, and an integrated company-owned sales and service network. All of the company’s current EV models—the Ola S1 Pro, S1 Air, and S1 X+—are distributed, sold, and serviced on the same platform, and they can all be charged on the same network of charging stations.

The company’s model is vertically integrated across R&D and technology, manufacturing, supply chain, sales and service, and charging facilities.

Market Information of Ola Electric Mobility Ltd.

| Current Market Price | ₹56 |

| Market Capitalization (in ₹ Crores) | 24,701 |

| 52 Week High | ₹158 |

| 52 Week Low | ₹46.3 |

| ROCE (%) | -32.1% |

| Face Value | ₹10 |

Read Also: Vedanta Case Study: Business Model, Financial Statement, SWOT Analysis

SWOT Analysis of Ola Electric

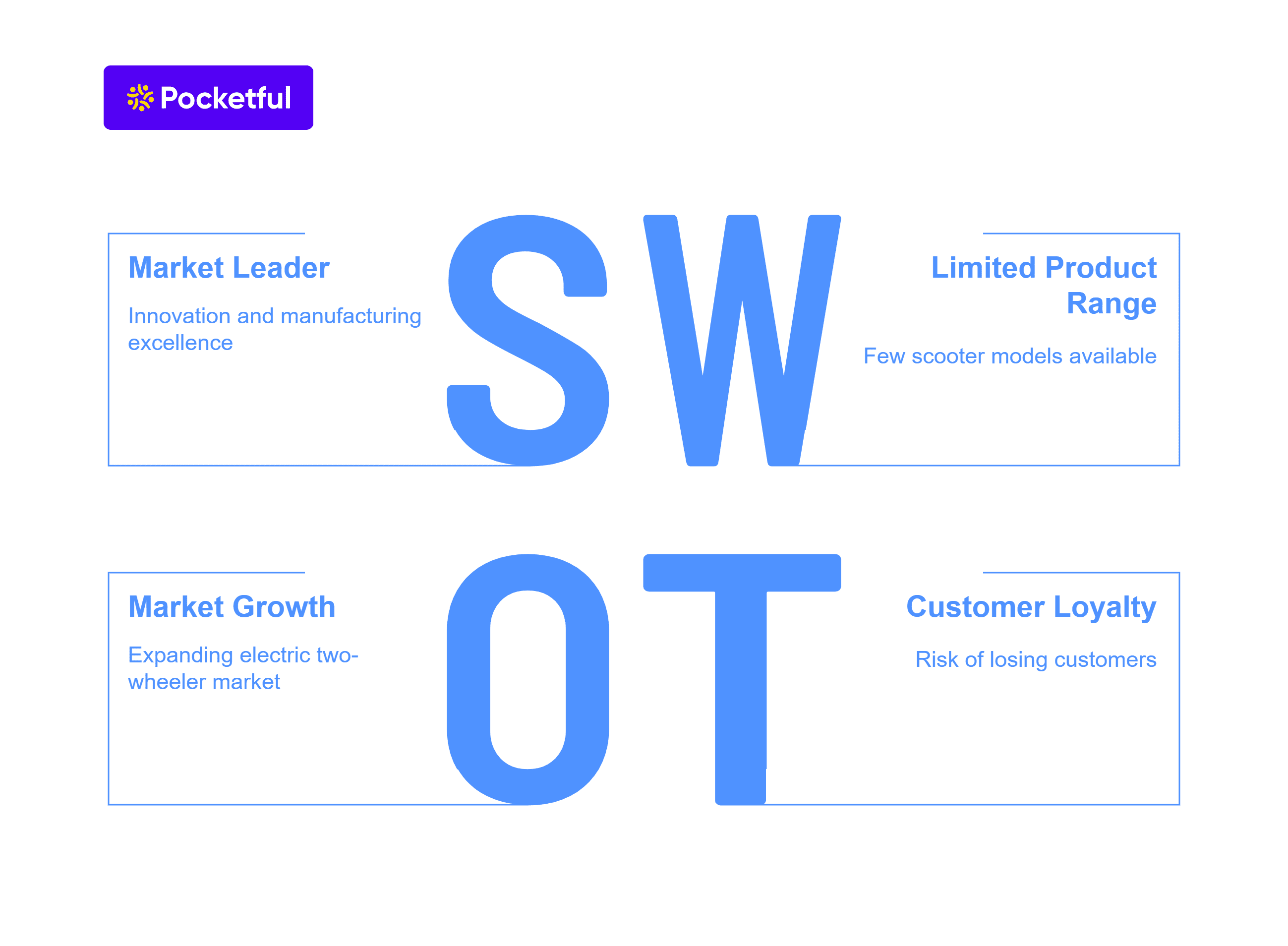

The Ola Electric SWOT Analysis reveals the company’s strengths in innovation and manufacturing, while highlighting weaknesses like limited product range and potential service challenges.

Strengths

- Ola is leading the rapidly expanding electric two-wheeler market in India; Ola Electric is a pure EV player and a major force in the country’s electric vehicle landscape.

- Driven by a visionary founder, the company benefits from a team of seasoned leaders and has received several accolades, such as India 30 under 30 from Forbes India in 2014 and Entrepreneur of the Year from the Economic Times in 2017

- The company’s emphasis on R&D drives its internal capacity to create EV technology. Ola also conducts research and development (R&D) in the US, the UK, and India to develop innovative EV goods and essential EV parts, including motors, battery packs, and vehicle chassis.

- Ola has the biggest integrated and automated E2W manufacturing plant in India in terms of production capacity, and most of its EV components give them enhanced control of the supply chain.

Weaknesses

- Currently, Ola Electric offers just a few scooter models, which might limit their appeal to a broader customer base with diverse needs.

- Building a robust service and after-sales network across India can take time and resources.

- Some initial batches of Ola scooters faced quality concerns. If not addressed effectively, this can damage the brand reputation and customer trust.

Opportunities

- The Indian electric two-wheeler market is projected to grow significantly in the coming years. This presents a big opportunity for the company to capture a large market share.

- Ola Electric can explore expanding its product range to cater to different segments, like high-performance electric scooters or motorcycles.

- It can also explore opportunities for vertical integration, such as setting up battery manufacturing facilities, to control costs and ensure supply chain resilience.

Threats

Failure to capture and retain a loyal customer base could severely impact the business in all aspects.

The company is in the early stages of development. It lacks the extensive track record of more established players in the market. Adding fuel to fire, its operations have resulted in accumulated losses and a negative cash flow.

Read Also: Asian Paints Case Study: Business Segments, KPIs, Financials, and SWOT Analysis

Financial Highlights of Ola Electric

Income Statement

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Income | 5,243 | 2,782 | 456 |

| Total expenses | 6,641 | 4,146 | 1,222 |

| EBIT | -1,397 | -1,364 | -766 |

| Net Profit | -1,584 | -1,472 | -784 |

(Above mentioned figures are in INR Crores unless stated otherwise)

Balance Sheet

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Current Assets | 4,047 | 3,450 | 4,064 |

| Non-Current Assets | 3,689 | 2,124 | 1,332 |

| Current Liabilities | 4,008 | 2,351 | 1,157 |

| Non-Current Liabilities | 1,708 | 866 | 578 |

(Above mentioned figures are in INR Crores unless stated otherwise)

Cash Flow Statement

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating Activities | -633 | -1,507 | -884 |

| Cash Flow from Investing Activities | -1,136 | -318 | -1,321 |

| Cash Flow from Financing Activities | 1,589 | 658 | 3,084 |

(Above mentioned figures are in INR Crores unless stated otherwise)

Inferences that can be drawn from the above statements are as follows

- Revenue of the company significantly increased by 88% to ₹5,243 crores compared to ₹2,782 crores in FY 2023.

- Net Loss also increased from about ₹1,472 crores in FY 2023 to ₹1,584 crores in FY 2024 .

- Since the company is burning cash heavily, they are relying on capital financing to cover operational costs.

Future Outlook

Ola Electric is poised for significant growth as India’s electric vehicle (EV) market expands. With a strong focus on innovation, vertical integration, and a robust manufacturing ecosystem, the company is well-positioned to capture a larger share of the two-wheeler market. As demand for eco-friendly mobility solutions increases, Ola Electric’s expansion into electric motorcycles and further product diversification could fuel its success. However, the company must address challenges related to quality control, service infrastructure, and competition from established automobile giants. By overcoming these hurdles, Ola Electric can lead India’s transition to sustainable transportation, driving long-term growth and profitability.

Conclusion

Ola has emerged as a significant player in the Indian ride-hailing and electric two-wheeler market. The company is well-positioned to capitalize on the future growth in both these sectors. However, they face challenges like limited product range, a nascent service network, and intense competition from competitors.

Addressing these weaknesses alongside navigating external threats like price moderation, battery technology, and charging infrastructure will be important for the company’s long-term success. Their strategic decisions and ability to adapt to market dynamics will determine their ultimate performance.

Frequently Asked Questions (FAQs)

What is Ola known for?

Ola is known across India as a ride-hailing service and a leading manufacturer of electric two-wheeler scooters.

When was Ola Electric listed?

Ola Electric was listed on 9 August 2024.

Which companies are Ola’s competitors?

Ola faces tough competition in ride-hailing services from companies like Rapido, InDrive, and Uber. It also faces competition from established automobile companies like Bajaj, Hero Motocorp, Honda, etc in the automobile sector.

Is Ola-Electric a new company?

While Ola Cabs has been around since 2010, Ola Electric, its electric vehicle subsidiary, is a relatively new player.

Who is the founder of Ola?

The founders of Ola are Bhavish Aggarwal and Ankit Bhati.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle