| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-11-24 |

- Blog

- pnb vs bank of baroda

PNB Vs Bank of Baroda: Which is Better?

Choosing between the shares of PNB and Bank of Baroda (BoB) has been a tough call for many investors. While PNB boasts a wider network and customer base, BoB is a potent player across borders due to its innovative use of modern technology.

In this blog, we will discuss their financial health, growth potential, and risk factors to aid investors in choosing which stock better fits their goals amid evolving market dynamics and economic conditions.

Punjab National Bank Overview

Punjab National Bank is one of the oldest and largest public sector banks in India, set up in 1894. The bank, established in Lahore by the great national leader, Lala Lajpat Rai, has spread over a vast area with a substantial all-India network of over 10,000 branches and 13,000 plus ATMs and serves over 180 million customers. Its legacy includes surviving the partition of India in 1947 and several mergers, the most notable being those with Oriental Bank of Commerce and United Bank of India in the year 2020, which put it on its way to becoming the second-largest public sector bank in the country.

At PNB, the business model focuses on universal banking, which comprises a wide range of products and services encompassing retail, corporate, international, and treasury segments. Other retail banking services include savings and current accounts, fixed deposits, home and auto loans, and credit cards. Term loans, cash management, trade finance, and other services are also available to corporate customers.

Punjab National Bank has substantial assets and is focusing on aggressively enhancing its digital channels through mobile banking, internet banking, and payment wallets. The bank has an international footprint through branches in countries like the UK, Hong Kong, and Dubai, mainly for trade finance and remittances.

Bank Of Baroda Overview

Bank of Baroda, set up on 20th July 1908 by the Maharaja Sayajirao Gaekwad III in Vadodara, Gujarat, is among the biggest PSBs in India. BoB has over 115 years of legacy and has grown to serve more than 153 million customers globally through a huge network of more than 8,200 domestic branches and more than 11,600 ATMs, with 96 overseas offices in more than 17 countries. It finally merged with Vijaya Bank and Dena Bank in 2019 to further consolidate its market position and emerge as the third-largest bank in India in terms of assets.

BoB is working on the universal banking model with a complete range of products and services across retail, corporate, international, treasury, and rural banking. It offers retail customers various services, including savings and current accounts, fixed deposits, home and personal loans, credit cards, and insurance. For corporate clients, BoB offers working capital loans, project finance, cash management, and trade finance.

With its substantial assets, BoB is increasingly working to achieve digital transformation and improve mobile banking, internet banking, and other miscellaneous digital payment solutions. BoB is a big player in the Indian banking industry, having a huge footprint across the globe with diversified service offerings and a strong focus on expanding digital and international banking services.

Company’s Comparative Study

| Particular | Punjab National Bank | Bank of Baroda |

|---|---|---|

| Current Share Price | INR 116 | INR 251 |

| Market Capitalization (in INR Crores) | 1,27,948 | 1,30,034 |

| 52 Week High Price | INR 143 | INR 300 |

| 52-Week Low Price | INR 62.5 | INR 186 |

| FIIs Holdings (%) | 5.51 | 11.45 |

| DIIs Holdings (%) | 10.76 | 16.03 |

| Book Value per Share | INR 100 | INR 231 |

| PE Ratio (x) | 10.9 | 6.84 |

Read Also: Bank of Baroda vs SBI

Financial Statements Comparison

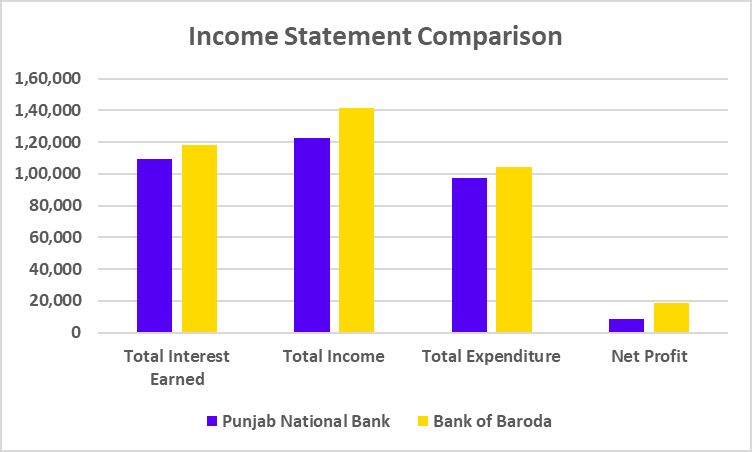

Income Statement Comparison (FY 2024)

| Particular | Punjab National Bank | Bank of Baroda |

|---|---|---|

| Total Interest Earned | 1,09,064 | 1,18,379 |

| Total Income | 1,22,394 | 1,41,778 |

| Total Expenditure | 97,343 | 1,04,174 |

| Net Profit | 8,329 | 18,471 |

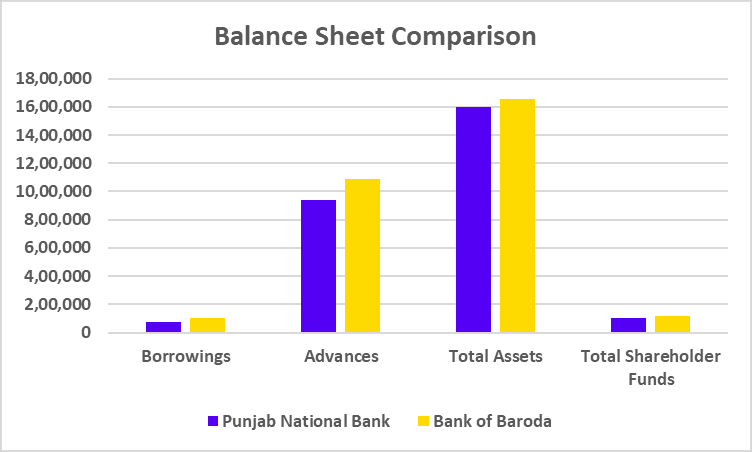

Balance Sheet Comparison (FY 2024)

| Particular | Punjab National Bank | Bank of Baroda |

|---|---|---|

| Borrowings | 72,585 | 1,01,959 |

| Advances | 9,41,762 | 10,88,983 |

| Total Assets | 15,98,635 | 16,54,779 |

| Total Shareholder Funds | 99,878 | 1,18,676 |

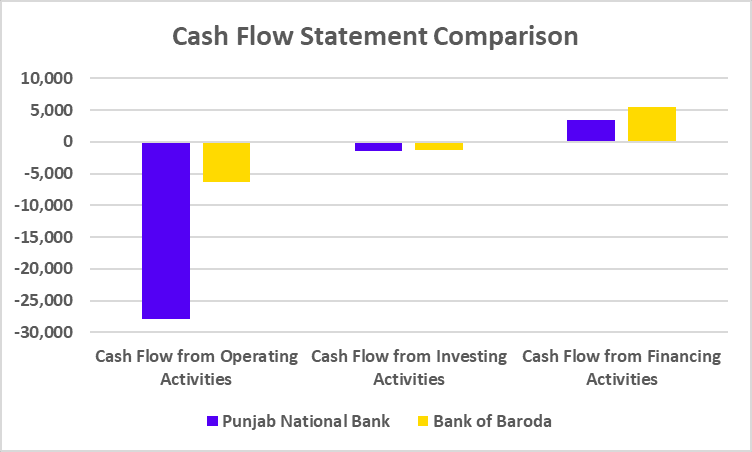

Cash Flow Statement Comparison (FY 2024)

| Particular | Punjab National Bank | Bank of Baroda |

|---|---|---|

| Cash Flow from Operating Activities | -27,939 | -6,273 |

| Cash Flow from Investing Activities | -1,506 | -1,285 |

| Cash Flow from Financing Activities | 3,517 | 5,475 |

Key Performance Indicators

| Particular | Punjab National Bank | Bank of Baroda |

|---|---|---|

| Net Interest Margin (%) | 2.53 | 2.92 |

| ROE (%) | 8.92 | 15.67 |

| Capital Adequacy Ratio (%) | 16.00 | 16.31 |

| Dividend Yield | 1.29 | 3.02 |

Read Also: PNB vs SBI

Conclusion

From the comparison between Punjab National Bank and Bank of Baroda, it is found that both banks have an extensive network and strong market presence. However, the Bank of Baroda has a slightly higher net interest margin and significantly higher dividend yield than Punjab National Bank. However, both banks are facing asset quality problems and regulatory issues. Investors are always advised to consult a financial advisor prior to making any investment in the stock market.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | HDFC Bank vs Axis Bank |

| 2 | SBI vs ICICI Bank |

| 3 | Bank of Baroda vs Canara Bank |

| 4 | HDFC vs SBI |

| 5 | Axis Bank vs ICICI Bank |

Frequently Asked Questions (FAQs)

How does PNB differ from BoB from a digital banking perspective?

Both banks are investing heavily in digital banking; however, BoB is well underway in its digital transformation journey with comprehensive mobile and internet banking solutions as compared to PNB.

How do PNB and BoB differ in terms of international operations?

BoB has a much larger international presence than PNB, with 96 overseas offices in 17 countries, while the latter has only two international branches.

Bank of Baroda or PNB, which bank is more digitally active?

Bank of Baroda is more digitally active and aggressively expanding its presence in digital banking channels and solutions than PNB.

How about their branch networks?

The domestic branch network of PNB is over 10,000 branches, whereas BoB operates more than 8,200 branches across India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.