| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-02-24 | |

| Add new links | Nisha | Mar-04-25 |

- Blog

- procter gamble case study

Procter & Gamble Case Study: Business Model, Financial Statements, And SWOT Analysis

Procter & Gamble Hygiene and Health Care, a subsidiary of Procter & Gamble, has played a vital role in the evolution of hygiene standards in India. This blog aims to present a complete case study on P&G Hygiene and Health Care Ltd., including a company overview, business model, and products it provides.

Procter & Gamble Hygiene & Health Care Ltd. Overview

Procter & Gamble Hygiene & Health Care Limited, an Indian subsidiary of US-based multinational company P&G, was incorporated on 20 July 1964 and is headquartered in Mumbai. The company operates in the FMCG sector in India, and its core operations are manufacturing and selling packaged FMCG products like feminine hygiene and health care products. The company has created a reputation for selling high-quality products to meet the ever-changing needs of consumers. P&G Hygiene and Health Care is one of the best FMCG companies in India.

Business Model of Procter & Gamble Hygiene and Health Care Ltd

Procter & Gamble Hygiene and Health Care Ltd. operates a very robust business model centred around product innovation, brand strength, and wide distribution. This results in the company generating revenue through personal care products, such as sanitary napkins, healthcare items, and beauty products, which amount to around 70% of the sanitary protection segment.

Strong brand loyalty and a portfolio of brands like Whisper and Vicks have contributed to its stable revenues. The company uses both conventional retail channels and e-commerce platforms. This helps ensure a very large outreach and accessibility for consumers across all strata of urban and rural society, further strengthening overall sales performances.

Products Portfolio of Procter & Gamble Hygiene and Health Care Ltd

The company operates in two segments: Health care products and Hygiene products. The hygiene products segment consists mainly of feminine hygiene products and other skin care hygiene products, whereas the health care segment comprises ointments and creams, cough drops and tablets, etc.

As of 2024, the company portfolio includes some very familiar brands such as Whisper, with more than 25% market share in sanitary napkins and Vicks, a popular healthcare product. The beauty segment includes Olay, while Gillette products cover the grooming segment. With over 40 different items in various categories, the company has a wide customer base. The company has such a big customer base mainly due to the firm’s line of women’s hygiene, oral care, and health supplements. P&G’s focus on quality and innovation helps the company build a loyal consumer base.

Market Details of Procter & Gamble Hygiene and Health Care

| Current Market Price | INR 16,579 |

| Market Capitalization (In Crores) | INR 53,816 |

| 52 Week High | INR 19,250 |

| 52 Week Low | INR 15,306 |

| Book Value | INR 239 |

| P/E Ratio (x) | 79.7 |

Read Also: Case Study on Procter & Gamble Marketing Strategy

Financial Statements of Procter & Gamble Hygiene and Health Care Ltd

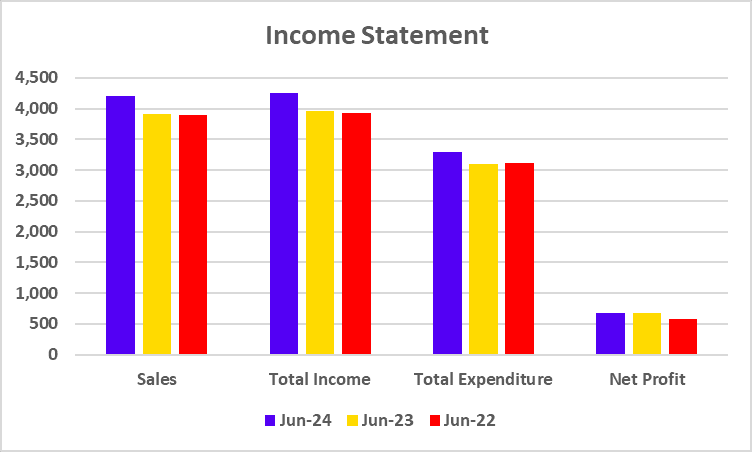

Income Statement

| Particulars | June 2024 | June 2023 | June 2022 |

|---|---|---|---|

| Sales | 4,205 | 3,917 | 3,900 |

| Total Income | 4,257 | 3,958 | 3,925 |

| Total Expenditure | 3,291 | 3,107 | 3,123 |

| Net Profit | 675 | 678 | 575 |

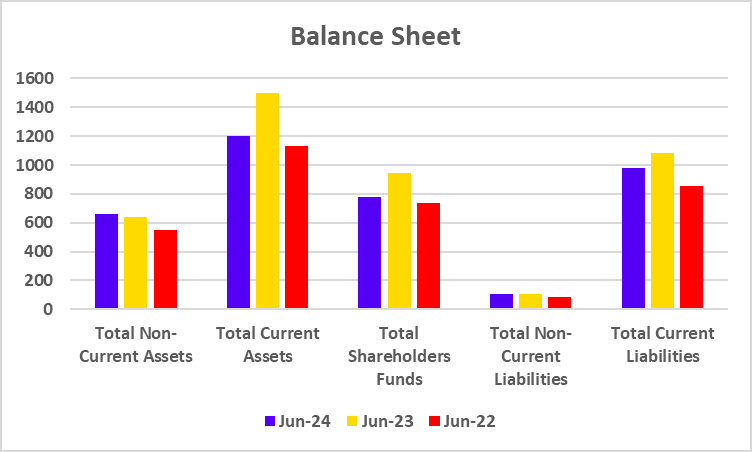

Balance Sheet

| Particulars | June 2024 | June 2023 | June 2022 |

|---|---|---|---|

| Total Non-Current Assets | 659 | 642 | 547 |

| Total Current Assets | 1,200 | 1,496 | 1,134 |

| Total Shareholders Funds | 775 | 946 | 738 |

| Total Non-Current Liabilities | 103 | 106 | 86 |

| Total Current Liabilities | 981 | 1,085 | 858 |

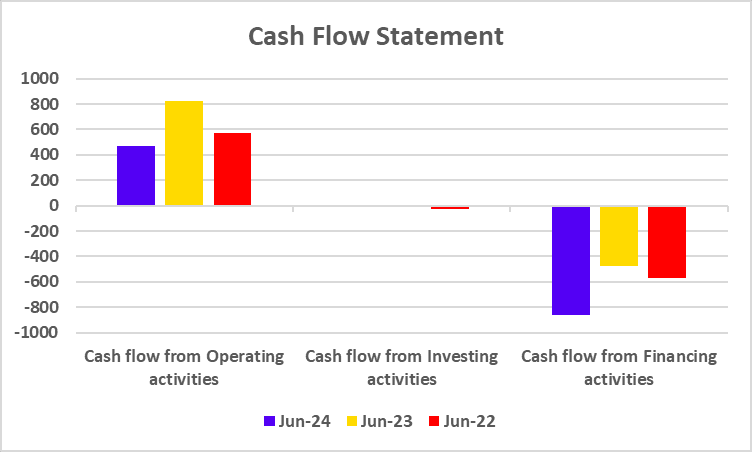

Cash Flow Statement

| Particulars | June 2024 | June 2023 | June 2022 |

|---|---|---|---|

| Cash flow from Operating activities | 471 | 825 | 573 |

| Cash flow from Investing activities | 1 | -9 | -26 |

| Cash flow from Financing activities | -862 | -477 | -568 |

Key Performance Indicators (KPIs)

| Particulars | June 2024 | June 2023 | June 2022 |

|---|---|---|---|

| Net Profit Margin (%) | 16.05 | 17.30 | 14.75 |

| Return on Equity (%) | 87.11 | 71.68 | 78.06 |

| Return on Capital Employed (%) | 110.03 | 80.85 | 97.31 |

| Current Ratio (X) | 1.22 | 1.38 | 1.32 |

| EV/EBITDA (x) | 52.19 | 49.99 | 50.19 |

SWOT Analysis of Procter & Gamble Hygiene and Health Care Ltd

Strength

- Strong Portfolio of Brands: P&G has a broad portfolio of well-known brands around the world, like Whisper and Vicks, that command significant market shares.

- Robust R&D Capabilities: The company spends a great amount on R&D, which supports new ideas and the creation of new and better products for its end-users.

Weakness

- High Operational Costs: Due to intense competition in these segments, they are experiencing high production and distribution costs, which may affect performance.

- Dependence on Mature Markets: Developed countries account for a large portion of P&G’s sales, which makes it susceptible to economic instability in those countries.

Opportunities

- Changing Health Constraints: A higher degree of knowledge of hygiene and health will lead to more consumers seeking health-related P&G products.

- Expansion in Emerging Markets: Emerging regions are commonly characterized by increased disposable income and, therefore, present a growth opportunity for P&G.

Threats

- Regulatory Hurdles: Product safety and environmental concerns have a lot of regulatory rules associated with them that P&G must follow. Strict regulations result in high operating costs and make product development more complex.

- Changing Consumer Behaviour: Consumer shifts toward natural and organic products can threaten the existing product lines of the company.

Read Also: Gillette India Case Study: Business Model, SWOT Analysis, and Financial Overview

Conclusion

Procter & Gamble Hygiene and Health Care Ltd. stands out due to its strong portfolios of brands, commitment to innovation, and its direction toward sustainability and e-commerce. Even with such harsh conditions coming in the form of intense competition and economic fluctuations, the strategic focus on sustainability and e-commerce development has helped the company grow significantly over the years. Procter & Gamble is in a very great position to continue as a market leader and constantly looks to reach new consumer bases with improved products.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Case Study on Apple Marketing Strategy |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | D Mart Case Study |

Frequently Asked Questions (FAQs)

How does P&G maintain its product quality?

P&G follows very stringent quality standards through highly advanced research and development as well as aggressive testing on every product.

Is P&G committed to sustainability?

Yes, P&G has a strong commitment towards sustainability. For example, the company aims to use 100% recyclable or reusable packaging by 2030.

What is P&G’s market share in the sanitary napkin category?

P&G has about 25% of the market share in the sanitary napkin category due to its flagship brand, Whisper.

How relevant was P&G’s investment in R&D for the company?

Investments in research and development (R&D) made by P&G led to new product offerings that had positive responses from the market, enhanced customer satisfaction, and strengthened the firm’s competitive advantage.

In what ways did P&G reach out to the consumers regarding the hygiene initiatives?

P&G reached out to consumers by conducting surveys, community programs and social media & feedback pages.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.