| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-09-24 | |

| Update Formatting | Nisha | Mar-04-25 |

- Blog

- punjab national bank vs state bank of india

Punjab National Bank vs State Bank of India

You put in a lot of effort, earned money, and decided to invest it in a public sector bank. However, you aren’t sure which bank to choose—the State Bank of India or Punjab National Bank.

In today’s blog post, we will compare the Punjab National Bank and the State Bank of India.

Punjab National Bank Overview

Lala Lajpat Rai and Dyal Singh Majithia, leaders of the Swadeshi Movement, established the bank in Lahore, Pakistan, in 1894. The bank relocated its headquarters to New Delhi after India’s independence, and it was nationalized along with thirteen other banks later in 1969. It bought Nedungadi Bank in 2003 and merged with the United Bank of India and Oriental Bank of Commerce in 2020 to become India’s second-biggest public sector bank. The bank has 12,645 ATMs, 10,092 branches in India, and two international branches as of September 2023. The Punjab National Bank offers a wide range of services, including credit cards, insurance, mutual funds, fixed deposits, home loans, personal loans, etc. The company caters to the needs of MSMEs, retail investors, and big corporations.

SBI Bank Overview

SBI is India’s largest public sector bank and a titan of the nation’s banking sector, with the largest market share. SBI is a large financial institution with almost 200 years of history. Its main office is in Mumbai. SBI was established when the Bank of Calcutta, the first joint stock bank in British India, was established in 1806. Three separate presidential banks (the Bank of Bengal, the Bank of Bombay, and the Bank of Madras) arose throughout British India. In 1921, the three presidential banks merged to form the Imperial Bank of India. The Imperial Bank of India was nationalized by the Indian government in 1955 and was renamed the State Bank of India. Later, SBI bought several commercial and state-affiliated banks. To improve efficiency, the State Bank of India merged with its five affiliated banks—State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala, and State Bank of Travancore in 2017. Rural communities now have access to banking services due to SBI. SBI currently has a robust distribution network with 65,627 ATMs and 22,405 branches.

Company’s Comparative Study

| Particular | Punjab National Bank | State Bank of India |

|---|---|---|

| Current Share Price | INR 117 | INR 816 |

| Market Capitalization (In INR Crores) | 1,28,355 | 7,27,891 |

| 52-Week High Price | INR 143 | INR 912 |

| 52-Week Low Price | INR 65.5 | INR 543 |

| FIIs Holdings (%) | 5.51 | 11.15 |

| DIIs Holdings (%) | 10.76 | 23.64 |

| Book Value Per Share | INR 100 | INR 465 |

| PE Ratio (x) | 10.9 | 9.99 |

Read Also: PNB vs Bank of Baroda

Financial Statements Comparison

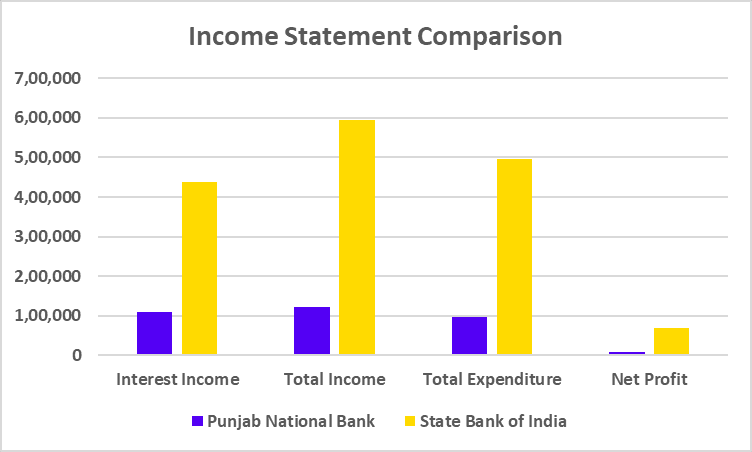

Income Statement Comparison (FY 2024)

| Particular | Punjab National Bank | State Bank of India |

|---|---|---|

| Interest Income | 1,09,064 | 4,39,188 |

| Total Income | 1,22,394 | 5,94,574 |

| Total Expenditure | 97,343 | 4,95,543 |

| Net Profit | 8,329 | 68,224 |

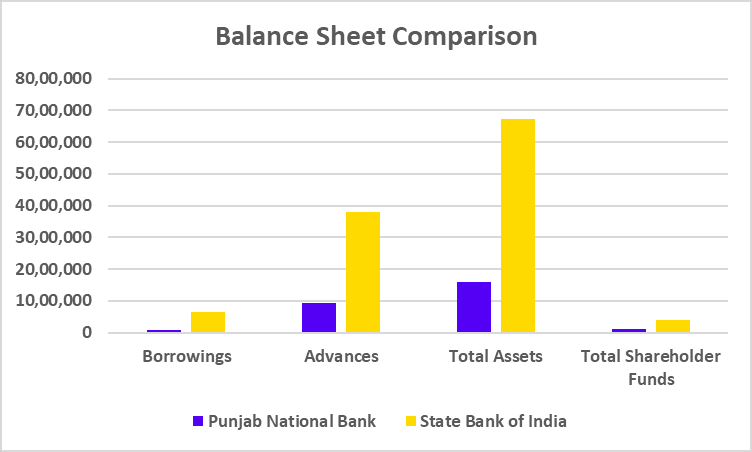

Balance Sheet Comparison (FY 2024)

| Particular | Punjab National Bank | State Bank of India |

|---|---|---|

| Borrowings | 72,585 | 6,39,609 |

| Advances | 9,41,762 | 37,84,272 |

| Total Assets | 15,98,635 | 67,33,778 |

| Total Shareholder Funds | 99,878 | 3,86,491 |

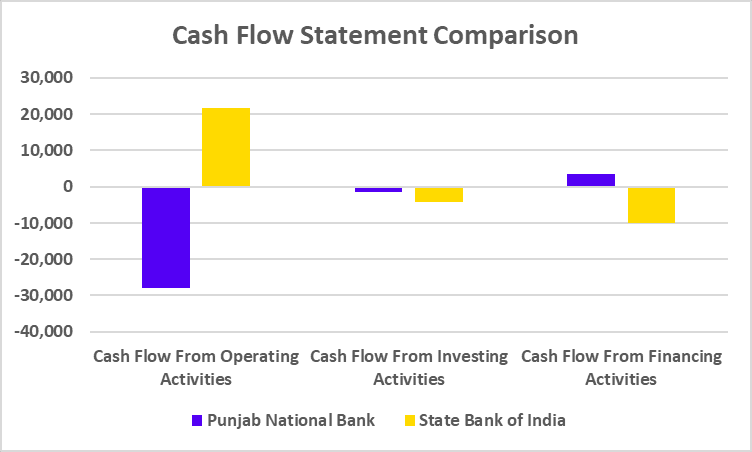

Cash Flow Statement Comparison (FY 2024)

| Particular | Punjab National Bank | State Bank of India |

|---|---|---|

| Cash Flow From Operating Activities | -27,939 | 21,632 |

| Cash Flow From Investing Activities | -1,506 | -4,251 |

| Cash Flow From Financing Activities | 3,517 | -9,896 |

Key Performance Indicators

| Particular | Punjab National Bank | State Bank of India |

|---|---|---|

| Net Interest Margin (%) | 2.53 | 2.66 |

| Net Profit Margin (%) | 7.63 | 15.51 |

| ROE (%) | 8.92 | 17.31 |

| ROCE (%) | 1.60 | 1.63 |

| CASA (%) | 40.22 | 39.92 |

Read Also: SBI vs ICICI Bank

Conclusion

To sum up, the State Bank of India and Punjab National Bank are regarded as major players in the Indian banking sector. An investor can choose the ideal investment opportunity by being aware of the differences between the two. However, one should evaluate their risk tolerance and speak with an investment advisor before making any financial decisions.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | HDFC Bank vs Axis Bank |

| 2 | Bank of Baroda vs SBI |

| 3 | Bank of Baroda vs Canara Bank |

| 4 | HDFC vs SBI |

| 5 | ICICI Vs HDFC Bank |

Frequently Asked Questions (FAQs)

Which bank, the State Bank of India or Punjab National Bank, has a higher market capitalization?

Compared to Punjab National Bank, the State Bank of India has a larger market capitalization.

Where is the headquarters of Punjab National Bank located?

The headquarters of Punjab National Bank is located in New Delhi.

Which bank, SBI or Punjab National Bank, is more profitable?

In FY 2024, SBI reported a profit of 68,224 crores, whereas Punjab National Bank reported a profit of 8,329 crores. This shows that SBI is the more profitable of the two.

How many branches does Punjab National Bank have?

Punjab National Bank has 10,092 branches throughout the country.Q5. Who is the chairman of the

State Bank of India?

As of 31 August 2024, Mr. Challa Sreenivasulu Setty is the chairman of the State Bank of India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.