| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-03-24 | |

| Add new links | Nisha | Mar-04-25 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- rbi retail direct platform

RBI Retail Direct Platform

Ever wondered how to invest in government securities directly without any intermediary? In this blog, we’ll uncover how you can do this at no cost with a platform launched by India’s central bank.

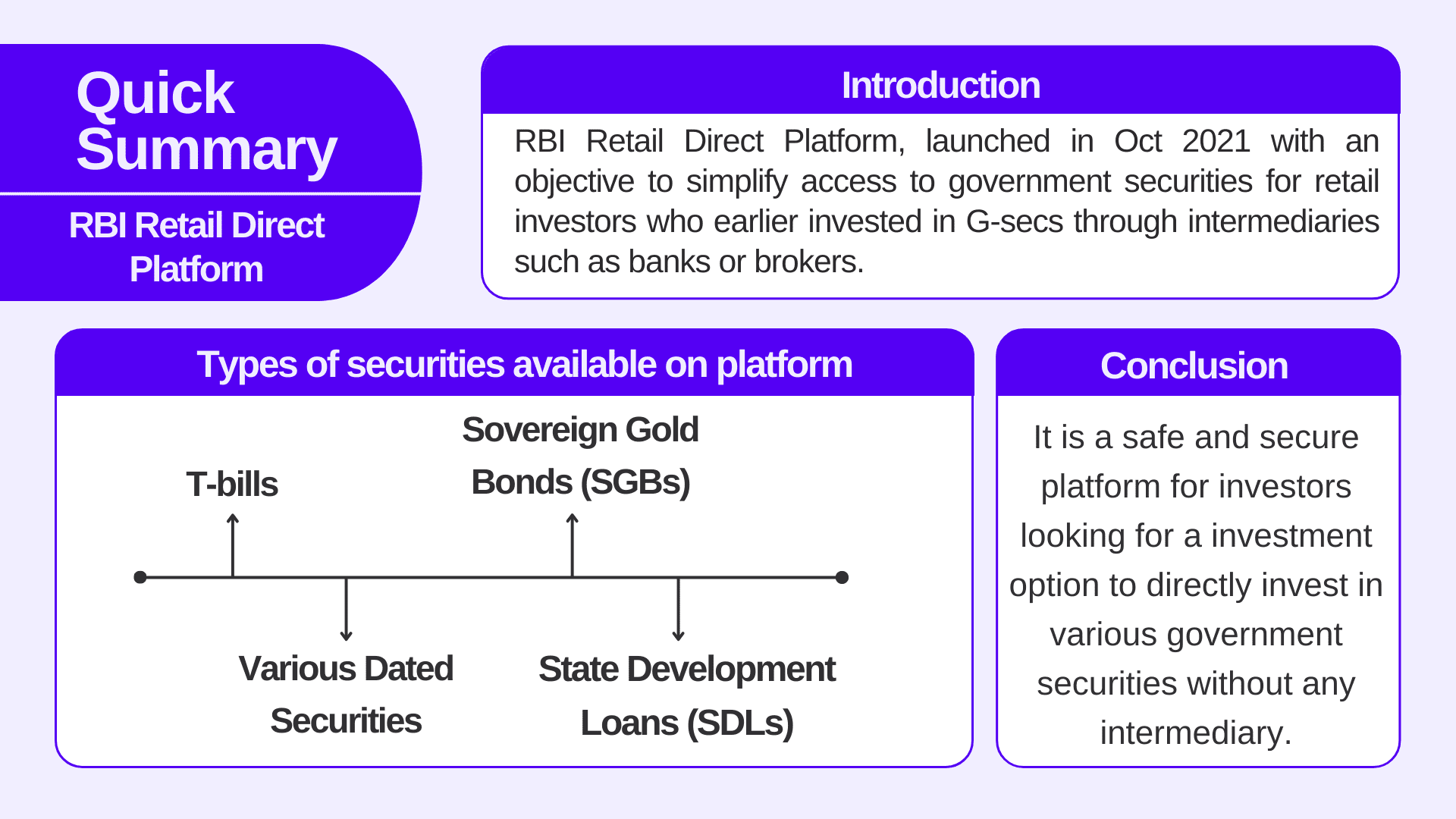

Retail Direct Platform

The Reserve Bank of India (RBI) launched an online platform in October 2021, the RBI Retail Direct Platform. The objective of this platform is to simplify access to government securities for retail investors who earlier invested in G-secs through intermediaries such as banks or brokers.

This scheme allows retail investors to open a Gilt Securities Account – Retail Direct Gilt (RDG). RDG account will allow investors to buy or bid government securities directly in the primary market as well as buy or sell in the secondary market.

Government securities can be a good long-term investment option for retail investors. They are considered the safest instruments as they are backed by the sovereign guarantee.

Any individual who is a natural person with a domestic savings account, a PAN card (permanent account number), any officially valid document for KYC such as aadhar card, a valid email ID, and a registered mobile number can open an RDG account.

Read Also: RBI Action On Kotak Mahindra Bank: Should You Invest?

Types of Securities

Using the RBI Retail Direct Platform, the investor can invest in the following Government Securities:

- Government of India Treasury Bills (T-Bills) – Treasury bills are short-term money market debt instruments. The RBI issues the T-bills in India. Currently, T-bills are available in three maturities – 91 days, 182 days, and 364 days.

- Government of India dated securities (Dated G-secs) – Dated Government securities are a type of bond issued by the government of India. These are debt instruments and maturity of these securities ranges from 5 years to 40 years. The coupon or say interest rate on these securities can be either fixed or floating. There are multiple types of Dated securities: floating rate bonds, fixed rate bonds, zero coupon bonds, inflation indexed bonds, etc.

- State Development Loans (SDLs) – SDLs are dated securities. State governments issue these securities to fund their deficit. SDLs are generally issued for 10 years and Investor receives the interest half-yearly.

- Sovereign Gold Bonds (SGBs) – The RBI issues the SGBs on behalf of the govt. of India. They are denominated in grams of gold. SGBs are alternatives for digital or physical gold. The SGBs will be redeemed on maturity in cash and have a lock-in period of 8 years. Further, apart from capital gains from the increase in gold prices, investors also receive 2.5% interest p.a. on the bond amount.

Dated G-secs, SDLs, and T-Bills are issued in the primary market through auctions executed by the Reserve Bank of India (RBI). An investor, depending upon eligibility, can bid in an auction under Competitive Bidding or Non-Competitive Bidding.

Features / Benefits of Retail Direct Platform

- Easy Access – Investors can easily access and buy/sell Government securities such as treasury bills, Government of India bonds, etc. through the platform.

- Simple to Use – The platform is user-friendly, making it easy for even first-time investors to invest in Government securities.

- Higher Returns – Investors can earn good interest by investing in G-secs through RBI Retail direct platform. SDLs and other long term G-secs generally provide better returns than regular bank FDs.

- No Transaction Fees – The platform does not charge any transaction fee for your investments as there is no intermediary. Further, there is no account opening fee.

- Safe & Secure – RDG is an RBI-backed platform that is completely safe and secure to use.

How to open RDG (Retail Direct Gilt account)

One can easily open an RDG account by following a few simple steps:

- Visit the website and register using the registration link to open an account.

- Enter the details asked such as your name, PAN number, e-mail, address, etc. After that, authentication of mobile number and email address using OTP.

- After completing above steps, KYC verification is needed to be done.

- Once the KYC is complete, choose your nominee as it is mandatory to fill the Nominee details. And you’re done!

Maximum and Minimum Investment Amount

The are minimum and maximum limits in investing via the RBI Retail Direct platform. The maximum and minimum Investment amount through Retail Direct Platform is as follows:

| Security | Minimum Investment Amount | Maximum Investment Amount |

|---|---|---|

| T-Bills | INR 10,000. | The allocation of all non-competitive* bids will be limited to 5% of the total nominal amount of the issue. |

| Government of India dated securities | INR 10,000. | INR 2 crore per security per auction. |

| State Developments Loans (SDLs) | INR 10,000. | 1% of the total amount per auction. |

| Sovereign Gold Bonds (SGBs) | One gram of gold. | Upto 4 kgs of gold. |

*Non-competitive bid in Government securities means a bid that is offered to a retail investor at a discounted rate by the RBI.

Limitations of Investing in RDG

- Compared to other investment platforms, RBI Retail Direct primarily focuses on government securities and lacks diversification. Further, there are limited short term investment options available as most govt. issued securities are of long term maturity.

- The minimum investment amount is INR 10,000, which can be high for individual investors.

- The platform relies on self-directed research and lacks comprehensive research tools.

- Government securities carry various market-related risks such as interest rate risk, i.e., an investor can generate lower or higher returns due to fluctuations in interest prices if they sell their investment before the maturity. However, the credit risk, i.e., loss of capital is almost nil in the govt. securities.

Read Also: How Interest Rate Changes Affect the Stock Market

Conclusion

The RBI Retail Direct Platform is a great initiative by the RBI to promote the inclusion of government securities in the portfolio of a retail investor. It is a safe and secure platform for investors looking for a investment option to directly invest in various government securities without any intermediary.

Frequently Asked Questions (FAQ)

What is the full form of the RDG scheme?

RDG stands for Retail Direct Gilt Scheme.

Mention the government securities an investor can invest in using the RDG scheme.

Treasury Bills, Dated G-secs, State Development Loans (SDLs), etc.

What is the minimum investment amount in T-bills?

The minimum investment amount in T-bills is INR 10,000.

Are govt. securities 100% safe?

No, Govt. securities are not 100% safe; there are various market related risks such as interest rate risk if you sell your investment before maturity.

Who can invest in the Retail Direct Scheme?

Any individual in India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle