| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-26-23 | |

| Update Formatting | Nisha | Mar-12-25 |

- Blog

- relative strength index what is it and how to use it

Relative Strength Index – What Is It And How To Use It?

You have entered into the world of Stock Markets and are looking to sharpen your technical analysis skills. You come across the word “RSI” and wonder what exactly it is. We’ll unravel the knots of RSI in this blog.

If you’re not familiar with this word, RSI stands for Relative Strength Index. It is the most widely used technical indicator to measure the momentum of a security.

RSI was developed by American engineer and technical analyst J. Welles Wilder Jr. in the year 1978. It was introduced in his book “New Concepts in Technical Trading Systems.”

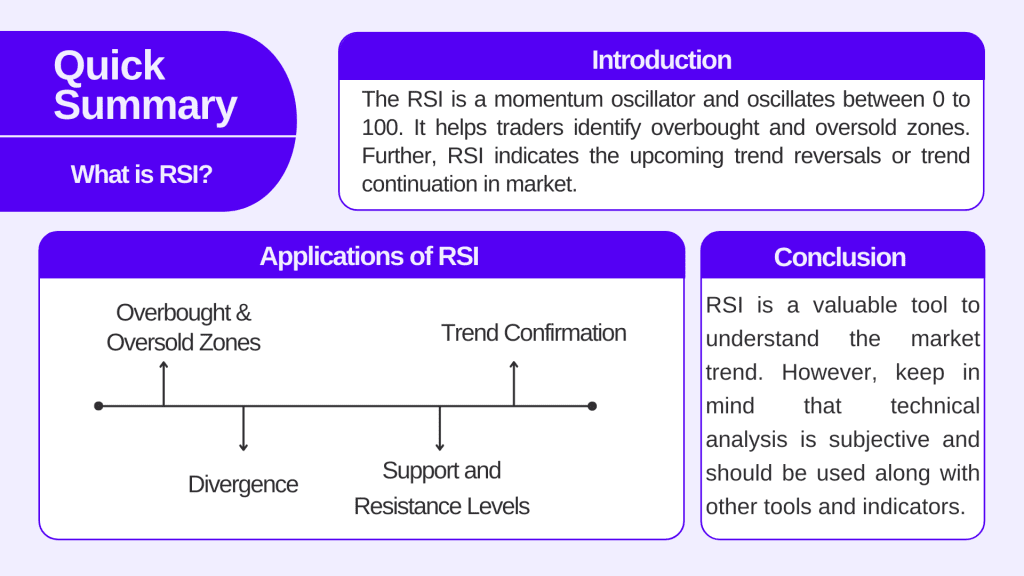

The RSI is a momentum oscillator and oscillates between 0 to 100. Momentum Oscillators help traders identify overbought and oversold zones. In the overbought zone, markets are considered as bullish and bearish in the oversold zone. Further, RSI indicates the upcoming trend reversals or trend continuation in market.

With the help of RSI, traders and technical analysts can make informed decisions in the market.

Calculation of RSI

RSI is calculated using a rolling period of 14 days. The period could be changed as per the suitability. However, the most preferred period is 14 days only.

For each day, calculate the price change, i.e., if the closing price is higher than the previous closing price, calculate the gain, and if the closing price is lower, calculate the loss. Then, calculate the average gain or average loss.

In the last step, calculate the Relative strength (RS) by dividing the average gain by the average loss and calculate the RSI using the formula given below.

RSI = 100 – (100/1+RS)

Don’t get confused by looking at the formula of RSI; charting software will do all the calculations for you.

Formulas:

- Price Change = Today’s Closing Price – Last day’s Closing Price.

- Average Gain = Sum of gains over the given period / Number of days in the period.

- Average Loss = Sum of losses over the period / Number of days in the period.

- Relative Strength (RS) = Average Gain / Average Loss.

How to use RSI

A few applications of RSI are listed below:

1. Overbought & Oversold Conditions

If the value of the RSI is above 70, it is considered that the price of the stock is in the overbought zone and a price correction is expected. In contrast, values of the RSI below 30 indicate that the stock price is in the oversold zone, and a price rebound is expected.

2. Divergence

RSI divergence occurs when the asset price makes higher highs, but RSI makes higher lows and vice versa. RSI and the price of a security move in the opposite direction. This indicates the weakening of the current trend or trend reversal.

Further, Divergence can be of two types:

- Regular Divergence – In regular divergence, the asset price and the RSI move in the opposite direction. Further, regular divergence is classified into bullish divergence and bearish divergence.

- Hidden Divergence – Hidden Divergence occurs when the asset price and the RSI moves in the same direction and the asset price makes a new high or new low, but the high or low on the RSI is in the same direction. Future, hidden divergence is classified into bearish hidden divergence and bullish hidden divergence.

3. Trend Confirmation

RSI is used to confirm the strength of a trend. If the RSI increases along with the price, it indicates a strong uptrend in the asset. On the other hand, if the RSI falls along with the price, it indicates a strong downtrend in the asset.

4. Support and Resistance Level

RSI can be used in combination with support and resistance levels. For example, the stock price is at its resistance level, and the RSI is in the overbought zone, i.e., above 70. This could indicate a trend reversal in the asset from the current level.

Advantages of RSI

- RSI can be applied to multiple financial instruments, including stocks, foreign exchange, cryptocurrencies, etc.

- Traders can customise the look-back period for the RSI calculation based on their preferences.

- RSI confirms the strength of the current trend in the market and can be useful in identifying overbought and oversold zones.

Disadvantages of RSI

- RSI can generate false signals in a sideways market.

- RSI focuses purely on price action and does not take into consideration any other external factor, such as news or other economic events.

- Interpreting the values of RSI is a subjective task. Different traders may have different opinions regarding the zones of RSI.

- RSI is a lagging indicator that reacts to price changes after it happens. This could lead to delayed signals.

Common Mistakes While Using RSI

1. Relying heavily on overbought and oversold zones

The most common mistake that traders make is relying solely on the overbought and oversold zones suggested by the RSI.

2. Ignoring Trend Direction

Traders sometimes forget to consider the overall trend of the market. Their major focus is on the RSI zones and on interpreting these signals. This can lead to poor trading decisions.

3. Impatient Behaviour

Traders may ignore stop losses and make impulsive decisions while focusing on signals generated by the RSI. This increases the risk of significant losses in the market.

Tips for using RSI

- Use RSI in combination with other technical indicators and do not solely rely on signals generated by RSI. Keep yourself updated about the upcoming news and corporate events that could affect the price of the asset.

- Before getting into any trade, analyse the RSI on different timeframes to get a better view of the market.

- Use RSI only as a trend confirmation tool to identify the current market trend.

- Be cautious about the false signals generated by RSI.

Read Also: Top Indicators Used By Intraday Traders In Scalping

Conclusion

We have un-winded the RSI, a widely used and valuable technical indicator. The concept of RSI is easy to understand the market trend. One can use RSI indicator across different financial instruments like cryptocurrencies, forex, etc.

However, it’s essential to remember that technical analysis is subjective and RSI should be used along with other tools and indicators for more comprehensive decision-making.

Frequently Answered Questions (FAQs)

Who developed RSI?

J. Welles Wilder Jr.

What is the full form of RSI?

Relative Strength Index.

Is RSI a leading or lagging indicator?

Lagging indicator.

What is the formula for RSI?

Formula for RSI is [100 – (100/1+RS)].

Is RSI above 70 considered an overbought zone?

Yes.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.