| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-16-24 | |

| Add new links | Nisha | Mar-12-25 |

- Blog

- reliance power case study

Reliance Power Case Study: Business Model, Financial Statements, And SWOT Analysis

When summertime rolls around, all you have to do is turn on the air conditioner when you get home from work to enjoy the cool air. But have you ever wondered how electricity reaches your homes and which companies are involved in generation and distribution? Reliance Power is one such company that undertakes power projects in India and abroad.

In this blog, we will provide an overview of Reliance Power, its business model, financial information and a SWOT analysis.

Reliance Power Limited Overview

The company was first established in 1995 under the name Bawana Power Private Limited, a subsidiary of the Reliance Group, as a means of diversifying into the energy sector. Later, in 2006, when the Reliance Group split, Anil Ambani gained control of the company and renamed it Reliance Power Ltd. The corporation operates power projects both in India and abroad. They chose to raise more than INR 11,000 crore in 2008 to fund their continued expansion, and the offering was oversubscribed by the public, making it the largest initial public offering (IPO) in Indian history at that time. From 2009 to 2015, the corporation worked on several projects. The Sasan Ultra Mega Power Project, a 3,960 MW coal-based power project, was one of those projects. Following their early success, the company encountered several regulatory obstacles, which caused their financial situation to deteriorate and their debt load to rise over time. Since 2020, the company has been focusing on debt restructuring, and now it has shifted its focus to renewable energy. The organization’s headquarters is in Mumbai.

Business Model of Reliance Power Limited

With a focus on energy infrastructure development, the company develops and operates several power projects throughout the nation. The following lists the specifics of the company’s business model:

- Power Purchase Agreements – The business signs long-term contracts with central and state governments that last for 20 to 25 years, giving them a steady income stream.

- Subsidies – The government provides numerous incentives for this industry, so the company benefits from various subsidies and tax breaks.

- International Expansion – In an attempt to increase its market share and earnings, the company is exploring the potential of the global renewable energy sector.

The company provides end-to-end solutions for power development projects, which can be mentioned in the following steps-

- Planning – The company identifies the location and sets up the power plant in areas with abundant natural resources.

- Commissioning – After identifying the location, the company will get the project commissioned by the government and get the required license.

- Construction of Plants – After obtaining permission from the government, the construction of the plant begins.

- Operations – Finally, after the completion of the construction process, the company starts operations by managing fuel supplies and power transmission, as well as maintaining plant efficiencies.

Source of Revenue of Reliance Power Limited

The company receives revenue from various sources, which are mentioned below-

- Power Generation – The company’s primary source of income is the distribution and sale of power. The business accomplished this through several PPA agreements with the government.

- Open Market Distribution – The business offers the surplus power produced by its operations for sale in the open market.

- Renewable Energy – Reliance Power receives credits for using different renewable energy sources, such as solar and wind. The company earns Renewable Energy Certificates (RECs), which are bought by other firms that are not eco-friendly, thereby increasing the revenues of Reliance Power.

Product Portfolio of Reliance Power Limited

The Reliance Power company has a diversified product portfolio-

Energy Portfolio – The company has diversified electricity generation facilities capable of using different energy sources, such as:

- Thermal Power – The company generates a major portion of its total power from coal-based power plants.

- Renewable Energy – Reliance Power has significant investments in the renewable energy sector, such as solar and wind projects.

- Hydro Electric Projects – The company is also involved in hydro-electric power generation projects.

Market Details of Reliance Power Ltd.

| Current Market Price | INR 43.5 |

| Market Capitalization (In INR Crores) | INR 17,518 |

| 52 Week High | INR 54.2 |

| 52 Week Low | INR 15.5 |

| Book Value | INR 28.9 |

| Face Value of Share | INR 10 |

| P/E Ratio (x) | -9.34 |

Financial Statements of Reliance Power Limited

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 7,892 | 7,542 | 7,503 |

| Total Income | 8,260 | 7,882 | 7,686 |

| Total Expenditure | 7,837 | 5,653 | 5,859 |

| Net Profit | -2,242 | -361 | -565 |

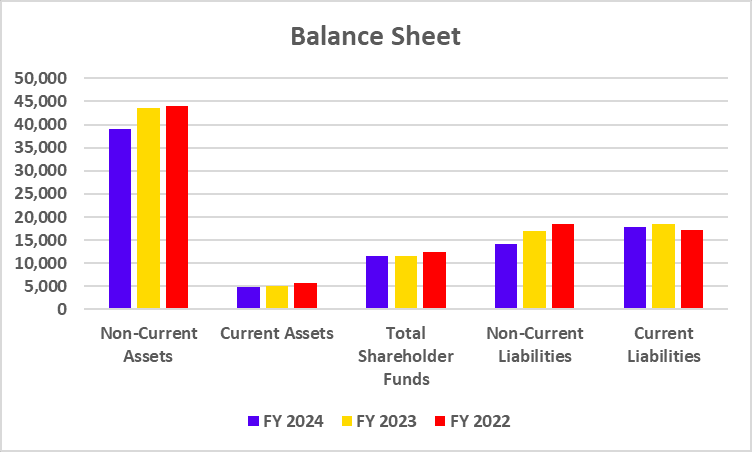

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Non-Current Assets | 39,013 | 43,512 | 44,002 |

| Current Assets | 4,747 | 5,024 | 5,810 |

| Total Shareholder Funds | 11,614 | 11,595 | 12,463 |

| Non-Current Liabilities | 14,252 | 16,874 | 18,502 |

| Current Liabilities | 17,894 | 18,374 | 17,225 |

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating Activities | 3,173 | 4,023 | 3,613 |

| Cash Flow from Investing Activities | -192 | -354 | 256 |

| Cash Flow from Financing Activities | -2,734 | -3,623 | -3,848 |

Key Performance Indicators

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Operating Profit Margin (%) | 5.86 | 15.8 | 24.35 |

| Net Profit Margin (%) | -26.20 | -5.34 | -7.41 |

| ROE (%) | -17.80 | -4.05 | -4.86 |

| ROCE (%) | 1.79 | 3.95 | 5.60 |

| Current Ratio | 0.27 | 0.27 | 0.34 |

| Debt to Equity Ratio | 1.62 | 1.83 | 1.85 |

Read Also: Reliance Industries Case Study: Marketing Strategy and SWOT Analysis

SWOT Analysis of Reliance Power Limited

Strength

- Company’s Image – The Reliance Group of Companies, formed by Mr Dhirubhai Ambani, has built a global brand image for its products and services, which helps the company build trust among investors.

- Long-Term Contracts – The company has long-term power purchase agreements with state and central governments, thereby providing a steady flow of income.

- Renewable Energy Portfolio – Reliance Power utilizes several energy sources, such as solar, wind, hydro, etc. to generate electricity.

Weakness

- High Debt – The company’s high debt is a significant problem.

- Delay in Projects – The corporation is encountering regulatory obstacles that are causing delays in its projects.

- Losses – Reliance Power has struggled to be profitable in recent years, which makes it difficult for the business to address shareholder concerns.

Opportunities

- Renewable Energy – With several incentive programs, the government is encouraging the usage of renewable energy sources, which may eventually help the enterprise.

- Growing Industry – India’s growing energy consumption offers the business a substantial possibility for expansion.

- Export Opportunities– In the long run, the company’s revenue may rise if it boosts its energy output and begins exporting power to other nations.

Threat

- Financial Challenges – The company is not performing well in terms of financial performance; its debt levels are very high, and it has been incurring losses for the past few years.

- Fuel Supply – Power prices are vulnerable to fluctuations in fuel prices, especially coal and gas. Any drastic price changes could adversely impact the margins of the company.

- Shift Towards Renewable Energy – A shift towards renewable energy sources could impact the company’s performance in the short term.

Read Also: Jio Financial Services: Business Model And SWOT Analysis

Conclusion

To sum up, Reliance Power is a prominent player in the Indian energy market, having inked multiple long-term contracts with the government to produce and supply electricity to various regions of the nation. However, because of its large debt load, which is also negatively impacting the company’s financial performance, it is also dealing with several other operational issues. Make sure you speak with your investment advisor before making any investments in this company.

Frequently Asked Questions (FAQs)

Where is the headquarters of Reliance Power Limited?

The headquarters of Reliance Power Limited is situated in Mumbai.

Is Reliance Power a large-cap or mid-cap Company?

Reliance Power Limited is classified as a mid-cap company with a market capitalization of INR 17,518 crores as of 14 October 2024.

Who is the CEO of Reliance Power Limited?

Mr Raja Gopal Krotthapalli is the current CEO of Reliance Power Limited as of 14 October 2024.

Is Reliance Power Ltd. a profitable company?

No, Reliance Power Limited is not profitable as it has reported a net loss of INR 2,242 crores for FY 2024 and INR 361 crores in FY 2023.Q5. Who are Reliance Power Ltd.’s major competitors?Ans. The major competitors of Reliance Power are Adani Power Ltd., Tata Power Ltd., NTPC Ltd., and Power Grid Corporation Ltd.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.