| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-28-23 | |

| Add new links | Nisha | Mar-12-25 |

- Blog

- satyam scam case study know the story indians

Satyam Scam Case Study: Know The Story Indians

In today’s blog, we will explain how an IT company committed the biggest fraud of all time. The story was backed up in 2009 when the owner of an IT company came up front in the media and exposed himself.

The Information and Technology Industry is the industry that works on the model based on collecting, processing, distribution & use of Information. Also, there are few IT companies involved in the design, manufacturing & marketing of hardware such as processors, networking equipment and storage devices. One such tech company was Satyam Computers.

About Satyam Computers

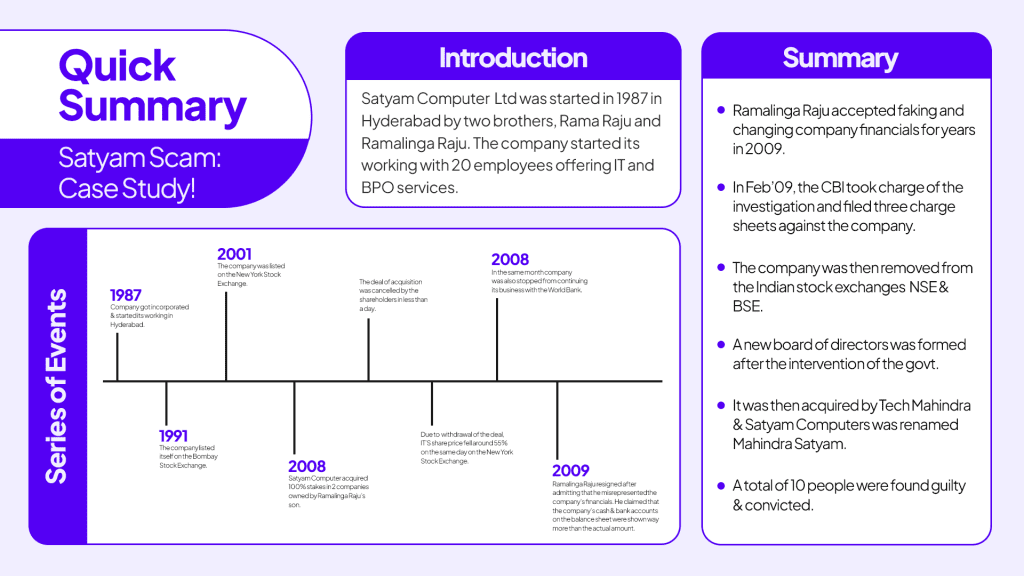

Satyam Computer Ltd was started in 1987 in Hyderabad by two brothers, Rama Raju and Ramalinga Raju. The company started its working with 20 employees offering IT and BPO services.

The success enabled the company to list itself through Initial Public Offering (IPO) in the year 1991 on the Bombay Stock Exchange. After listing Satyam got its first major client. This further allowed the business to grow and it soon became one of the top software-exporting IT companies in the market after TCS, Wipro, and Infosys.

We will give our readers a summary of the Satyam Scandal that shocked India’s corporate world in 2009.

We will be focusing on the below-mentioned points-

- Ramalinga Raju, founder, and CEO of Satyam Computers, a Hyderabad-based software Company had accepted faking and changing company financials for years in 2009.

- In February 2009, the Central Bureau of Investigation took charge of the investigation and filed three charge sheets against the company.

- The company was then removed from the Indian stock exchanges NSE & BSE.

- A new board of directors was formed after the intervention of the government.

- The company was then acquired by one of the IT giants, Tech Mahindra and Satyam Computers was renamed Mahindra Satyam. All the operational activities of the company were brought to a close.

- A total of ten people were found guilty and convicted. All of them including Raju were sentenced to 7 years of imprisonment. Raju and his brother were penalised with a heavy amount of Rs 5.5 crore each.

Having known some highlights of the scandal let’s dig deep into what happened in 2009.

Series Of Events In The Satyam Computers Scam

- 1987 – The company got incorporated & started its working in Hyderabad.

- 1991 – The company listed itself on the Bombay Stock Exchange.

- 2001 – The company was listed on the New York Stock Exchange.

- 2008 – Satyam Computer acquired 100% stakes in 2 companies owned by Ramalinga Raju’s son.

- The deal of acquisition was cancelled by the shareholders in less than a day.

- Due to the withdrawal of the deal, the share price of Satyam Computer fell around 55% on the same day on the New York Stock Exchange.

- 2008 – In the same month company was also stopped from continuing its business with the World Bank.

- 2009 – Ramalinga Raju resigned after admitting that he misrepresented the company’s financials. He claimed that the company’s cash and bank accounts on the balance sheet were shown way more than the actual amount.

Satyam was trying to guarantee its clients and investors that it could keep the firm operational. However, U.S.-based law firms filed a case against Satyam Computers on behalf of its U.S.-based clients. Finally, the Indian Government took a decision to step in and appointed 3 persons to the Board of Directors thereby forming a new board in order to save the company.

Now, our readers must be thinking why Satyam’s Raju all of a sudden out of nowhere came forward and took a decision to expose himself!

The Satyam Computer scam was one of the most destructive events in the history of Indian tech companies. Mr Raju decided to confess instead of running away because there was a sharp fall in real estate properties he owned and his personal finances as well. Hence, he was left with no other option and was finally arrested and charged with criminal conspiracy, breach of trust, and cheating.

We updated our readers about the company, what the scam was, year-wise events of the scam and why Raju confessed, what’s left is, in the series of events how Raju and the auditors misrepresented the data, what all they did to show the good picture.

The Role Of Raju

The role of Raju was that he knowingly showed overvalued and fake assets that never existed which was around 1.47 billion dollars. He faked various bank statements for many years. Not only this but also, but he also created fake customer and employee identities and showed fake invoices and salaries in their names. Mr Raju transferred the company’s funds to other companies that he owned and also used the same for his personal benefits. Price Water House Coopers (PwC), a global auditing company, has been auditing Satyam’s records for many years. Satyam paid almost double the amount that any company would ever pay for auditing.

The matter was finally discovered when one of the independent directors received an email from a whistle-blower and he forwarded the mail to S. Gopalakrishnan, who was a partner in the auditing company PWC.

Read Also: Scam 1992: Harshad Mehta Scam Story

Steps Taken By The Government

After this unfortunate event, the Indian government took some significant steps to avoid further scams like Satyam Computers. The then existing Company’s Act 1956 was removed and the new Companies Act 2013 was introduced and implemented. To brief the law stated that the director of every company should be changed after every 5 years. The government also formed a regulatory body (SERIOUS FRAUD INVESTIGATION OFFICE) The only objective of which was to look into business and accounting fraud activities in India.

Read Also: BluSmart Shutdown & Gensol Scam

Conclusion

That’s all for today. Wrapping up our blog here and ending our reader’s curiosity that after all the mess that happened in 2009 what actually happened to the company?

As a result, Satyam Computers was acquired by Tech Mahindra. The IT giant bought an almost 51% stake in Raju’s company and renamed it “Mahindra Satyam.” Later, in June 2013, Mahindra Satyam merged into Tech Mahindra thereby, bidding final goodbye to all the baddoings and immoral behaviour. The Satyam scam served as a wake-up call for India’s business sector.

See you in the next blog, until then don’t forget to share your thoughts on our today’s newsletter.

By the time do not forget to share this article on WhatsApp, LinkedIn & X (formerly Twitter).

FAQs (Frequently Asked Questions)

When did the Satyam computer scam happen?

The Satyam scam happened in the year 2009.

What happened to Satyam computers?

It was later acquired by Tech Mahindra and was renamed Mahindra Satyam.

Who was the main culprit behind the Satyam scam?

The main person behind the Satyam scam was Mr Raju, founder and chairman of the company

How the scam was identified?

A whistle-blower mailed the independent directors about the two companies that Satyam Computers was planning to buy. (For our Reader’s reference whistle-blower is a person who informs about fraudulent activities)

Was Satyam computers listed on the New York Stock Exchange?

Yes, it was listed on the New York Stock Exchange.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.