| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-12-24 | |

| Add new links | Nisha | Apr-14-25 |

- Blog

- suzlon energy case stud

Suzlon Energy Case Study: Business Model, Financial Statement, SWOT Analysis

Our natural resources are at the point of exhaustion, and renewable energy is the only way to fulfill the energy demands in future. India is ranked fourth in the world in renewable energy installed capacity. Firms engaged in manufacturing wind turbines will have a crucial role in harnessing wind energy and moving towards a sustainable future.

Suzlon Energy Ltd is one the companies engaged in the renewable energy sector. In today’s blog post, we will share the overview and business model of Suzlon Energy. Moreover, we will discuss its financial performance and do a SWOT analysis of the company.

Suzlon Energy Company Overview

Suzlon Energy is an Indian multinational wind turbine manufacturer with its headquarters in Pune. It was established in 1995 by Mr. Tulsi Tanti and is now a leader in providing renewable energy solutions. Suzlon’s efforts in wind energy reduce 53.37 million tonnes of CO2 emissions annually by generating 54.62 TWh of clean energy each year. The company has operations in 17 countries and has installed more than 13,000 wind turbines.

Business Model of Suzlon Energy

Suzlon Energy has mastered the “Concept to Commissioning” Suzlon business model to provide comprehensive renewable energy solutions to its clients. The “Concept to Commissioning” model involves the following steps:

- Feasibility Studies

- Complex Engineering Design

- Manufacturing of wind turbines and components

- Installation

- Commissioning of wind farms

- 24*7 operations and maintenance

Since its inception, Suzlon has grown significantly, reaching a global presence with installations in 17 countries. It is the only Indian company to reach 20 GW wind energy installations.

Product Offerings

Suzlon Energy provides the following products:

- S120 Wind Turbine Generator: S120 has a 2.1 MW capacity and is available in three variants. This product is suitable for low-wind sites.

- S133 Wind Turbine Generator: S133 has a 3 MW capacity and can be installed in any wind site.

- S144 Wind Turbine Generator: It is the latest model of wind turbine generator developed by Suzlon with 40% higher power generation than other models.

Market Details of Suzlon Energy Ltd.

| Current Market Price | ₹ 80.4 |

| Market Capitalization (in Crores) | ₹ 1,08,658 |

| 52 Week High | ₹ 80.4 |

| 52 Week Low | ₹ 19.3 |

| P/E Ratio (x) | 127.56 |

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Suzlon Energy Financial Statements

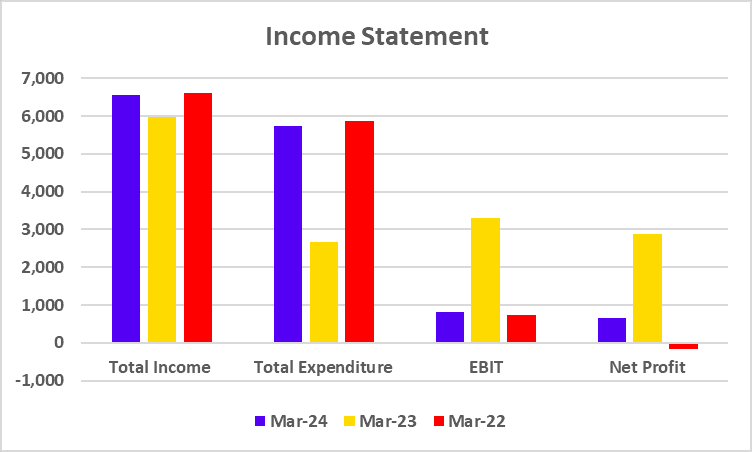

Income Statement

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Total Income | 6,567 | 5,990 | 6,603 |

| Total Expenditure | 5,743 | 2,677 | 5,869 |

| EBIT | 823 | 3,312 | 734 |

| Net Profit | 660 | 2,887 | -166 |

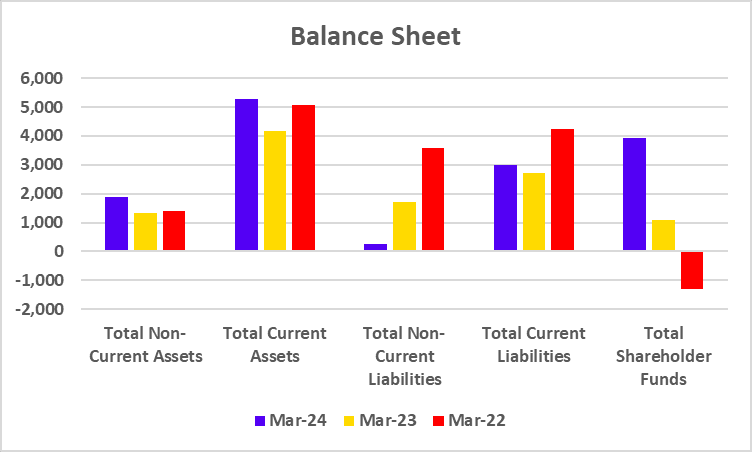

Balance Sheet

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Total Non-Current Assets | 1,891 | 1,345 | 1,389 |

| Total Current Assets | 5,287 | 4,177 | 5,084 |

| Total Non-Current Liabilities | 249 | 1,723 | 3,578 |

| Total Current Liabilities | 3,008 | 2,700 | 4,234 |

| Total Shareholder Funds | 3,920 | 1,099 | -1,316 |

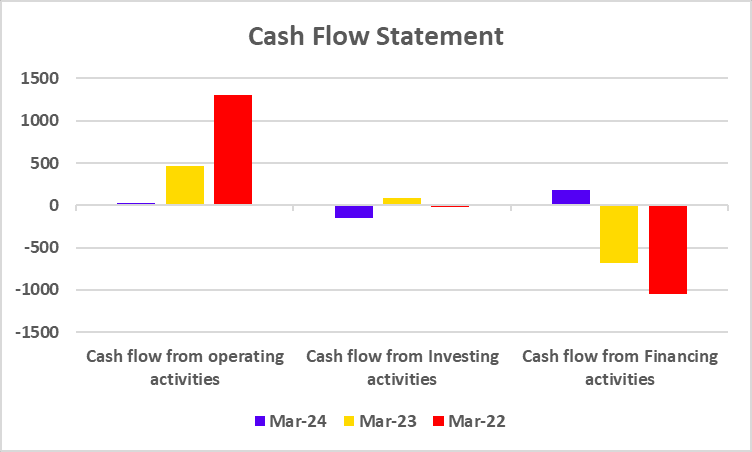

Cash Flow Statement

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Cash flow from operating activities | 33 | 466 | 1,301 |

| Cash flow from Investing activities | -151 | 84 | -18 |

| Cash flow from Financing activities | 177 | -684 | -1,044 |

Key Performance Indicators (KPIs)

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Net Profit Margin (%) | 10.11 | 48.35 | -2.52 |

| ROCE (%) | 21.04 | 20.96 | 29.09 |

| Current Ratio | 1.76 | 1.55 | 1.20 |

| Debt to Equity Ratio | 0.03 | 1.73 | -1.18 |

SWOT Analysis of Suzlon Energy

Strengths

- Technological expertise: The company excels in wind turbine technology, providing efficient and cost-effective solutions. Suzlon invests in R&D to continually improve turbine design and efficiency.

- Market position: Suzlon is a leading player in India’s wind energy market and has a strong market share.

Weaknesses

- High Debt: Suzlon’s profitability and ability to invest in new projects have been significantly reduced due to high debt levels.

- Operational Challenges: Suzlon has been facing operational challenges, such as delayed project execution and increased costs.

- Low cash flow from operations: Company financials show lower cash inflow from operating activities for the last 2 years.

Opportunities

- Growing demand for renewable energy: The demand for the company’s products will increase in future, which will result in increased revenues and profits

- Strategic Partnerships: Suzlon can expand its operations in international markets by forming strategic alliances with other companies.

Threats

- Regulatory Changes: Changes in government policies can have a negative impact on the company’s profitability.

- Environmental Risks: Suzlon Energy has been majorly involved in harnessing wind energy, and any changes in wind patterns can affect energy production.

Read Also: Nestle India Case Study: Business Model, Financial Statement, SWOT Analysis

Conclusion

Suzlon Energy Ltd., a known company in India’s renewable energy sector, uses its technological expertise to provide renewable energy solutions to its clients. The company’s ability to provide effective solutions makes it the market leader in the renewable energy industry. However, variable cash flow from operations, high P/E ratio, etc., also represent significant risks. Investors must thoroughly analyze the financial statements, gauge their risk tolerance capacity, or consult a financial advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Elcid Investments – India’s Costliest Stock |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | Zara Case Study |

Frequently Asked Questions (FAQs)

Does Suzlon Energy have international operations?

Suzlon operates in 17 countries, showcasing its global reach and expertise in wind energy solutions.

Does Suzlon offer any hybrid energy solutions?

Suzlon also provides wind-solar hybrid solutions, combining wind and solar power for enhanced power generation.

What is Suzlon’s role in India’s renewable energy landscape?

Suzlon is one of the top companies in India’s renewable energy sector, contributing significantly to the country’s wind power capacity.

How does Suzlon manage its financial challenges?

Suzlon is actively working on reducing its debt and improving profitability through strategic investments and operational efficiency.

What is Suzlon Energy’s business model?

Suzlon Energy works on the “Concept to Commissioning” model, which indicates the company’s ability to provide service to its customers, starting from concept development to 24*7 operations and maintenance of the commissioned equipment.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.