| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-25-24 | |

| Infographic Update | Ranjeet Kumar | Apr-03-25 |

- Blog

- tata group penny stocks

Tata Penny Stocks List – Benefits, and How to Invest?

Suppose you are an investor who continuously searches for new investment opportunities in the stock market. In that case, you must be looking for a few reliable companies with a low share price that have the potential to provide multi-bagger returns over the next few years. There are many penny stocks in the Indian stock markets, but they may not present a reliable investing opportunity. But what if I told you that you could invest in the penny stocks of one of India’s most famous corporate groups?

In this blog, we will give you an overview of the Tata penny stocks, the benefits of investing in them and how they differ from other penny stocks.

What is Tata Group Penny Stock?

Those companies owned by the Tata Group, which have a lower market price and lesser market capitalization than the flagship companies under the Tata Group, are referred to as Tata Group penny stocks. Investors looking to buy these stocks should be aware of the extreme volatility in the share prices of penny stocks. Due to the lack of sufficient information and the unreliability of their operations, investors avoid penny stocks. However, Tata penny stocks are not the same as they have the brand name of the Tata Group, which signifies reliability and ethics.

Tata Penny Stock List With Price

The two Tata Group penny stocks under ₹100 are as follows-

| S.No. | Stock Name | Stock Industry |

|---|---|---|

| 1. | Tayo Rolls Ltd | Castings, Forgings & Fastners |

| 2. | Tata Teleservices (Maharashtra) Ltd | Telecomm-Service |

1. Tata Teleservices (Maharashtra) Limited

The primary goal of Tata Teleservices (Maharashtra) Limited, often known as TTML, is to provide internet and IT services in India. The firm was first established in 1995 as Hughes Ispat Limited. Tata Teleservices (Maharashtra) Limited was the new name for the company after the Tata Group bought the majority of its shares in 2003. The company became the first private telecommunications operator to offer 3G services in 2010. However, intense competition, large losses and huge debts forced the organization to sell its consumer mobile business to Airtel in 2017. Currently, TTML offers broadband, cloud & SaaS, cyber security services, etc. The company’s head office is situated in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -16.44% | -50.03% | 3,176.60% |

2. Tayo Rolls

As a joint venture between Tata Steel, Nissho Iwai Corporation and Yodogawa Steel Works, Tata-Yodogawa Limited was established in 1968. The company’s main business was to manufacture cast iron and cast steel rolls for metallurgical industries. Its other products include forged rolls, engineering forgings and ingots. The business launched its IPO in 1969 to raise funds from the general public. The funds were used to increase its capacity to meet the demands of customers worldwide. The business expanded its product line later in 1995 and began producing special castings for power plants. The company’s name was changed to Tayo Rolls in 2003. The company began experiencing financial difficulties and decided to close its operations in 2016. The headquarters of Tayo Rolls is situated in Jamshedpur.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -7.45% | -30.56% | 254.06% |

Caution: Tayo Rolls closed its operations in 2016, but its share continues to trade on the stock market. After Covid, the stock increased from INR 19 to INR 200, which caught the attention of most new investors. This increase in share price was not due to strong financial performance but largely due to speculative activities. Many market experts termed trading activities in this stock as a part of the pump and dump scheme. Investors should remain cautious and consult a financial advisor before investing in any security mentioned in this blog.

Read Also: Best Adani Penny Stocks

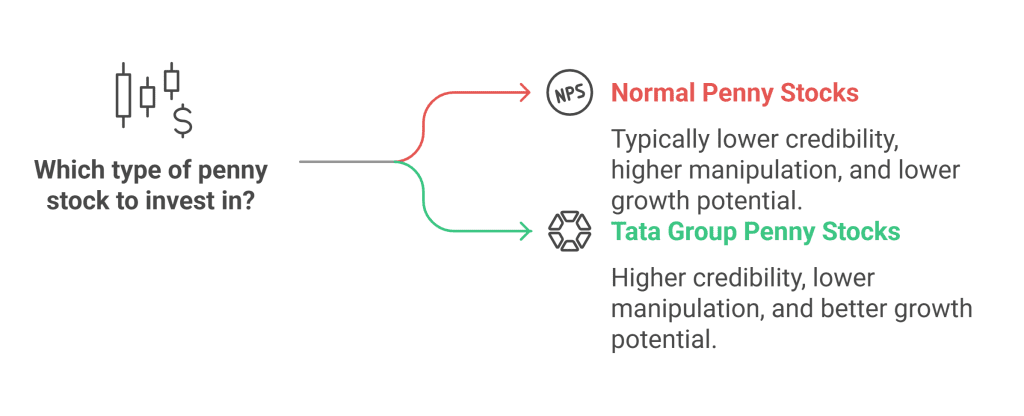

What is the Difference Between Normal Penny Stock and Tata Group Penny Stock?

The following are the primary distinctions between normal penny stocks and Tata penny stocks:-

| Particulars | Normal Penny Stocks | Tata Penny Stocks |

|---|---|---|

| Credibility | A typical penny stock is of a lesser-known company. | These shares are issued by companies that are owned by the Tata Group. |

| Business | Normal penny stocks may have an unproven track record. | Tata Group penny stocks have a proven track record. |

| Manipulation | Normal penny stocks can face high levels of manipulation. | Tata Group penny stocks usually face lower manipulation. |

| Growth Potential | These companies typically have lower growth potential as they don’t have strong fundamentals. | Tata Group penny stocks have long-term growth potential as they are supported by Tata Group. |

| Liquidity | Normal penny stocks may have lower liquidity. | The liquidity in Tata Group stocks is better than other penny stocks. |

| Market Capitalization | These penny stocks generally have lower market capitalization. | The Tata Group penny stocks have higher market capitalization than other penny stocks. |

Benefits of Investing in Tata Group Penny Stock

The advantages of investing in Tata Group Penny stocks are listed below-

1. Low Cost – Because of their low prices, Tata penny stocks are accessible to investors with small investment amounts.

2. High Returns – These companies can grow their businesses considerably in the future, which can result in substantial returns for investors.

3. Portfolio Diversification – Investing in penny stocks of the Tata Group can help investors diversify their portfolios.

4. Brand Value – The brand name of Tata Group can positively impact stock performance as investors have faith in them.

5. Long-Term – The fact that Tata Group companies are engaged with almost all sectors puts them in a powerful position for long-term growth.

6. Merger Possibility – Tata Group could merge these companies with its other well-established companies.

7. Dividend – The Tata Group companies consistently pay dividends along with capital appreciation.

Future of the Tata Group

The companies included in the Tata Group are one of the largest business corporations in India and the world. Its companies operate in various industries and offer a wide range of products. These companies are committed to sustainability and innovation. The ongoing transition from fossil fuel to renewable energy supports long-term growth prospects for the Tata Group as its companies are already market leaders in electric vehicles and renewable energy. Some of the major companies of the Tata Group are Tata Consultancy Services (TCS), Tata Steel, Tata Motors, Tata Power, etc. TCS has been focussing on artificial intelligence and cutting-edge technology. Tata Motors is a well-known EV manufacturer, and Tata Power has been working on renewable energy initiatives. In conclusion, the Tata Group has a bright future.

Read Also: Best Mukesh Ambani Penny Stocks

How to Invest in the Tata Group Penny Stock

If you are looking to invest in Tata Group Penny Stocks, then you must follow the below-mentioned steps –

- Visit the website of Pocketful.

- Click on the “Open Demat Account” Tab.

- Complete the Know Your Customer (KYC) process and enter all the relevant information for opening a Demat account. Verify your contact details using an OTP.

- Enter the Bank Account details of the bank account you want to link with your trading account. You can transfer funds from this bank account to your trading account to buy or sell securities. After the successful execution of trades, the shares are either credited or debited from the Demat account.

- Submit scanned copies of documents such as PAN card, Aadhaar card, income proofs, etc.

- Complete the in-person verification using a webcam or smartphone and E-sign the Demat account opening form.

- After verification of the information and documents provided, your demat account will be opened with us.

- The login credentials will be sent to your registered mail ID.

- Visit the website again and click on the Login Section on the Home Page. You can also download our mobile application to trade and invest.

- Log into your account and search the stocks you want to invest in and purchase them.

Conclusion

To sum up, investing in Tata penny stocks gives you the chance to make money over the long term. However, penny stocks also pose several dangers, including a lack of liquidity and weak financial performance. You should only consider investing in penny stocks if you are willing to take these risks. However, because the Tata Group backs the stocks mentioned in the blog above, these penny stocks are more trustworthy than others. Additionally, it would help if you spoke with your investment advisor before making an investment decision.

Frequently Asked Questions (FAQs)

In which company Tata Group has invested?

Apart from its well-established businesses in various sectors, the Tata Group has made investments in numerous businesses, such as Zivame, Paytm, and Ola.

How many stocks are there in Tata Group?

There are 26 publicly listed Tata Group companies spanning various industries.

Which company is a Tata Group penny stock?

TTML or Tata Teleservices (Maharashtra) Limited and Tayo Rolls can be considered penny stocks as both of them have a share price below INR 100.

Which is the most valuable Tata Group company listed on the stock market?

Among all the Tata Group’s listed corporations, TCS, or Tata Consultancy Services, is considered the most valuable. It offers consulting services in the IT sector and has a large market capitalization.

Who is the current chairman of Tata Group?

The chairman of the Tata Group is Natarajan Chandrasekaran, as of 25 November 2024.

Which Tata share is under INR 100?

TTML or Tata Teleservices Limited and Tayo Rolls’ share price is below INR 100.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Best Reliance Penny Stocks in India |

| 2 | Best Highest Dividend Paying Penny Stocks |

| 3 | Best PSU Penny Stocks in India |

| 4 | Best Semiconductor Penny Stocks in India |

| 5 | Best Solar Penny Stocks in India |

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.