| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-31-24 |

- Blog

- tata motors vs maruti suzuki analysis of auto stocks

Tata Motors vs Maruti Suzuki? Analysis of Auto Stocks

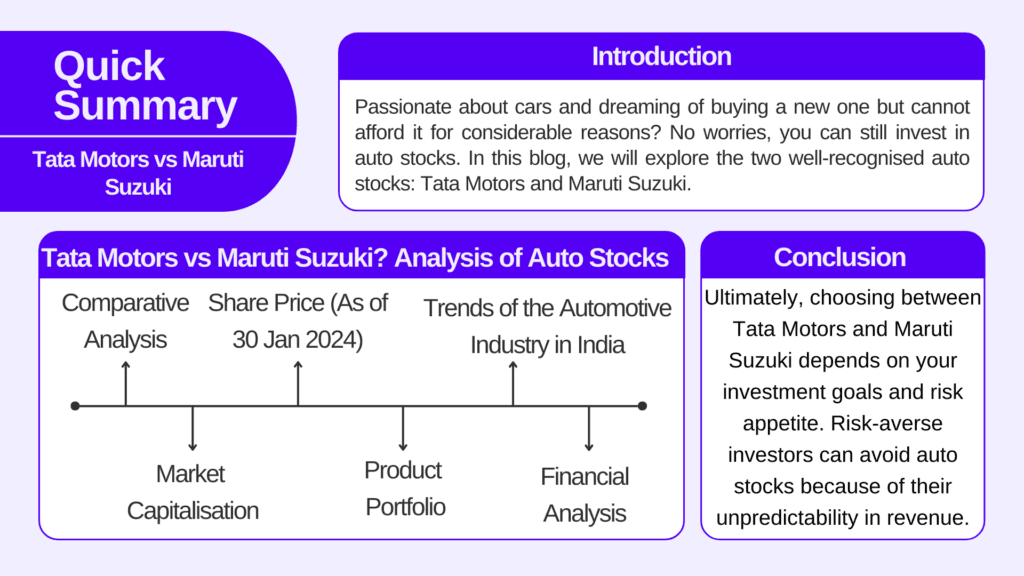

Passionate about cars and dreaming of buying a new one but cannot afford it for considerable reasons? No worries, you can still invest in auto stocks. In this blog, we will explore the two well-recognised auto stocks: Tata Motors and Maruti Suzuki.

Tata Motors

Tata Motors is India’s largest automobile company and is a leading global manufacturer of cars, utility vehicles, buses, trucks, and defence vehicles. It was incorporated in the year 1945 and was a part of the Tata Group which was founded by Jamshedji Tata in the year 1868.

Some of the world’s most iconic brands, including Jaguar Land Rover in the UK and Tata Daewoo in South Korea, are part of the automotive operations of the group.

The company is committed to developing innovative and sustainable vehicles for the future of mobility. By operating on a philosophy of ‘giving back to society’.

Maruti Suzuki

It is a well-known company in India and has an intriguing history with the evolution of the Indian Automotive industry. In 1981, the Indian Government established Maruti Udyog Limited which was a joint venture with Suzuki Motor Corporation of Japan.

Maruti Suzuki India Limited is a subsidiary company of Suzuki Motor Corporation, Japan that currently holds almost 58% of the equity of the company. It is one of the largest car makers. The company manufactures and sells passenger vehicles in India and is also the largest exporter of passenger vehicles in India.

The company believes in value creation and connects well with the customers to understand their needs.

Maruti Suzuki vs. Tata Motors – A Comparative Analysis

Both Maruti Suzuki and Tata Motors are leading automobile companies catering to the needs of different segments.

Maruti Suzuki holds a dominant position in the market with a significant market share in the passenger segment. In contrast, Tata Motors has a smaller share but is a leader in the commercial segment.

Market Capitalisation (As of 30 Jan 2024)

- Tata Motors – ₹3,15,751 Crore

- Maruti Suzuki – ₹3,12,817 Crore

Share Price (As of 30 Jan 2024)

Below is the Tata motors vs Maruti Suzuki Share price

- Tata Motors – INR 859

- Maruti Suzuki – INR 9,952

Maruti Suzuki has higher profitability and market capitalisation, whereas Tata Motors is facing challenges in the passenger vehicle segment but is profitable in the commercial segment.

Product Portfolio

- Tata Motors – Tata Motors offers SUVs like Nexon, Harrier, and Safari. Sedans like Tiago, Altroz, etc.

- Maruti Suzuki – The company offers fuel-efficient, affordable, compact Hatchbacks and Sedans such as Wagon R, Baleno, Dzire, Alto 800, Swift, etc.

Trends of the Automotive Industry in India

The automotive industry in India is currently seeing a rapid transformation, driven by several key trends. Some of the ongoing trends are listed below.

1. Electrification

Electrification is undoubtedly the most important trend since the adoption of electric vehicles is consistently increasing due to concerns about climate change and government policies. Experts and industry analysts predict this growth will continue in the coming years.

2. Autonomous Driving

The development of self-driving cars is another major trend. While fully autonomous vehicles are still some years away, at-least in India, advancements in sensor technology and artificial intelligence are progressing each day, which could lead to significant changes in car usage.

3. Connectivity

Cars are becoming more connected and advanced with features like real-time traffic updates, in-vehicle infotainment systems, etc. This trend is being driven by the Internet of Things (IoT) and 5G networks, allowing cars to communicate with each other.

4. Shared Mobility

The rise of ride-sharing services is creating a change in the way people think about car ownership. The car-sharing services are more reasonable, affordable, and convenient alternatives as compared to owning a car. This trend is likely to grow as technology evolves.

5. Sustainability

The auto industry is also focusing on providing consumers with more sustainable vehicles by using recycled materials, and reduced emissions in the manufacturing process. This will eventually improve the fuel efficiency.

Financial Analysis – Tata Motors vs. Maruti Suzuki

Have a look at the table with an in-depth analysis of the recent financial statements of both the companies:

| Metrics | Tata Motors (in crores) | Maruti Suzuki (in crores) |

|---|---|---|

| Net Profit | INR 3,783 | INR 3,706 |

| Revenue | INR 106,758 | INR 37,902 |

| Total Assets | INR 336,081 | INR 84,596 |

| Current Liabilities | INR 155,027 | INR 20,107 |

| Debt-to-equity Ratio | 2.77 | 0.02 |

| PE Ratio | 66.90 | 30.51 |

From the above table, we can see that:

- Tata Motors leads with comparatively higher revenue and high net profits.

- Maruti Suzuki, on the other hand, has a much lower debt-to-equity ratio, which implies a stronger and stable financial position.

- Both the stocks have relatively high P/E ratios, which reflects the investors’ expectation of future growth.

Impact of Market Conditions on Auto Stocks

- During economic expansion or boom, consumer confidence rises and so does their income, leading to a boost in car sales and stock prices.

- Lower interest rates can make car loans affordable, which in turn will stimulate the demand for auto sales. Conversely, higher interest rates can reduce borrowing and dampen sales, affecting the stock price negatively.

- Fluctuations in fuel prices can have a significant impact on consumer car-buying decisions. Rising fuel prices will boost the sales of fuel-efficient cars.

- An upgrade in the technology like the development of electric vehicles can create new opportunities for the auto sector and enhance their stock prices.

Read Also: Mahindra & Mahindra vs Tata Motors: Which is Better?

Conclusion

Ultimately, choosing between Tata Motors and Maruti Suzuki depends on your investment goals and risk appetite. Risk-averse investors can avoid auto stocks because of their unpredictability in revenue. Keep in mind to do thorough research before making any kind of investment decision and find which stocks best align with your investment needs.

Additionally, remember that auto companies operate in a cyclical industry, which means economic growth can significantly influence their sales volume.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Tata Power Vs Adani Power |

| 2 | Tata Motors vs Maruti Suzuki |

| 3 | Tata Steel vs. JSW Steel |

| 4 | TCS vs Wipro |

| 5 | IndiGo vs SpiceJet |

Frequently Answered Questions (FAQs)

Which brand saves you more at the pump?

Maruti Suzuki is well-known for its fuel-efficient engines.

Who zooms ahead in the race for Electric Vehicles?

Both the auto stocks are actively investing and focusing on EVs and analysing the future growth of this segment.

Is the auto industry a cyclical industry?

Yes, the auto industry is cyclical as sales can be significantly influenced by economic growth.

Are there any other Indian automakers to consider?

There are several other stocks, such as Hero Moto Corp, Mahindra & Mahindra, Eicher Motors, Bajaj Auto, TVS Motors, Ola, etc.

What are the biggest challenges faced by the auto sector?

Some of the biggest challenges the auto sector faces are rising input costs, global shortage of semiconductors, shifts in consumer preferences, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.