| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-10-24 |

- Blog

- tata steel vs jsw steel

Tata Steel vs. JSW Steel: A Comparative Analysis Of Two Steel Giants

The steel industry in India is a critical sector that powers the country’s infrastructure and manufacturing capabilities. There are multiple players in this sector, however, two of the biggest players in this industry are Tata Steel and JSW Steel.

In this blog, we will compare these steel giants in detail, including their financial performance, key performance indicators, etc.

Tata Steel Overview

Tata Steel, a flagship company of the Tata Group, was established in 1907 and is one of the oldest steel companies in India. Headquartered in Mumbai, Tata Steel operates in over 26 countries and has a significant presence in Europe and Southeast Asia. The company is known for its integrated steel plants, cutting-edge technology, and sustainable practices.

The Indian product portfolio of Tata Steel is divided into multiple segments – Automotive and Special Products, Industrial Products, Projects and Exports, Branded Products, Retail, etc. The Company supplies hot-rolled, cold-rolled, galvanised, branded solution offerings and more.

As of March 2024, the company has an annual crude steel capacity of 35 million tonnes (MnTPA) and it is one of the world’s most geographically diversified steel producers. It is one of a few steel players that are fully integrated – from mining to the manufacturing and marketing of finished products. The company’s focus on innovation, quality, and sustainability has positioned it as a leader in the global steel market.

Did You Know?

In 1907, Tata Steel was established in India as Asia’s first integrated private steel company.

JSW Steel Overview

JSW Steel, is the flagship business of the diversified US$ 24 billion JSW Group. The group has a presence in various sectors including Steel, Energy, Infrastructure, Cement, Paints, Venture Capital, Sports, etc. The group also boasts a diverse workforce across India, USA, Europe, etc. and directly employs nearly 40,000 people.

Coming to JSW Steel, it was founded in 1982 and has rapidly grown to become one of India’s leading steel manufacturers. It has a diverse range of steel products that serve industries such as automotive, infrastructure, and energy.

The company’s strategic focus on expanding capacity and improving operational efficiencies has allowed it to scale its production to over 28 million tons per annum. Not only that, it has consistently led in research and innovation, maintaining a strategic collaboration with the global leaders such as JFE Steel of Japan.

Comparative Study of Tata Steel and JSW Steel

| Particulars | Tata Steel | JSW Steel |

|---|---|---|

| Current Price (CMP) | INR 154 | INR 948 |

| Market Capitalization (in crores) | INR 1,91,870 | INR 2,31,890 |

| 52-Week High Price | INR 185 | INR 969 |

| 52-Week Low Price | INR 114 | INR 723 |

| FIIs Holdings (June 24) | 19.68% | 25.52% |

| DIIs Holdings (June 24) | 23.33% | 10.52% |

| Book Value per Share | INR 74 | INR 318 |

| PE Ratio (x) | 119 | 33.3 |

Read Also: Tata Steel Case Study: Business Model, Financial Statements, SWOT Analysis

Financial Statements Comparison

Let’s have a look at the financials of TATA Steel and JSW Steel.

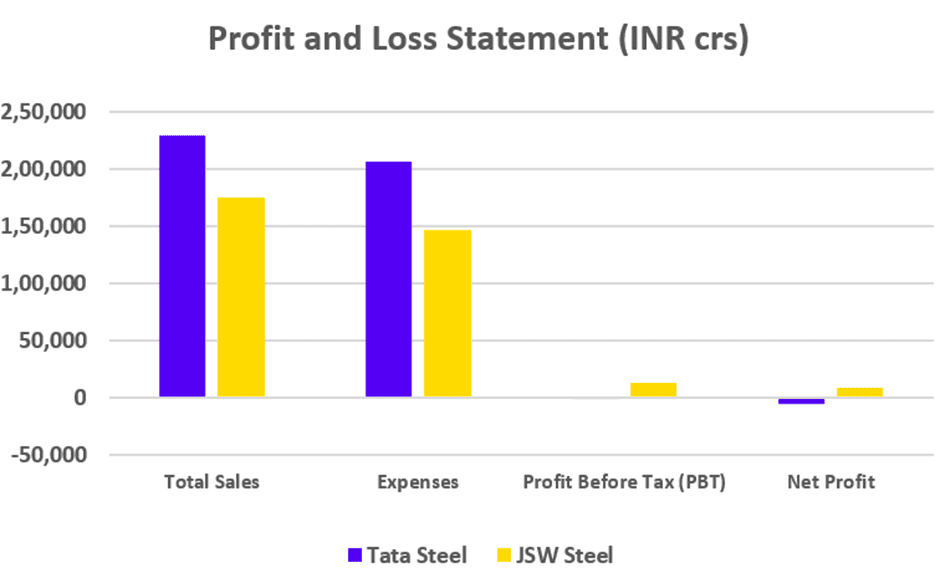

Profit and Loss Statement (FY 2024)

| Particulars | Tata Steel (INR crore) | JSW Steel (INR crore) |

|---|---|---|

| Total Sales | 229,171 | 175,006 |

| Expenses | 206,923 | 146,849 |

| Profit Before Tax (PBT) | (1,147) | 13,380 |

| Net Profit | (4,910) | 8,973 |

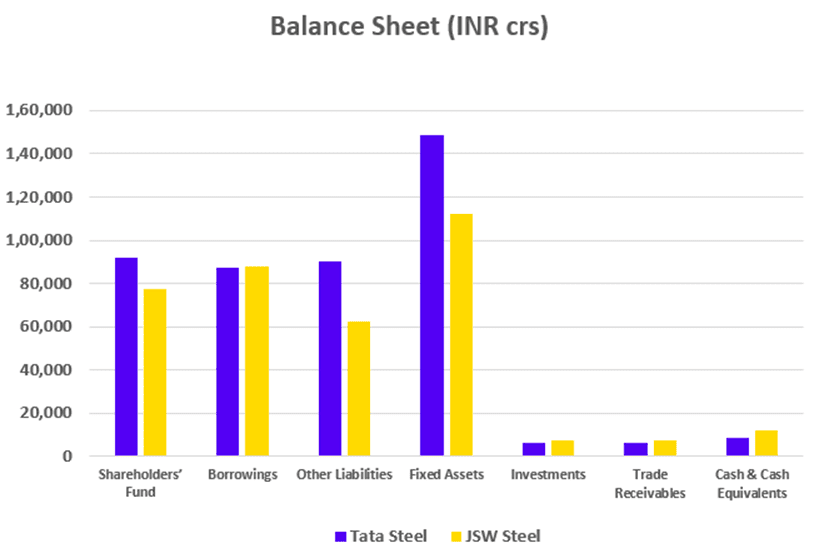

Balance Sheet (FY 2024)

| Particulars | Tata Steel (INR crore) | JSW Steel (INR crore) |

|---|---|---|

| Shareholders’ Fund | 92,035 | 77,669 |

| Borrowings | 87,082 | 87,984 |

| Other Liabilities | 90,195 | 62,245 |

| Fixed Assets | 148,814 | 112,461 |

| Investments | 6,258 | 7,246 |

| Trade Receivables | 6,264 | 7,548 |

| Cash & Cash Equivalents | 8,678 | 12,348 |

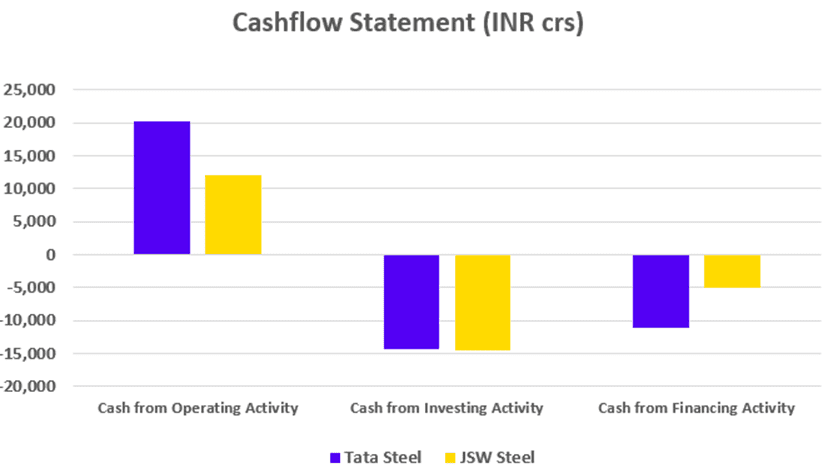

Cash Flow Statement (FY 2024)

| Particulars | Tata Steel (INR crore) | JSW Steel (INR crore) |

|---|---|---|

| Cash from Operating Activity | 20,301 | 12,078 |

| Cash from Investing Activity | (14,253) | (14,467) |

| Cash from Financing Activity | (11,097) | (5,005) |

Key Performance Indicators (FY 2024)

| Particulars | Tata Steel | JSW Steel |

|---|---|---|

| Operating Profit Margin | 10% | 16% |

| ROE | 6.55% | 11.8% |

| ROCE | 7.02% | 13.3% |

| Earnings Per Share | INR (3.55) | INR 36.03 |

Read Also: All Share List of Tata Group

Conclusion

In summation, the comparison between Tata Steel and JSW Steel highlights the strengths and market positions of both companies in the Indian steel industry. While Tata Steel enjoys a legacy of over a century, JSW Steel’s aggressive growth strategies have made it a formidable competitor.

Investors can find value in both companies based on their preferences and risk tolerance. It’s advisable to consult with a financial advisor before making any investment decision.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Tata Motors vs Maruti Suzuki |

| 2 | Mahindra & Mahindra vs Tata Motors |

| 3 | Tata Power Vs Adani Power |

| 4 | ITC vs HUL |

| 5 | Flair Vs DOMS |

Frequently Asked Questions (FAQs)

When was the Tata Steel founded?

Tata Steel was founded in 1907.

Which company has a larger market capitalization: Tata Steel or JSW Steel?

As of August 2024, Tata Steel has a market capitalization of INR 1.92 lakh crore and JSW Steel has a market capitalization of INR 2.32 lakh crore.

What are the main products offered by Tata Steel and JSW Steel?

Tata Steel offers a wide range of products including flat and long steel products, automotive steel, and other specialty products. JSW Steel offers hot rolled coils, cold rolled coils, galvanised products, TMT bars, etc.

Which company is more profitable: Tata Steel or JSW Steel?

As of March 2024, Tata Steel reported a net loss of INR 4,910 crore, however, JSW steel reported a net profit of INR 8,973 crore.

Which company has a stronger international presence?

Tata Steel has a stronger international presence with significant operations in Europe and Southeast Asia, whereas JSW Steel is primarily focused on the Indian market and has some presence in the US and Europe.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.