| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-13-24 | |

| Add new links | Nisha | Mar-12-25 |

- Blog

- tcs case study

TCS Case Study: Business Model, Financial Statement, SWOT Analysis

The Indian IT industry is a global powerhouse, contributing to the nation’s economic growth. With the digital revolution, this industry has the potential to offer exciting investment opportunities for investors. However, with several IT companies vying for attention, TCS has been at the forefront of the global IT industry for over 5 decades. With an unwavering commitment to innovation and digital transformation, the company has played a vital role in empowering organizations to harness the power of technology.

In today’s blog, we will explore TCS’s rich history, business model, and services it offers.

TCS Company Overview

Tata Consultancy Services (TCS) is an Indian multinational IT services and consulting company. TCS is headquartered in Mumbai and has more than 6,00,000 employees in 55 countries.

TCS was founded in 1968, when Mr Fakir Chand Kohli, known as the Father of India’s IT industry, brought together a young team of IT professionals to provide punched card services to its sister company, TISCO (now Tata Steel). In the early years, TCS played an important role in establishing India’s IT industry. It was one of the first companies to provide software development and IT services. TCS has expanded its operations beyond India to have a significant presence in countries across America, Europe, Asia Pacific, the Middle East, and Africa, recognizing the growth opportunities in the global market.

Business Model OF TCS

TCS operates on a service-based business model that allows it to offer tailored solutions to meet each client’s specific needs. This approach has contributed to TCS’s success in building long-term relationships with its customers.

TCS offers a range of IT services, which are discussed in the next section.

Services offered by TCS

TCS offers the following services:

- TCS BaNCS – A banking and financial solutions platform. 8 out of the top 10 custodian and asset management firms run on TCS BaNCS. This service is used by 30% of the global population in over 100 countries.

- TCS ADD – ADD stands for Advanced Drug Development, and TCS ADD is an advanced software suite that uses AI to transform drug development and clinical trials.

- TCS CHROMA – It is a cloud-based HRMS platform with in-built intelligence and smart automation. HRMS stands for human resource management system

- TCS OmniStore – It is an AI-powered commerce platform for seamless customer experiences. It offers a unified, personalized checkout experience for shoppers on different channels.

- Ignio – AI-driven automation platform for IT and business operations with end-to-end closed-loop automation

- TCS MasterCraft – Digital platform to optimally automate and manage IT processes.

- Quartz Smart Solutions – It combines on-chain services deployed on blockchain and off-chain services residing in traditional files. The service ensures that business processes that are well suited for the blockchain are deployed on it.

Furthermore, their customer-centric approach ensures that TCS products not only meet the needs and expectations of customers but also drive tangible results and create value for their businesses. With a deep understanding of market trends and technologies, TCS can deliver innovative solutions that make a difference.

Market Details of TCS

| Current Market Price | INR 4,196 |

| Market Capitalization | INR 15,17,719 Crores |

| 52 Week High | INR 4,431 |

| 52 Week Low | INR 3,311 |

| P/E Ratio (x) | 31.9 |

TCS Financial Statements

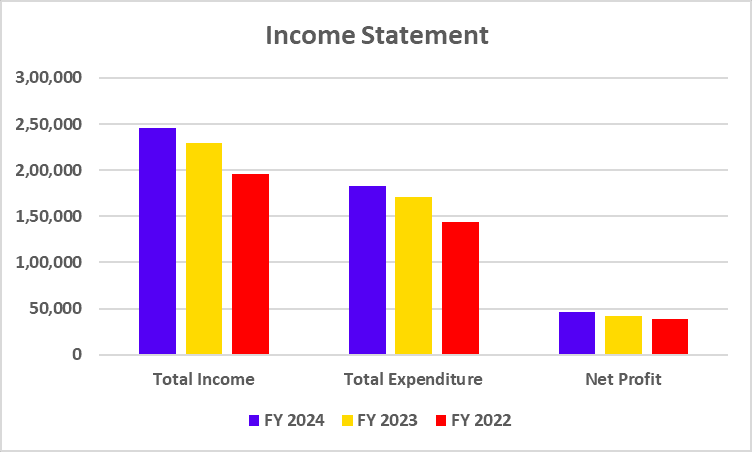

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Income | 2,45,315 | 2,28,907 | 1,95,772 |

| Total Expenditure | 1,82,540 | 1,71,221 | 1,43,301 |

| Net Profit | 46,099 | 42,303 | 38,449 |

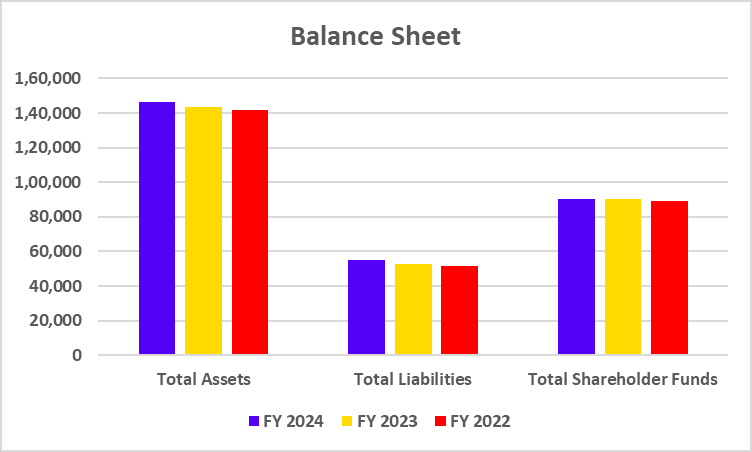

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Assets | 1,46,449 | 1,43,651 | 1,41,514 |

| Total Liabilities | 55,130 | 52,445 | 51,668 |

| Total Shareholder Funds | 90,489 | 90,424 | 89,139 |

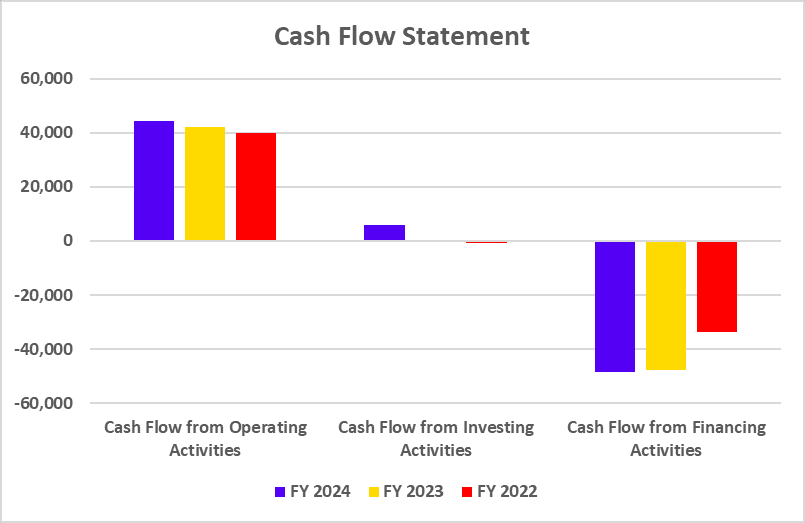

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating Activities | 44,338 | 41,965 | 39,949 |

| Cash Flow from Investing Activities | 6,026 | 39 | -897 |

| Cash Flow from Financing Activities | -48,536 | -47,878 | -33,581 |

Key Performance Indicators

| Particulars (in %) | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| ROE (%) | 50.73 | 46.61 | 42.99 |

| ROCE (%) | 63.51 | 57.63 | 52.91 |

| Gross Profit Margin | 28.52 | 27.81 | 29.67 |

| Debt-to-equity Ratio | 0 | 0 | 0 |

Read Also: Case Study on Trent Limited: Financials, Business Model, Marketing Strategies, and SWOT Analysis

SWOT Analysis OF TCS

Strengths

- TCS has global operations that allow it to offer affordable and high-quality IT services to clients all over the world.

- TCS focuses on industry-specific solutions and has expertise in providing IT solutions to the banking, finance, insurance, retail, and manufacturing sectors.

- It has a large and skilled workforce, allowing it to handle complex IT projects.

- Being a part of the TATA group of companies, TCS benefits from robust financial support, which empowers it to make significant investments in research and development, acquisitions, etc.

Weaknesses

- TCS relies heavily on a few major clients, which is risky.

- Talent retention is a challenging task, as it needs to maintain a high level of employee satisfaction and ensure that they stay loyal to the company.

- Geographical concentration can have a significant impact on revenue when there is an over-dependence on specific regions.

Opportunities

- TCS can benefit from the increasing demand for digital transformation services.

- Exploring opportunities in AI, the Internet of Things (IoT), blockchain, and other emerging technologies can help TCS grow.

- TCS can also focus on strengthening its partnerships with technology providers to gain a competitive edge in the market and enhance its offerings.

Threats

- The IT industry is very competitive, with many global companies competing for market share.

- Global economic recessions can cause a decrease in IT expenditure.

Read Also: BSE Case Study: Business Model And SWOT Analysis

Conclusion

TCS has firmly established itself as a global IT services behemoth and is renowned for its robust financial position, large talent pool, and wide range of services. The company’s focus on new technologies and flexibility in adapting to changing markets have been important for its success. Despite facing intense competition and economic uncertainties, TCS carries out its business operations efficiently. To maintain its leadership, the company must invest in research and development, build strong client relationships, and effectively manage risks.

Frequently Asked Questions (FAQs)

Does TCS cater to any specific industry?

Yes, TCS caters to several industries, with a strong focus on BFSI (Banking, Financial and Insurance), retail, healthcare, and manufacturing.

What is the work culture at TCS?

TCS is known for its employee-friendly culture, teamwork, and diversity.

Is TCS involved in any social initiatives?

Yes, TCS has a strong commitment towards Corporate Social Responsibility (CSR) and is involved in several community development programs.

What is the TCS’s vision for the future?

TCS aims to be the world’s leading digital transformation partner by using technology and creating value for its clients and society.

Should I invest in TCS?

TCS can be a good investment option. However, it is crucial to consult your financial advisor before making any financial decision.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.