| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-08-24 |

- Blog

- tcs vs wipro

TCS vs Wipro: Comparison Of Two IT Giants

The IT sector in India is a global powerhouse, driven by a competitive landscape of companies that are leaders in technology and innovation.

In this blog, we will compare two of India’s largest IT companies, Tata Consultancy Services (TCS) and Wipro, and discuss key insights, their financial performance, etc.

TCS Overview

Tata Consultancy Services (TCS), established in 1968, is a global IT services, consulting, and business solutions provider headquartered in Mumbai, India. The company is a division of Tata Group which is the largest multinational group in India. As of March 2024, the company employs more than 6 lakh employees, and 35% of the workforce is women.

The company offers a wide range of services, including software development, IT infrastructure services, cloud solutions, and enterprise applications. And it serves various industries, including banking, financial services, retail, telecommunications, healthcare, etc. Further, the company is known for its strong client relationships and robust service delivery models.

As of August 2024, TCS is the largest IT services company in India by market capitalization and revenue. Further, it consistently ranked among the top IT service providers globally. The company’s focus on innovation, quality, and customer satisfaction has earned it a stellar reputation in the IT industry.

Did You Know?

In 2004, TCS listed at the National Stock Exchange (NSE) and Bombay Stock Exchange with the largest IPO by a private sector company, raising an impressive USD 1 billion.

Wipro Overview

Wipro Limited, founded in 1945, is another major player in the Indian IT industry, headquartered in Bangalore, Karnataka. The company was established as a vegetable oil manufacturer and has transformed itself into a global IT services and consulting company.

It entered the IT sector in 1981 and has since diversified its offerings across various technology domains. It has a presence in over 66 countries and employs more than 2,50,000 people. Further, the company is known for its commitment to corporate social responsibility and ethical business practices.

The company provides IT services, including software development, business process outsourcing (BPO), cloud computing, digital transformation and much more. The company provide services to multiple industries such as banking, healthcare, energy, consumer goods, etc. Wipro’s global delivery model and emphasis on sustainability and innovation have positioned it as a key competitor in the global IT market.

Did You Know?

In 2000, Wipro grew to a one billion dollar company and was listed on the New York Stock Exchange.

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Comparative Study of TCS and Wipro

| Particulars | TCS | Wipro |

|---|---|---|

| Current Price (CMP) | INR 4,509 | INR 537 |

| Market Capitalization (in crores) | INR 16,31,300 | INR 2,80,900 |

| 52 Week High Price | INR 4,565 | INR 580 |

| 52-Week Low Price | INR 3,311 | INR 375 |

| FIIs Holdings (March 24) | 12.70% | 6.96% |

| DIIs Holdings (March 24) | 10.61% | 8.28% |

| Book Value per Share | INR 250 | INR 143 |

| PE Ratio (x) | 34.3 | 25.1 |

Financial Statements Comparison

Let’s have a look at the financials of both the companies.

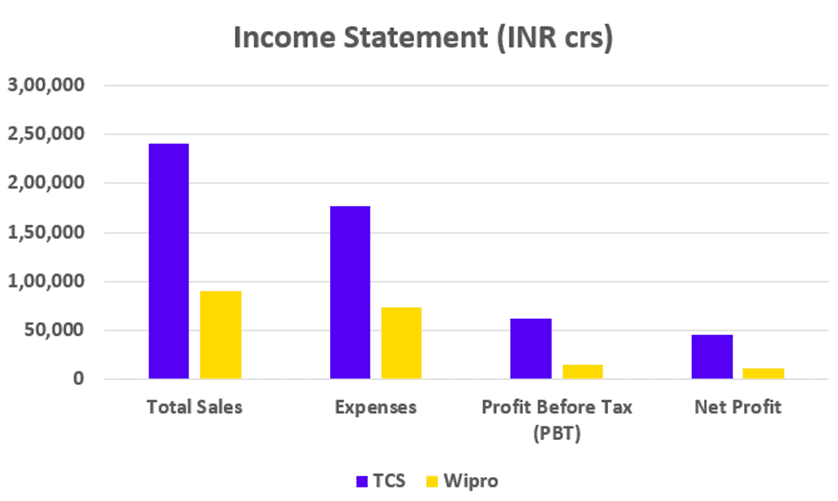

Income Statement (FY 2024)

| Particulars | TCS (INR crore) | Wipro (INR crore) |

|---|---|---|

| Total Sales | 2,40,893 | 89,760 |

| Expenses | 1,76,597 | 73,008 |

| Profit Before Tax (PBT) | 61,997 | 14,721 |

| Net Profit | 46,099 | 11,112 |

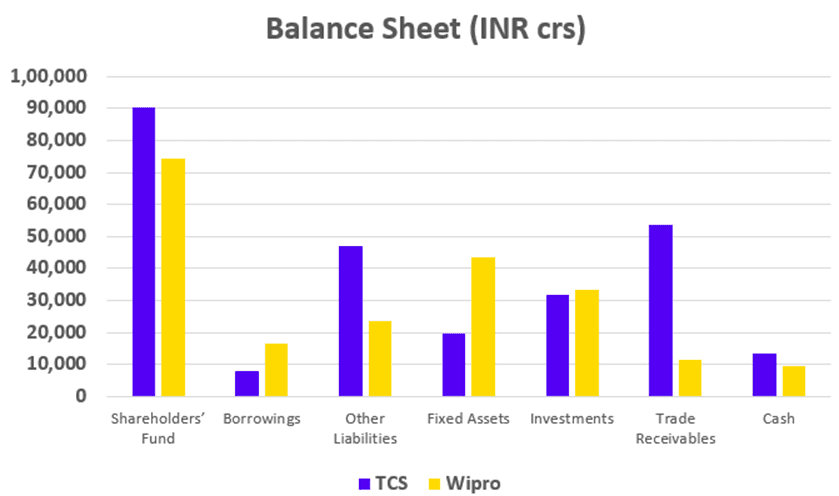

Balance Sheet (FY 2024)

| Particulars | TCS (INR crore) | Wipro (INR crore) |

|---|---|---|

| Shareholders’ Fund | 90,489 | 74,533 |

| Borrowings | 8,021 | 16,465 |

| Other Liabilities | 46,962 | 23,611 |

| Fixed Assets | 19,604 | 43,628 |

| Investments | 31,762 | 33,384 |

| Trade Receivables | 53,577 | 11,548 |

| Cash & Cash Equivalents | 13,286 | 9,695 |

Cash Flow Statement (FY 2024)

| Particulars | TCS (INR crore) | Wipro (INR crore) |

|---|---|---|

| Cash Flow from Operating Activities | 44,388 | 17,622 |

| Cash Flow from Investing Activities | 6,091 | 1,144 |

| Cash Flow from Financing Activities | (48,536) | (18,257) |

Key Performance Indicators (FY 2024)

| Particulars | TCS | Wipro |

|---|---|---|

| Operating Profit Margin | 27% | 19% |

| ROE | 51.5% | 14.3% |

| ROCE | 64.3% | 17% |

| Earnings Per Share | INR 127 | INR 21.14 |

Read Also: Wipro Case Study and Marketing Strategy

Conclusion

In summation, the comparison between TCS and Wipro highlights that both companies are giants in the IT services industry, however, TCS has a clear edge in terms of profitability because of larger market capitalization.

However, Wipro is not lagging behind and remains a strong competitor with its global presence and focus on innovation. Investors can find value in both companies based on their preferences and risk tolerance. It’s advisable to consult with a financial advisor before making any investment decision.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | NHPC vs NTPC |

| 2 | IndiGo vs SpiceJet |

| 3 | Infosys vs TCS |

| 4 | ITC vs HUL |

| 5 | XIRR Vs CAGR |

Frequently Asked Questions (FAQs)

When was the TCS founded?

Tata Consultancy Services (TCS) was founded in 1968.

What is the full form of TCS?

TCS stands for Tata Consultancy Services.

Who is the current CEO of Wipro?

Srini Pallia is the current CEO of Wipro. He joined the company in 1992 and previously held many leadership positions at the company, including President of Wipro’s Consumer Business Unit and Global head of Business Application Services.

Which company is more profitable: TCS or Wipro?

As of March 2024, TCS has a net profit of INR 46,099 crores compared to INR 11,112 crores of Wipro.

Which company has a larger market capitalization: TCS or Wipro?

As of August 2024, TCS has a market capitalization of around INR than 16.31 lakh crores and Wipro has a market capitalization of around INR 2.83 lakh crores.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.