| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-29-23 | |

| FAQs Formatting | Nisha | Mar-12-25 |

Read Next

- SEBI Action on Jane Street: Impact on Indian Markets

- What is Personal Finance?

- Military Wealth Management: Strategies for Growing and Preserving Your Assets

- India’s Republic Day 2025: Honoring the Nation’s Defense Achievements

- 10 Essential Financial Planning Tips for Military Members

- How Do You Apply for PAN 2.0 Online and Get It on Your Email ID?

- 10 Best YouTube Channels for Stock Market in India

- LTP in Stock Market: Meaning, Full Form, Strategy and Calculation

- 15 Best Stock Market Movies & Web Series to Watch

- Why Do We Pay Taxes to the Government?

- What is Profit After Tax & How to Calculate It?

- Budget 2024: Explainer On Changes In SIP Taxation

- Budget 2024: F&O Trading Gets More Expensive?

- Budget 2024-25: How Will New Tax Slabs Benefit The Middle Class?

- Semiconductor Industry in India

- What is National Company Law Tribunal?

- What is Capital Gains Tax in India?

- KYC Regulations Update: Comprehensive Guide

- National Pension System (NPS): Should You Invest?

- Sources of Revenue and Expenditures of the Government of India

- Blog

- top 10 personal finance lessons for self learning

Top 10 personal finance lessons for self-learning

In a world where money navigates the flow of your life, it is very important to learn about Personal Finance. This article is not only for young individuals who have just started earning but for every person who wants to take charge of their financial decisions and future. We all know that our traditional education system does not teach us about the real financial world. For example, how to file your taxes, how to do retirement planning, what is a credit score, how credit cards work, and more. Once you enter the real world you have to decide on the things that you were never taught about.

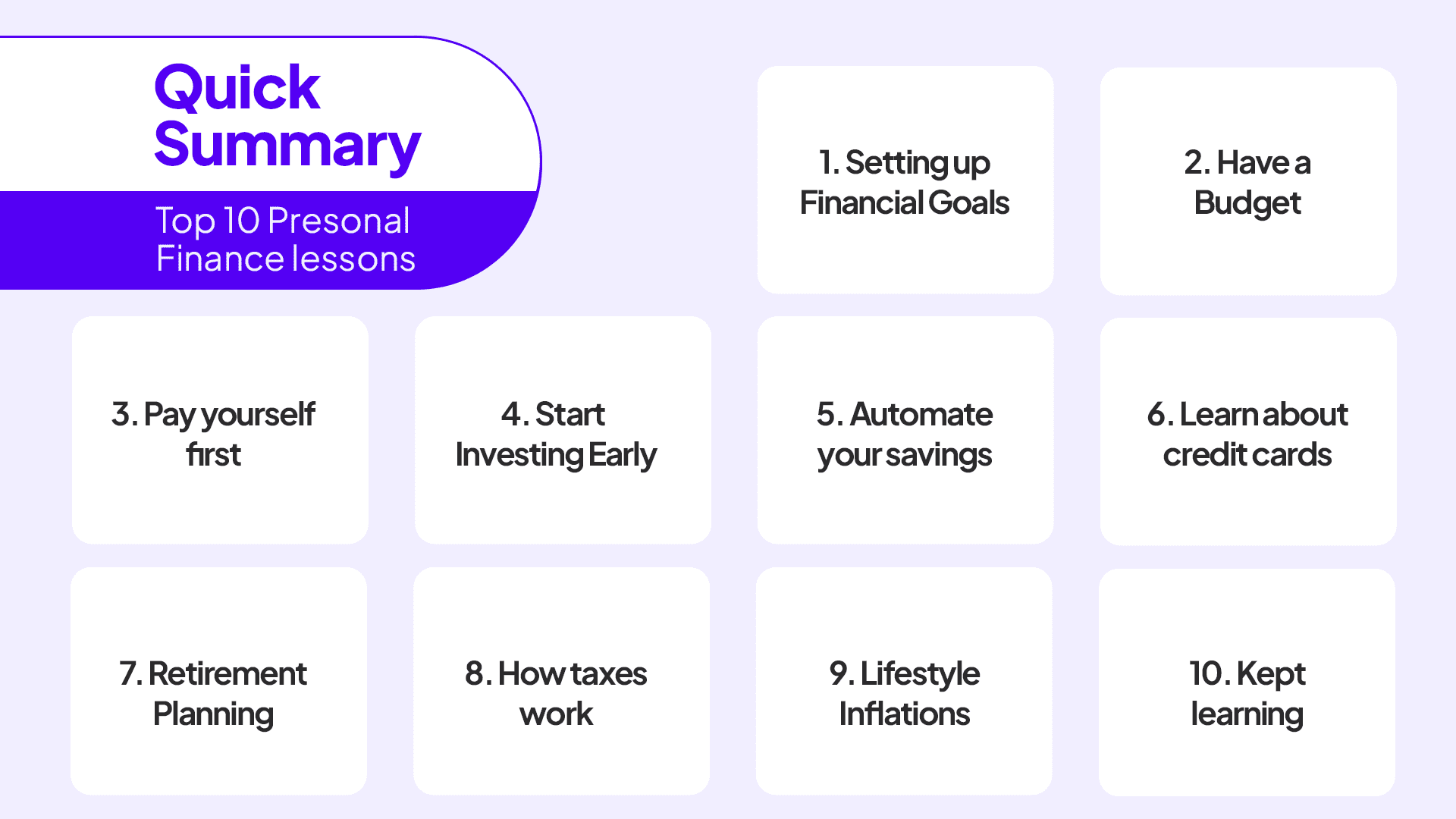

Here are 10 personal finance lessons for self-learning –

Read Also: P2P Lending: Definition, Benefits, And Limitations

1. Setting up financial goals:

Having clarity about your financial aspiration Lays a strong foundation for your financial future setting up short-term and long-term goals helps to form a road map to achieve them. The financial goal varies from person to person depending on their situation. Setting up financial goals that are realistic, attainable, and measurable is very important.

Some financial goals could be:

- Buying a house in the next 10 years

- Buying a car in the next two years

2. Have a budget:

Pen down all your income and expenses on a piece of paper, and see where your money is going. Analyze how could you allocate your income in a better way, so that the utility derived from your income could be maximized. Try to eliminate necessary expenses, fix the budget for every expense and try to stick with it.

3. Pay yourself first:

The first thing you should do when you get your paycheck is to pay yourself first. It means that you should keep a fixed amount aside every month for your future depending upon your financial aspirations. It is important to save for your future because we live in a world full of uncertainties, and believe it or not money may not be the most important thing in life but it affects everything that is.

4. Start investing early:

Investing work on the principle of compounding. Interesting fact that Albert Einstein famously referred to compound interest as the 8th wonder of the world. Compounding is accumulating wealth by allowing returns to generate more returns amplifying the benefits of saving and investing.

Let’s try to understand the benefit of early investing through an example:

Suppose Mr Sam is 30 years old and starts investing 25000 rupees Every month at the rate of 12% p.a. for the next 25 years.

At the age of 55 years, the value of his investment would be 4,70,000 rupees.

But, if Mr Sam had started investing just 5 years ago, i.e. when he was 25 years old then.

At the same age of 55 years, the value of his investment would be roughly around 8,80,000 rupees.

5. Automate your saving:

Saving your money is very important, if you save money in your good time your money will save you in your bad times. Set up automatic Transfer from your paycheck account to a separate savings account. Then slowly and gradually increase the amount you will be stunned to see how rapidly your savings will compound. Automating your savings gives you peace of mind because you know that you are building and saving your funds.

6. Learn about credit cards:

Credit cards can be both a boon and a bane. It just depends on the person and how they use them. If you are someone who can pay their bills on time then believe it, credit cards are a blessing for you.

There are various advantages of using a credit card such as

- Helps in building credit history.

- Helps you in tracking your expenses.

- Used as an emergency fund.

- Comes with a lot of rewards.

- Convenient pay method.

7. Retirement planning

It is never too early to plan for your retirement since who doesn’t want a comfortable and hassle-free life in their Golden years? so it’s better to start planning for your retirement as soon as possible. First, create a retirement budget and figure out an amount that you think will be enough for you to have your desired lifestyle in your retirement age. Then look for retirement accounts like IRAs or retirement pension plans to start your savings, Apart from this you can also figure out different sources of generating passive sources of income.

For example, invest in real estate by taking a loan from a Bank in your working year and then enjoy the rental income and capital appreciation in the following years.

8. How taxes work:

Learn and have a fair understanding of how taxes work. Learn about Income Tax, wealth tax, rebates, deductions, and credit scores. Identify your tax slabs and understand how to file taxes. ITR is very important if you are looking forward to taking a loan. When you approach the bank for the same they ask you for your tax return filing. Apart from this the government also give various types of relief if you fulfil certain financial obligations. These reliefs can sometimes help you to save a lot of money while making big purchases.

9. Lifestyle inflation:

Lifestyle inflation is a situation when a person starts spending more on their lifestyle than average because their income has increased. As your income grows it is normal to upgrade your lifestyle. But you should be mindful of where your money is going. It is important to distinguish between your needs and wants. However, being mindful of lifestyle inflation and saving a significant portion of increased income can accelerate your progress towards your financial goals.

10. Kept learning:

Understand that learning is a continuous and never-ending process. Everyone at some point in their lives has taken wrong financial decisions. But it is okay because everybody makes mistakes. What matters is how much you have learned from those mistakes. Financial missteps are a part of the learning journey. Cherish your mistakes as learning opportunities. Analyze what went wrong and accordingly adjust your strategy.

Conclusion

Remember that learning about financial independence is a lifelong endeavour. Which takes time. Being disciplined and having patience over the longer term makes achieving your financial goals more easy.

So educate yourself, set your goals, and take productive steps to make your future financially secure. By doing so, you are not just saving your money but investing in a more fulfilling and secure future.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | China Plus One Strategy |

| 2 | Debentures: Meaning, Features, Types, Benefits and Risks |

| 3 | Explainer On Geopolitical Tensions |

| 4 | Intrinsic Value vs Book Value |

| 5 | What are Treasury Bills: Meaning, Benefits and How to Buy? |

FAQs (Frequently Asked Questions)

What is personal finance?

Personal finance is the management of monetary resources in such a way that you can maximize its utility. And planning to spend your money in such a way that you can fulfil your present needs and also save for your future.

How to save money wisely?

To save your money wisely first identify where your money is going or where you are spending your money. Then distinguish between your needs and wants and accordingly cut your unnecessary expenses.

What is the PYF rule?

According to the PYF pay yourself first rule you first pay yourself out of your paycheck i.e. you keep an amount aside to invest or save for your future. By following this rule you are creating a safety cushion on which you can rely in your hard times.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle