| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-04-24 | |

| Add new links | Nisha | Mar-12-25 |

- Blog

- top dividend paying stocks in india

Top 5 Highest Dividend Paying Stocks in India

The stock market is unpredictable because stock prices can fluctuate a lot. Regular income from the stock market seems to be quite a difficult task to achieve, but not if you own shares of the companies that pay dividends. What if we told you that a small number of businesses give you the chance to receive dividends regularly?

Dividend-paying stocks are stocks of those companies that distribute a percentage of their profits to shareholders regularly, usually on a yearly or quarterly basis. Usually, companies that pay dividends generate consistent earnings.

We’ll provide an overview of the top 5 dividend-paying firms in today’s blog.

List of Best Dividend Companies in India

1. Vedanta Limited

Vedanta is an Indian corporation that operates in the mining, oil, and gas industries. The firm was previously known as Sterlite Industries Limited and started its business operation in 1979. Vedanta owns India’s largest copper smelter, which contributes nearly 50% of its profits. Vedanta also takes corporate social responsibility seriously and has contributed USD 37 million towards community development. It has been ranked as one of the top ten sustainable firms in India. It has 97,015 employees.

2. Indian Oil Corporation Limited

The Indian Oil Corporation Limited (IOCL) operates in the oil and gas industry and is owned by the Ministry of Petroleum and Natural Gas, Government of India. The Indian Oil Company Limited and Indian Refineries Limited were two distinct businesses that were merged to form Indian Oil Corporation Limited in 1964. IOCL owns subsidiaries in other countries as well. As of 2022, the company is ranked 94th on the Fortune 500 list. The corporation serves its customers through 34,000 petrol stations across India, and it can produce approximately 3,200 kilotons of petrochemicals annually. IOCL spent Rs. 1,800 crore on healthcare, education, environmental sustainability, etc.

3. Coal India Limited

Coal India Limited was founded in 1975 and has its headquarters in Kolkata, West Bengal. It is one of the biggest coal mining companies in the world. The Indian government granted the corporation the designation of “Maharatna” in 2011. The company owns multiple subsidiaries that are involved in coal mining operations. It was listed on the stock market in 2010. Coal India Limited contributes approximately 85% of India’s total coal production.

4. Bharat Petroleum Corporation Limited

The company was founded in 1928 and was initially known as Burmah Shell Oil Storage and Distributing Company of India Limited. It has more than 20,000 fuel stations across India. They began selling LPG cylinders to Indian households in the mid-1950s. The corporation was nationalized in 1976. Bharat Petroleum also started a joint venture named Indraprastha Gas Limited (IGL) with the Gas Authority of India Limited (GAIL).

5. Oil and Natural Gas Corporation Limited

The Oil and Natural Gas Corporation Limited (ONGC) is owned by the Ministry of Petroleum and Natural Gas, Government of India. ONGC was established in 1956 by the Government of India and produces 70% of India’s domestic crude oil production and around 84% of natural gas. It has a subsidiary named ONGC Videsh Limited (OVL), which manages its global production and exploration operations.

Read Also: Highest Dividend Paying Penny Stocks List

What is Dividend Yield?

The dividend yield is a financial ratio used to measure the dividend amount as a percentage of its share price.

Dividend Yield = (Annual Dividends per Share) / (Price per Share)

A company’s historical dividend yield does not guarantee that it will continue to pay out the same yield in the future due to several factors. For example, a downturn in the economy will always reduce the company’s profitability and cash flows, and high interest rates can occasionally deter investors from buying dividend stocks. As a result, dividend investing might be a smart choice for cautious investors.

Types of Dividend

The companies discussed above provide different types of dividends. Investors need to understand the different types of dividends mentioned below:

- Final Dividend – A company generally declares this type of dividend at the end of a financial year based on the company’s annual profits. This dividend is announced after financial statements are audited and released.

- Interim Dividend – The company declares and pays an interim dividend in the middle of the fiscal year.

- Stock Dividend – A stock dividend is paid in the form of additional shares rather than cash.

- Special Dividend – These dividends are non-recurring and are only paid out in specific circumstances. For example, when a company accumulates profit over time, it distributes it in the form of a special dividend to its shareholders.

Annual Dividend Yields

| Company | Annual Dividend Yield |

|---|---|

| Vedanta Ltd. | 6.44% |

| Indian Oil Corporation Ltd. | 7.13% |

| Coal India Ltd. | 5.32% |

| Bharat Petroleum Corporation Ltd. | 13.80% |

| Oil and Natural Gas Corporation Ltd. | 4.46% |

Comparative Study of Dividend Paying Companies

| Company | Share Price | Market Capitalization (In crores) |

|---|---|---|

| Vedanta Limited | 457.85 | 1,70,192 |

| Indian Oil Corporation Limited | 168.3 | 2,37,660 |

| Coal India Limited | 479.1 | 2,95,256 |

| Bharat Petroleum Corporation Limited | 304.4 | 1,32,064 |

| Oil and Natural Gas Corporation Limited | 274.85 | 3,45,768 |

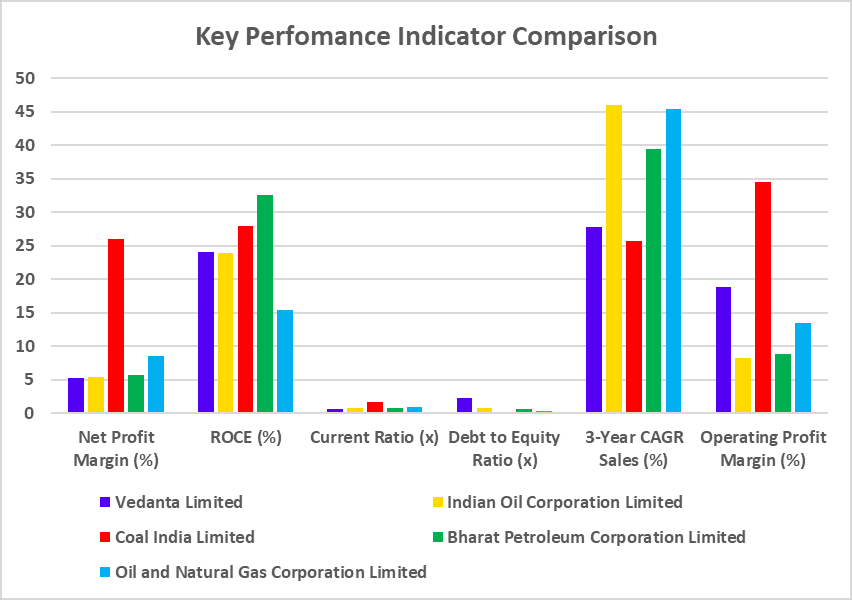

Key Performance Indicators

| Particular | Vedanta Limited | Indian Oil Corporation Limited | Coal India Limited | Bharat Petroleum Corporation Limited | Oil and Natural Gas Corporation Limited |

|---|---|---|---|---|---|

| Net Profit Margin (%) | 5.24 | 5.36 | 25.95 | 5.75 | 8.50 |

| ROCE (%) | 24.09 | 23.90 | 27.89 | 32.53 | 15.43 |

| Current Ratio (x) | 0.66 | 0.73 | 1.70 | 0.81 | 0.88 |

| Debt to Equity Ratio (x) | 2.34 | 0.72 | 0.08 | 0.60 | 0.36 |

| 3-Year CAGR Sales (%) | 27.78 | 46.05 | 25.73 | 39.53 | 45.44 |

| Operating Profit Margin (%) | 18.8 | 8.18 | 34.57 | 8.82 | 13.41 |

Out of all the companies described above, IOCL has the highest growth rate during the past three years, as demonstrated by the graph above, but it also has the lowest operating profit margin.

(Source – Company Financials)

Advantages of Investing in Dividend Paying Companies

Dividend-paying companies usually have the following features:

- It is suitable for investors who are looking to earn a stable income.

- Dividends can be reinvested to get the benefit of compounding.

- In addition to dividends, investors also benefit from increased stock prices over time.

- These companies are less volatile when compared with growth companies.

Read Also: How to invest in dividend stocks in India?

Conclusion

To sum up, investing in dividend-yield companies allows you to generate consistent income over time. Since these businesses are typically regarded as stable and less volatile, they are appropriate for conservative investors. However, always consult an investment advisor before making any decisions.

Frequently Asked Questions (FAQs)

What is the future of dividend-paying stocks in India?

Dividend-paying stocks offer a combination of dividend income and capital appreciation as they are profitable, distribute dividends to their shareholders, and retain some profit for future growth.

Is investing in dividend-paying stocks a safe and good option?

Dividend-paying companies are suitable for a cautious investor seeking steady income with minimal risk.

What is a dividend yield?

Dividend Yield is calculated by dividing the annual dividend by the share’s current market price, showing how much a corporation pays in dividends as a percentage of its share price.

A dividend yield company must declare a dividend every year.

No, dividend companies are not required to pay dividends annually. The decision to distribute dividends depends on several circumstances, including the company’s profit and the board of director’s discretion.

Name a few dividend-paying companies in India.

A few well-known dividend-paying businesses in India are Bharat Petroleum Limited, Indian Oil Corporation Limited, Vedanta Limited, and Coal India Limited.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.