| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-03-24 | |

| Add new links | Nisha | Mar-13-25 |

- Blog

- top investors in india and their portfolios

10 Top Investors In India And Their Portfolios

India is a growing country that has witnessed an increase in investment activities and a growing number of investors. Assets under Management (AUM) of Mutual Funds is growing by double digits, and demat accounts in India crossed the ten crore mark. The tale of India is being told by these metrics.

In this blog, we delve into the portfolios of some of the top investors of India.

1. Radhakishan Damani

Radhakishan Damani is a well-recognized name in the investment world. Damani is an entrepreneur and is the founder of a well-known retail chain in India, D-Mart. He is recognized for his eccentric approach to the stock market. He manages his portfolio through his investment firm, Bright Star Investments Limited. According to Forbes, he is the 8th richest person in India.

Damani was born in Mumbai on 15 March 1954 in a Marwari Hindu family. He studied Commerce at the University of Bombay but dropped out after one year. After the death of his father, he tried his hands in the stock market in the year 1980, and became a broker and investor. He made profits by short-selling the stocks in the 90s.

Investment Philosophy

Damani is a value investor and focuses on long-term investments. He is often associated with a conservative and risk-averse investment style and, invests in undervalued companies with strong fundamentals and has a good track record of consistently outstanding performance. He conducts his research to choose the stock and is patient with his investment strategies during market fluctuations.

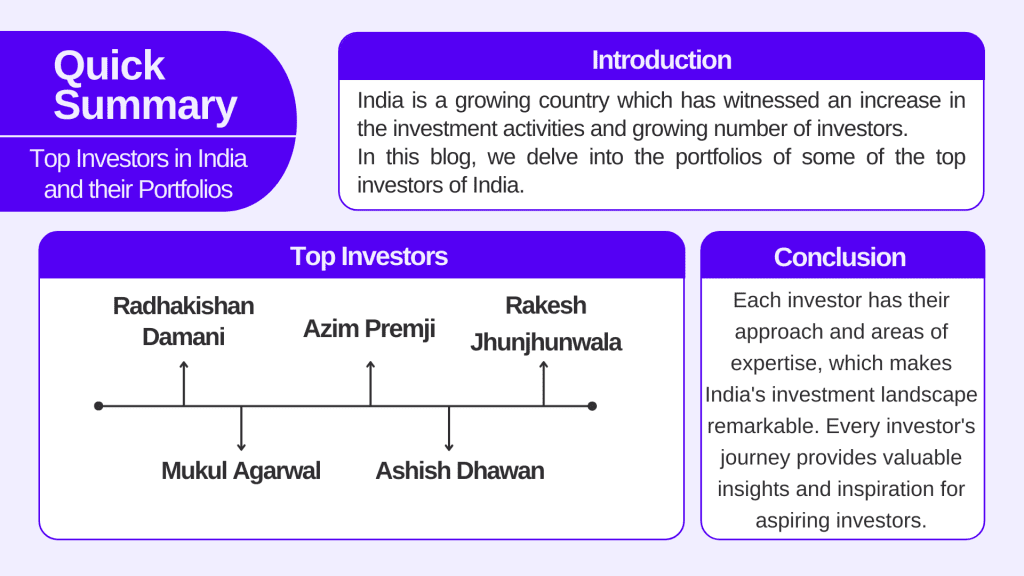

Radhakishan Damani’s Portfolio

As of September 2024, his portfolio valuation stood at INR 182,559 Crs. The table below shows the top ten stocks from his portfolio:

| Stocks | Value (IN cr) |

|---|---|

| Avenue Supermart Ltd. | 160909.07 |

| Trent ltd | 3067.4 |

| VST industries Ltd | 1609.2 |

| Other | 2270.7 |

2. Rakesh Jhunjhunwala

Rakesh Jhunjhunwala, also known as the Big Bull and the ‘Warren Buffet’ of the Indian stock market. He was a chartered accountant and a famous equity investor in India and one of India’s richest people. He was born in Mumbai, on July 5, 1960. Jhunjhunwala died on August 14, 2022, because of an adverse medical condition.

Rakesh developed an interest in stocks when he observed his father discussing stocks with his friends. Rakesh started his career in the stock market in 1985 with an investment of INR 5,000. Investments in companies like Titan, Infosys & CRISIL in 2000 brought him early success.

Rakesh Jhunjhunwala’s Investment Philosophy

Rakesh was recognized for his value-investing approach in the stock market. He had always chosen undervalued companies with strong fundamentals in the market. He believed that these companies hold an immense potential to generate great returns over the long term. Rakesh invested in companies across different sectors to maximize his returns and was always focused on extensive research of stocks.

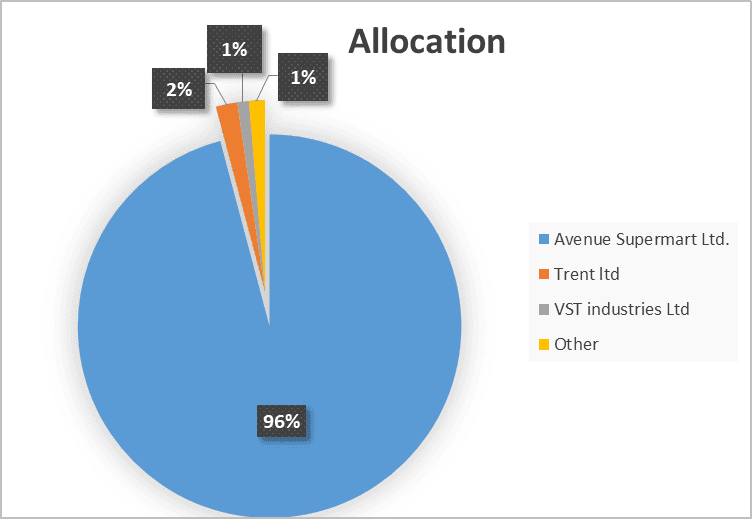

Rakesh Jhunjhunwala Portfolio

As of September 2024, Jhunjhunwala’s net worth stood at INR 51,079 Crore. Have a look at the sector-wise breakup of Rakesh Jhunjhunwala’s portfolio.

Further, have a look at the top stocks of his portfolio:

| Stocks | Value (IN cr) |

|---|---|

| Titan Company ltd | 15,169 |

| Concord Biotech Ltd. | 5,526.40 |

| Star Health and Allied Insurance Company Ltd. | 4,789.80 |

| Tata Motors Ltd. | 3,804.20 |

| Metro Brands Ltd. | 3,260.20 |

| Others | 18349.6 |

3. Mukul Agarwal

Mukul Agarwal, as an investor has gained prominence in recent years. Currently, he is the director of three companies, namely Param Capital Research Private Limited, Permanent Technologies Private Limited, and Mahavir Prasad Nevatia Education Institution. He entered the market in the late 90s.

Mukul Agarwal’s Investment Philosophy

Mukul is the fresh face of the Indian stock market. He adopts a long-term investment strategy with a major focus on diversification of portfolio. He does not believe in making impulsive decisions and knows how to stay disciplined while investing.

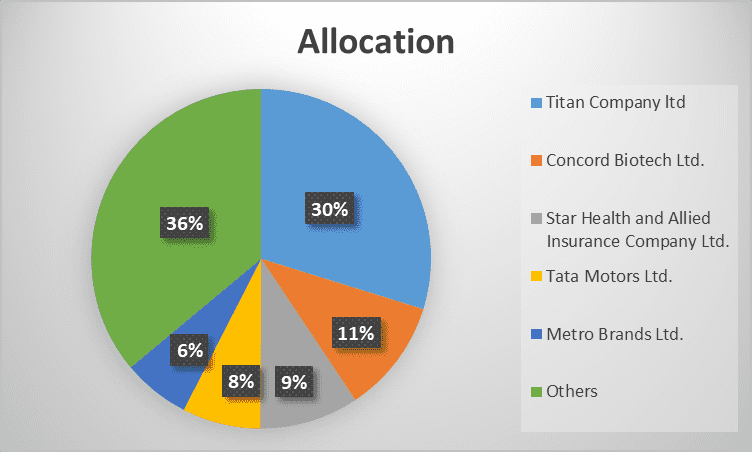

Mukul Agarwal’s Portfolio

As of September 2024, Mukul Agarwal’s net worth stood at INR 7189.8 Crore. Have a look at the top ten stocks from his portfolio:

| Stocks | Holding value (INR CR) |

|---|---|

| BSE Ltd | 912 |

| Neuland Laboratories Ltd. | 676.7 |

| Nuvama Wealth Management Ltd. | 335 |

| Radico Khaitan Ltd. | 329.6 |

| Capacit’e Infraprojects Ltd. | 229.5 |

| Others | 4725 |

4. Azim Premji

Azim Premji is a philanthropist, business tycoon, and the former chairman of one of the leading tech giants of India, Wipro Limited. Azim Premji was born in Mumbai in the year 1945. Premji holds a bachelor’s degree in electrical engineering from Stanford University He took over Wipro from his father in the year 1966. At that time, Wipro was a vegetable oil company. Premji later recognised the emerging IT trends in the country and decided to expand Wipro’s Business. As a philanthropist, he has donated over $21 billion to his Azim Premji Foundation. Premji has been awarded with Padma Bhushan in the year 2011. Wipro made Premji one of the wealthiest investors in India.

Azim Premji’s Investment Philosophy

Premji is known for his disciplined and long-term investment strategies. He has a long-term perspective on the stock market. Premji focuses on value investing principles and thoroughly analyses the company’s fundamentals and growth potential. He believes in diversification of portfolio and knows how to manage risk effectively.

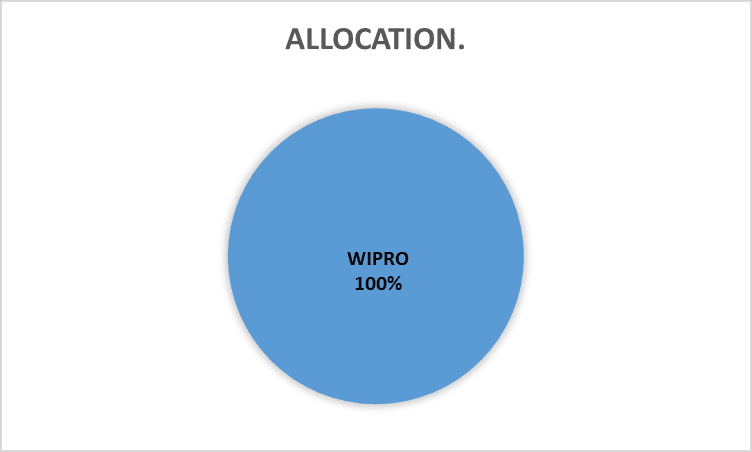

Azim Premji’s Portfolio

As of September 2024, Premji’s net worth stood at INR 110901.3 Crore. Have a look at the sector-wise breakup of Azim Premji’s portfolio:

The table below shows the top stocks from his portfolio:

| Stocks | Holding Value (INr cr) |

|---|---|

| Wipro | 110901.3 |

5. Ashish Dhawan

Ashish Dhawan is a well-known investor in India who has achieved significant returns in the stock market through his analytical approach. Ashish was born on March 10, 1969. He is the co-founder of Chrys Capital, a leading private equity firm.

After a successful career in investing, he switched to philanthropy and education. Dhawan is also the founder of a non-profit organization named Central Square Foundation which works towards improving and transforming the quality of education. He also played a major role in the establishment of Ashoka University in Haryana.

Ashish Dhwan’s Investment Philosophy

Ashish spreads his investments across various sectors and asset classes to minimize risk. He emphasizes long-term returns and conducts detailed analyses of market conditions, and companies before investing. He looks for undervalued gems in the stock market.

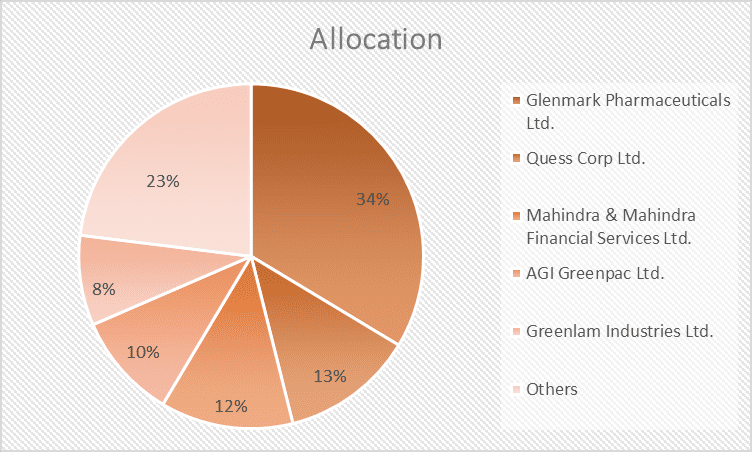

Ashish Dhawan’s Portfolio

As of September 2024, Dhawa’s net worth stood at INR 3,332.7 Crore. Have a look at the top ten stocks from his portfolio:

| Stocks | Holding Value(inr cr) |

|---|---|

| Glenmark Pharmaceuticals Ltd. | 1,126 |

| Quess Corp Ltd. | 417.6 |

| Mahindra & Mahindra Financial Services Ltd. | 416.9 |

| AGI Greenpac Ltd. | 332.9 |

| Greenlam Industries Ltd. | 283.1 |

| Others | 771.4 |

6. Vijay Kishanlal Kedia

Vijay Kedia’s portfolio is among the most followed in the Indian market, both due to his reputation as a “market master” and the historical returns his portfolio has delivered over the years Born on 1959 in Kolkata, Kedia has made a name for himself as a self-made investor who started his journey in the stock market at a young age, overcoming significant financial challenges to establish himself as one of India’s most respected market voices.

Kedia has been a keynote speaker at IIM Ahmedabad, IIM Bangalore & MDI Murshidabad and he has been a TEDx speaker 2 times He was also invited to speak at London Business

Vijay Kedia’s Investment Philosophy

Speaking about his investment rationale, Kedia says, “One should scout for companies which have good management. Find very good, very honest management and see the product in which the management is going to outperform its peers and the economy. Invest in those companies for the next 10-15 years, and you cannot go wrong.” He uses the SMILE approach in his portfolio investments – ‘small in size, medium in experience, large in aspiration, and extra-large in market potential’.

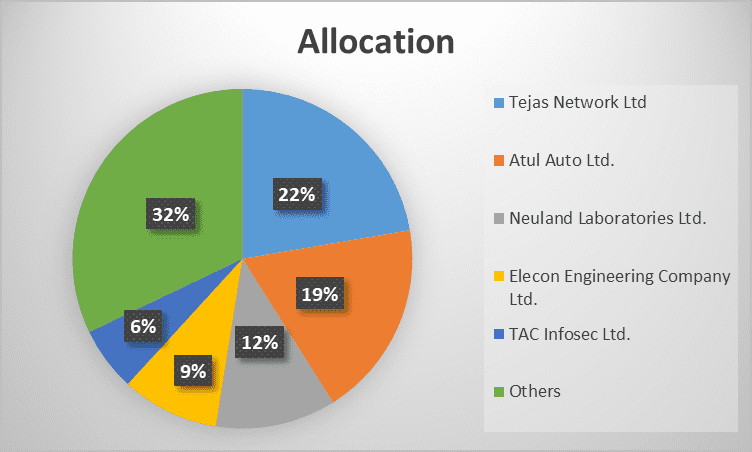

Vijay Kedia’s Portfolio

As of September 2024, Vijay’s net worth stood at INR 1928.2 Crore. Have a look at the top ten stocks from his portfolio:

| Stocks | Holding Value(INR CR) |

|---|---|

| Tejas Network Ltd | 431 |

| Atul Auto Ltd. | 362.6 |

| Neuland Laboratories Ltd. | 221.7 |

| Elecon Engineering Company Ltd. | 179.6 |

| TAC Infosec Ltd. | 117.8 |

| Others | 621 |

7. Ashish Kochalia

Ashish Kacholia is a prominent Indian stock market investor renowned for his astute investment strategies and knack for selecting multi-bagger stocks that deliver exceptional returns over the long term.

Often referred to as the “Big Whale” of the Indian equity markets, Kacholia has built a formidable reputation for his deep research With a career that spans decades, Kacholia initially co-founded the renowned brokerage firm Edelweiss, which laid the foundation for his extensive understanding of market dynamics. Over time, he transitioned to become an independent investor, amassing a well-diversified portfolio across sectors such as technology, consumer goods, chemicals, and manufacturing.

Ashish Kacholia’s success has made him a sought-after figure in the financial world, where he is often lauded as an inspiration for retail investors looking to build wealth in equity markets. Despite his success, he maintains a low public profile, letting his impressive track record and investment philosophy speak volumes.

Ashish Kochalia’s Investment Philosophy

His investment style is characterized by patience, a focus on business fundamentals, and a deep conviction in the companies he invests in. He identified high-growth potential in small-cap and mid-cap companies and remain invested in them for a long time which delivers exceptional returns

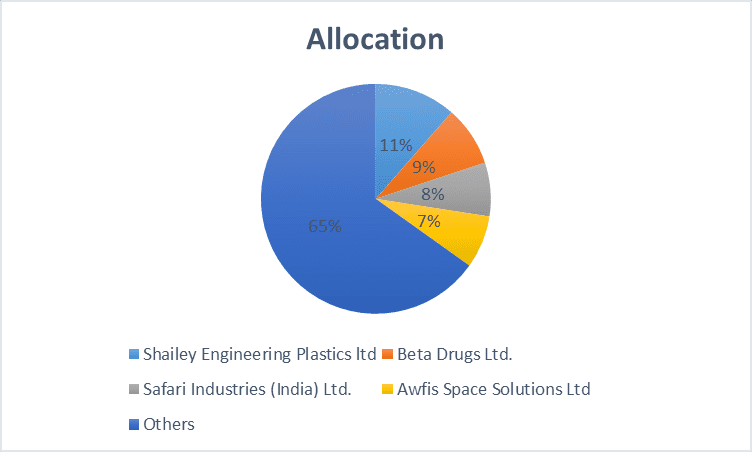

Ashish Kochalia’s Portfolio

As of September 2024 Ashish Kochalia’s net worth stood at INR 3,158.7 Crore. Have a look at the top stocks from his portfolio:

| Stocks | Holding Value(INR Cr) |

|---|---|

| Shailey Engineering Plastics ltd | 361.2 Cr |

| Beta Drugs Ltd. | 267.4 Cr |

| Safari Industries (India) Ltd. | 238.6 Cr |

| Awfis Space Solutions Ltd | 234.3 Cr |

| Others | 2057.3 |

8. Madhusudan Kela

Madhusudhan Kela is a renowned Indian investor and financial strategist celebrated for his deep insights into equity markets and a career spanning over three decades. He gained prominence during his tenure as Chief Investment Strategist at Reliance Mutual Fund, where his visionary investment strategies played a pivotal role in delivering outstanding returns and building a robust reputation for the fund.

Madhusudhan Kela’s Investment Philosophy

Kela’s investment philosophy is rooted in the principles of identifying long-term trends, deeply analyzing business fundamentals, and maintaining a high conviction in his bets. Known for his contrarian approach, he often seeks opportunities in undervalued or overlooked sectors, emphasizing patience and the ability to withstand market volatility. His disciplined, research-driven methodology and knack for spotting multibagger opportunities have made him a revered figure in Indian capital markets.

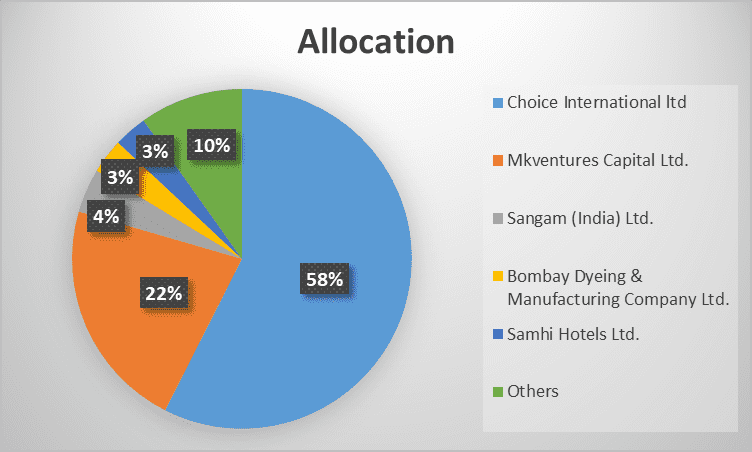

Madhusdhan’s Kela Portfolio

As of September 2024, Madhusudhan Kela’s net worth stood at INR 2,224.0 Crore. Have a look at the top stocks from his portfolio:

| Stocks | Holding Value(Rs cr) |

|---|---|

| Choice International ltd | 1,278 |

| Mk Ventures Capital Ltd. | 489.90 |

| Sangam (India) Ltd. | 93.00 |

| Bombay Dyeing & Manufacturing Company Ltd. | 73.70 |

| Samhi Hotels Ltd. | 70.40 |

| Others | 218.8 |

9. Akash Bhansali

Akash Bhansali is a prominent Indian investor and the Managing Director of Enam Holdings, a private investment firm renowned for its strategic investments across diverse sectors. With decades of experience in the financial markets, Bhansali has earned a reputation as a sharp and forward-thinking investor who focuses on creating long-term wealth through disciplined and well-researched investments. His ability to identify trends early and align his portfolio with India’s growth story has made him a respected figure in the investment community.

Akash Bhansali’s Investment Philosophy

Bhansali’s investment philosophy revolves around identifying quality businesses with robust fundamentals, strong management teams, and scalable growth opportunities. He emphasizes patience, value creation, and a deep understanding of the industries he invests in. His portfolio often reflects a balance between traditional industries and emerging sectors, showcasing his belief in diversification and adaptability. Akash Bhansali’s strategic and thoughtful approach serves as an inspiration for investors aiming to achieve sustainable wealth creation.

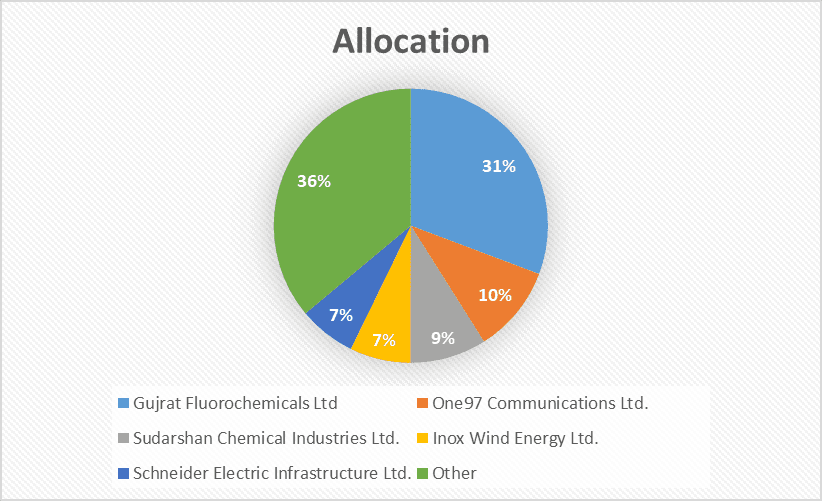

Akash Bhansali’s Portfolio

As of September 2024, Vijay’s net worth stood at INR 6952.7 Crore. Have a look at the top stocks from his portfolio:

| Stocks | Holding Value(Rs cr) |

|---|---|

| Gujrat Fluorochemicals Ltd | 2,137 |

| One97 Communications Ltd. | 717.1 |

| Sudarshan Chemical Industries Ltd. | 627 |

| Inox Wind Energy Ltd. | 497.5 |

| Schneider Electric Infrastructure Ltd. | 467.6 |

| Other | 2506.79 |

10. Anil Kumar Goel

Anil Kumar Goel is a highly regarded Indian investor known for his exceptional expertise in identifying high-potential opportunities in small-cap and mid-cap companies. With decades of experience in equity markets, Goel has carved out a niche for himself by focusing on undervalued and often overlooked sectors, particularly in the manufacturing and industrial space. He is also known as “Sugar Baron” on Dalal Street because of his picks in sugar stocks. His success has made him a well-respected figure among value investors in India.

Anil Kumar Goel’s Investment Philosophy

Goel’s investment philosophy centers around deep value investing, where he meticulously analyzes a company’s financials, business fundamentals, and industry prospects. He is known for his preference for companies with strong cash flows, minimal debt, and consistent growth potential. Goel often takes a long-term approach, patiently holding his investments as the value of the business unfolds over time. His ability to spot hidden gems and turn them into multibaggers has made him an inspiration for retail and institutional investors alike.

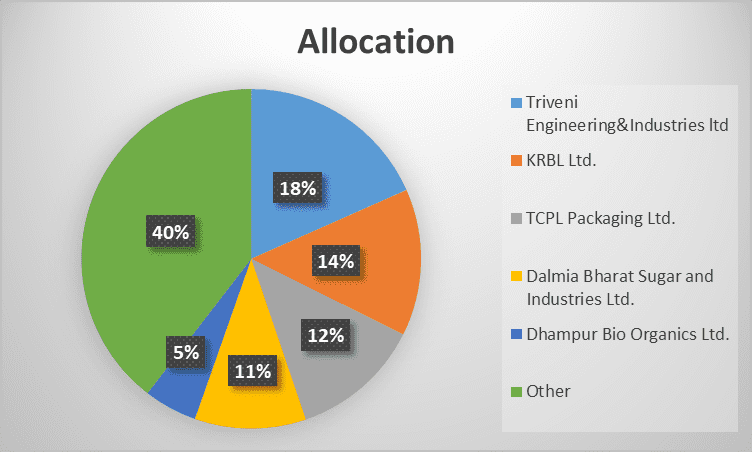

Anil Kumar Goel’s Portfolio

As of September 2024, Anil Kumar Goel’s net worth stood at INR 2164.2 Crore. Have a look at the top stocks from his portfolio:

| Stocks | Holding Value(Rs cr) |

|---|---|

| Triveni Engineering&Industries ltd | 397 |

| KRBL Ltd. | 302.80 |

| TCPL Packaging Ltd. | 268.50 |

| Dalmia Bharat Sugar and Industries Ltd. | 229.40 |

| Dhampur Bio Organics Ltd. | 109.50 |

| Other | 855 |

Read Also: Top 10 Most Expensive Stocks in India

Conclusion

Each investor that we have discussed, has their approach and areas of expertise, which makes India’s investment landscape remarkable. Every investor’s journey provides valuable insights and inspiration for aspiring investors.

To warp it up, there is no “best” way to invest in the stock market. One can observe by analysing the portfolio of top investors that long-term investing, discipline, and patience are the key factors to a successful investing journey. Create your strategies and uncover opportunities that might lead you to the ladder of success.

Frequently Asked Questions (FAQs)

Who played a major role in the foundation of Ashoka University?

Ashish Dhawan.

Who is known as the “Warren Buffet of India”?

Rakesh Jhunjhunwala

Who was the former chairman of Wipro?

Azim Premji

What is the investment style of Ashish Dhawan?

Ashish Dhawan focuses on long-term investing and picks undervalued stocks with strong fundamentals.

Who was the founder of Avenue Supermarts Limited?

Radhakishan Damani

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.