| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-31-24 | |

| Update Formatting | Nisha | Mar-13-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Blog

- top power companies in india

Top Power Companies in India

India’s growth brings a bigger need for power. As cities and industries grow, so does the demand for electricity. Some companies lead this charge, shaping our future. With the advent of discount brokers, you can now own a part of these companies and benefit from their growth.

In this blog, we will provide an overview of India’s top companies engaged in the production and transmission of power to your household.

Role of India in Energy Sector

As of March 2024, India is the third-largest electricity producer in the world, with an installed power capacity of 442 GW (Giga Watt). According to data released by the Ministry of Power, the country is growing at an annual rate of 7.7%. By 2047, India plans to increase the installed capacity of non-fossil fuel to 90%.

Factors Affecting Power Companies

- Changes in government regulation related to the power sector can impact the performance and profitability of the companies.

- The growing market of renewable energy due to increasing awareness of climate change can negatively impact the market share of traditional energy companies.

- Older and inefficient infrastructure related to the power supply through grids could lead to loss of energy during the process, which could impact the company’s revenue.

Top Power Companies in India

NTPC

The company was established in 1975 as a public sector enterprise by the Indian government in response to the nation’s electricity needs. The corporation first prioritized using coal to generate electricity but eventually turned its attention to renewable energy sources. By 2032, the corporation hopes to reach a capacity of 130 GW. In 2023–2024, the company generated 400 billion units of electricity.

Power Grid Corporation Limited

The Indian government has bestowed on this corporation the title of Maharatna. Founded as National Power Transmission Corporation Limited in 1989, it is a wholly owned government subsidy of the Indian government. In 1992, the firm changed its name to Power Grid Corporation of India, and the government’s ownership had decreased to 51.34%. In 2007, they listed themselves on the stock exchange. As of April 30, 2024, the corporation operated 278 sub-stations and 1,77,790 circuit kilometers of transmission line.

Tata Power Company Limited

Power generation, distribution, and transmission are all activities carried out by the company. Established in 1915 as Tata Hydroelectric Power Supply Corporation, the corporation changed its name to Tata Power Company Limited in 2000. The company has an available maximum capacity of 14,690 megawatts. In addition to producing electricity, the company also installs solar panels on roofs and provides home automation systems and electrical charging stations.

Adani Power Limited

Founded in 1996, the company primarily focused on power trading. Later, in 2009, it started producing power and started its first plant in Mundra, Gujarat. As of today, the company operates facilities in Gujarat, Maharashtra, and Rajasthan and has a capacity of 15,250 megawatts of electricity. It also has a 40-megawatt solar power facility in Gujarat.

JSW Energy Limited

The business was established in 1994 and is a member of the JSW Group, regarded as one of India’s top conglomerates. It operates in several industries, including infrastructure, steel, energy, and cement. In 2007, the company went through an initial public offering (IPO) to list on a stock exchange. The company currently stands as India’s one of the top private power companies with a total power generation capacity of 6,677 megawatts, which includes 3,158 MW from their thermal power plants, 1,391 MW from hydropower plants, 1,461 MW from wind power plants, and 667 from solar power plants. The company also holds some stake in South African natural resources companies.

Comparative Study of Power Companies

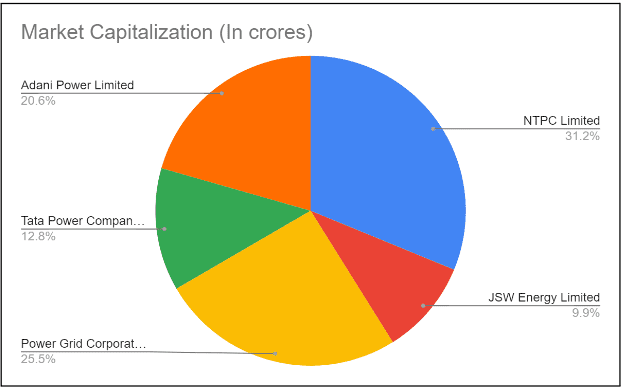

Market Capitalization

| Company | Market Capitalization (In crores) |

|---|---|

| NTPC Limited | 3,63,576 |

| Power Grid Corporation of India Limited | 2,96,503 |

| Tata Power Company Limited | 1,42,895 |

| Adani Power Limited | 2,72,839 |

| JSW Energy Limited | 1,04,979 |

We may infer from the preceding graph that NTPC has the biggest market capitalization among the aforementioned organizations, followed by Power Grid Corporation and Adani Power Limited.

Read Also: Different Types of Companies in India

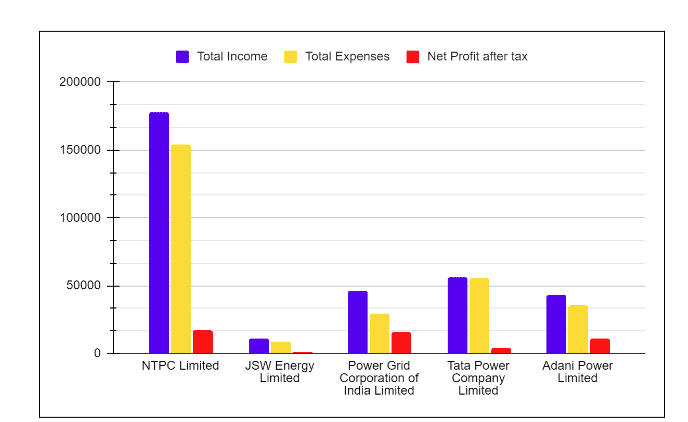

Financial Statement Highlights

Income Statement (FY 2023)

| Company | Total Income | Total Expenses | Net Profit after tax |

|---|---|---|---|

| NTPC Limited | 177,977.17 | 154,426.35 | 17,121.35 |

| JSW Energy Limited | 10,867.05 | 9,063.50 | 1,480.12 |

| Power Grid Corporation of India Limited | 46,605.64 | 29,070.47 | 15,417.12 |

| Tata Power Company Limited | 56,547.10 | 55,213.61 | 3,809.67 |

| Adani Power Limited | 43,040.52 | 35,365.82 | 10,726.64 |

Among the enterprises listed above, JSW Energy Limited reported the lowest net profit after tax of INR 1,480 crore. According to the income statement above, NTPC reported the most significant profit at INR 17,121 crore.

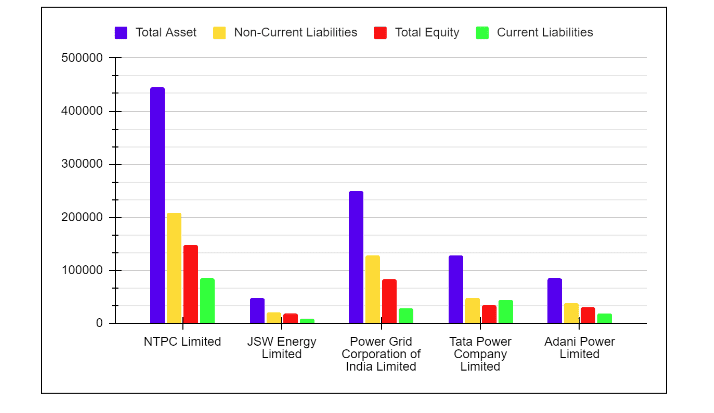

Balance Sheet (FY 2023)

| Particulars | Total Asset | Non-Current Liabilities | Total Equity | Current Liabilities |

|---|---|---|---|---|

| NTPC Limited | 446,021.45 | 207,582.38 | 147,023.17 | 84,534.97 |

| JSW Energy Limited | 48,741.70 | 21,001.90 | 18,734.18 | 8,937.71 |

| Power Grid Corporation of India Limited | 250,295.55 | 128,975.23 | 83,014.51 | 28,142.29 |

| Tata Power Company Limited | 128,349.04 | 48,816.80 | 34,204.12 | 43,979.22 |

| Adani Power Limited | 85,821.27 | 38,201.02 | 29,875.66 | 17,744.59 |

According to the above table, NTPC has the highest total asset, followed by Power Grid Corporation of India Limited, with JSW Energy having the lowest total asset.

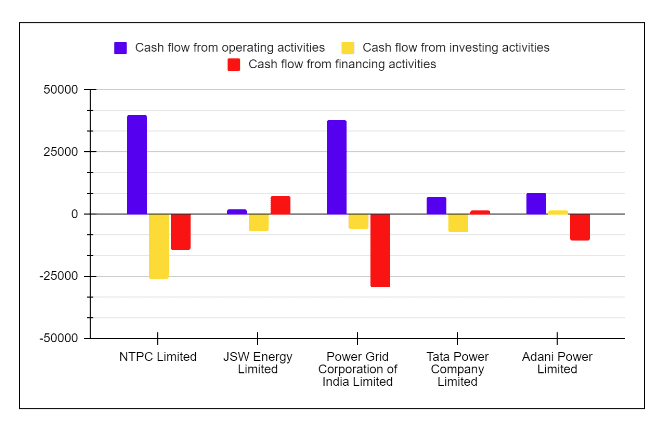

Cash Flow Statement (FY 2023)

| Particulars | Cash flow from operating activities | Cash flow from investing activities | Cash flow from financing activities |

|---|---|---|---|

| NTPC Limited | 40,051.55 | -26,107.20 | -14,154.47 |

| JSW Energy Limited | 2,084.27 | -7,009.48 | 7,327.48 |

| Power Grid Corporation of India Limited | 38,004.74 | -6,125.70 | -29,263.98 |

| Tata Power Company Limited | 7,159.13 | -7,375.25 | 1,340.77 |

| Adani Power Limited | 8,430.53 | 1,544.43 | -10,408.46 |

The firms’ financial statements show that, except Adani Power Limited, all of them have negative cash flows from their investing activities; Power Grid Corporation Limited, on the other hand, has the largest negative cash flow from financing activities.

KPIs (FY 2023)

| Particular | NTPC Limited | JSW Energy Limited | Power Grid Corporation of India Limited | Tata Power Company Limited | Adani Power Limited |

|---|---|---|---|---|---|

| Net Profit Margin (%) | 9.27 | 14.13 | 34 | 1.10 | 41.36 |

| ROCE (%) | 9.68 | 6.66 | 12.81 | 6.87 | 31.59 |

| Current Ratio (x) | 0.93 | 1.07 | 0.91 | 0.87 | 1.62 |

| Debt to Equity Ratio (x) | 1.5 | 1.33 | 1.52 | 1.70 | 0.80 |

| 3-Year CAGR Sales (%) | 26.87 | 11.75 | 9.89 | 37.53 | 38.57 |

| Operating Profit Margin (%) | 19.69 | 25.62 | 59.60 | 10.35 | 48.02 |

The net profit margin of JSW Energy, as shown by the key indicators above, was 1.10, the lowest of all the firms discussed. However, the company’s YoY sales growth rate was the highest.

Conclusion

The government of India’s plans for infrastructure development will require new transmission lines and sustainable energy technologies, which would spur the expansion of power industry businesses. However, the industry is also vulnerable to regulation changes, fuel price variations, and difficulties arising from infrastructural investments. Therefore, before investing, an investor must review all the risk factors associated with the companies they wish to invest in and consult an investment advisor.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Vodafone Idea: Business Model And SWOT Analysis |

| 2 | Breakdown of CTC: A Detailed Analysis |

| 3 | Ratio Analysis: List Of All Types Of Ratio Analysis |

| 4 | What Was the Great Depression? Impact & Causes |

| 5 | Explained | Why the 127-year-old Godrej Group is splitting |

Frequently Asked Questions (FAQs)

Which power stocks have the highest market cap?

As of 24th May, NTPC had a market capitalization of INR 3,63,576 crores, making it the largest power firm in terms of market capitalization. Power Grid Corporation and Adani Power follow NTPC.

Who are the major players in the Indian Power Sector?

NTPC, Tata Power, JSW Energy, Power Grid Corporation, and Adani Power are the main players in the Indian power industry.

How many listed power stock companies are in India?

In India, 42 listed companies are engaged in the power generation and distribution business.

Is it worth investing in power stocks?

Power stocks are involved in vital functions like producing and distributing electricity, which is a basic necessity for contemporary society. As the nation’s population grows, so will the need for power. However, before making any investment decisions, one must take into account the risk associated with the company, including its debt load and operating profit margins.

Is NTPC a government company?

Yes, the Indian government owns about 84.5% of NTPC’s share capital. As a result, the company is regarded as a public sector initiative because the government of India is the entity that oversees its board of directors.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle