| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-24-25 |

- Blog

- top stocks to watch during ipl

7 Top IPL-Related Stocks to Watch in 2025

Indian Premier League, or IPL 2025, is not just a cricket tournament; it is also a significant economic event. The league draws millions of viewers worldwide, generating major revenue from sponsorships, ads, ticket sales, and digital platforms. The popularity of IPL positively impacts FMCG, hospitality, media, and other sectors.

In this blog, we will discuss the sectors and companies that can be positively impacted due to IPL 2025.

Top 7 IPL Related Stocks List 2025 – Market Information

| S.NO. | Company | Current Market Price (₹) | Market Capitalization (in ₹ crores) | 1 Month Return | 6 Month Return |

|---|---|---|---|---|---|

| 1 | Zomato Limited | 223 | 2,14,913 | 0.07% | -23.61% |

| 2 | CEAT Limited | 2,843 | 11,501 | 7.87% | -4.91% |

| 3 | Reliance Industries Limited | 1,301 | 17,61,035 | 7.25% | -12.54% |

| 4 | Varun Beverages Limited | 531 | 1,79,605 | 6.25% | -17.88% |

| 5 | ITC Hotel Limited | 196 | 40,781 | 22.03% | 13.93% |

| 6 | Indian Hotels Limited | 842 | 1,19,796 | 15.43% | 18.32% |

| 7 | United Breweries Limited | 1,968 | 52,034 | -3.57% | -8.92% |

Below are the top 7 stocks to watch out for during IPL 2025, along with their overviews:

1. Zomato

Zomato is an Indian restaurant aggregator and provides food delivery services from affiliated eateries in more than 1,000 Indian towns and cities. Initially called “Foodiebay,” Zomato was established in 2008 by Deepinder Goyal and Pankaj Chaddah.

IPL Impact: As most people watch matches at home or in groups, the IPL increases demand for food delivery services, thereby increasing revenue.

2. Ceat Tyres

Previously known as Cavi Electtrici e Affini Torino (Electrical Cables and Allied Products of Turin), CEAT Limited is a well-known and prominent international tyre manufacturer with its headquarters located in Mumbai, India. They produce tyres for a variety of vehicles, including cars, trucks, buses, and motorcycles.

IPL Impact: Strategic timeouts featuring CEAT’s brand ads, an official IPL partner, can increase brand recall and possibly increase sales.

4. Reliance Industries

Reliance was founded in 1966 by Mr. Dhirubhai Ambani. Later in 1980, it began expanding its operations in the petrochemical sector. Following his death, Dhirubhai Ambani’s two sons, Anil and Mukesh Ambani, divided the company. Under Mukesh Ambani’s leadership, the business expanded into several sectors, including communications and retail, and achieved new heights.

IPL Impact: RIL has a strong presence in IPL broadcasting and digital streaming through its subsidiaries, such as Viacom18, and platforms, JioTV and JioHotstar and is positioned to profit from the higher viewership during the IPL season.

5. Varun Beverages

The chairman of RJ Corp., Ravi Jaipuria, founded Varun Beverages Limited in 1995. The business is named after Ravi Jaipuria’s child. The business produces and sells beverage bottles. The company initially established PepsiCo product packaging facilities in India. The company’s main operations involve the production and distribution of bottles for PepsiCo’s product line.

IPL Impact: Varun Beverages is a prominent manufacturer, bottler and distributor of PepsiCo products in India, producing well-known beverages like 7Up, Mountain Dew, and Pepsi. Soft drink sales may increase because the IPL takes place during the peak summer months.

5. ITC Hotels

One of the biggest hotel chains globally, ITC Hotels has over 100 hotels featuring luxurious accommodations. Some of the prominent ITC Hotel brands are Mementos, ITC Hotels, Welcomhotel, Fortune Hotels, etc.

IPL Impact: ITC Hotels will be in focus during the IPL Tournament because premium room bookings will be driven by IPL teams, officials, tourists and corporate guests staying at their lavish hotels.

Moreover, increased IPL snack consumption benefits ITC’s FMCG division. An increase in revenue from FMCG and hospitality sales during the IPL season is also expected.

6. Indian Hotels

The company was established in 1903 by Jamsetji Tata, and it initially operated a hotel in Mumbai called The Taj Mahal Palace. The company bought the Taj Lake Palace in Udaipur and opened additional hotels across the country to expand its holdings. In 1980, the company introduced several innovative brands known by the name of Vivanta and Ginger in response to changing consumer demands and also bought hotels abroad.

IPL Impact: Indian Hotels will have a few of its hotels featured as team hotels for some IPL teams, which will have a positive impact on the company because of higher rates of hotel occupancy.

7. United Breweries

The late Mr Vittal Mallya bought the business in 1947. It has continuously expanded ever since. With more than 60% of the beer market, United Breweries is considered the biggest producer in India. The company’s headquarters is in Bangalore. When the company was founded in 1915, it had five breweries in southern India.

IPL Impact: Increased alcohol consumption during IPL matches benefits companies like United Breweries. Nightlife in host cities sees greater interest in parties, pubs, and sports bars, thereby increasing the sale of alcohol and the revenues of alcohol companies.

IPL 2025 Sponsors and Market Influence

Some of the prominent sponsors of IPL 2025 are:

1. Tata Group

Tata Group is one of India’s oldest and largest conglomerates, founded in 1868 by Jamsetji Tata. It operates across diverse sectors, including steel, automobiles, IT, hospitality, and more. Known for its ethical values and philanthropy, Tata Group includes companies like Tata Steel, Tata Motors, TCS, and Tata Power, with a global footprint across 100+ countries.

IPL Link: Tata Group is the title sponsor of IPL 2025 and has paid a total sum of ₹2,500 crores for retaining title sponsorship from 2024 to 2028.

2. My11Circle.

My11Circle is an Indian fantasy sports platform owned by Games24x7. It allows users to create virtual teams for cricket, football, and kabaddi and earn points based on real-time performance. Known for its user-friendly interface and celebrity endorsements (e.g., Sourav Ganguly), it has quickly emerged as a major player in the fantasy gaming industry.

IPL Link: In 2024, My11Circle agreed to pay a total of ₹625 crores over a period of 5 years to be the associate sponsor of IPL.

3. Angel One

Angel One (formerly Angel Broking) is a leading Indian stockbroking and wealth management firm. Established in 1996, it offers services like equity trading, commodities, mutual funds, and portfolio management. With a strong digital platform and low brokerage fees, Angel One caters to retail investors and traders, making investing accessible across Tier 2 and Tier 3 cities.

IPL Link: Angel One is the associate sponsor of IPL 2025.

4. RuPay

RuPay is India’s domestic card payment network launched by the National Payments Corporation of India (NPCI). Designed to promote financial inclusion, RuPay offers debit, credit, and prepaid cards. Accepted widely across ATMs, POS terminals, and online platforms, RuPay has become a key player in India’s digital payments ecosystem, challenging global networks like Visa and Mastercard.

IPL Link: In 2025, RuPay will serve as the associate sponsor of IPL.

5. Wonder Cement

Wonder Cement is a part of the RK Group and one of India’s fastest-growing cement companies. Established in 2010, it manufactures premium-quality Portland Pozzolana and Ordinary Portland Cement. With plants in Rajasthan, Maharashtra, and Madhya Pradesh, Wonder Cement focuses on innovation, sustainability, and customer satisfaction in the construction and infrastructure space.

IPL Link: Wonder Cement agreed to pay a total of ₹50 crores for a period of 4 years to become the official umpire partner in IPL.

6. CEAT

CEAT Ltd., part of the RPG Group, is one of India’s leading tyre manufacturers. Founded in 1958, CEAT produces tyres for two-wheelers, cars, trucks, and buses and exports to over 100 countries. Known for its durability and performance, CEAT invests in innovation and sustainability and is a major player in India’s growing automotive sector.

IPL Link: Strategic Timeout marks an important event in the game of cricket and CEAT paid a total of ₹240 crores in 2024 for a period of 5 years to have its name associated with the key event.

7. Star Sports

Star Sports is a leading Indian sports broadcasting network formerly owned by Disney Star. Disney and Reliance recently formed a joint venture named JioStar, which owns Star Sports that holds broadcasting rights to major tournaments like IPL, ICC Cricket, Pro Kabaddi, and international football leagues. Offering content in multiple Indian languages, Star Sports revolutionized sports viewership in India with in-depth coverage, expert analysis, and high-definition broadcasts.

IPL Link: Star Sports won the IPL TV rights for 5 years after bidding a total sum of ₹23,575 crores.

8. JioHotstar

JioStar is a joint venture between Reliance and Disney. JioStar owns JioHotstar, which offers movies, web series, TV shows, and live sports, including IPL and international cricket. With free access to major events, JioHotstar has become a top OTT player, challenging platforms like Netflix, Amazon Prime, and Disney+.

IPL Link: In 2022, Viacom18, a subsidiary of Reliance Industries, bid ₹23,758 crores to win the digital rights of IPL for a period of 5 years. In 2023, Disney explored a joint venture or sale of its India assets with Reliance Industries. Ultimately, a joint venture named JioStar was formed with Reliance along with its subsidiary, Viacom 18, which owns approximately 63% of JioStar.

How does IPL Impact Stock Performance?

IPL can influence the profitability of a company and impact its stock performance in the following ways:

- Brand association with the IPL can greatly impact the company’s stock performance. The game has a vast audience, reaching millions on TV and online, providing exceptional brand visibility.

- Companies that sponsor leagues often see improved brand recognition, resulting in higher sales and revenue.

- This positive outlook can increase stock valuation, especially for companies and consumer-focused industries such as FMCG, automotive, beverages, and e-commerce.

- Past trends suggest that companies that use IPL for marketing campaigns or product launches often see a temporary rise in their stock prices due to increased brand visibility.

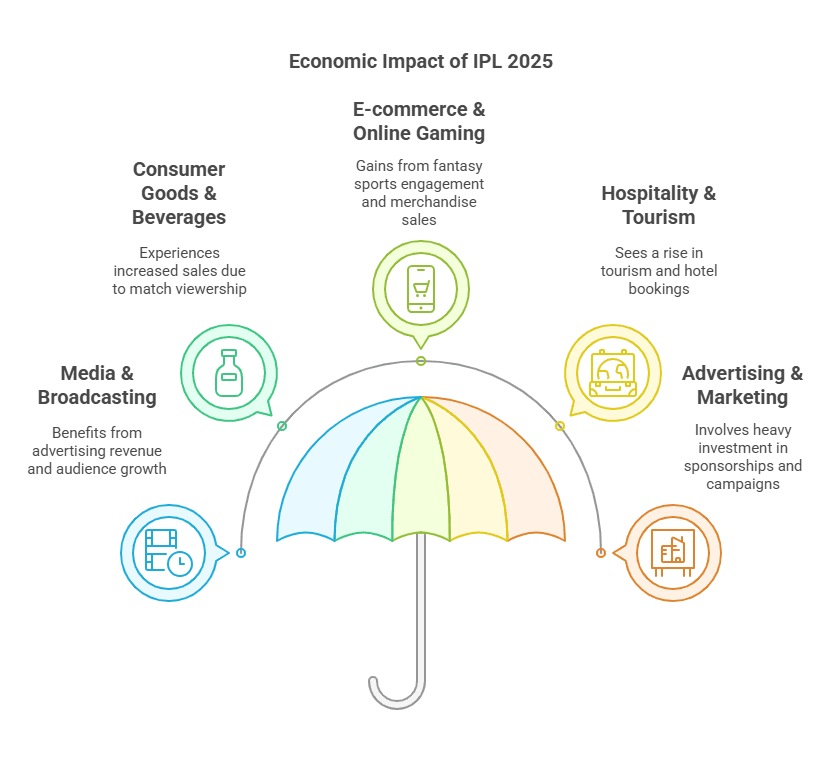

Sectors Expected to Benefit from IPL 2025

Let’s look at the sectors expected to benefit from IPL 2025:

Media & Broadcasting

- The IPL’s large audience brings significant advertising revenue for TV broadcasters and digital streaming platforms.

- These platforms gain more subscribers and viewership, especially among younger audiences during the IPL season, which increases the revenue from subscriptions and digital advertisements.

- The rivalry between TV and digital platforms fosters innovation in broadcasting and streaming technology.

Consumer Goods & Beverages

- The demand for soft drinks, snacks, and packaged foods rises during IPL matches due to social gatherings and home viewing parties.

- Companies that manufacture these products and other convenience foods see a substantial increase in their sales.

- This increased demand can boost production and distribution, benefiting the entire supply chain.

E-commerce & Online Gaming

- Fantasy sports platforms, such as My11Circle, experience a surge in user engagement during the IPL season.

- E-commerce platforms use IPL’s popularity for selling exclusive merchandise, team jerseys, and special promotions.

- Online food delivery services see a spike in orders during these times.

- The usage of mobile applications for shopping and entertainment has also witnessed a substantial rise, according to past trends.

Hospitality & Tourism

- Hotels, restaurants, and travel companies are all gaining from IPL tourism. When these cities host IPL matches, there’s a sudden spike in tourism, which means the related companies will get a lot more customers.

- Travel companies offering IPL match packages often experience higher demand.

- The increase in tourist arrivals benefits the local economy and boosts revenue for the hospitality sector.

Advertising & Marketing

- With companies investing in IPL sponsorships for maximum brand visibility, the championship offers a unique opportunity for brands to connect with a wide and diverse audience.

- Companies across various sectors invest heavily in IPL sponsorships and advertising campaigns which leads to increased revenues.

How to Identify the Stocks Expected to Benefit from IPL?

Investors can identify the stocks that can be positively impacted by IPL in the following ways:

- The IPL season offers a chance for investors to profit from the economic boost it brings. Investors can improve their portfolios by identifying companies connected to the IPL ecosystem.

- Increasing viewership boosts consumer spending, leading to revenue growth for related businesses.

- Companies that invest in sponsorship advertising and product promotions frequently experience a boost in brand visibility and sales.

- Media entertainment and consumer goods sectors usually see improved stock performance during the IPL seasons.

Risks & Challenges in IPL-Driven Stock Investments

An individual should consider the risks associated with investing in stocks whose performance is directly or indirectly linked with IPL. Some of the most common risks are listed below:

- The IPL significantly impacts the stock market, often causing short-term volatility and speculative trading. Companies involved as lead sponsors or associate partners often attract more investors because of greater brand visibility and revenue potential.

- This increased excitement can cause a surge in stock prices both before and during the tournament. Nonetheless, market reactions are often unpredictable, resulting in increased volatility.

- The rise in popularity of online betting platforms among younger audiences might also encourage speculative trading behaviour in the Indian financial markets.

- Some stocks may rise temporarily, while others could correct after the tournament ends and excitement fades. It is suggested for investors to approach IPL-related stocks with caution.

Mistakes to Avoid When Investing in IPL Stocks

Below are some of the most common mistakes an investor should avoid when investing in IPL-related stocks:

Excessive Speculation

- One of the most common mistakes is making trades based on hype or media buzz. IPL-related stocks may see short-term price increases, but without strong fundamentals, these gains are unlikely to last.

- Investors should rely on financial analysis instead of making impulsive decisions.

Overlooking Diversification

- Ignoring diversification by concentrating investments in one sector, like media, FMCG, or gaming, increases the sector-specific risks.

- Diversifying your portfolio across different industries helps reduce the risk of losses.

Well-Defined Exit Strategy

- Chasing quick profits without a proper exit strategy can result in extreme losses.

- Stocks may rise for some time during the IPL, but they could drop after the season ends.

- Fixing the price targets and tracking market trends is essential.

Falling for Market Hype

- The stock tips and recommendations easily available during the IPL season can be misleading.

- Do not simply go along with the crowd; instead, take the time to do your own research.

Conclusion

Investing in IPL-related stocks can be profitable, but it needs careful planning and research. The IPL season boosts consumer spending, ad revenues, and brand recognition, creating opportunities for both short-term and long-term investments. Investing driven by speculation or emotional reactions can result in financial losses. Focus on conducting thorough research and data analysis to discover companies with growth possibilities. With the help of data-backed risk assessment, investors can set stop loss levels and diversify their portfolios to reduce losses. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Can investing in IPL-related stocks lead to quick profits?

While short-term gains are possible, it is important to research a company’s fundamentals and avoid emotional investing.

Is it risky to invest in IPL-related stocks?

Yes, market volatility can be high during IPL, which increases the risk of losses.

How can I track IPL-related stock trends?

Follow financial news, technical indicators and market trends to stay updated.

What are the official dates for IPL 2025?

Official dates for IPL 2025 are from 22 March 2025 to 25 May 2025.

What is the best investment strategy for IPL stocks?

Consider a balanced approach with a mix of short-term trades in IPL-related stocks along with long-term investments in fundamentally strong companies. However, it is important to consult a financial advisor before investing.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.