| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-20-24 | |

| Add new links | Nisha | Mar-13-25 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- top sugar companies in india

Top Sugar Companies In India

When something pleasant happens to us, we all want to eat something sweet. When a child starts crying, we buy them chocolate, but have you ever considered how much profit sugar companies make and how they operate?

No worries. Read the blog and explore the performance of India’s top five sugar companies based on the market capitalization.

Overview of Sugar Companies

Sugar companies specialize in producing, processing, and distributing sugar, sweeteners, and associated products such as ethanol and power. The Indian sugar sector dominates the global market, producing 37 million metric tons in 2022. The sugar industry is India’s second most agro-based sector, behind cotton. Sugar production contributes significantly to India’s GDP and economic growth.

Reasons to invest in India’s Sugar sector

There are numerous reasons why one should invest in sugar companies, a few of which are mentioned below:

- Sugar is a commodity with steady global demand; it is utilized not just for direct consumption but also as a raw material in various sectors, including the food and beverage industry.

- Sugar firms have direct exposure to food and beverage markets. Rapid income and urbanization result in increasing consumption of processed food and beverages.

- Sugar firms also produce ethanol, which, when combined with gasoline, can be considered a valuable complement to the company’s growth.

Factors to be considered before investing in the Sugar sector

One should consider the below mentioned factors before investing in Sugar companies:

- Sugar prices are regarded as highly volatile due to demand and supply factors, which directly impact a company’s revenue and stock price movements.

- The numerous government policies could substantially impact the company’s growth and profit margins.

- The shift toward healthy behavior can directly affect sugar demand; any negative impact could significantly impact the companies’ revenues.

Overview of the best Sugar Companies in India

Let’s analyse the top sugar companies in India based on their market capitalisation:

Triveni Engineering & Industries Ltd.

The company was founded in 1932 by Shri Ganga Prasad Agarwal, and its main office is in Kanpur, Uttar Pradesh. Over time, the company has entered several new industries. The company is well known for employing efficient manufacturing processes and for creating sugar goods of the greatest quality. The company operates seven factories, each producing 61,000 tons of sugar.

Bajaj Hindusthan Sugar Ltd.

Former freedom fighter turned businessman Shri Jamnalal Bajaj founded Bajaj Hindusthan Sugar Limited on November 24, 1931. The company opened its first plant at Gola Gokaran Nath in the Lakhimpur Kheri area of Uttar Pradesh. From 400 to 13,000 tonnes of crushed cane per day, the company’s capacity increased. The districts of Pratappur, Rudauli, Kundarkhi, and Utraula in Uttar Pradesh are home to the company’s four production sites.

Balrampur Chini Mills Ltd.

It is one of India’s leading sugar-producing firms, formed in 1975 and headquartered in Kolkata, West Bengal. The company is part of the K.K. Birla Group. The company’s operations include the manufacture of ethanol, power, and sugar and generating biogases as a byproduct of sugarcane processing. The corporation operates several sugar mills in Uttar Pradesh. The corporation has an extensive distribution network via which it exports its sugar to numerous foreign markets.

Shree Renuka Sugars Ltd.

The company was founded in 1995 by Narendra Murkumbi and his mother, Vidya Murkumbi. The company has a total crushing capacity of 46,000 TCD (tons crushed per day) and a refining capacity of 1.7 MTPA (million tons per year). They proudly operate one of the world’s largest sugar refineries at Kandla on the western coast and another in Haldia on the eastern coast. The firm is India’s largest ethanol manufacturer, with a capacity of 1,250 kiloliters per day.

EID Parry (India) Ltd.

The company sells sweeteners and nutraceuticals. It was started in 1788 by a British trader, Thomas Parry, who opened its first sugar mill at Nellikuppam, Chennai, in 1842. EID Parry became an Indian firm in 1975, changing its name to EID Parry India Limited, and it was eventually acquired by the Murugappa group in 1981. The company has six sugar factories and has a crushing capacity of 40,000 tons.

Read Also: List Of Best Ethanol Stocks in India

Comparative study of top Sugar Companies:

| Company | Share Prices (INR) | Market Capitalization (INR crores) |

|---|---|---|

| Triveni Engineering & Industries Ltd. | 363 | 7,947 |

| Balrampur Chini Mills Ltd. | 382 | 7,711 |

| Shree Renuka Sugars Ltd. | 42.8 | 9,110 |

| Bajaj Hindusthan Sugar Ltd. | 33.6 | 4,288 |

| EID Parry (India) Ltd. | 636 | 11,282 |

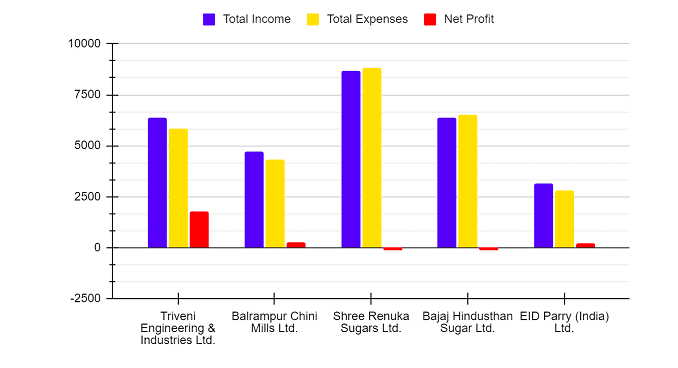

Income Statement Analysis (F.Y. 2023 | INR crore)

| Company | Total Income | Total Expenses | Net Profit |

|---|---|---|---|

| Triveni Engineering & Industries Ltd. | 6,390.51 | 5,844.40 | 1,791.80 |

| Balrampur Chini Mills Ltd. | 4,728.65 | 4,331.68 | 275.53 |

| Shree Renuka Sugars Ltd. | 8,686.20 | 8,808.90 | -135.7 |

| Bajaj Hindusthan Sugar Ltd. | 6,360.34 | 6,498.50 | -134.74 |

| EID Parry (India) Ltd. | 3,152.90 | 2,797.50 | 196.8 |

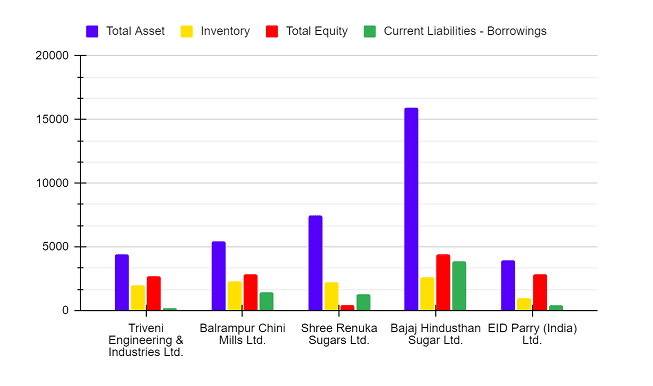

Financial Statement Analysis (F.Y. 2023 | INR crore)

| Particular | Total Asset | Inventory | Total Equity | Current Liabilities – Borrowings |

|---|---|---|---|---|

| Triveni Engineering & Industries Ltd. | 4,454.44 | 1,996.49 | 2,665.25 | 222.4 |

| Balrampur Chini Mills Ltd. | 5,402.16 | 2,318.68 | 2,875.43 | 1,449.87 |

| Shree Renuka Sugars Ltd. | 7,494.40 | 2,237.00 | 412.7 | 1,248.40 |

| Bajaj Hindusthan Sugar Ltd. | 15,939.34 | 2,612.72 | 4,434.80 | 3,851.15 |

| EID Parry (India) Ltd. | 3,985.60 | 978.6 | 2,882.10 | 397 |

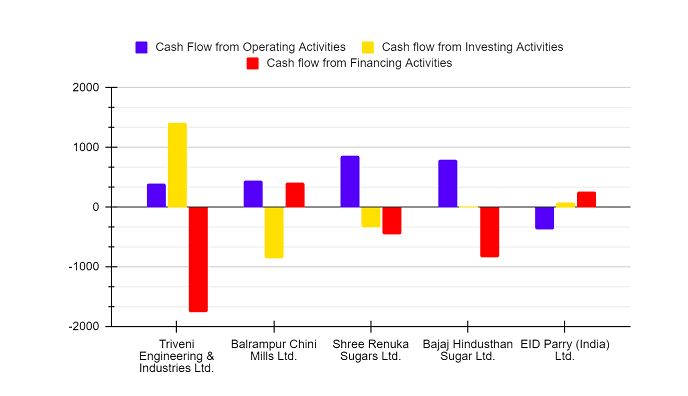

Cash flow analysis (F.Y. 2023 | INR crore)

| Particular | Triveni Engineering & Industries Ltd. | Balrampur Chini Mills Ltd. | Shree Renuka Sugars Ltd. | Bajaj Hindusthan Sugar Ltd. | EID Parry (India) Ltd. |

|---|---|---|---|---|---|

| Cash Flow from Operating Activities | 397.44 | 452.91 | 856.6 | 792.31 | -366.55 |

| Cash flow from Investing Activities | 1,413.65 | -858.75 | -344.7 | 12.33 | 76.08 |

| Cash flow from Financing Activities | -1762.36 | 405.82 | -453.1 | -833.2 | 268.98 |

The cash flow from operational operations for EID Parry India Ltd. in FY 2023 was negative, as seen in the above table, whereas all other firms reported positive figures.

Key Performing Indicators (FY 2023)

| Particulars | Triveni Engineering & Industries Ltd. | Balrampur Chini Mills Ltd. | Shree Renuka Sugars Ltd. | Bajaj Hindusthan Sugar Ltd. | EID Parry (India) Ltd. |

|---|---|---|---|---|---|

| Net Profit Margin (%) | 31.6 | 5.9 | -2.18 | -1.42 | 9.17 |

| ROCE (%) | 19.67 | 12.96 | 17.12 | 0.7 | 27.71 |

| P/E Ratio | 3.64 | 29.29 | -47.42 | -42.1 | 8.78 |

Future of the Sugar Industry

The government has implemented several initiatives to stimulate ethanol production, which is essential for the industry’s growth. The “National Policy on Biofuels” indicates that the government set a target of 20% ethanol blending in petrol by 2030, which was later moved to 2025-26.

In addition, the processed food and beverage industry, particularly alcohol and soft drinks containing sugar, is expanding rapidly. As a result, the sugar industry’s future seems more promising.

Read Also: List Of Best FMCG Stocks In India

Conclusion

In summation, the sugar industry is considered a defensive sector because sugar demand is consistent. Including sugar stocks in your investment portfolio can provide good diversification. However, before making any investment decision, you should extensively study the companies and industry difficulties. Further, it is suggested that you consult with your financial advisor before making any investment decision.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | List Of Best Jewelry Stocks in India |

| 2 | List of Best Liquor Stocks in India |

| 3 | List of Best Chemical Stocks in India |

| 4 | List Of Best PSU Stocks in India |

| 5 | List Of Best Pharma Stocks in India |

Frequently Asked Questions (FAQs)

Which Indian state is a leader in sugarcane production?

Uttar Pradesh is the highest sugarcane-producing state in India, followed by Maharashtra and Karnataka.

Which is the largest sugar company in India?

Based on market capitalisation, as of May 2024, EID Parry (India) Limited is the largest sugar company in India.

How do we evaluate the performance of sugar companies’ stocks?

Sugar companies’ stock performance can be evaluated based on various factors, such as revenue, net profit margins, inventory turnover ratios, geographical diversification, and production capacity.

What are the long-term prospects of the sugar sector?

Sugar companies’ future outlook is bright due to the increase in the population and disposable income of consumers, which will raise the demand for sugar. Further, the government of India has set a target of 20% ethanol blending in petrol by 2026, which will further improve sugar stocks’ revenues.

What are the various factors that affect sugar stock prices?

Various factors affect sugar stock prices, including but not limited to: government regulation, commodity prices, technological development, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle