| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-18-23 | |

| Add new links | Nisha | Mar-13-25 |

Read Next

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

- List of Best Commodity ETFs in India

- Bullish Options Trading Strategies Explained for Beginners

- Best Brokers Offering Free Trading APIs in India

- Top Discount Brokers in India

- Best Charting Software for Trading in India

- Benefits of Intraday Trading

- What are Exchange Traded Derivatives?

- What is Margin Shortfall?

- What is Central Pivot Range (CPR) In Trading?

- Benefits of Algo Trading in India

- Blog

- trading for beginners

Trading For Beginners: 5 Things Every Trader Should Know

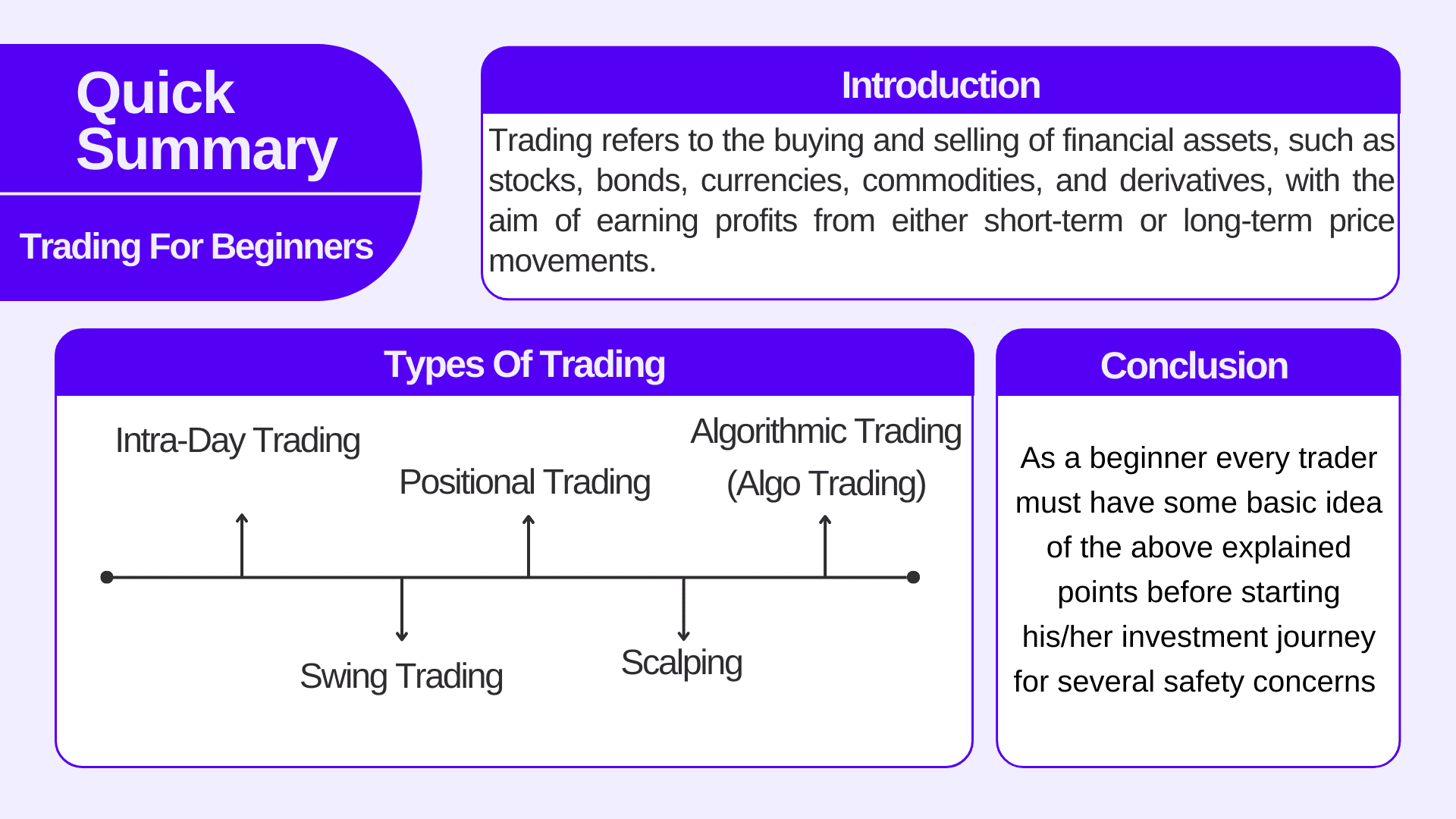

What Is Trading?

Trading refers to the buying and selling of financial assets, such as stocks, bonds, currencies, commodities, and derivatives, with the aim of earning profits from either short-term or long-term price movements. Trading can take many forms, and it is conducted by a diverse group of market participants, including individual retail traders, institutional investors, and financial institutions.

Investors use fundamental analysis (evaluating an asset’s underlying value based on economic and financial data) and traders use technical analysis (examining historical price and volume data) to make informed trading decisions. (For your information there is a significant difference between trading and investing).

Trading can be pursued as a full-time profession or as a part-time endeavour, depending on individual goals and resources. It requires a strong understanding of market dynamics. After knowing what is trading let us understand stock exchanges in India and how they have evolved over time.

Read Also: What Are The Challenges Traders Face When Trading In The Stock Market?

Stock Exchanges in India

The two major and most prominent stock exchanges in India are

National Stock Exchange (NSE)

The NSE is one of the leading stock exchanges in India. It was established in 1992 and is located in Mumbai. The NSE is known for its electronic trading platform and is considered the largest stock exchange in India in terms of daily trading volume. It lists a wide range of financial instruments, including equities, derivatives, exchange-traded funds (ETFs), and more.

Bombay Stock Exchange (BSE)

The BSE is one of the oldest stock exchanges in Asia, dating back to 1875. It is also located in Mumbai and is sometimes referred to as the “BSE Sensex” because it is home to the Sensex, one of India’s most widely followed stock market indices. BSE lists various financial products, including equities, fixed-income securities, derivatives, and mutual fund units.

In addition to the NSE and BSE, India has several other stock exchanges, including regional stock exchanges and commodity exchanges. However, the NSE and BSE dominate the Indian financial markets and serve as the primary platforms for trading and investment.

Trading Platforms

Trading platforms are software applications or online interfaces that facilitate the execution of financial transactions in various asset classes, including stocks, bonds, commodities, currencies, and derivatives. These platforms provide traders and investors with the tools and resources to analyse financial markets, place orders, and manage portfolios. There are various types of trading platforms available, each catering to specific needs and preferences. Many brokerage firms offer mobile apps that allow traders to trade on the go using smartphones and tablets. Mobile trading apps provide essential features for executing trades and monitoring portfolios.

When selecting a trading platform, traders and investors should consider their specific trading objectives, experience level, preferred asset classes, and budget. Additionally, they should evaluate factors such as user interface, charting tools, order types, technical analysis features, and customer support. Most platforms offer demo accounts for users to practice and explore the platform’s functionality before commencing real trading.

What is a Demat Account

A Demat account, or “Dematerialized account,” is an electronic or digital account that allows individuals to hold, store, and manage their financial securities and investments in electronic form. It is equivalent to a physical share certificate, eliminating the need for paper-based records and transactions. Demat accounts are commonly used for purchasing various types of securities, including stocks, bonds, exchange-traded funds and mutual fund units. The purchased securities are credited to or debited from the Demat account. Demat accounts generally offer a high level of security and protection for investors’ holdings. Transactions and securities are recorded and stored electronically, reducing the risk of fraud or loss. These accounts come in various types, including individual, joint, corporate, and minor accounts, catering to different types of investors.

To open a Demat account, an individual needs to approach a Depository Participant (DP), which could be a bank, financial institution, or brokerage firm. The DP facilitates the account opening process, verifies documents, and provides the account holder with a unique Demat account number.

Open your Demat account today with Pocketful.

Types of Trading

Trading encompasses a variety of approaches and strategies to buy and sell financial instruments with the goal of making a profit. Different types of trading cater to different time frames, risk profiles, and strategies. Here are some common types of trading:

Intra-Day Trading

Day traders open and close positions within the same trading day, often making numerous small trades to profit from intraday price fluctuations. They do not hold positions overnight.

Swing Trading

Swing traders aim to capture price swings or “swings” in the market over a period of a few days to several weeks. They rely on technical and fundamental analysis to identify potential entry and exit points.

Positional Trading

Position traders take a longer-term approach, holding positions for weeks, months, or even years. They often rely on fundamental analysis to make investment decisions and are less concerned with short-term price fluctuations.

Scalping

Scalpers make a large number of small, rapid trades, often holding positions for just seconds to minutes. They profit from small price movements and aim to capitalize on liquidity and order flow.

Algorithmic Trading (Algo Trading)

Algorithmic traders use computer algorithms to execute high-frequency trades based on predefined criteria, such as technical indicators, news sentiment, and market patterns.

Each type of trading has its own advantages and challenges, and traders often choose the approach that aligns with their risk tolerance and trading strategy. It’s important to thoroughly understand the chosen trading style and to practice risk management to minimize losses.

Now let us understand about price movements and technical analysis of stocks.

Read Also: Lowest MTF Interest Rate Brokers in India | Top 10 MTF Trading Apps

Price Movement

Price movement, in the context of financial markets, refers to the changes in the price of a particular financial instrument, such as a stock, bond, commodity, currency, or cryptocurrency, over a given period of time. Monitoring and analysing price movements is a fundamental aspect of trading and investing, as it provides valuable information for making informed decisions.

Price movement can be observed and analysed over various time frames, ranging from intraday (minutes or seconds) to longer-term (daily, weekly, or monthly). Traders and investors often choose their time frames based on their trading or investment strategies.

Candlestick charts are commonly used to visualize price movement. Each candlestick represents a specific time period and includes information about the opening, closing, and high, and low prices during that period. The patterns and shapes of candlesticks can provide insights into market sentiment.

Price movement can exhibit trends, which are sustained directional movements. Trends can be classified as bullish (upward), bearish (downward), or sideways (in consolidation). Traders often seek to identify and follow trends.

Support levels are price levels where an asset tends to find buying interest and reverse upward, while resistance levels are where it finds selling interest and reverses downward. Identifying these levels can help traders make decisions.

A breakout occurs when the price moves above a significant resistance level, while a breakdown occurs when it falls below a key support level. Breakouts and breakdowns can signal potential changes in trend direction.

With the help of price movements, we can technically analyse a particular stock and for that, we need to learn technical analysis.

What is Technical Analysis?

Technical analysis is a method of analysing financial markets and making investment or trading decisions based on the historical price and volume data of assets, primarily stocks, bonds, currencies, and commodities. It relies on the premise that past price movements and trading volumes can provide valuable insights into the future direction of an asset’s price. Technical analysts use various tools and techniques to study price charts, identify patterns, and make predictions about future price movements.

Technical analysts identify key price levels where an asset tends to find buying interest (support) and selling interest (resistance). These levels can influence trading decisions.

Chart patterns, such as head and shoulders, double tops and bottoms, flags, and triangles, are formations that appear on price charts. Analysts look for these patterns to make predictions about future price movements.

Technical analysts use a wide range of technical indicators, such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), to provide quantitative measures of price movements, trend strength, and overbought or oversold conditions.

It’s important to note that technical analysis is based solely on historical data and patterns, and it does not consider fundamental factors like earnings, economic indicators, or company financials.

Read Also: What is Options Trading?

Conclusion

To conclude, as a beginner every trader must have some basic idea of the above explained points before starting his/her investment journey for several safety concerns otherwise chances are likely that he/she may commit errors.

As a beginner, you must start educating yourself by reading books or taking online courses and should start practising with a demo account and implement risk management strategies like setting a stop-loss.

FAQs (Frequently Asked Questions)

What is trading?

Trading refers to the buying and selling of financial assets, such as stocks, bonds, currencies, commodities, and derivatives, with the aim of earning profits.

Name two stock exchanges in India.

Two stock exchanges of India are the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

What is a demat account?

A Demat account is an electronic or digital account that allows individuals to hold, store, and manage their financial securities in electronic form.

Define intra-day trading.

When traders open and close positions within the same trading day before the closing of the market i.e., 3:30 p.m.

How an individual can do risk management in the securities market?

Any individual can manage his/her risk by setting stop losses according to his capital.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle