| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-30-24 | |

| Add new links | Nisha | Mar-18-25 |

What is a Bid-Ask Spread?

The stock market in India has witnessed a record number of new investors in the past year. It’s crucial to develop a solid understanding of the bid-ask spread.

In this blog, we will explore the concept of bid-ask spread, the factors that influence it and its significance.

What is Bid and Ask?

Bid and ask can be defined as:

- Bid Price: The bid price is the price a buyer is willing to pay for a security. It’s the amount a seller can receive if they sell their security at that moment.

- Ask Price: The asking price, also known as the offer price, is the price at which a seller is willing to sell a security. It’s the amount a buyer must pay to buy the security.

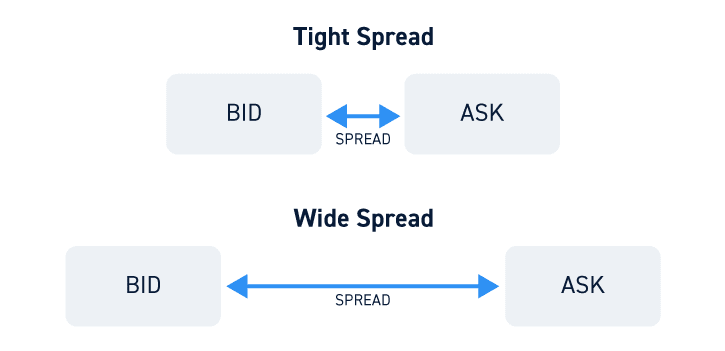

What is Bid-Ask Spread?

The difference between the bid and ask prices is known as the “Bid-Ask Spread.” This spread indicates the liquidity and volatility of security. A narrow spread typically suggests a highly liquid market with low volatility, while wider spreads indicate lower liquidity with higher volatility.

Calculation of Bid-Ask Spread

The bid-ask spread can be calculated using the following formula:

Bid-Ask Spread = Lowest Ask Price – Highest Bid Price

Example: Suppose a stock is trading with low liquidity and is currently trading at INR 107. A trader wishes to purchase a stock and sees the following information:

| Number of Buyers | Bid Prices | Ask Prices | Number of Sellers |

|---|---|---|---|

| 7,000 | 105 | 110 | 8,000 |

| 5,000 | 104 | 112 | 5,000 |

| 3,000 | 102 | 114 | 4,000 |

| 2,000 | 101 | 115 | 2,000 |

Lowest Ask Price = INR 110

Highest Bid Price = INR 105

In order to purchase the stock immediately, the trader must pay the ask price, which is the price a seller is willing to accept to sell the security. Bid-Ask spread, in this case, is INR 5. Now, let’s see what narrow and wide bid-ask spreads signify.

Narrow Bid-Ask Spread

In a narrow bid-ask spread, the gap between bid and ask prices is tiny. It’s generally a sign of high liquidity, a condition where lots of potential buyers and sellers are present. This makes trading the stock simpler and doesn’t drastically swing its price.

Wide Bid-Ask Spread

In a wide bid-ask spread, the bid and ask prices are far apart. That’s a sign of low liquidity. Selling or buying a stock can be a tough task without causing a lot of change in the price. The execution cost per share increases, and you may have to pay more for purchasing a share or accept a lower price when selling a share.

Significance of Bid-Ask Spread

The bid-ask spread can be used in the following ways:

- Liquidity Indicator: A narrow bid-ask spread indicates high liquidity, while a wide bid-ask spread indicates lower liquidity.

- Transaction costs: A wide bid-ask spread indicates that the transaction costs would be higher. On the other hand, a narrow bid-ask spread indicates lower transaction costs.

- Volatility Indicator: A wide bid-ask spread means the participants in the market are cautious of high volatility. Meanwhile, markets with a narrow bid-ask spread indicate low volatility.

- Market efficiency: In efficient markets, the market information flows freely, and due to the low probability of volatile movements, the bid-ask spreads are generally narrow. On the other hand, inefficient markets often have a wide bid-ask spread.

Factors that Influence BID-ASK Spread

Various factors that affect the bid-ask spread are given below:

- Liquidity: Highly liquid stocks, such as those of large, well-known companies, generally have narrower spreads because there are many buyers and sellers. Whereas less liquid stocks often have wider spreads due to fewer market participants.

- Market Conditions: During periods of high volatility or market uncertainty, spreads can widen as market participants become less willing to transact at the current prices.

- Stock Price: Higher-priced stocks have larger absolute spreads, although the percentage spread may remain small. Lower-priced stocks can have relatively smaller absolute spreads.

- Trading Volume: Stocks with higher trading volumes have narrower spreads due to the high competition among buyers and sellers.

- Time of Day: Usually, spreads are wider at the market open and close due to increased volatility and lower liquidity during these times.

Read Also: What is Spread Trading?

Conclusion

The gap between bid and ask is key to trade execution. A trader should trade in markets with a narrow bid-ask spread as a wider bid-ask spread increases the transaction costs and, thus, reduces the profit of the trader. However, it is advised to consult a financial advisor before making any investment decision.

Frequently Answered Questions (FAQs)

How does the bid-ask spread affect day traders differently from long-term investors?

Day traders often experience higher costs due to frequent trading, as the bid-ask spread can accumulate quickly. Long-term investors are less affected because they trade less frequently.

Is it possible for the bid-ask spread to be zero?

While rare, a zero spread occurs in extremely liquid markets or during certain market-making activities where bid and ask prices converge.

How do electronic trading platforms impact the bid-ask spread?

Electronic trading platforms reduce the spread by increasing market efficiency and the number of market participants.

How can retail investors leverage bid-ask spreads to identify trading opportunities?

Retail investors can use the spread to gauge market liquidity and execute trades when spreads are narrower to reduce costs.

How does high-frequency trading (HFT) influence the bid-ask spread?

HFT can narrow spreads by providing liquidity and increasing trading volume.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.