| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-20-24 |

- Blog

- trading

- candlestick patterns

- bearish three line strike

Bearish Three-Line Strike Pattern

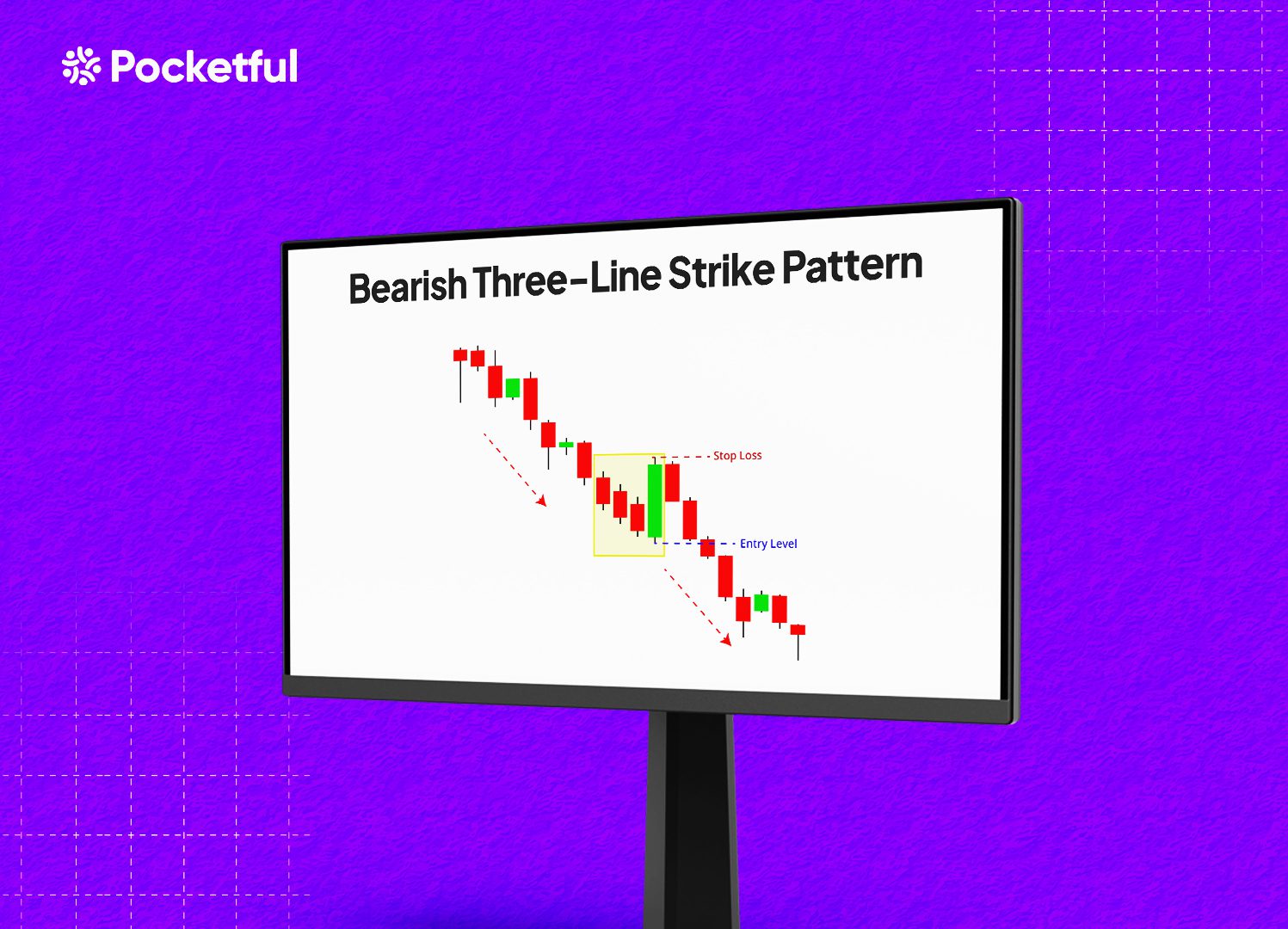

A Bearish Three-Line Strike Pattern is one of those patterns that rarely occurs and gives a bold signal of trend reversal in the face of strong bearish momentum. However, a group of technical analysts disagree and consider it a continuation pattern. Let’s look at the Bearish Three-Line Strike pattern in detail and find out whether it is a reversal or a continuation pattern with the help of examples. Moreover, we will discuss the advantages and limitations of the pattern.

What is a Bearish Three-Line Strike Pattern?

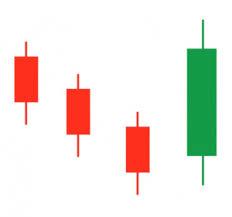

The Bearish Three-Line Strike candlestick pattern consists of four candlesticks. The first three candles are bearish, followed by one large bullish candle that engulfs the previous three candles. This pattern signals a reversal from the current bearish trend after the fourth big bullish candle engulfs the three bearish candles.

The Bearish Three-Line Strike candlestick pattern consists of three consecutive bearish candles, each with lower lows followed by a big bullish candle. Some analysts describe it as a bearish continuation pattern, but Bulkowski disagreed and said trend reversal happens when a big green candle engulfs the previous three candles. The bullish candle signals a bullish reversal when the price gives a breakout and closes above the high of the first bearish candlestick.

As per Bulkowski, the Bearish Three-Line Strike candlestick pattern signals a bullish reversal 84% of the time, instead of the bearish continuation pattern, which generally candlestick theory suggests.

Read Also: Measured Move – Bearish Chart Pattern

Pattern Interpretation

The Bearish Three-Line Strike candlestick pattern can be easily understood through the following key points:

- Formation: The pattern consists of three bearish candles, and the fourth candle appears as a strong bullish candle that engulfs all three bearish candles.

- Price Action: The fourth bullish engulfing candle suggests the buyers are in control and a strong shift in market sentiments from bearish to bullish.

- Market Sentiments: It often occurs near the end of a prolonged bearish trend as the market struggles to find direction.

- Volume: Volume can also be erratic during the formation of the pattern, but during breakout, look for an increase in volume with breakout for a strong confirmation.

- Breakout: The pattern can breakout in either direction. However, it generally generates a reversal signal when the price breaks above the high of the three-candle formation.

- Risk Management: Proper stop-loss placement and risk management strategies are crucial while using any pattern.

Trading Setup

Bearish Three-Line Strike candlestick pattern can be effectively used by following the below trading setup:

- Entry Point: Since it is a reversal pattern, wait for a breakout above the high of the previous three bearish candles. Further confirmation from an increase in volume is important to avoid false breakouts.

- Stop-Loss: A stop-loss can be placed below the high of the first bearish candlestick to manage risk if the pattern gives a false breakout.

- Target: Take profit at the nearest significant resistance level or as per your risk-to-reward ratio.

Advantages of Bearish Three-Line Strike Pattern

The advantages of the Bearish Three-Line Strike pattern are:

- It works in any market, such as equity, currency, or commodity market.

- It works more efficiently in a shorter time frame.

- It is a reversal signal indicator.

- The candlestick pattern is easy to identify.

- This pattern has the potential to generate big moves.

- The pattern works well with other indicators.

- This pattern gives a complete setup for stop-loss and target.

- This pattern gives quite accurate results in trending markets with strong volumes.

Limitations of Bearish Three-Line Strike Pattern

The limitations of the Bearish Three-Line Strike pattern are:

- The pattern could give false signals, which can result in losses in choppy and sideways markets.

- The Bearish Three-Line Strike candlestick pattern occurs rarely.

- The pattern is of limited use in markets with low volumes.

- Confirmation from other indicators may be required to accurately predict reversal.

- The candlestick pattern can generate false signals.

- This pattern could be affected by various market factors like volatility, news, policy change, political instability, or other factors.

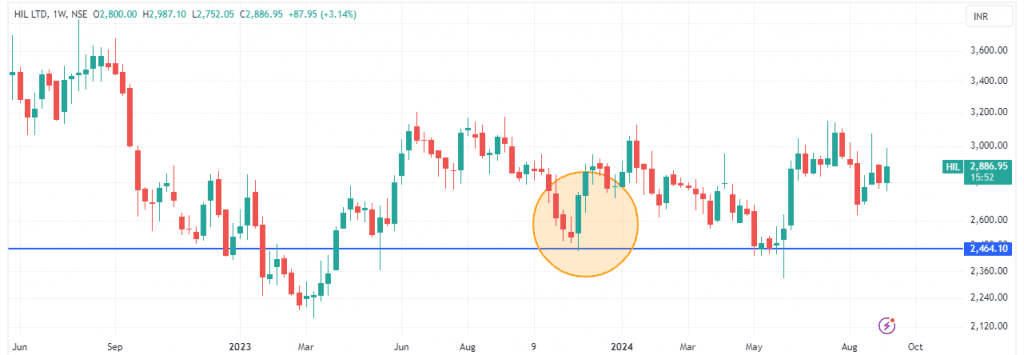

Example 1: Bearish Three-Line Strike Pattern of HIL Ltd. (As a Continuation Pattern)

The above image shows the weekly chart of HIL Ltd. We can see the formation of the Bearish Three Line Strike chart pattern as the stock price made three consecutive lows from October 2023 to November 2023. In November 2023, the stock made a big bullish green candle covering the previous three bearish candles and closed above the first candlestick’s high. The stock consolidated for a while before continuing its downtrend and even breached the low of the third candle, indicating a continuation of the prior downtrend as volumes weren’t huge during the bullish breakout. Traders who want to trade using this pattern should buy once the big bullish candle occurs with huge volumes, keep the stop-loss just below the high point of this first candlestick, and take profit at the nearest resistance.

Example 2: Example of Bearish Three-Line Strike Pattern of Bajaj Finserv Ltd. (As Reversal Pattern)

The above image shows the weekly chart of Bajaj FinServ Ltd. We can see the formation of the Bearish Three-Line Strike pattern between September 2020 and October 2020, and in November 2020, the stock price made a bullish candle and closed above all three bearish candles around 627 with big volumes, indicating a bullish reversal and made a high of 1929 in October 2021. Keep the stop loss below the lowest point of this 4-candle pattern or just below the high point of the first candlestick and take profit at the nearest resistance, or keep trailing the stop-loss and book profits as per your risk-reward ratio.

Read Also: Bearish Engulfing Pattern

Conclusion

The Bearish Three-Line Strike candlestick pattern is a powerful pattern that usually generates a reversal signal in a bearish trend. It consists of three consecutive bearish candles followed by a large bullish candle that engulfs the previous three candles, signaling a shift in market sentiment from bearish to bullish. While it provides a strong indication of a potential reversal, it is important to confirm the signal with other technical indicators or studies and use appropriate strategies for risk management, such as stop-losses and target levels, before entering a trade. The pattern occurs rarely but has the potential to generate huge gains. Hence, it is very important to understand the pattern’s characteristics, trade setup, and risk management before using this pattern. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What does the Bearish Three-Line Strike pattern indicate?

It suggests a potential reversal of the prevailing bearish trend.

What is the success rate of the Bearish Three-Line Strike pattern?

The Bearish Three-Line Strike pattern’s accuracy depends upon the market conditions, liquidity of the asset, and time frames. It is more effective in a shorter time frame and trending markets.

Can the Bearish Three-Line Strike pattern fail?

Like any other chart pattern, this pattern also gives false breakouts, particularly if a breakout occurs with low volumes or market conditions and news is against the pattern.

How reliable is the Bearish Three-Line Strike Pattern?

It can be a strong signal for trend reversal, but its reliability increases when confirmed by other technical indicators or studies like RSI, Moving averages, and support and resistance levels.

What is the basic structure of the Bearish Three-Line Strike pattern?

A Bearish Three-Line Strike pattern is formed when three bearish candles make consecutive lows, followed by a big bullish candle that covers all the previous three candles.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.