| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-23-24 | |

| Add new links | Nisha | Mar-18-25 |

- Blog

- trading

- candlestick patterns

- black marubozu

Black Marubozu Candlestick Pattern

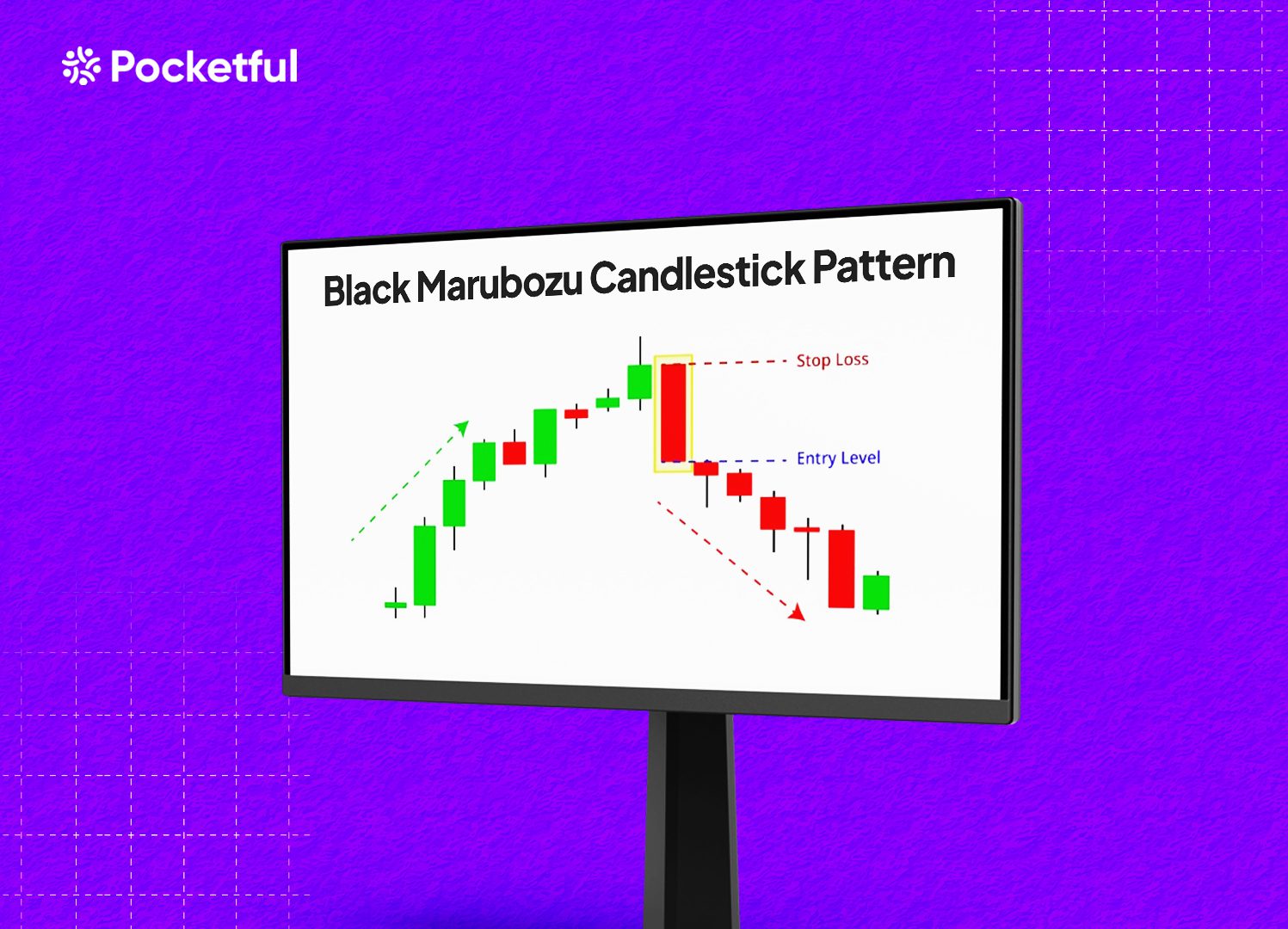

Have you ever wondered how to spot a fall in the market or a particular stock before it happens? The Black Marubozu candlestick pattern might just hold the key. With its long body and no shadows, this candlestick pattern has been feared and respected by traders for a long time.

In this blog, we will explore the Black Marubozu candlestick pattern and how traders can incorporate this pattern into their trading strategies.

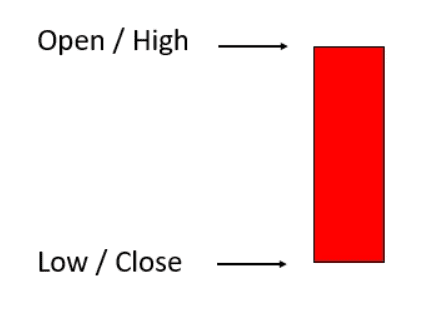

What is the Black Marubozu Pattern?

The Black Marubozu pattern is a candlestick pattern that indicates a strong bearish sentiment in the market. It is characterized by a long red candle with little to no shadows, suggesting that sellers dominated the trading session from open to close. The absence of shadows or wicks means the asset’s price has dropped consistently, with no attempts by the buyers to reverse the trend during the session. The price opens at the high and closes at the low in a trading session, reflecting persistent downward pressure throughout the trading session. Traders often interpret this pattern as a signal to create short positions, anticipating further downward movement.

A Black Marubozu candlestick in a downtrend usually indicates that the bearish trend may continue. If it appears in an uptrend, it could be a sign of a bearish reversal. Furthermore, the overall market sentiment and broader economic conditions should be considered.

How to Determine Target and Stop-Loss?

Target and stop-loss are the two key elements in any trading strategy. Determination of target and stop-loss determines the profitability of the strategy. Targets can be determined for a Black Marubozu pattern using various methods:

- Risk-to-Reward Ratio: Traders can define their Risk-to-reward ratio and set a target accordingly. For instance, if you aim for a 1:2 risk-to-reward ratio, your target should be positioned at twice the distance from your entry point as your stop loss.

- Major Support Levels: Traders can set a target near the next significant support level.

No pattern has 100% accuracy, and the Black Marubozu pattern is no different. Asset price can make a Black Marubozu candle and continue to trend upwards. Therefore, it is important to use stop-loss to protect against false breakdowns. The stop-loss for this pattern can be set in several ways:

- High of Black Marubozu candle: A stop-loss can be placed slightly above the high of the Black Marubozu candlestick to protect against false breakdowns.

- Customized Stop-Loss: You can also ascertain your maximum acceptable loss and adjust your trade quantity. A trader can reduce the trade quantity to implement a wider stop-loss.

Additionally, as the price moves in your favor, you can adjust your stop loss to lock in profits while minimizing possible losses. This strategy allows a trader to ride the trend longer while protecting your capital from sudden reversals.

Read Also: Marubozu Candlestick Pattern: Means, History & Benefits

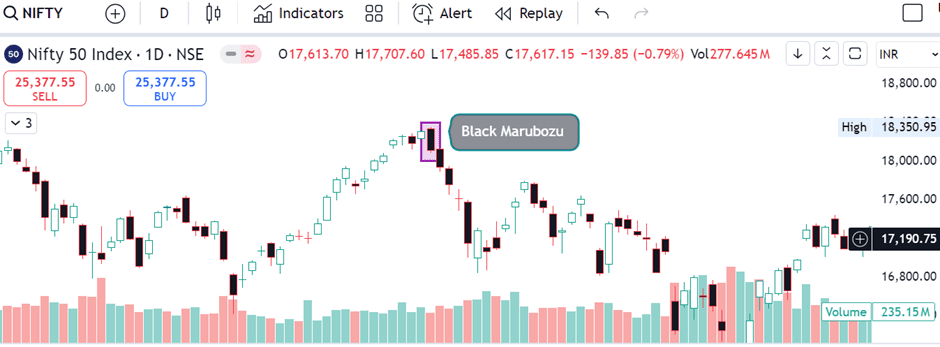

Example of Black Marubozu Pattern

The charts below show the formation of the Black Marubozu candlestick pattern on the price chart of NIFTY 50 on a daily time frame. The Black Marubozu candlestick pattern can work both as a reversal and a continuation pattern, as depicted below:

- Black Marubozu in an Uptrend: The image below indicates that the Black Marubozu candlestick works as a bearish reversal candlestick pattern in an uptrend.

- Black Marubozu in a downtrend: The image below indicates that the Black Marubozu candlestick works as a bearish continuation candlestick pattern in a downtrend.

Read Also: Closing Black Marubozu Candle

Advantages of Black Marubozu Pattern

The advantages of the Black Marubozu pattern are:

- Strong Bearish Indication – The pattern can be used to predict a substantial decline in prices, making it an effective tool for recognizing possible selling opportunities.

- Compatible with other Technical tools – The Black Marubozu candle can be used with additional indicators to predict the onset of a significant downtrend.

- Identify Entry and Exit Points – Traders can use a Black Marubozu candle to find good entry and exit points. For example, in a downtrend, traders may create a short position after the price moves below the low of the Black Marubozu candle and place a stop-loss just above the high of the Black Marubozu candle.

Limitations of Black Marubozu Pattern

The limitations of the Black Marubozu pattern are:

- Ineffectiveness to predict Short-term Trends – Although the pattern is effective for analyzing long-term bearish momentum, it does not provide a reliable signal regarding the short-term trend, as the market noise, volatility, political events, etc., can result in false breakdowns.

- Vulnerable to Misinterpretation – Traders might misinterpret the Black Marubozu pattern as a strong sign of downward movement or reversal in an uptrend. However, relying solely on a single pattern can lead to poor decision-making without additional signals like volume.

- False Signals – Despite being a powerful indicator, it can occasionally generate misleading signals, especially in volatile or sideways markets.

Read Also: Closing Black Marubozu Candle

Conclusion

The Black Marubozu pattern is a reliable candlestick pattern that can predict strong bearish trends in the financial markets. It’s clear and can be easily identified, which makes it invaluable for novice and seasoned traders. However, traders must look for confirmation from other technical indicators, such as volume, RSI, or additional candlestick patterns, to increase the reliability of the pattern’s signals. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Are there any variations of the Black Marubozu pattern?

While the classic Black Marubozu candle has no shadows, there can be variations with small shadows, but the overall bearish sentiment remains strong.

What time frame is the Black Marubozu candlestick pattern most effective?

The Black Marubozu candlestick pattern is more effective in a longer time frame than a shorter one, as factors such as market noise, volatility, political events, etc., can result in false breakdowns.

Is the Black Marubozu pattern effective in all market conditions?

The Black Marubozu pattern works best in trending markets, especially during downtrends. It may be less effective in sideways or volatile markets.

What should be the stop-loss for trading a Black Marubozu candlestick pattern?

The stop-loss can be placed just above the Black Marubozu candle to protect against false breakdowns.

Can I depend on a Black Marubozu pattern alone for trading decisions?

No, it is suggested that the Black Marubozu candlestick pattern be used alongside other indicators and market analysis to avoid false signals.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.