| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-20-24 |

- Blog

- trading

- candlestick patterns

- closing white marubozu

Closing White Marubozu Pattern

Candlestick patterns are key components of technical analysis, providing traders and investors a glimpse into market psychology and trends. The Closing White Marubozu pattern is one of the most reliable patterns that signals a bullish trend. It is easy to spot, and therefore, someone doesn’t need to be an expert to use this pattern.

In this blog, we will discuss the features, significance, advantages and limitations of the Closing White Marubozu pattern. Moreover, we will give you a trading setup to assist you in effectively executing trades based on this pattern.

What is a Closing White Marubozu pattern?

The Closing White Marubozu pattern is a bullish candlestick pattern, signifying an intense bullish movement is around the corner. The pattern consists of a single candlestick, and an overview of key features of the pattern is mentioned below.

- Long white/green body: The candlestick has an elongated white or green real body, indicating substantial upward price movement.

- Opening Price above the Low: The opening price of the candlestick is above the low of the trading session.

- Close at the High: The trading session’s close price is approximately equal to the high, resulting in no upper shadow and a small lower shadow.

Interpretation: The pattern shows that buyers drove the price up consistently as the closing price is near the high of the trading session. The small lower shadow indicates minor support near the opening price, and the overall sentiment remains bullish. The candlestick often appears during a downtrend and signals a possible bullish reversal. However, during an uptrend, this pattern acts as a continuation pattern and strengthens the bullish trend.

How to Determine Target & Stop Loss?

Entry, Target and Stop-loss are the most important aspects of a trading setup, which helps traders take advantage of a trading setup. Traders can follow the methods mentioned below to set a target and stop-loss.

Entry: Wait for the subsequent candle to close above the Closing White Marubozu candlestick to validate the bullish momentum. Create a long position upon confirmation.

Stop-Loss: Place the stop-loss slightly below the low of the Closing White Marubozu candle. This is because a breakdown below the low would invalidate the bullish signal. Add a small buffer to account for market noise and avoid premature exits.

Targets: Use Fibonacci extensions to identify target projections for the Closing White Marubozu pattern after the price gives a breakout above the pattern. Furthermore, traders can identify historical resistance levels where prices may reverse. These levels can serve as targets.

Assess the risk by calculating the distance from your entry point to the stop-loss. Establish a target that aligns with a defined risk-to-reward ratio, such as 1:2 or 1:3. Additionally, use trailing stop-loss to secure your profits as the price moves towards your targets.

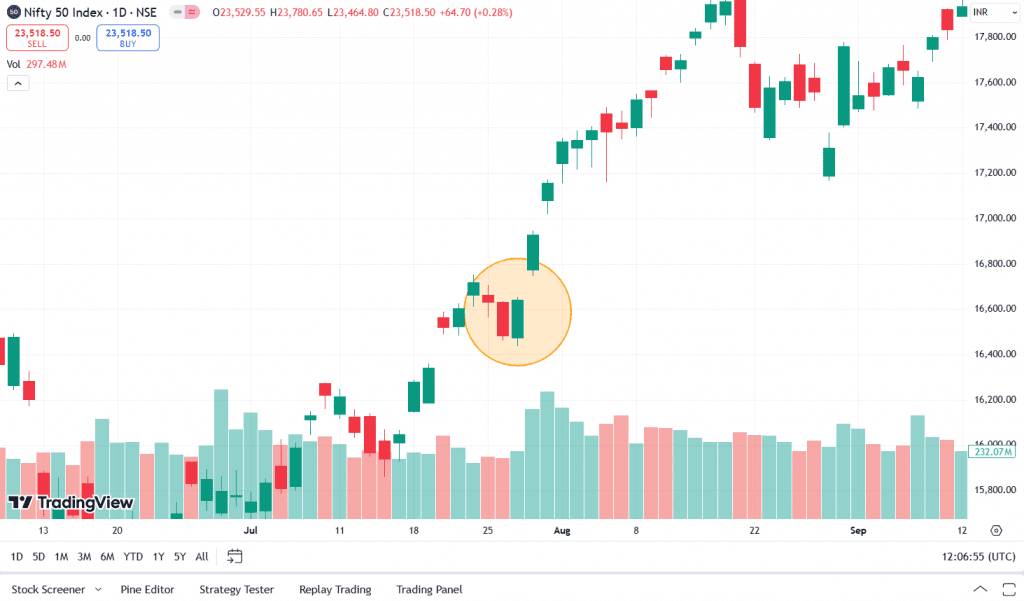

Example of Closing White Marubozu Pattern of Nifty 50 Index

The image shows the chart of NIFTY 50, the Indian index representing the top 50 companies. A clear formation of a Closing White Marubozu pattern on 27 July 2022, and the index gave a breakout on 28 July 2022 at 16,929. On 19 August 2022, Nifty 50 closed at 17,758, i.e. more than 800 point move.

Advantages of Closing White Marubozu pattern

The advantages of using a Closing White Marubozu pattern are:

- Strong Bullish Signal: The Closing White Marubozu pattern signals a strong surge in buyer activity, showcasing a bullish sentiment. The pattern helps predict a possible bullish trend.

- Simplicity: It is easily identifiable due to its distinct elongated white body, characterized by the absence of an upper shadow and the presence of a small lower shadow. Beginner traders can easily use it since it does not require extensive trading knowledge.

- Versatile application: The pattern works across various time frames, seamlessly adapting to intraday, daily, and weekly charts. It can also be used across multiple markets, including stocks, commodities, etc.

- Can be combined with other indicators: Combining it with other indicators, such as RSI, MACD, or Bollinger Bands, enhances its reliability as these other tools confirm the bullish signal of the pattern. Volume analysis can increase confidence in the signal of a pattern.

Limitations of Closing White Marubozu pattern

The limitations of using a Closing White Marubozu pattern are:

- Vulnerable to Market Noise: In volatile markets, a Closing White Marubozu pattern can emerge, following which the asset price may struggle to increase. Abrupt reversals or unexpected news can lead to false signals.

- Limited Context on its own: It offers no insights into the overall market trend or key fundamentals. To use it effectively, the trader must do additional analysis, like support or resistance levels and overall trends.

- No Guarantee of Success: Patterns do not assure price direction; their effectiveness depends on market conditions, timeframes, and supporting analysis.

- May Fail in Downtrend: Amid a downtrend, a Closing White Marubozu pattern can often signify a mere temporary retracement instead of indicating a reversal in the trend. Taking action without considering the bigger picture may result in losses.

Conclusion

The Closing White Marubozu candlestick pattern signals strong bullish momentum and offers insights into the market sentiment in technical analysis. Its simplicity and clarity make it an easy pattern for novice and experienced traders, especially when combined with other indicators and market context. It should not be used in isolation; rather, it must be integrated into a comprehensive strategy that includes confirmation signals, effective risk management, and a deep understanding of market trends. Traders can improve their trading performance by using their strengths and addressing their limitations. Always trade with a plan and consult a financial advisor before trading.

Frequently Asked Questions (FAQs)

Is the Closing White Marubozu a bullish or bearish pattern?

It is a bullish pattern, often signaling an upward momentum or trend continuation.

What is the difference between a White Marubozu and a Closing White Marubozu pattern?

A White Marubozu pattern has no shadows, i.e. the candle opens at the low and closes at the high, while a Closing White Marubozu candlestick pattern has a small lower shadow.

How can volume confirm the pattern?

High trading volumes during the pattern’s formation increases the reliability of the pattern.

What timeframe is best for using this pattern?

It works on all timeframes, but higher timeframes like daily or weekly provide more reliable signals.

Can the Closing White Marubozu pattern signal a breakout?

Yes, the Closing White Marubozu pattern can signal a breakout when it forms near resistance levels or after consolidation.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.