| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-28-24 |

- Blog

- trading

- candlestick patterns

- hanging man

Hanging Man Candlestick Pattern

Picture yourself involved in a gripping thriller movie, and out of nowhere, a dark figure appears on the screen. This closely resembles coming across a Hanging Man candlestick pattern on a price chart. It is a sign that something might be off with the current trend in the market, suggesting the market participants to be vigilant and attentive.

In this blog, we will learn about the Hanging Man candlestick pattern, its target and stop-loss, and its advantages and limitations.

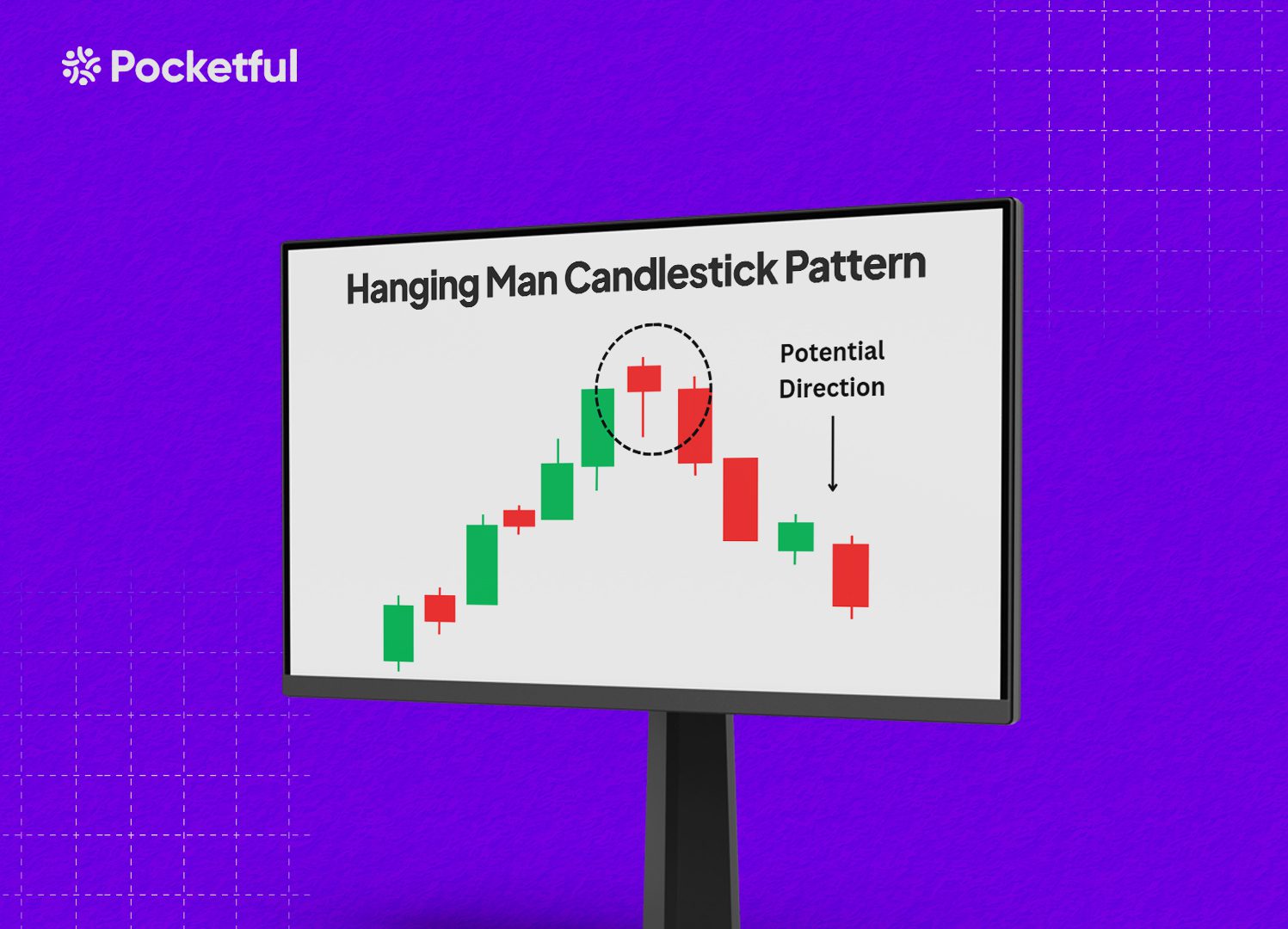

What is the Hanging Man Candlestick Pattern?

The hanging man is a single candlestick pattern that frequently suggests a shift from an uptrend to a downtrend. It is defined by a small real body, signifying that the opening and closing prices are nearby, which reflects a state of indecision. Also, the long lower shadow indicates strong selling pressure that pushed the price down during the trading session, and a minimal or absent upper shadow suggests that buying pressure remained quite weak.

The combination of these factors shows that buyers were unable to maintain control, and sellers may be gaining strength. Traders often look for confirmation through subsequent price action before making any decision.

The pattern is more meaningful when it appears after a sustained uptrend. However, waiting for confirmation from subsequent candlestick or other technical indicators is often recommended before entering a short position.

How to Determine Target and Stop-Loss?

The Hanging Man pattern indicates a possible reversal, so traders must keep their target levels close to the nearest support zone from where the price had previously bounced back. Support levels can be determined by analyzing historical price charts. Furthermore, numerous traders adhere to a risk-reward ratio, such as 1:2 or 1:3. This approach helps traders maximize their possible profits while minimizing losses.

Positioning your stop-loss just above the peak of the Hanging Man candlestick is one of the most prevalent and secure strategies to protect your investment against losses. If the price rises above the previous high, it indicates that the downtrend suggested by the pattern may not occur, and upward momentum can persist. Additionally, certain traders opt to include a slight buffer above the high, generally ranging from 1-2%, to protect themselves from minor market fluctuations or false breakouts.

Read Also: Introduction to Bearish Candlesticks Patterns: Implications and Price Movement Prediction

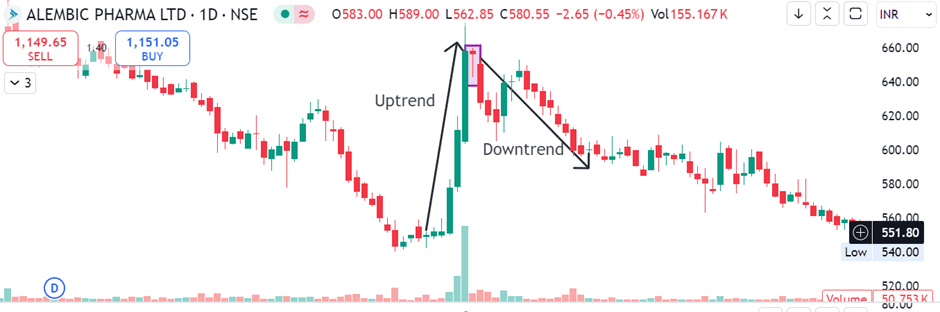

Example of the Hanging Man Candlestick of Alembic Pharma

The above chart shows the clear formation of the Hanging Man candlestick on the daily timeframe of Alembic Pharma after a continuous uptrend of almost four days. The candlestick has a small body with a long lower shadow and a little upper shadow, which is followed by a downtrend.

Advantages of Hanging Man Candlestick Pattern

The advantages of using the Hanging Star candlestick pattern are:

- Early Warning of Trend Reversal – The Hanging Man pattern appears at the peak of an uptrend and acts as an early signal that bullish momentum could be losing strength. It helps traders predict the upcoming reversals before they occur, enabling them to proactively adjust their positions.

- Simple to Identify – This pattern is easily recognizable on price charts due to its unique appearance, i.e., featuring a small real body accompanied by a long lower shadow and minimal to no upper shadow. Traders can easily recognize it without complex indicators or analysis.

- Works well with confirmation – This pattern is more effective when confirmed by signs like a bearish candlestick or a gap down the next day. This enhances traders’ confidence in the validity of the pattern before making a trade, thereby minimizing the likelihood of false signals.

Limitations of Hanging Man Candlestick Pattern

The limitations of using the Hanging Star candlestick pattern are:

- Needs Confirmation – The Hanging Man candlestick pattern, on its own, lacks sufficient strength as a trading signal. Traders seek validation from the subsequent candlestick, usually in the form of a bearish candle or a gap-down. Making decisions solely based on the Hanging Man pattern can lead to misleading signals.

- Subject to Market Noise – Candlestick patterns like Hanging Man rely on short-term price fluctuations. In turbulent markets, asset prices can experience significant fluctuations, resulting in patterns that may not accurately represent the broader trend.

- Does not Indicate the Strength of Reversal – The pattern does suggest a possible reversal, yet it cannot indicate the magnitude or intensity of that reversal.

Read Also: Tweezer Top Candlestick Pattern

Conclusion

The Hanging Man candlestick pattern helps traders identify possible bearish reversals. Its simplicity makes it easy for beginner investors to identify, and its reliability improves when used alongside confirmation and other technical indicators. However, the pattern may give inaccurate signals, especially during strong trends or in volatile markets, and should never be relied upon alone. Understanding the broader market context, patiently awaiting confirmation, and using supplementary technical tools can improve trading performance. Ultimately, consistent practice and patience are important for effectively incorporating it into your trading strategy.

Frequently Asked Questions (FAQs)

How does a Hanging Man differ from a Hammer candlestick pattern?

While both patterns look similar, the Hanging Man candlestick forms in an uptrend, while the Hammer candlestick appears in a downtrend.

What does the long lower shadow in a Hanging Man candlestick depict?

The long lower shadow shows sellers pushed the price lower during the session, but buyers regained control by closing. However, it signals a possible weakness in the uptrend.

Is the Hanging Man pattern reliable in the sideways market?

No, the pattern is less reliable in the sideways market as it is most effective at the top of an established uptrend.

Should I immediately sell after seeing a Hanging Man candlestick pattern?

No, it is often recommended to wait for confirmation from subsequent candlesticks or other technical indicators before entering a short position.

What is the importance of volume in the Hanging Man candlestick pattern?

Increased volume can strengthen the bearish signal, as it shows heightened selling pressure in the market.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.