| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-23-24 | |

| Post updated | Pocketful Team | Oct-23-24 |

- Blog

- trading

- candlestick patterns

- opening white marubozu

Opening White Marubozu Pattern

There are several technical analysis tools available that can completely transform a trader’s performance. Traders typically use many complex technical tools to better grasp a stock’s price bullish momentum. However, a bullish trend can be predicted by a simple pattern known as the Opening White Marubozu pattern.

In this blog, we will provide you with information about the Opening White Marubozu pattern, its features and interpretation. We will also discuss the advantages and disadvantages of using this pattern.

What is the Opening White Marubozu Pattern?

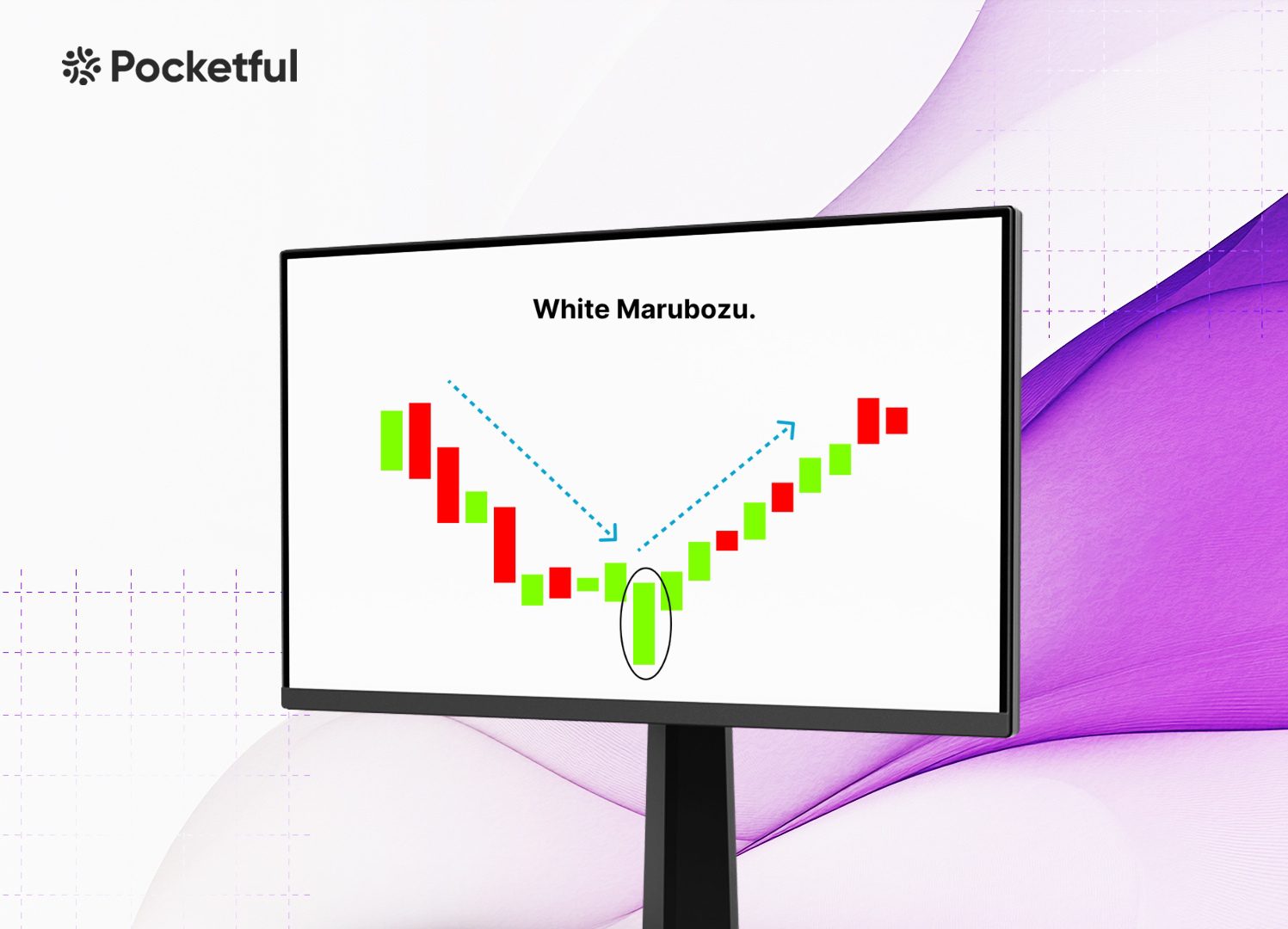

The word “Marubozu” in Japanese means “bald,” which gives the pattern its name as a Maruzobu candle doesn’t have any wicks. The Opening White Marubozu pattern is a single-candle pattern that typically appears at the end of a downward trend and predicts a significant upward movement. This candlestick can have a little wick at the top and a long, white body, but it lacks a lower shadow or wick. The candle’s body indicates buyers are attempting to increase prices by taking long positions. However, it is important to consider broader market conditions as they may be against the pattern, which can result in the continuation of the previous trend.

Features of Opening White Marubozu Pattern

The main characteristics of the Opening White Marubozu pattern are as follows-

- Long Body – This pattern’s large or long white body suggests that the price is trending upward.

- No Lower Shadow – There is no lower shadow in the Opening White Marubozu pattern since the price did not drop below the session’s opening levels.

- Small Upper Wick – This candle pattern has a tiny upper wick, which suggests that the stock price increases swiftly but does not close at the session’s high due to mild selling pressure near the high. Occasionally, it does close near the session’s high, indicating strong purchasing momentum.

- Bullish Sentiment– This pattern suggests a bullish sentiment among the market participants.

Interpretation of Opening White Marubozu Pattern

The Opening White Marubozu pattern can be interpreted in the following ways:

- Usually, this pattern emerges at the end of a downtrend and signals the beginning of an uptrend.

- This indicator suggests buyers are entering the market and building long positions.

- As is typically observed in this pattern, buyers attempt to drive prices as high as they can; however, sometimes, they may not be successful, in which case the candlestick pattern may have a little wick at the top.

Read Also: Marubozu Candlestick Pattern: Means, History & Benefits

How to Determine Target & Stop-Loss?

There are several ways to determine the target price for the Opening White Marubozu pattern. A couple of these techniques are as follows:

1. Height of Candle – Measure the candle’s height, i.e., the difference between the candle’s open and close prices. Project this upwards from the candle’s closing price to determine your target price.

2. Resistance Level – Technically, you can also consider the closest resistance level as your target price. This resistance level is the region from where the stock has recently experienced selling pressure.

3. Average True Range (ATR) – A trader can also use ATR to determine the stock’s target price while also considering volatility.

When trading the Opening White Marubozu pattern, the stop-loss can be determined in the following ways.

1. Previous Day Low – An individual can set a stop-loss just below the prior day’s low to limit losses.

2. Low of Candle – Stop-loss can be positioned below the low of the Opening White Marubozu candle. It is the most often used stop-loss by traders.

3. Support Levels – A trader can set a stop-loss bear the closest level of support using technical charts.

Example Of Opening White Marubozu Pattern

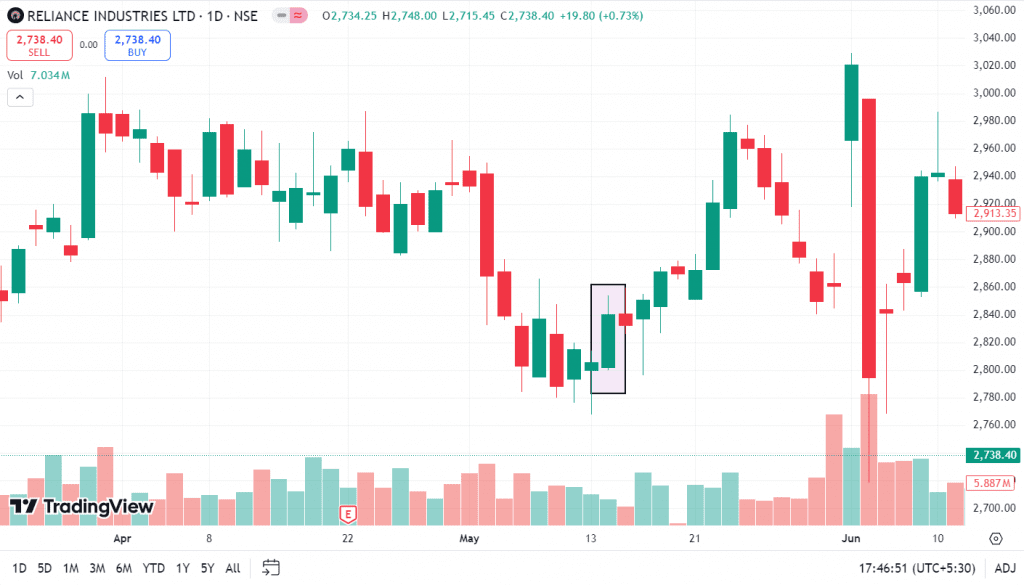

In the above image, the price chart of Reliance Industries is shown. The stock was in a downtrend and declined from INR 2,971 on 28 March 2024 to INR 2,805 on 13 May 2024. The stock made an Opening White Marubozu Candlestick Pattern on 14 May 2024, with a small upper wick. It was a signal of bullish reversal and the stock price increased from INR 2,840 on 14 May 2024 and made a high of INR 2,972 on 23 May 2024.

Advantages of Opening White Marubozu Pattern

The following are the main benefits of the Opening White Marubozu pattern:

- Easy Identification – This trading pattern is easily recognizable due to the absence of lower shadow, indicating a distinct upward trend in the market.

- Indication of Market Trend – The Opening White Marubozu pattern signals a significant upward trend in the stock price.

- Entry Signal – The pattern helps traders determine when to enter the market and create a long position.

- High Rewards – This pattern can be highly profitable because it usually functions as a bullish reversal pattern, appearing at the end of a bearish trend.

Limitations of Opening White Marubozu Pattern

Opening White Marubozu candlestick pattern has some drawbacks, which are listed below:

1. Lacks Confirmation – The Opening White Marubozu pattern consists of only one candlestick and lacks confirmation, due to which it can occasionally generate false signals.

2. Dependent on other tools – The pattern relies on other technical tools, such as volume, RSI, MACD, etc., to give a strong bullish signal.

Read Also: Closing White Marubozu Pattern

Conclusion

In trading, the Opening White Marubozu pattern serves as a crucial tool that suggests a possible bullish signal. The pattern provides clear entry and exit points, making this pattern popular among investors. To have a profitable trade, you must employ this pattern in conjunction with other patterns like the MACD.

Frequently Asked Questions (FAQs)

Is Opening White Marubozu a bullish or bearish pattern?

The Opening White Marubozu pattern is a bullish candlestick pattern.

Is there any difference between the Opening White Marubozu and White Marubozu candlestick pattern?

Yes, there is a little distinction between the White Marubozu candlestick pattern and the Opening White Marubozu pattern. The White Marubozu pattern lacks shadows on either side, while the Opening White Marubozu pattern has a small wick at the top of the candle.

Can the Opening White Marubozu pattern occur in any market?

Can the Opening White Marubozu pattern occur in any market?

Is Opening White Marubozu a reliable candlestick pattern?

When paired with other analytical tools, the Opening White Marubozu chart pattern can be considered a reliable chart pattern.

Does the Opening White Marubozu candlestick pattern have a wick?

A tiny wick above the candle’s close price is seen in the Opening White Marubozu candlestick pattern.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.