| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-03-24 |

- Blog

- trading

- candlestick patterns

- piercing

Piercing Pattern

Technical analysis has gained popularity among the new market participants in recent years. There is a wide range of chart patterns available for traders to predict the market direction, but there are very few chart patterns that predict a bullish reversal in an already established bearish trend. A Piercing pattern is one such pattern that can help you spot buying opportunities near the bottom of the downtrend.

In this blog, we will discuss the Piercing pattern or Piercing Line pattern, its interpretation, advantages and disadvantages. Moreover, we will provide a trading setup to use the pattern effectively and test the setup on a real-world example.

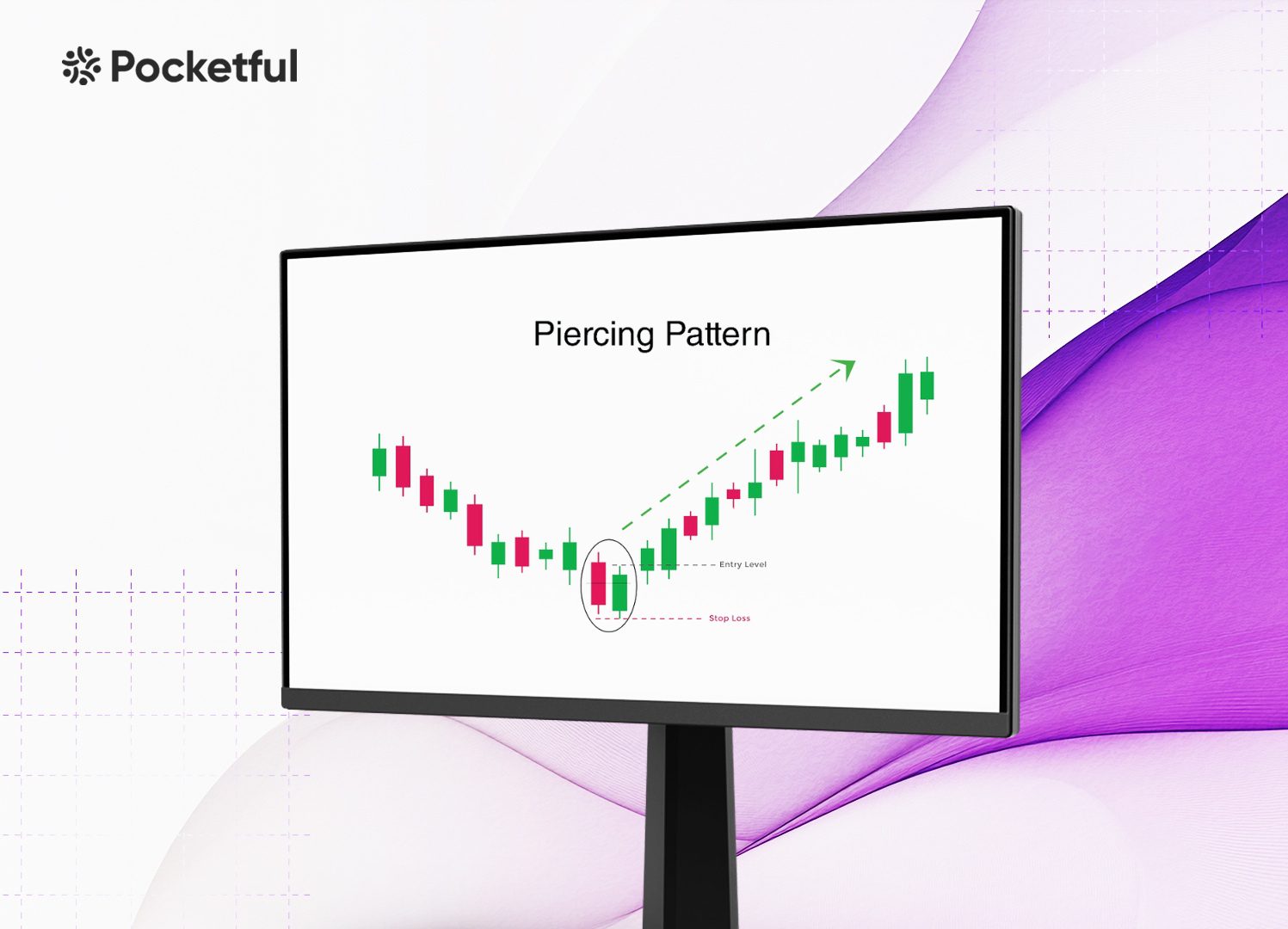

What is the Piercing Pattern?

The Piercing Candlestick Pattern is a bullish reversal chart pattern that consists of two candlesticks. The first candle in the piercing line pattern must be a long, bearish candlestick, while the second candle must be bullish. The bullish candle opens below the closing price of the first candle and closes above the midpoint of the bearish candle. The pattern generally forms near the end of a downtrend, which indicates that the security is going to enter an uptrend.

Interpretation

Whenever a trader sees a Piercing Line pattern, the trader can expect that the downtrend has come to an end and the beginning of a bull run in the security. Traders can use volume analysis for better accuracy. Taking a trade using the Piercing Line Pattern after confirmation from other indicators or analysis can be rewarding for the trader.

Things to consider while looking for a Piercing Line Pattern:

- The open price of the second candle must be below the close price of the previous long bearish candle.

- The close price of the second candle must be above the middle point of the previous long bearish candle or slightly below the previous candle’s open price.

- The high price of the bullish candle must be below the high price of the previous bearish candle.

- The trade volume during the first bearish candle should be less than the trade volume in the second candle. In other words, the volume of the bullish candle should be more than that of the bearish candle.

How to Determine Entry, Target & Stop-Loss?

A well-defined trading setup is essential for trading any chart pattern. An individual can follow the below-mentioned steps to effectively use the Piercing pattern.

- Entry: When the asset price closes above the open price of the bearish candle in the pattern, traders can create a long position.

- Stop-Loss: A stop-loss can be set below the low of the bullish candle.

- Target: A target can be set near the resistance levels or as per the risk-reward ratio of an individual.

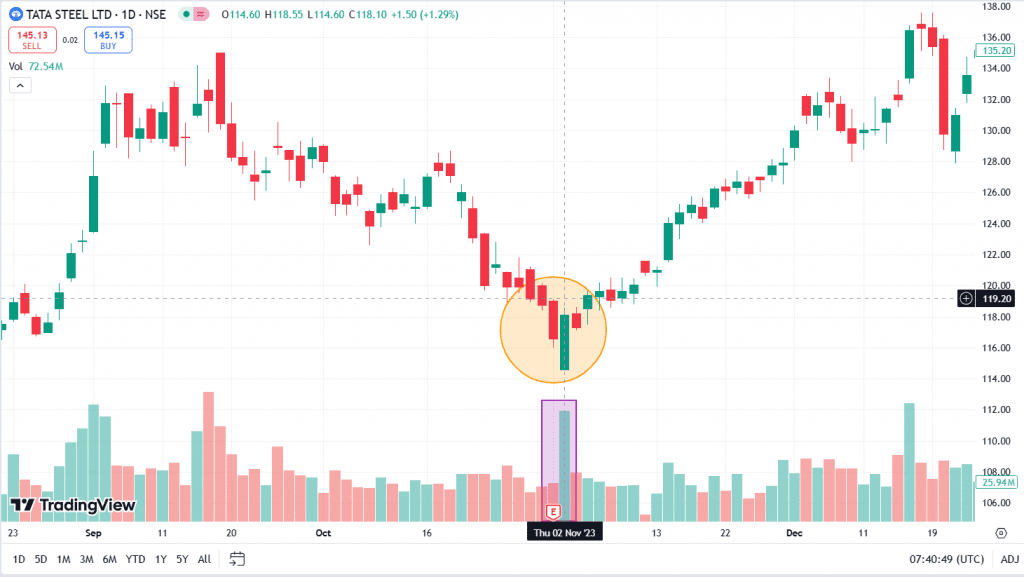

Example of Piercing Pattern of TATA STEEL LTD.

The above image shows the price chart of Tata Steel on a daily timeframe. The stock was in a downtrend as it declined from INR 130.45 to INR 118.75. On 2 November 2023, the stock formed the Piercing pattern. Pay close attention to the volume data; the trading volume during the bullish candle is more than twice than that of the trading volume during the bearish candle. The stock price increased from INR 119 to INR 140 between 6 November 2023 and 29 December 2023, i.e., a 17% jump in less than 2 months.

Read Also: Introduction to Bearish Candlesticks Patterns: Implications and Price Movement Prediction

Advantages of Piercing Line Candlestick Pattern

The advantages of using a Piercing Line candlestick pattern are:

- Strong Bullish Reversal Signal: The pattern signals a possible change in the trend from downward to upward and can thus be a crucial indicator for those trading based on a bullish reversal. It gives a clear bullish signal when the second candle opens lower and closes above the midpoint of the first candle.

- Simple to recognize: It is simple to observe on charts because of its simple two-candle structure, which makes it useful for beginners.

- Can be used for Different Asset Classes: The Piercing Line pattern can be used for different asset classes, including stocks, forex, and commodities.

Limitations of Piercing Line Candlestick Pattern

The limitations of using a Piercing Line candlestick pattern are:

1. Not Self-Confirming: Like most candlestick patterns, the Piercing Line pattern often requires confirmation from other indicators or subsequent price action for a reliable bullish signal.

2. Only Valid during Downtrends: The Piercing Line pattern is most effective when it appears after a downtrend. In sideways markets or bull markets, the pattern holds little significance.

3. Can Produce False Signals: The Piercing Line pattern can generate false signals in volatile markets, which can cause losses for traders using this pattern.

Conclusion

The Piercing Line candlestick pattern is a reliable bullish reversal pattern that helps a trader realize that the downtrend has come to an end and an uptrend might begin. It is simple and can be used in different markets, which makes it useful for new and experienced traders. It is important to use the pattern in combination with other technical tools or studies to increase the accuracy in trading decisions or reduce the occurrence of false signals. Consult a financial advisor before trading based on the Piercing Line chart pattern.

Frequently Asked Questions (FAQs)

How is the Piercing Line Pattern formed?

The Piercing Line pattern generally forms near the bottom of the downtrend and consists of a long bearish candle, followed by a bullish candle that opens lower but closes above the midpoint of the previous candle.

What does a Piercing Line pattern indicate?

It indicates a bullish reversal in an established downtrend.

Does the Piercing Line Pattern work well at all times?

The pattern works best if it appears after a downtrend. However, in volatile or sideways markets, it may generate false signals.

Is confirmation needed after the formation of a Piercing Line pattern?

When the asset price crosses above the high of the pattern’s first candle, it confirms the pattern’s bullish reversal signal.

Does the Piercing Line pattern generate false signals?

Yes, under volatile market conditions, this pattern will give false signals.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.