| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-24-24 | |

| Post updated | Pocketful Team | Oct-24-24 |

- Blog

- trading

- candlestick patterns

- three outside down pattern

Three Outside Down Pattern

The Indian stock market has witnessed a wave of new participants over the past few years. Whether it is a new trader or an experienced one, everyone wants to find a way to predict when the bullish trend is near its end to exit their long positions timely. The Three Outside Down pattern is one of those patterns that appear at the end of an uptrend and signals a potential bearish reversal.

In this blog, we will discuss the Three Outside Down pattern, its interpretation, advantages and limitations. We will also provide a real world example to understand the trading setup better.

What is the Three Outside Down Pattern?

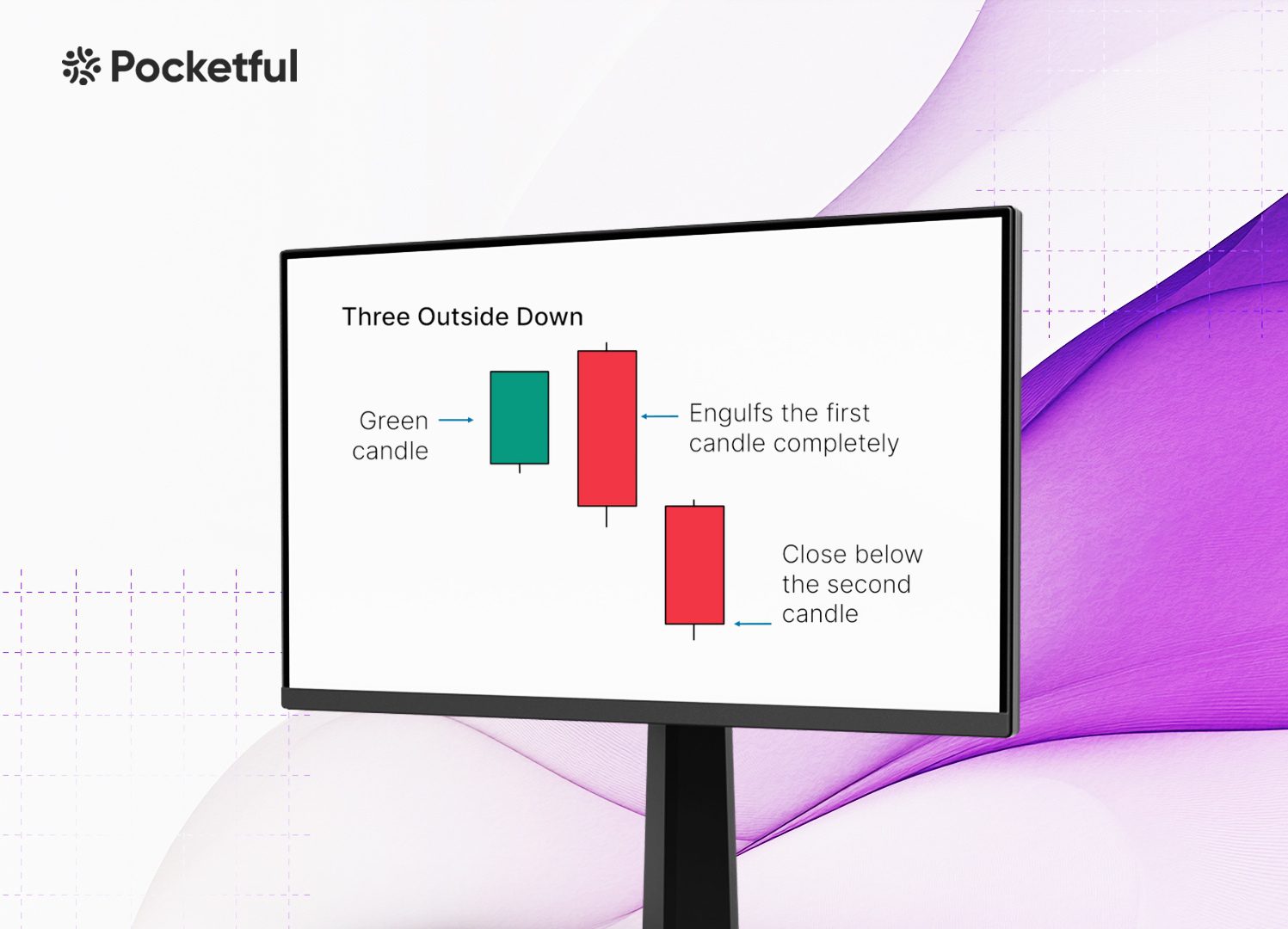

The Three Outside Down pattern is a candlestick pattern that can be used to predict a bearish reversal. It has three candles, and its characteristics are specified below:

1. First Candle: A medium-sized candle in an established uptrend shows that the buyers are still in control and pushing the prices higher. This candle signifies the continuation of an uptrend.

2. Second Candle: A big bearish candle completely engulfs the first bullish candle, and the price closes below the low of the first candle, signifying that the buying pressure may be weakening and sellers are about to enter the market.

3. Third Candle: A big bearish candle opens at or below the close price of the second candle and closes significantly lower than the low of the second candle.

As the name suggests, The Three Outside Down is the bearish reversal pattern that can be observed through candlesticks. It is a three-candle pattern that usually appears after a prolonged uptrend and signals a potential shift from uptrend to downtrend. Let’s interpret the pattern in more detail.

Pattern Interpretation

The Three Outside Down pattern can be interpreted as follows:

- Formation: This pattern forms after a bullish trend near the top of the uptrend.

- Price Action: The pattern consists of 3 candles, out of which the first candle is a green candle with a small body, which represents the continuation of the prior uptrend where buyers are still in control, but the trend is weakening as the body of the candle is smaller than the previous bullish candles. The first red candle completely engulfs the green candle, and the second bearish candle, which closes below the first red candle, confirms the beginning of a bearish trend.

- Market Sentiments: It often occurs near the end of a prolonged uptrend as the market struggles to find direction. So when the first red candle engulfs the bullish candle, it signals a shift in market sentiment, and the second candle confirms the bearish reversal.

- Volume: The pattern generates more accurate signals of bearish reversal if it forms with a higher trading volume.

- Risk Management: For any chart pattern, proper stop-loss placement and risk management strategies are crucial.

Trading Setup

A trading setup is important to effectively use a chart pattern in making trading decisions:

- Entry Point: Since it is a reversal pattern, it is important to wait for confirmation. Hence, the entry point should be when the price closes below the third candle. Also, take confirmation from an increase in volume.

- Stop-Loss: A stop-loss should be placed above the high of the second engulfing candle so that the trader can manage risk by limiting losses in case the pattern gives a false breakdown.

- Target: The target can be set near the nearest significant support level, Fibonacci retracement levels or as per your risk-reward ratio.

Read Also: Three Outside Up Pattern

Example of Three Outside Down Pattern of Bajaj Finserv Ltd.

The above image shows the daily chart of Bajaj FinServ Ltd. The stock was in an uptrend and then the stock made the Three Outside Down pattern between 5th January 2024 to 10th January 2024. On 5th January, the stock price made a small bullish candle, and on the next day, it made a strong bearish candle, which completely engulfed the small bullish candle. Moreover, the third bearish candle closed below the low of the bearish candle, which confirmed the bearish reversal. The stock price declined from a high of INR 1,723 to a low of INR 1,559 on 18th January 2024. The nearest support was around 1,568 due to which the price closed at INR 1,581. While trading this pattern, traders should keep a stop-loss above the high of the second candle, i.e., INR 1,723, and take profit at the nearest support level, i.e. INR 1,568. You can also use the Fibonacci level for deciding the target price or keep trailing the stop-loss.

Advantages of Three Outside Down Pattern

The advantages of the Three Outside Down pattern are:

- It can be used in any market, such as equity, currency, and commodity markets.

- It works more efficiently in a short to medium time frame, indicating a short-term reversal is on the cards.

- It is a reliable reversal signal indicator.

- It is easy to identify.

- The third candle offers an additional confirmation.

- The pattern works well with other indicators.

- This pattern gives a complete setup for stop-loss and target.

- This pattern gives quite accurate results in a trending market with strong volumes.

Limitations of Three Outside Down Pattern

The limitations of the Three Outside Down pattern are:

- The pattern could give false signals, which can result in losses in choppy and sideways markets.

- The Three Outside Down pattern is a three-candle pattern, which makes it a rare pattern.

- The pattern is of limited use in low-volume markets.

- It needs confirmation and support from other indicators or studies.

- It works well in the short to mid-term and effectively indicates a bearish reversal.

- This pattern’s effectiveness could be affected by various market factors like volatility, news, policy change, political instability, etc.

Read Also: Three Inside Up Pattern

Conclusion

The Three Outside Down candlestick pattern can be used to get a powerful reversal signal. It consists of one bullish and two consecutive bearish candles, signaling a shift in the market sentiment from bullish to bearish. While it provides a strong indication of a potential reversal, it is important to confirm the signal with other technical indicators or studies and set appropriate strategies for risk management, such as stop-loss and target levels, before entering a trade. However, it is advised to consult a financial advisor before trading.

Frequently Asked Questions (FAQs)

What does the Three Outside Down Pattern indicate?

The Three Outside Down pattern is a bearish reversal pattern, which suggests the uptrend may be fading and sellers are taking control.

Is the Three Outside Down pattern suitable for beginners?

The Three Outside Down pattern is a relatively simple pattern to spot and use, even for beginners. However, traders should use it with other technical analysis tools and indicators to improve the accuracy of their trading decisions, as relying solely on one pattern can be risky.

What is the success rate of the Three Outside Down Pattern?

The success rate of the Three Outside Down pattern depends upon the market conditions, liquidity of the asset, and time frames. It is more effective if the pattern appears after an uptrend and in trending markets.

Can the Three Outside Down Pattern fail?

Yes, like any other chart pattern, this pattern also can fail and give false signals particularly if market conditions and news are against the pattern.

How reliable is the Three Outside Down Pattern?

The Three Outside Down pattern can effectively predict a bearish reversal, but its reliability increases when confirmed by other technical indicators or studies like volume, RSI, moving averages and support, and resistance levels.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.