| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-19-24 |

Read Next

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

- List of Best Commodity ETFs in India

- Bullish Options Trading Strategies Explained for Beginners

- Best Brokers Offering Free Trading APIs in India

- Top Discount Brokers in India

- Best Charting Software for Trading in India

- Benefits of Intraday Trading

- What are Exchange Traded Derivatives?

- What is Margin Shortfall?

- What is Central Pivot Range (CPR) In Trading?

- Benefits of Algo Trading in India

- Blog

- trading

- candlestick patterns

- three outside up

Three Outside Up Pattern

Technical analysis provides an extensive array of tools for forecasting price movements, and candlestick patterns are some of the most widely used. One such intriguing pattern that traders often look for is the Three Outside Up candlestick pattern, which significantly helps in identifying possible bullish reversals across various financial markets. This particular pattern helps traders gauge the market sentiment and provides pivotal insights into possible upward price movements. Understanding and using the Three Outside Up pattern can be a game changer for those capitalizing on market trends.

This blog will detail the Three Outside Up pattern and explore its structure, psychology, interpretation, and how to use it in a trading strategy.

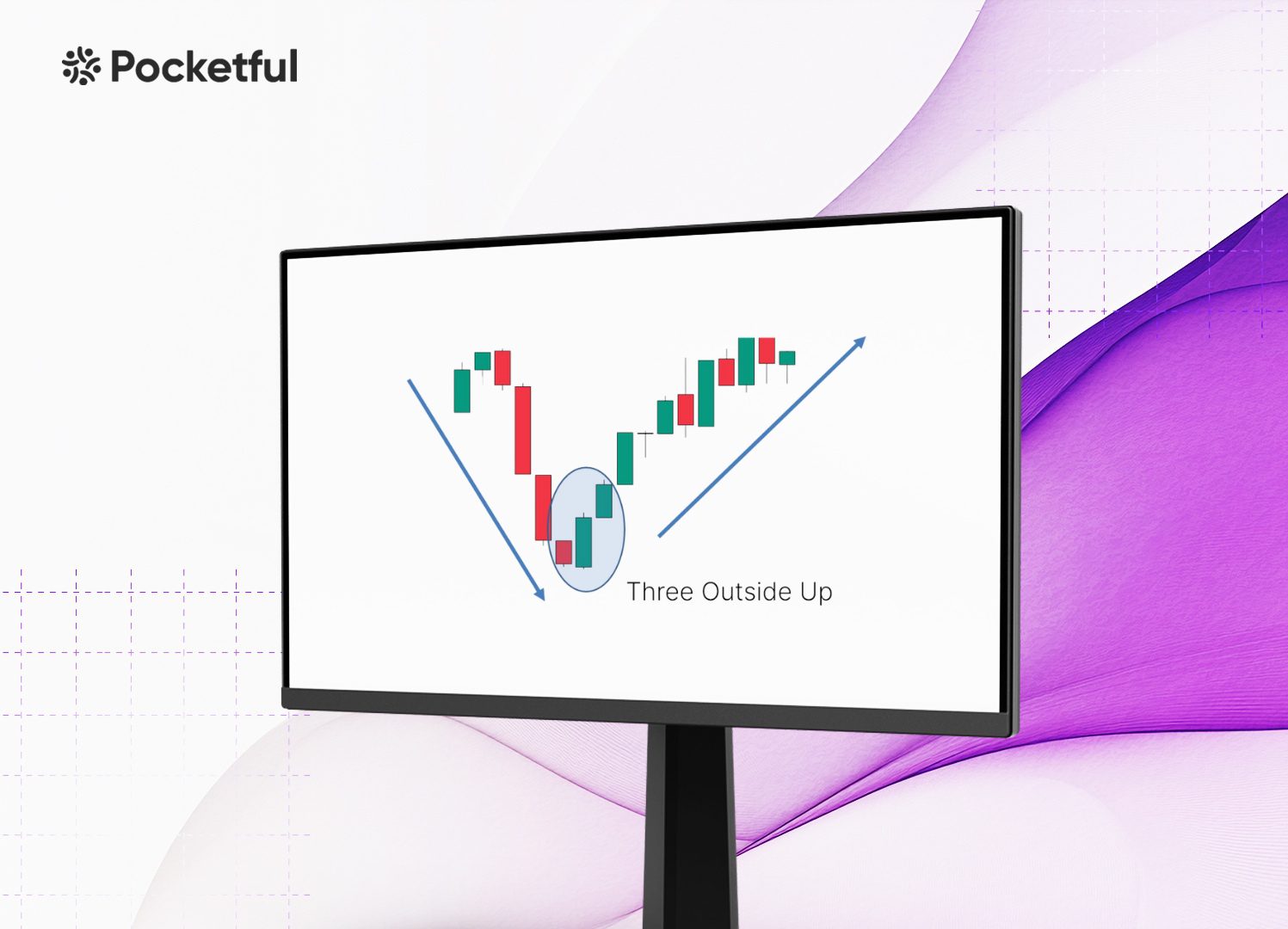

What is the Three Outside Up Pattern?

The Three Outside Up candlestick pattern is a bullish reversal pattern consisting of three consecutive candles that usually indicate a shift from a downtrend to an uptrend.

- First Candle – A long, red, bearish candle.

- Second Candle – The second candle must completely engulf the first candle, which means the second candle’s body completely covers the first candle’s body. This engulfing pattern shows strong buying momentum.

- Third Candle – This is usually a long green candle that closes above the high of the first candle.

The pattern usually occurs at the end of a downtrend, suggesting that selling pressure is decreasing and a bullish reversal may be on the way.

Interpretation of the Three Outside Up Chart Pattern

The understanding of this pattern can be broken down into three parts.

- Downtrend: The initial long red candle signifies that the prevailing downtrend is likely to continue, and sellers are driving prices down.

- Decreasing selling pressure: The big bullish engulfing candle shows that selling pressure is easing and buyers are increasingly taking action, yet they have not yet managed to reverse the current downtrend.

- Bullish Breakout: The appearance of another green candle that closes above the high of the previous candle shows a strong bullish sentiment, suggesting that buyers have effectively surpassed the selling pressure and are pushing the price upward.

How to Determine Target & Stop-Loss?

Determining a target is crucial to lock in profits before the markets move against you. An individual can determine the target levels using the following ways:

- Resistance Levels: A common way to set a profit target is to identify previous resistance levels where the price had difficulty breaking through. These levels represent areas where sellers may intervene, leading to price consolidation or reversal.

- Risk-Reward Ratio: Another effective method to set targets can be the risk-reward ratio. Frequently employed ratios are 1:2 or 1:3, which can significantly enhance your trading process. This method ensures that even if a small percentage of your trades succeed, the profits from winning trades will exceed the losses.

For any trading strategy, setting a stop-loss is important to limit losses in case of a false breakout. Some common ways to set a stop-loss for the Three Outside Up pattern are:

- Low of the First Bearish Candle: A simple and effective strategy is to set the stop-loss just below the low of the first bearish candle in the Three Outside Up pattern. If the first candle’s low is broken, it invalidates the bullish reversal signal. If the price drops below the first candle’s low, it indicates that sellers are in control, suggesting the bullish reversal has likely failed.

- Support Levels: Furthermore, support levels, marked by previous lows, can act as effective stop-loss points. Placing a stop-loss just under a key support level confirms a failed bullish reversal if the price falls below it.

Read Also: Three Outside Down Pattern

Example of Three Outside Up Pattern

The example above illustrates the Three Outside Up pattern on the daily chart of Apollo Hospitals, which emerges after a decent downtrend. The long red candle signifies a sustained wave of selling pressure. However, the next green candle, which almost engulfs the first red candle, shows diminishing selling pressure and the subsequent long green candle closing above the first candle’s high shows a bullish breakout. We can see that the stock price increased from INR 4,276 to INR 5,733 between 27 October 2021 and 17 November 2021.

Advantages of the Three Outside Up Pattern

The advantages of using a Three Outside Up pattern are:

- Strong Reversal Signal: The Three Outside Up pattern gives a strong signal for a bullish reversal, showing a potential shift from a downtrend to the onset of an uptrend. It gives traders clear visual signals of a market shift from bearish to bullish, helping them identify and trade bullish reversal opportunities.

- Inherent Confirmation: A key benefit of this pattern is the inherent confirmation offered by the third bullish candle. The third bullish candle in the Three Outside Up pattern confirms that the reversal is genuine, unlike other candlestick patterns that may not provide clear confirmation.

- Simple Formation: The pattern is easy to observe on price charts, making it accessible for beginner traders. The three-candle structure allows traders to quickly spot the pattern and take action.

Limitations of the Three Outside Up Pattern

The limitations of using a Three Outside Up pattern are:

- False Signals: The pattern occasionally gives false signals, particularly in low liquidity or high volatility markets. Traders relying only on a single pattern may suffer losses if the market moves in the opposite direction.

- Late Entry Point: The Three Outside Up pattern is characterized by a three-candle formation, indicating that it only becomes apparent after the third candle is closed. At this point, a considerable portion of the reversal movement may have already occurred, especially in dynamic markets. Traders seeking early entries may find that the pattern validates the trend too late, eventually diminishing the possible profit margins.

- Misinterpretation: This candlestick pattern can be interpreted in different ways. Variations in candle size, shape, and the positioning of the subsequent candles can lead to different interpretations among traders. Traders may perceive patterns differently based on their analysis methods.

Common Mistakes When Trading the Three Outside Up Pattern

Although the Three Outside Up pattern is a valuable trading tool, traders often make errors that can diminish its effectiveness. Here are some common pitfalls to avoid when trading the Three Outside Up pattern.

- Ignoring the Trend – The Three Outside Up pattern works best if it appears after a downtrend. In a sideways or bullish market, the pattern may not indicate a genuine reversal. Always consider the broader market context before making a trading decision.

- Overlooking Volume – Volume plays an important role in validating candlestick patterns. A Three Outside Up pattern accompanied by low volumes may suggest weak market conviction, decreasing the chances of a bullish reversal. Ensure that the second and third candles form with increasing volumes to confirm the pattern’s validity.

- Not using other Indicators – Exclusively depending on the Three Outside Up pattern without incorporating other technical indicators can be risky. Always use other indicators like RSI, MACD, or moving averages alongside the pattern for better trading decisions.

Read Also: Three Inside Up Pattern

Conclusion

The Three Outside Up candlestick pattern is a simple method for recognizing possible bullish reversals. Its clear structure and confirmation make it popular among traders seeking bullish reversal signals in declining markets. Nonetheless, similar to all technical patterns, it is not foolproof. Integrating the pattern with effective risk management techniques and other technical tools can boost the probability of executing successful trades.

Frequently Asked Questions (FAQs)

How reliable is the Three Outside Up candlestick pattern?

It is considered more reliable than other reversal patterns because of inherent confirmation from the third candle. However, it should be used in combination with other indicators for better accuracy.

Can this pattern be used in any market?

Yes, this pattern works across different markets, including stocks, forex, commodities etc.

Can the Three Outside Up pattern fail?

The Three Outside Up pattern can fail, especially in strong downtrends or sideways markets, where the market conditions overpower the bullish reversal signal of the pattern.

What is the difference between Three Outside Up and Bullish Engulfing Pattern?

The Three Outside up pattern has a third bullish candle, which confirms the bullish reversal, making it more reliable than the two-candle Bullish Engulfing pattern, which lacks confirmation.

How do I know if the reversal signal is strong?

The size of the engulfing candle and the third candle’s strength, along with high trading volume, can show the strength of the reversal signal.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle