| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-07-24 | |

| Add new links | Nisha | Mar-18-25 |

- Blog

- trading

- candlestick patterns

- three white soldiers

Three White Soldiers Pattern

The”ThreeWhiteSoldiers” is a bullish pattern used in the technical analysis to predict a potential reversal in a downtrend. It consists of three consecutive long-bodied white (or green) candles that closehigher than the previous candle, indicating the strong buying momentum. Traders use this pattern as a signal to create long positions, as it often reflects a shift in the market control from sellers to buyers. Understanding that “ThreeWhiteSoldiers” can help the investors to identify the potential upward trends in stock or asset prices.

In this blog, we will discuss the Three White Soldiers pattern, its interpretation, advantages and limitations. Moreover, we will explore how to determine target and stop-loss for this pattern with the help of a real-world example.

What is the Three White Soldiers pattern?

The Three White Soldiers is a bullish reversal candlestick pattern which is used in the technical analysis to signal a potential shift from a downtrend to an uptrend. This pattern appears at theend of a bearish market, and it also indicates that thetidemay be turning in favor of buyers.

Thepattern consists of three consecutive long-bodied white or green candles, each of which closes higher than the previous one. The Three White Soldiers candlestick pattern includes three candlesticks, which convey the following message:

- First Candle: Marks theinitial sign of reversal showing a strong bullish moveafter a period of selling pressure. It typically opens near the low of the previous bearish candleand closes near its high.

- Second Candle: Reinforces the shift in the market sentiment. It opens within or near the previous candle’s body and closes higher, which confirms the continued buying interest. Thesecond candleshould not havea long shadow as it reflects strength in thebuyers.

- Third Candle: Confirms thebullish reversal. It opens within the second candle’s body as it closes even higher and establishes the strong upward momentum. Likethesecond candle, thethird candle should also haveminimal upper wicks that show the persistent buying pressure.

Thekey feature of theThreeWhite Soldiers pattern is that each candleopens near theprevious candle’s body and closes near its high with minimal shadows indicating the steady and strong buying pressure.

Interpretation of Three White Soldiers Pattern

The Three White Soldiers pattern indicates a strong bullish reversal signal in technical analysis, reflecting a significant shift in market sentiment from bearish to bullish. When this pattern appears after a continued downtrend or during a period of market consolidation, it suggests that buyers are gaining control and that an upward trend may be on the horizon.

Here’s how theThreeWhiteSoldiers pattern is typically interpreted:

- Reversal Indicator: The appearance of three consecutive bullish candles indicates that selling pressure is weakening and the buyers have taken over. This is seen as a potential reversal of a downtrend and signalling that a new bullish phasemay begin.

- Strength of theTrend: Theconsecutive long-bodied candles with minimal upper shadows suggests that buyers arein control and push the prices higher with confidence. The absenceof long wicks indicates that the market price closed near the high of the trading session, and it also underscores the strong buying momentum throughout the session.

- Momentum Confirmation: Traders interpret this pattern as a confirmation of bullish momentum. If thesecond and third candles continue to open within or near theprevious candle’s body, it suggests sustained interest in buying and further validation of thestrength of thereversal.

- Entry and Exit Signals: Many traders seetheThreeWhiteSoldiers pattern as an opportunity to create long positions and expect the bullish trend to continue. However, caution is advised if themаrket is already overbought, which can result in a false breakout followed by consolidation.

Read Also: What are Candlestick Patterns? Overview and Components

How to Determine the Target and Stop-Loss?

An investor or trader can determinetargets and stop-loss (SL) levels when trading the3 White Soldiers pattern by following thesesteps:

- Entry Point: Create a long position аfter thethird bullish candlecloses, confirming theformation of the pattern.

- Stop-Loss (SL): Set thestop-loss below the low of the first candle of the pattern. This protects against sudden market reversals and minimizes the potential losses if thebullish trend fails.

- Target: Set a target based on a risk-reward ratio (typically 1:2 or 1:3). You can also use nearby resistance levels or previous swing highs to determinea target.

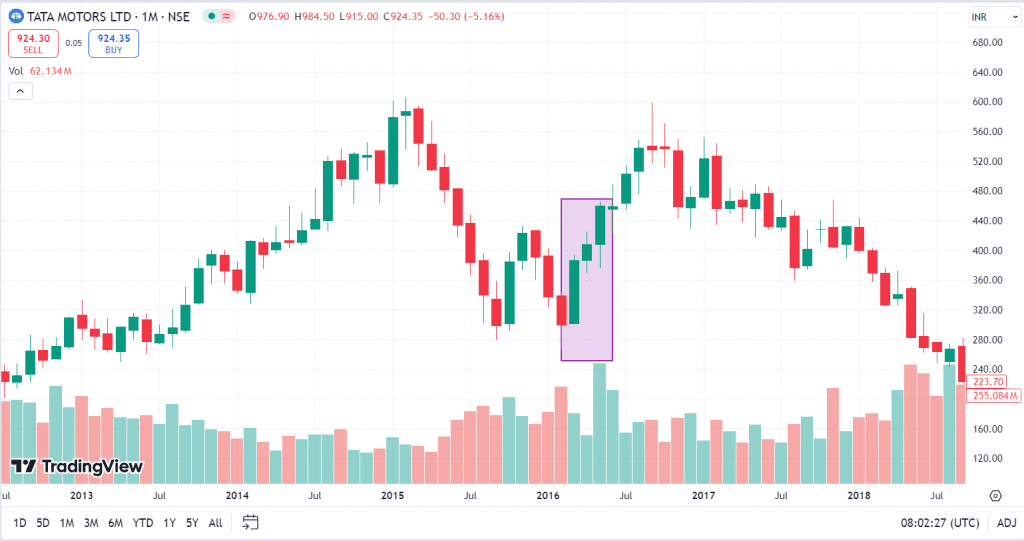

Example of Three White Soldiers Pattern of TATA MOTORS LTD.

The above image shows Tata Motors’ price chart on a monthly time frame. The stock was in a downtrend and made a low of INR 265 in February 2016. The stock price increased significantly in March 2016, as indicated by the first green candle, which had an opening price of INR 301 and closed at INR 386. The stock made three consecutive bullish candles, and the Three White Soldiers pattern was completed in May 2016, when the stock price closed at INR 459. After the formation of the pattern, we can see that the stock price increased further and made a high of INR 598 in September 2016.

Read Also: Three-Line Patterns

Advantages of Three White Soldiers Pattern

TheThreeWhiteSoldiers candlestick pattern is a popular pattern in technical analysis offering several advantages for traders looking to identify potential bullish reversal. Below аresomekey advantages of using this pattern:

- ReliableBullish Signal: One of the major advantages of theThree WhiteSoldiers pattern is its reliability in signaling a trend reversal. It is formed after a downtrend, indicating a strong shift in market sentiment from bearish to bullish, making it a reliable indicator of a potential upward trend.

- Easy to Identify: Thepattern consists of threeconsecutivebullish candlesticks, with each opening within the previous one’s body and closing higher. This makes it easy to spot and allows for quick decision-making.

Limitations of Three White Soldiers Pattern

WhiletheThreeWhiteSoldiers pattern is a useful tool for identifying the bullish reversals; it also has certain limitations that traders should beawareof:

- Susceptible to other Market Factors: The pattern’s signal of a bullish reversal can be affected by various market factors, such as volatility, news, policy changes, political instability, etc.

- FalseSignals in Sideways Markets: Thepattern is most effective in trending markets. In sideways or range-bound markets, the pattern may generate false signals leading traders to believea new uptrend is forming when, in fact, themаrket may continue to remain sideways.

Conclusion

In conclusion, theThree White Soldiers pattern is a reliableindicator of a bullish reversal, giving a clear signal of upward momentum. The pattern is easy to identify due to its simple structure and provides a complete trading setup for target and stop-loss levels. However, it should be used cautiously as falsesignals can occur, especially in sideways markets or due to other market factors. To maximizeaccuracy, traders should use this pattern with other technical indicators. Hence, it is advisable to consult a financial advisor before trading.

Frequently Asked Questions (FAQs)

What does the Three White Soldiers pattern indicate?

TheThreeWhiteSoldiers pattern indicates a potential bullish reversal as it usually appears after a downtrend. It consists of three consecutive long-bodied bullish candlesticks signaling a strong buying pressureand a shift in market sentiment from bearish to bullish.

How can I identify theThree White Soldiers pattern?

To identify theThreeWhiteSoldiers pattern, an individual can look for threeconsecutive bullish candlesticks. Each candlestick should open within the body of the previous candle and closehigher than the previous one, preferably with little to no upper wicks. This pattern suggests increasing buyer’s confidence and bullish momentum.

Is the Three White Soldiers pattern reliable?

While the Three White Soldiers pattern is generally considered a reliable bullish signal, it’s essential to confirm it with additional indicators such as volume, moving averages or other indicators. Relying only on this pattern can result in losses due to false signals, especially in volatile or sideways markets.

Can the Three White Soldiers pattern beused in different markets?

Yes, theThreeWhite Soldiers pattern can be applied across various asset classes including the stocks, forex and commodities. Its flexibility makes it a valuable tool for traders, but it is crucial to consider the market conditions and use the confirmation from other technical indicators for more accurate trading decisions.

What should be the stop-loss when trading the Three WhiteSoldiers pattern?

A trader can place a stop-loss just below the low of the first bullish candle or near the closest support level to protect against false breakouts.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.