| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-03-24 | |

| Add new links | Nisha | Mar-18-25 |

Read Next

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

- Blog

- trading

- chart patterns

- rising wedge

Rising Wedge Chart Pattern

Several trading chart patterns are available in the field of technical analysis that can make a trader profitable. To better understand a stock’s price momentum, traders typically use many chart patterns, either separately or in combination with other technical indicators.

In today’s blog, we will explain the “Rising Wedge Chart Pattern” and how it can be used.

Overview of Rising Wedge Pattern

Often referred to as an ascending wedge pattern, the rising wedge chart pattern is a technical analysis tool that occurs after a downtrend, followed by a wedge-shaped formation. Typically, this pattern appears in bearish markets. The lower trendline of this pattern has a more steep slope compared to the slope of the upper trendline, giving the appearance of an upward-sloping wedge.

Features of Rising Wedge Chart Pattern

The features of rising wedge chart patterns are mentioned below:

- This pattern is characterized by two trend lines connecting higher highs and higher lows.

- At the time of formation of the pattern, if the volume decreases, it suggests a weakening of bullish momentum.

- The breakout often occurs in the downward direction with an increase in volume.

Interpretation of Rising Wedge Chart Pattern

A bearish reversal is indicated by the rising wedge pattern, which is interpreted when the stock price crosses below the lower trend line. In addition, a thorough analysis of the volume is necessary because any drop in volume during breakout can signal a possible fake breakout. Two trend lines that slope upward and converge as they stretch generate this pattern. This pattern receives a wedge shape from this convergence of the two trendlines. Along with a decline in trading volume, the price range narrows, which suggests a possible loss of upward momentum. When all these factors are taken into consideration, there may be a possibility that the stock price will swing from rising to falling.

Read Also: Best Options Trading Chart Patterns

Trading a Rising Wedge Chart Pattern

The following points must be kept in mind when trading:

- Entry Point: When the price breaks below the lower trend line with increased volumes, a trader can create a short position in the asset.

- Stop-Loss: The highest point of the wedge or a point just above the upper trendline can be used as a stop-loss.

- Target: Measure the height of the pattern at its widest point and subtract it from the breakout point to get the target price.

A trader should use other technical tools to confirm the bearish movement.

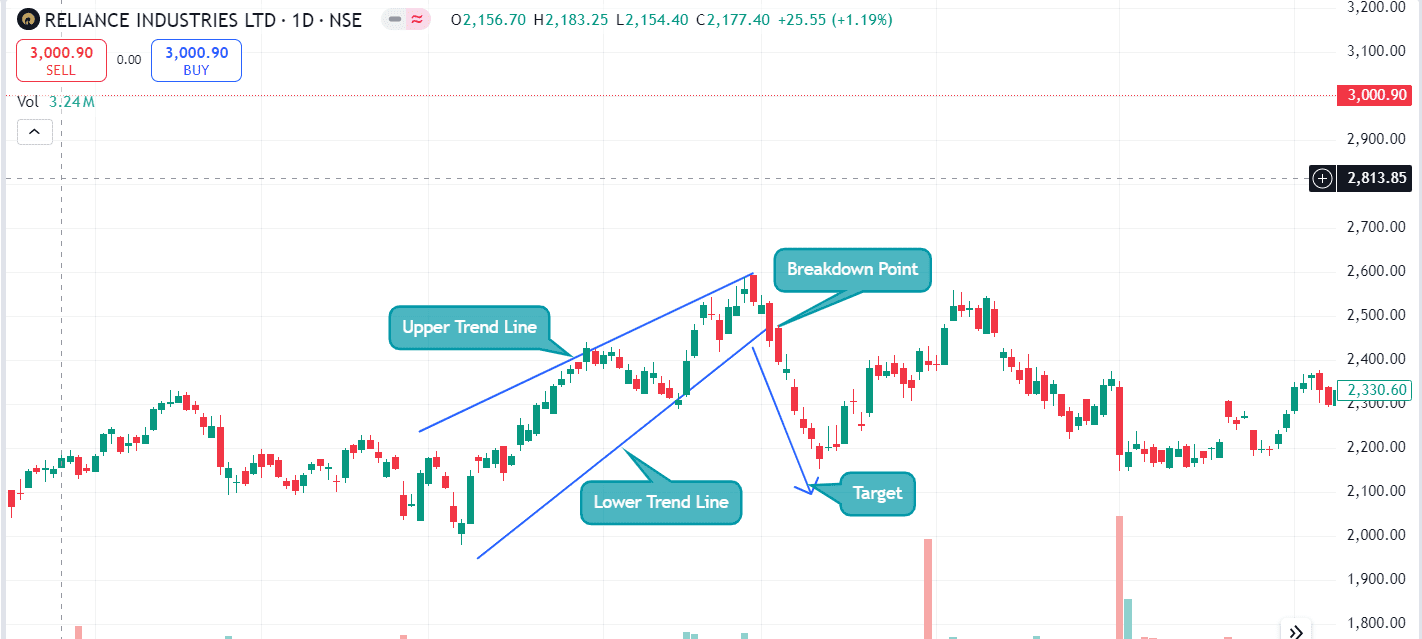

Example of Rising Wedge Pattern

The above image shows a Rising Wedge chart pattern for Reliance Industries over a daily time frame. The chart shows two trend lines converge, and the stock price fluctuates between them. Eventually, the price breaks below the lower trend line, indicating a downward trend in the stock price. The target is determined by the pattern’s height at its widest point.

Advantages of Rising Wedge Chart Pattern

The advantages of a rising wedge pattern are as follows:

- Signal TIming – This pattern provides an early sign of trend reversal, which helps traders to enter and exit timely.

- Common Pattern – This pattern can be easily identified.

- Target and Stop loss – A rising wedge pattern has clearly defined target and stop loss levels.

Disadvantages of Rising Wedge Chart Pattern

The disadvantages of the Rising Wedge pattern are as follows-

- False signals – Sometimes, the Rising Wedge pattern gives false signals, which might cause a trader to make incorrect trade decisions.

- Confirmation – The pattern requires confirmation from other indicators, which makes this a complex pattern to use in trading.

- Market Conditions – The pattern could be affected by various market factors, such as volatility, news, policy change, political instability, etc.

Read Also: Falling Wedge Pattern: Meaning & Trading Features

Conclusion

In summary, the Rising Wedge pattern is a valuable tool in technical analysis that suggests a possible bearish reversal signal. Investors rely on this pattern because it is easy to interpret and has clearly defined entry and exit levels. This pattern can be combined with other technical tools to get confirmation and increase your chances of success. However, it is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Is the Rising Wedge a bullish or bearish pattern?

The Rising Wedge chart pattern is a bearish pattern.

Is there any difference between a Rising Wedge and a Rising Triangle pattern?

A rising triangle is a continuation pattern in technical analysis, while a rising wedge is a bearish reversal pattern.

Is a Rising Wedge an accurate pattern?

The Rising Wedge pattern can be quite accurate when used with other technical indicators. However, no pattern can be 100% accurate.

How do we calculate the stop loss level for the Rising Wedge pattern chart pattern?

A stop-loss for a rising wedge pattern can be placed just above the upper trend line, or a trader can use a trailing stop-loss to lock in profits.

What is the target when the Rising Wedge pattern forms?

Measuring the pattern’s height at its widest point and subtracting it from the breakout price gives us the target price.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle