| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-30-24 | |

| Infographic Update | Ranjeet Kumar | Apr-04-25 |

Read Next

- What is Commodity Valuation?

- Exchange of Futures for Physical (EFP)

- Commodity Arbitrage – Types & Strategies in India

- Top Major Commodity Exchanges in India

- The Pros and Cons of Commodity Trading

- What is the Commodity Index?

- Types of Commodity Market in India

- Tax on Commodity Trading in India

- Understanding Commodity Market Analysis

- Risks in Commodity Trading and How to Manage Them

- 5 Tips for Successful Commodity Trading

- Best Online Commodity Trading Platforms in India: Top 10 Picks for Traders

- Commodity Trading Regulations in India: SEBI Guidelines & Impact

- What is the Timing for Commodity Market Trading?

- Stock Market vs Commodity Market

- How to Trade in the Commodity Market?

- What Is the National Commodity and Derivatives Exchange (NCDEX)?

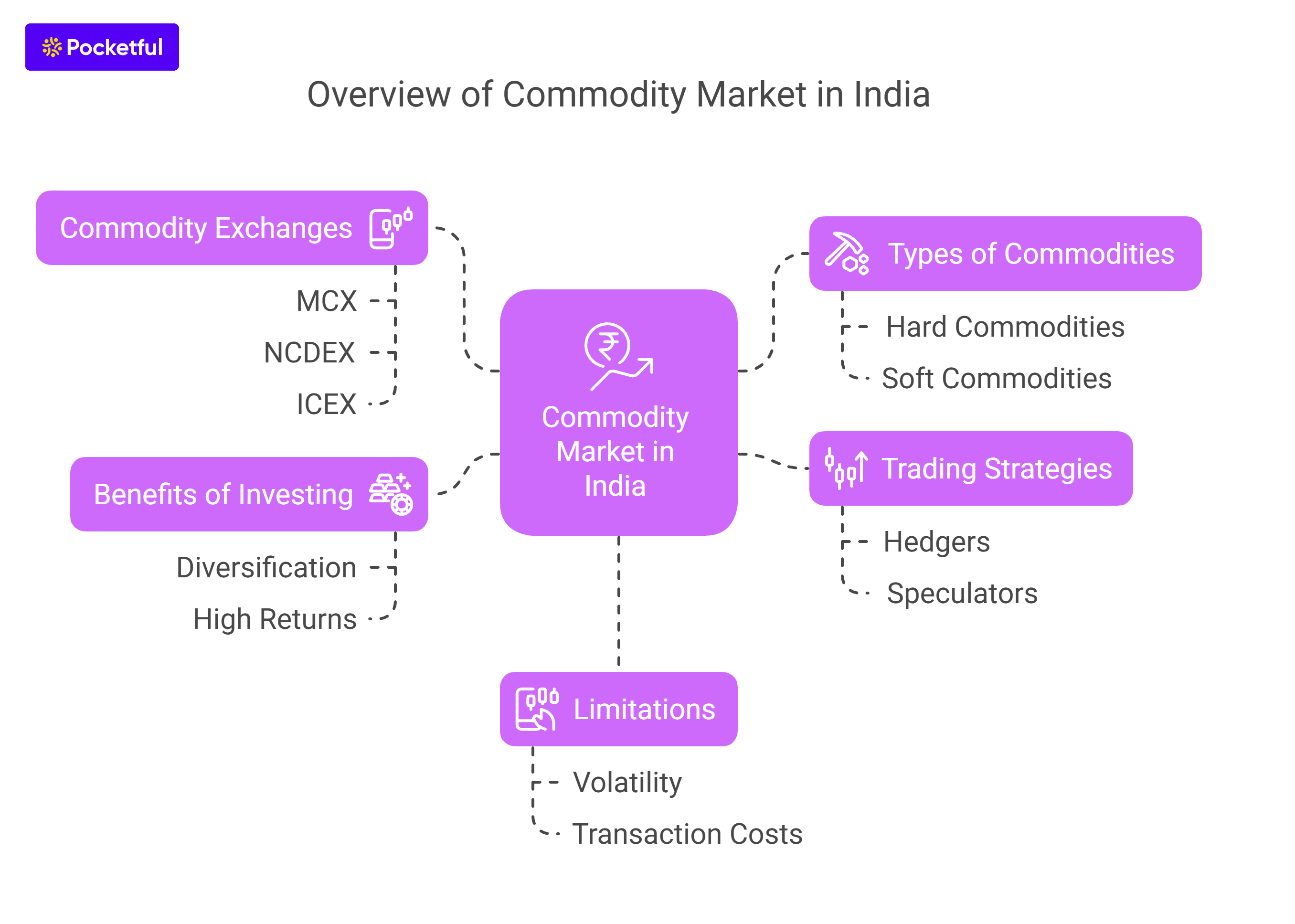

What is Commodity Market in India?

You might be thinking about investing in gold and silver to diversify your portfolio and lower its risk, as these tend to deliver good returns in volatile market conditions. However, you are currently clueless about which commodities are tradeable in India and how to begin trading in them.

In this blog, we will give you an overview of the Indian commodity market and tell you how you can start trading them to hedge your current assets or speculate on future price movements.

What is the Commodity Market?

A commodity market is regarded as a venue for the trading of various commodities, including copper, gold, silver, and natural gas. The purchasing and selling of these commodities is made easier by the commodity market. Both perishable and non-perishable goods are traded on the commodity market, which allows investors to diversify their holdings.

How Does a Commodity Market Work?

The dynamics of global supply and demand, including industrial demand, geopolitical events, weather, etc., influence commodity prices and commodity markets. It functions similarly to any other market in which a group of buyers and sellers get together to buy and sell a variety of commodities at any one time.

Types of Commodity Market

Based on the type of commodity, the settlement mechanism, and the nature of trading, the commodities market can be divided into different categories. The following lists the main categories of commodities markets:

Based on Trading: Based on the type of trading, the commodity can be categorized into two types-

1. Spot market: Commodities are purchased and sold instantly on the spot market, where prices are set by the current supply and demand.

2. Derivative market: Prices are established by taking the value or price of the commodity from the spot market. Participants make predictions about how the commodity’s price will move in the future, and the contracts they enter into are known as future and options contracts, and they are meant to be delivered or settled at a later time.

Based on Type of Commodity: The commodities can be divided into two different segments based on type of commodity-

1. Hard Commodities – Hard commodities are those natural resources which are mined or extracted, such as gold, silver, natural gas, crude oil etc.

2. Soft Commodities – This category of commodity includes agricultural products, like wheat, rice, sugar, etc.

Check Out – Free Commodities Screene

Pros of Investing in the Commodity Market

Investing in the commodity market comes with lots of benefits, a few of such benefits are mentioned below-

- Diversification: One can invest in a commodity market as it has a low correlation with other assets such as stocks, bonds, etc.

- Hedge: It provides a hedge against any price fluctuations, as producers and manufacturers can use futures contracts to lock in the prices and avoid losses.

- High Return: Investment in commodities can provide an investor with an opportunity to earn high returns.

- Currency Fluctuation: There are various commodities which can act as a hedge against any kind of fluctuations in the currency.

List of Commodity Exchanges in India

There are various commodity exchanges in India which provide trading opportunities in both spot and derivative markets:

1. MCX: MCX is known as Multi Commodity Exchange of India Limited. It has its headquarters situated in Mumbai, and offers trading in gold, silver, crude oil etc.

2. NCDEX: It is known as National Commodity and Derivative Exchange Limited, which offers trading opportunities in agricultural commodities like wheat, barley, cotton, etc.

3. ICEX: Indian Commodity Exchange Limited or ICEX is another exchange which provides trading opportunities in a mix of agriculture and non-agriculture commodities and includes diamond futures. It has its headquarters situated in Mumbai.

4. NMCE: National Multi Commodity Exchange of India is another exchange which has its headquarters situated in Ahmedabad, it is the first demutualized electronic commodity exchange in India.

5. ACE: Ace Derivatives and Commodity Exchange Limited is another commodity trading platform having its headquarters situated in Ahmedabad, it focuses on the regional market.

Read Also: What is the Timing for Commodity Market Trading?

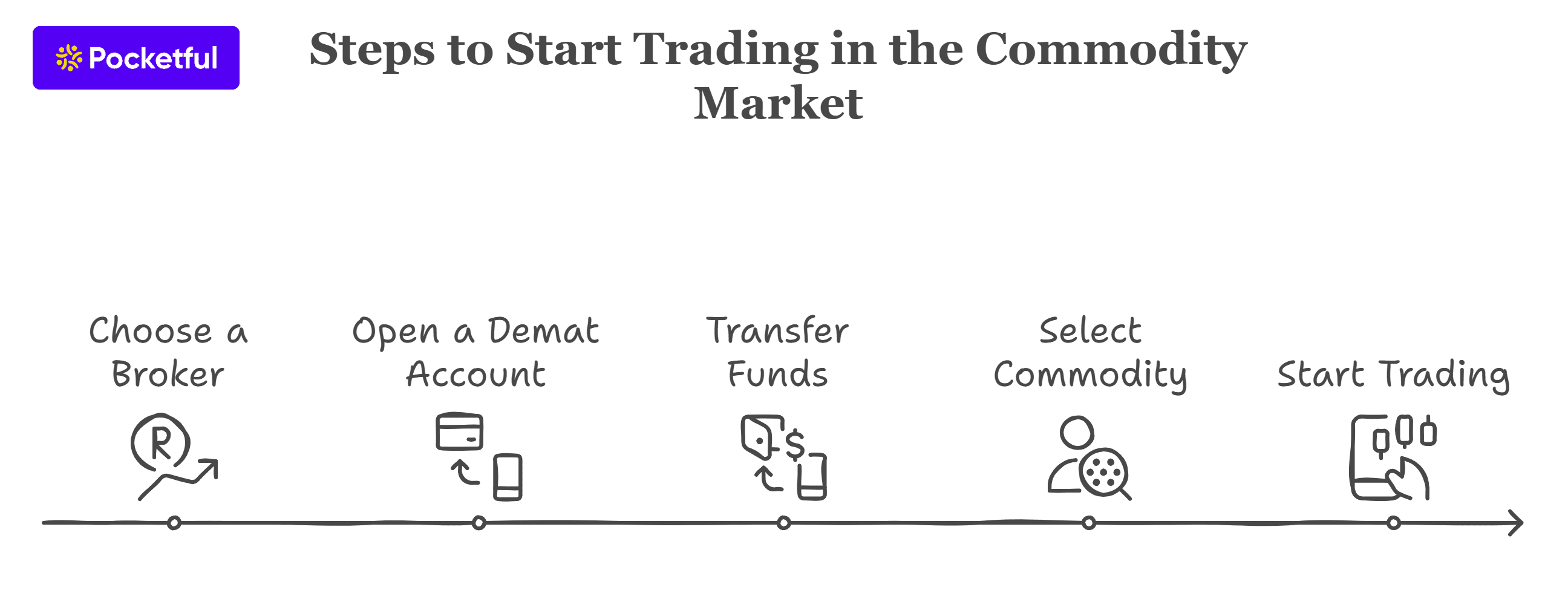

How to Start Trading in the Commodity Market?

To start trading in a demat account, one needs to have a demat and trading account, the steps of which are mentioned below:

1. Choose a Broker: The first step is to select a broker which offers services related to trading in commodities, has a good track record and offers you competitive brokerage rates.

2. Open a Demat Account: Then you are required to open a Demat account and a trading account.

3. Transfer Fund: Transfer funds to the demat account and begin your trading and investment in commodities.

4. Selecting the Commodity: Then, as per your risk appetite, you can select a commodity after doing research.

5. Start Trading: Once you develop a trading strategy, you can start investing in commodities by placing your order.

Read in Detail – How to Trade in the Commodity Market?

Traders in a Commodity Market

The commodities market is home to a diverse range of traders, each of whom is classified according to their trading tactics and goals. Some of these traders are listed below:

- Hedger: The hedgers are the persons who try to minimize the risk which arises due to volatility in prices of commodities.

- Speculators: They try to earn short-term profit from the price movement; they are generally individual, professional traders.

- Arbitrageurs: An arbitrageur tries to exploit the price difference between the contracts of the same commodity in two different markets.

- Institutional Traders: This group of traders includes banks, hedge funds, and pension funds, which invest large chunks of money.

- Retail Traders: Retail traders include an individual who earns profit from the change in the price of a commodity.

Importance of Investing in the Commodity Market

The major importance of investing in the commodity market are as follows:

- Accessibility: Through advanced technologies, one can have access to commodities as an investment option.

- Exposure: The investment in commodities reflects the trend of international economic trends.

- Safe Haven: There are various precious metals, such as gold and silver, which can be considered a haven during any economic downturn.

- Regulations: The commodity market in India is regulated by the Securities and Exchange Board of India, which makes investing in commodities safe.

Relationship Between Stock Market and Commodity Market

The stock market and commodity market have several things in common; a few highlights of the same are mentioned below:

- Both commodity and stock markets run on the fundamentals of supply and demand.

- There are certain sectors in the stock market, such as oil and gas, metal, etc. performance of which depends on the price of commodities.

- Due to the rise in prices of commodities, inflation increases, which can lead central banks to change their monetary policy; hence, it will impact the performance of stocks.

- Any rise in oil prices will impact the profit margins of the companies and lead to a fall in stock prices.

Limitations of Commodity Market

Along with the benefits, there are certain limitations to investing in the commodities market. A few of such limitations are mentioned below:

- Volatility: The prices of the commodity can be very volatile as they are sensitive to numerous global economic factors.

- Transaction Cost: The costs, such as brokerage fees, exchange charges, etc., are very high, which can reduce the overall profitability.

- Risk: The commodity market requires a deep understanding; hence, investing without proper knowledge can result in losses.

- No Regular Income: Unlike stocks and bonds, commodities do not generate any regular income.

Key Things to Note About Commodity Trading in India

The key points to note about the commodity trading in India are as follows:

- Risk: Commodity investment involves high risk because of significant price volatility.

- Regulations: The Securities and Exchange Board of India, whose primary duty is to uphold transparency and fair-trade standards, has enacted several regulations governing the Indian commodities market.

- Global Risk: The commodities which are traded are influenced by global factors such as economic events and trade wars.

- Taxation: The gains are taxed depending on the holding period.

How Are Prices Determined in Commodities Exchange?

The prices in commodity exchange depend upon various factors such as market dynamics, demand and supply, etc. The key factors which determine the price are mentioned below:

- Demand and Supply: The law of demand and supply applies in the commodities exchange, which means due to high demand and low supply the prices of the commodity will increase and vice versa.

- Market Trends: There are various external factors, such as prices of crude oils, currency rates, etc., which decide the market trends.

- Geopolitical Events: Geopolitical events such as wars, trade wars, and unstable political conditions will impact the prices of commodities.

- Currency: Commodities are generally priced in US dollars, any change in exchange rate will impact the prices of commodities.

Conclusion

Finally, there are several advantages to investing in commodities, such as the ability to diversify your holdings and lower risk. Nevertheless, there are also hazards associated with commodity investing, such as price volatility. It is, therefore, necessary to speak with a financial professional before investing in commodities.

Frequently Asked Questions (FAQs)

Who governs the commodity market in India?

Before September 2015, the Forward Markets Commission oversaw the commodity’s futures market. Currently, the Securities and Exchange Board of India oversees the country’s commodity derivatives market.

How can I trade in the commodity market?

To start trading in the commodity market, an investor is required to have a demat account.

Which commodities exchanges are operating in India?

The commodities exchanges that operate in India include Multi Commodity Exchange, Indian Commodity Exchange Limited, National Commodity and Derivative Exchange Limited, and Ace Derivatives and Commodities Exchange Limited.

Does Pocketful offer commodity trading?

Yes, Pocketful offers commodity trading, as one can open a demat account with Pocketful and begin trading in commodities.

Which commodities can we trade in India?

A variety of commodities, including gold, silver, natural gas, copper, aluminium, and various spices, can be traded in India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle