| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-15-25 | |

| Infographic and Content Update | Default Author | Apr-04-25 | |

| Add new links | Nisha | Nov-25-25 |

Read Next

- What is Commodity Valuation?

- Exchange of Futures for Physical (EFP)

- Commodity Arbitrage – Types & Strategies in India

- Top Major Commodity Exchanges in India

- The Pros and Cons of Commodity Trading

- What is the Commodity Index?

- Types of Commodity Market in India

- Tax on Commodity Trading in India

- Understanding Commodity Market Analysis

- Risks in Commodity Trading and How to Manage Them

- 5 Tips for Successful Commodity Trading

- Commodity Trading Regulations in India: SEBI Guidelines & Impact

- What is the Timing for Commodity Market Trading?

- Stock Market vs Commodity Market

- How to Trade in the Commodity Market?

- What is Commodity Market in India?

- What Is the National Commodity and Derivatives Exchange (NCDEX)?

Best Online Commodity Trading Platforms in India: Top 10 Picks for Traders

Commodity trading is a dynamic sector that requires speed, reliability, and accuracy; hence, before starting commodity trading, choosing the best commodity trading platforms is essential. A new trader who wishes to start their commodity trading journey is generally confused about which trading platform is suitable for them.

To clear your confusion, Pocketful is here with another blog explaining the key features of the top 10 commodities platforms in India.

What Makes a Good Online Commodity Trading Platform?

A commodity trading platform is a place where sellers and buyers come together to buy and sell different commodities such as crude oil, gold, etc. In India, there are various brokers offering trading services to investors, but choosing the best trading platform among them requires knowledge about their key features.

A good commodity trading platform plays an important role in commodity trading avenues; the major factors that make the best commodity trading brokers in India are as follows:

- User Interface: The interface of the commodity trading app provided by the broker must be user-friendly and easy to use.

- Reliability: The real-time data provided by the commodity trading platforms must be accurate and reliable

- Analytical Tools: The platform which you choose to trade in commodities should be equipped with advanced analytical tools.

- Support: The support system of the commodity trading platforms must be available 24/7 to resolve investors’ queries.

Top 10 Commodity Trading Platforms – Comparison Table

| Platform | Account Opening Charges | Brokerage Fees | Annual Maintenance Charges (AMC) | Key Features |

|---|---|---|---|---|

| Pocketful | ₹0 | Futures: ₹20 or 0.03% per executed order, whichever is lower Options: ₹20 per executed order | ₹0 | User-friendly interface, free APIs for trading automation |

| Angel One | ₹0 | ₹20 per executed order or 0.25% of transaction value (whichever is lower) | ₹240 per year | Robust advisory services, strong offline presence |

| Zerodha | ₹0 | Futures: ₹20 or 0.03% per executed order, whichever is lower Options: ₹20 per executed order | ₹300 per year | Flat-fee structure, extensive educational resources |

| Upstox | ₹0 | Up to ₹20 per order | ₹150 + GST per year | Advanced technical analysis tools, user-friendly platform |

| ICICI Direct Securities | ₹0 | ₹20 per order | ₹700–₹975 per year | Integrated 3-in-1 account (banking, trading, demat), comprehensive research |

| Kotak Securities Limited | ₹0–₹499 | ₹20 per executed order for delivery trades | ₹0–₹600 per year | Trusted brand, extensive educational support |

| Motilal Oswal Financial Services Limited | ₹0 | 0.02% for commodity futures; ₹200 per lot for options | ₹400 per year | Portfolio management services, in-depth research reports |

| IIFL | ₹0 | 0.25% of transaction value for commodity futures; ₹25 per lot for options | ₹250 per year | Robust research and advisory services, user-friendly platform |

| 5Paisa | ₹0 | ₹20 per executed order | ₹300 per year | Flat-fee trading across segments, cost-effective solutions |

| Sharekhan | ₹0 | ₹20 per order | ₹400 per year | Comprehensive training programs, powerful trading terminal |

1. Pocketful – Free Commodity Trading Apps

It is an emerging stock broking firm offering investment opportunities in various asset classes at low fees. The mobile app is easy to use and has a user-friendly interface. Pocketful was launched in 2024 and is a subsidiary of Pace Stock Broking Services. Pocketful has been developed by professionals with more than 27 years of experience. Pocketful is different from other discount brokers as it offers zero delivery and account opening fees, making it the best option for both traders and investors.

Key Features:

- Pocketful offers a free commodity trading platform, as there are no account opening fees.

- The account opening process is completely online and can be completed without any paperwork.

- Pocketful offers APIs to code your trading strategy and automate the trading process.

Best For: The Pocketful platform is suitable for all kinds of investors and traders as it provides a user-friendly interface offering zero brokerage on equity delivery and zero annual maintenance charges for the first year. It also provides advanced trading tools to analyze the market. Hence, one can consider opening a Demat account with Pocketful.

2. Angel One

Angel One is among the leading full-time brokers in India. The company was incorporated in 1996, offering a wide range of services, ranging from stock to commodity trading. It also offers investment advisory services. Their innovative platform focuses on customer needs and wants.

Key Features:

- Good customer support is considered the key benefit of opening a demat account with Angel One.

- It also provides technical analysis tools in their app.

- Angel One has a strong offline presence across the nation.

Best For: This platform is appropriate for individuals who rely on a broker for investing advice.

3. Zerodha

Zerodha is a prominent player in the Indian Stock broking industry. It offers trading facilities in commodity and other investment options. It was founded by the Kamath Brothers in 2010 with a focus on using advanced technology to develop a unique trading platform. Zerodha introduced a new pricing scheme, which was a flat brokerage for trading.

Key Features:

- Zerodha is known for its cutting-edge technology and easy-to-use trading interface.

- They also have a dedicated customer support team, which helps the investor to resolve their queries.

- Zerodha offers a platform known as Varsity, which is an open and free market education platform.

Best For: This platform is suitable for investors who wish to trade in a stock market, with the broker offering low brokerage fees.

4. Upstox

This platform offers a user-friendly trading platform. They have advanced technical tools that help an investor identify the trend of a commodity and execute a trade based on it. They also offer an option chain with a strategy mode in which you can build your strategy and execute the trade.

Key Features:

- Through the Upstock app, one can easily execute the trades.

- On the platform, you can make multiple watchlists and keep track of various commodities.

- The company charges zero AMC to maintain an account with them.

Best For: Traders who want to use technical analysis as a tool to take intraday and swing trades.

5. ICICI Direct Securities

ICICI Direct Securities is one of India’s leading stockbrokers and is a subsidiary of ICICI Bank, a major player in India’s private-sector bank. ICICI Direct offers a three-in-one account, which is a combination of savings, trading, and Demat accounts. Through their three-in-one account, an investor can easily transfer money from their savings account to their trading account.

Key Features:

- The company has a strong presence across the nation through its local offices, which helps its investors resolve their queries quickly.

- The company offers research and advisory services to their customers.

- It also offers personalized wealth management solutions to its investors.

Best For: Investors who wish to have support through local branch offices can opt for ICICI Direct Securities.

6. Kotak Securities Limited

Kotak Securities is a subsidiary of one of India’s biggest private sector banks called Kotak Mahindra Bank. Kotak Securities offers a wide range of products to its investors, including stocks, commodities, derivatives, etc. The web-friendly Kotak Stock Trader or the desktop-centric KEAT Pro X, for example, both cater to active traders with live data from the markets.

Key Features:

- In addition to commodity trading, Kotak Securities provides a variety of investment opportunities, including stocks, mutual funds, etc.

- Kotak Securities runs various programs to educate investors.

- The company has a strong brand reputation as it is backed by Kotak Bank.

Best For: Kotak Securities is suitable for investors who wish to access the learning material and tutorials about the stock market.

7. Motilal Oswal Financial Services Limited

Motilal is considered a prominent player in the Indian broking industry and was established in 1987. It offers various investment options, portfolio management services, advisory services, etc. They provide modern trading platforms, including a desktop terminal and a mobile app. The company has over 30 years of experience and provides research and advisory services.

Key Features:

- Motilal Oswal Financial Services Limited offers customized financial solutions to its customers.

- Motilal Oswal’s trading app is considered some of the best in the industry due to its user-friendly interface.

- Loan against securities facility is offered by Motilal, allowing an investor to pledge their securities and get the loan.

Best For: Suitable for an investor who wants other customized financial products in one place such as portfolio management services.

8. IIFL

IIFL was founded in 1985 as a part of the India Infoline Group. Initially, it was established as an advisory firm and focused on research and its related services. It was listed on the Indian Stock Exchange in the year 2005 and rebranded itself as India Infoline. Through their research reports, the company ensures that their investors make sound investment decisions, and they also offer an advanced commodity trading platform

Key Features:

- The company offers research and advisory services to their customers.

- The company offers a user-friendly commodity trading platform.

- IIFL provides various free educational sessions to help its clients enhance their knowledge.

Best For: Investors who want research and advisory services along with a good trading platform.

9. 5Paisa

5Paisa is one of the top discount brokers in India, providing commodity trading and other services. It was established in 2016 with the primary objective of offering affordable financial services. They are also acknowledged by AMFI as a mutual fund distributor.

Key Features:

- They offer a user-friendly web platform and a mobile trading platform to investors, offering them a seamless trading experience.

- 5Paisa offers investment in mutual funds through its platform.

- Their FnO 360 platform offers advanced tools so that investors can make informed trading decisions.

Best For: Investors looking to learn about the stock market through interactive sessions can opt for 5Paisa.

10. Sharekhan:

Sharekhan was founded in 2000, and it is one of the first broking firms in India to offer retail investors access to online trading platforms. It exponentially grows its business by offering franchisees throughout the country. It is known for its offline presence and customer support.

Key Features:

- They offer a desktop-based trading terminal known as Trade Tiger, which is equipped with advanced trading tools.

- Sharekhan offers an advanced training programme for its investors through its online courses, which is known as Sharekhan Classroom.

- It has a dedicated customer support team to address its customers’ queries.

Best For: Sharekhan is best suited for those who wish to learn something new about technical and fundamental analysis.

Check Out – Commodities Screener

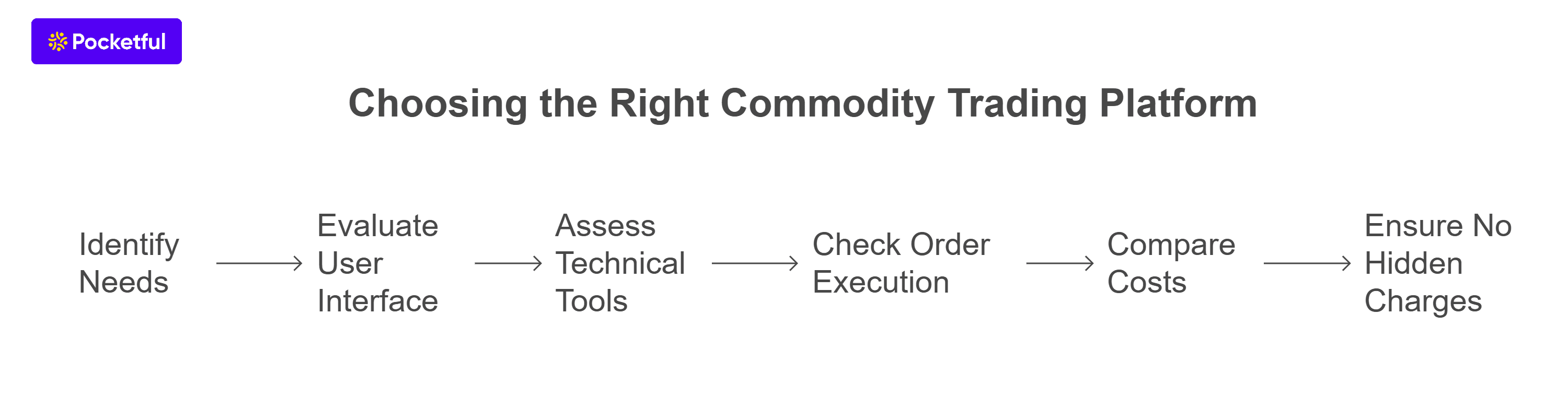

How to Choose the Right Commodity Trading Platform App?

There are various parameters that one should consider before choosing an online commodity trading platform; a few of such key features are mentioned below:

- Understanding Needs: Make sure the platform that you are opting for meets all of your needs.

- User Interface: The user interface of the application must be easy to understand and reliable to enhance the user experience.

- Technical Tools: There are various types of advanced trading tools that traders require to trade efficiently in the commodity market.

- Execution: The commodity trading platform must execute orders instantly and efficiently.

- Charges: The trading platform that you are opting for must offer its trade execution services at a low cost.

- Hidden Charges: There must be no hidden charges in the commodity trading platform that you are opting for.

Read Also: How to Trade in the Commodity Market?

Conclusion

To sum up, in this blog, we have given you an overview of the best commodity trading platforms in India. Trading in commodities gives you a chance to gain significant profit with knowledge and expertise. Although many brokers are offering online commodity trading platforms, it is advised that you evaluate brokers based on their fees, the trading platform, etc., offered by them and then select the one suitable for you.

Pocketful also offers you an online commodity trading platform with no account opening charges, and it is among the best commodity trading apps in India.

Frequently Asked Questions (FAQs)

What are the fees involved in commodity trading on these platforms?

There are various types of fees involved in this commodities trading platform, such as brokerage, STT, SEBI Turnover Fees, GST, etc.

Can I trade commodities in India without a broker?

No, you cannot trade in commodities unless you open a commodity account with a broker.

How can I practice commodity trading without real money?

One can practice commodity trading without using real money through paper trading strategies and using a free trading simulator.

Can I trade in Gold and Silver?

Yes, you can trade in gold and silver through a commodity trading account, and you can open it with a Pocketful.

Does Pocketful offer trading opportunities in commodities?

Yes, one can begin their trading journey in commodities by opening a Demat and a trading account with a Pocketful.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle