| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-09-25 | |

| Infographic Update | Ranjeet Kumar | Apr-04-25 |

What is the Timing for Commodity Market Trading?

In recent times, the commodity market for goods like precious metals, energy and crops has drawn attention from traders, investors, and hedgers. This market provides an opportunity for the market participants to buy and sell commodities. Yet, knowing the market’s opening and closing times is critical.

Commodity trading in India mainly takes place on MCX and NCDEX. These exchanges have specific trading hours based on domestic and international regulations. This blog covers the trading hours for commodities in India and gives tips for traders on how to enhance their efficiency during these hours.

What is the Commodity Market?

A commodity market is a place for the purchase and sale of commodities and related derivatives contracts. These commodities include metals, energy, agricultural products, etc. The market makes it possible to trade commodities in real form as well as through derivatives like options and futures.

Types of Commodity Market

- Spot Market: In the spot market, commodities are traded for immediate delivery and prices are determined by current supply and demand.

- Derivatives Market: In the derivatives market, commodities are traded via futures and options contracts that outline the delivery date and quantity.

Furthermore, major commodities traded are as follows,

- Agricultural commodities include wheat, rice, turmeric, cotton, sugar, etc.

- Energy commodities include crude oil and natural gas.

- Metals include gold, silver, copper, aluminium, zinc, etc.

Commodity Market Trading Timings

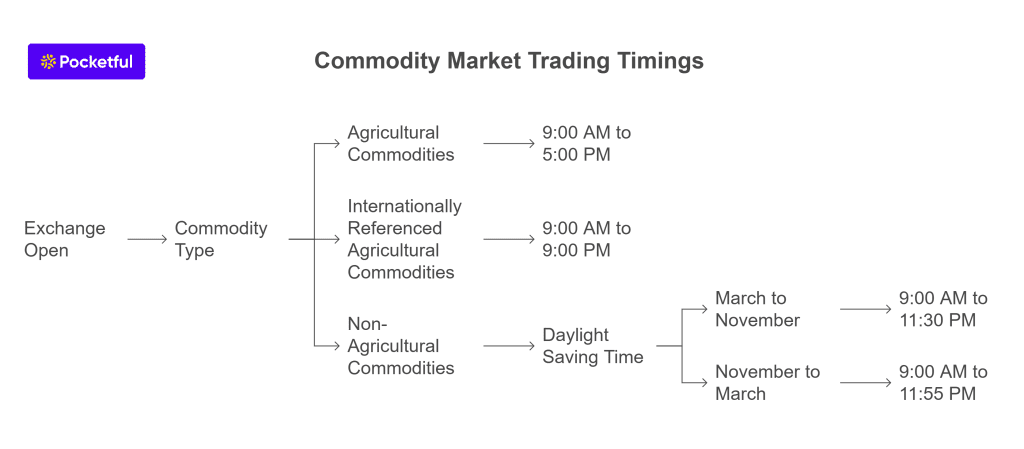

The commodity exchange is open every day except Saturdays, Sundays and holidays designated by the exchange. The exchange provides a list of holiday dates for each year in advance. The exchange holds trading sessions for various commodities from Monday to Friday as follows:

- Agricultural commodities: The trading starts at 9:00 AM and continues till 5:00 PM.

- Internationally Referenced Agricultural commodities: Trade starts at 9:00 AM and ends at 9:00 PM.

- Non-Agricultural Commodities: The trading hours of non-Agri commodities vary according to the concept of Daylight Saving Time, which is explained below. The trading hours are mentioned below:

- Trading starts at 9:00 AM and ends at 11:30 PM from March till November.

- Trading starts at 9:00 AM and ends at 11:55 PM from November to March during Daylight Savings Time.

(Internationally referenced commodities are those commodities whose prices and trading are guided by global markets and indices. These commodities are traded globally, with their prices influenced by international demand and supply, geopolitical events, and macroeconomic factors).

Did You Know?

After Daylight Saving Time (DST) begins in the spring in the U.S., India’s commodity trading end time is adjusted to match international commodity market hours. The concept of daylight savings time in the US involves moving clocks forward in the spring season months to extend evening daylight and save energy.

At the start of DST, clocks are set forward by one hour on the 2nd Sunday in March and at the end of DST, clocks are set back by 1 hour on the first Sunday in November, which is also known as ‘falling back’. During daylight saving time (DST), time zones include daylight in their names, for example, Eastern Daylight Time (EDT) instead of Eastern Standard Time EST.

In spring, usually starting on the second Sunday of March, the US moves the clock forward by 1 hour for daylight saving time (DST). This creates a one-hour time difference between the US and India. Commodity trading in India, especially on platforms like MCX, aligns with the trading hours of global benchmarks like NYMEX. To keep trading in sync, India adjusts its trading end time.

This synchronization gives Indian traders access to the latest price trends and market movements until the end of the major global commodity market.

In a nutshell,

| Commodity | Trade Start Time | Trade End Time | |

| After the start of US Day Light Saving in the Spring Season | After the End Time of US Day Light Savings in the Fall Season | ||

| Non-Agricultural Commodities | 09:00 | 23:30 | 23:55 |

| Internationally Referenced Agricultural Commodities | 09:00 | 21:00 | |

Trading Holidays in the Commodity Market 2025

The holidays mentioned below represent the days when both the morning session and evening session will not be held for trading.

| Day | Date | Holiday |

|---|---|---|

| Friday | 18 Apr 2025 | Good Friday |

| Friday | 15 Aug 2025 | Independence Day |

| Thursday | 02 Oct 2025 | Mahatma Gandhi Jayanti |

| Tuesday | 21 Oct 2025 | Diwali-Laxmi Pujan (Muhurat trading session) |

| Thursday | 25 Dec 2025 | Christmas |

Trading Hours for Major Commodity Exchanges

The trading hours of major commodity exchanges are:

- Multi Commodity Exchange of India Ltd.

The morning session starts at 9:00 AM and ends at 5:00 PM IST, and the evening session starts at 5:00 PM and ends at 11:30 PM. The trading end time shifts to 11:55 PM during US Daylight Saving Time for non-agricultural commodities. On the other hand, the trading session for agricultural commodities ends at 5:00 PM.

- National Commodity & Derivatives Exchange (NCDEX)

The trading session for the commodities derivatives segment starts at 10:00 AM and ends at 5:00 PM IST.

Best Times to Trade in the Commodity Market

The best times to trade in the commodities market are when the following conditions are met:

- High Liquidity: Liquidity is important for effective trading and accurate price discovery. Indian exchanges like MCX experience high trading activity during opening hours as traders respond to overnight trends in international markets.

- Volatility Timing: Volatility presents profit opportunities but also increases the risks. The post-afternoon session in the Indian commodity market coincides with the global markets, which is from 3:00 PM to 5:00 PM. European markets influence global commodity prices significantly. In the evening, the US markets are active, which impacts international commodities like crude oil, gold, and natural gas, resulting in greater volatility.

- Avoid Flat Periods: Avoid trading during lunch hours, i.e., from 1:00 PM to 3:00 PM, where liquidity tends to drop as traders take breaks or near market close as the market activity slows, decreasing the chances of profitable trades.

- Monitor News and Economic Data Releases: Trading around key events can be profitable but also risky. Significant events include crude oil inventory reports, US Federal Reserve announcements, and economic data such as employment figures or inflation reports.

- Based on Commodities: Trade in precious metals like gold and silver trade during US market hours (evening in India) between 7:00 PM to 11:55 PM as these commodities have increased liquidity during these hours.

If you are trading in energy commodities like crude oil and natural gas, the best time to trade is between 6:00 PM and 11:55 PM, as these commodities are considered highly responsive to New York Mercantile Exchange (NYMEX) activity.

Lastly, if you are trading in agricultural commodities, then domestic trading hours are the most active ones, and these are less influenced by international markets. The best time to trade is between 10:00 AM to 2:00 PM.

Read Also: Stock Market vs Commodity Market

How to Stay Updated on Market Timings and Holidays?

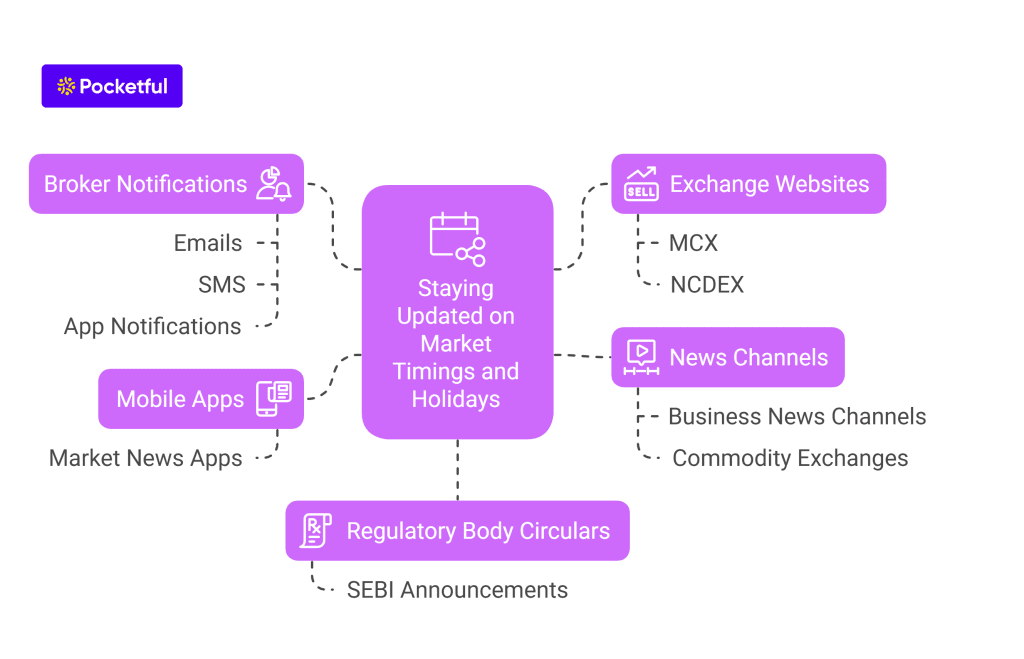

Keeping track of market timings and holidays is essential for a seamless trading experience in the commodity markets. You can keep yourself updated using the following resources:

- Exchange Website: Indian commodity exchanges such as MCX and NCDEX provide updates on market timings, holiday schedules, and special trading sessions on their websites. Regularly check these websites to keep yourself updated on changes in trading hours, public holidays, etc.

- Mobile Apps: Market news applications also provide updates on market timing and related events.

- Circular from Regulatory Body: Circulars released by the SEBI also provide updates on market events. Keep an eye on their official announcements. You can find these circulars on their website.

- Notification from Brokers: Most brokers send regular updates through emails, SMS, or mobile app notifications regarding changes in market trading hours or holidays and other settlement schedules, so make sure to enable notifications in your broker’s app.

- Follow News: Additionally, you can also follow the social media handles of major business news channels and commodity exchanges to keep yourself updated about the upcoming holidays.

Tips for Trading Around Holidays

Trading around holidays offers unique trading opportunities and risks because of lower liquidity due to a reduction in market participants and possible volatility. Below mentioned are some tips to consider for effective trading around holidays.

- Check the holiday list, as the financial market may be closed for a particular session or be closed entirely on certain holidays. Take time to understand the holiday schedules of the exchanges and plan your trades accordingly.

- When trading in internationally referenced commodities, be aware of holidays in other countries as they can impact the liquidity and price movements. Many traders take a break during holidays, which lowers trading activity. This can cause wider bid-ask spreads and increased slippage.

- Be cautious of sudden price changes in thinly traded markets, especially when using high-leverage strategies. Market closures can lead to price gaps when trading resumes, especially after major news events.

- Be aware of scheduled announcements, as key economic reports and earnings releases around holidays can affect the market. Additionally, it is also necessary to keep yourself updated about news, as unscheduled geopolitical or economic events can cause significant price changes in commodities.

- Markets often show distinct patterns during holidays, such as the “Santa Claus rally,” which is a year-end market rise where some sectors may perform well while others may slow down.

Conclusion

India’s commodity market provides a strong platform for trading various commodities. Knowledge about trading hours can greatly improve a trader’s ability to plan your trades and profitability. Staying informed is essential for both morning sessions focused on domestic markets and evening sessions influenced by international factors. In the commodity market, traders can increase their chances of success by adopting different tactics for each trading session. Winning at commodity trading relies not just on getting the timing right; it’s also about how well you’re prepared and how disciplined you are. However, commodity trading can be extremely risky, so it is advised to consult a financial advisor before trading.

Read Also: How to Trade in the Commodity Market?

Frequently Asked Questions (FAQs)

How often do market timings change due to daylight saving time or DST?

Market timings for the Indian commodity market change twice a year when the US begins the Daylight Savings Time mechanism in March and again in November.

Do commodities trade on Indian public holidays?

Some commodities linked to global markets may continue to trade even on Indian public holidays.

How do I know if there is a special trading session?

Exchanges announce special trading sessions in advance through circlers on their websites.

What happens if a holiday falls on the last settlement date?

The settlement is preponed, and exchanges will notify traders about the revised date.

What commodities are traded during evening and morning sessions?

Commodities like crude oil, silver, and natural gas are traded in the morning and evening sessions, while agricultural commodities are generally traded only during the morning session.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.