| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-30-24 | |

| Infographic Update | Ranjeet Kumar | Apr-04-25 |

How to Trade in the Commodity Market?

The commodity market is a world where raw materials meet investment opportunities. Think gold, oil, and wheat. These aren’t just abstract items—they’re things you see, use, or hear about daily. Trading them? It’s about more than money; it’s about understanding how the world ticks.

But let’s be real: getting into it can feel overwhelming. Charts, terms, margins—it’s like learning a new language. The good news? You don’t need to be a financial wizard to succeed. You just need the right guide. That’s what this is—a roadmap for how to trade in the commodity market, simplified, straightforward, and full of tips that actually work.

What is a Commodity Market?

Let’s start with the basics. The commodity market is where raw goods are bought, sold, and traded. The players? Farmers, manufacturers, traders, and investors like you. The products? Two main types:

1. Hard Commodities: Think of metals like gold and silver or resources like oil.

2. Soft Commodities: Crops like coffee, sugar, or wheat—goods that are grown, not mined.

Unlike stocks, where you invest in a company’s future, here you’re dealing with tangible items. A barrel of oil. A sack of sugar. The value of these goods depends on real-world factors like weather, politics, and global demand. If you’ve wondered how to invest in commodities in India, this is where it starts: knowing what you’re trading and why.

How the Commodity Market Works

At its heart, commodity trading in India is about predicting price changes. Will crude oil cost more tomorrow than today? Is gold going up or down?

Here’s how it plays out:

- Spot Market: Goods are bought and sold for immediate delivery. Simple, straightforward.

- Futures Market: You agree to buy or sell a commodity at a set price on a future date. It’s less about owning the item and more about betting on price movement.

Let’s say you expect wheat prices to rise due to poor harvests. You buy a futures contract. If your prediction is right, you profit. If not? You lose. This constant push-and-pull makes commodity trading dynamic—and risky. Knowing the ins and outs of this system is key to mastering how to trade in commodities effectively.

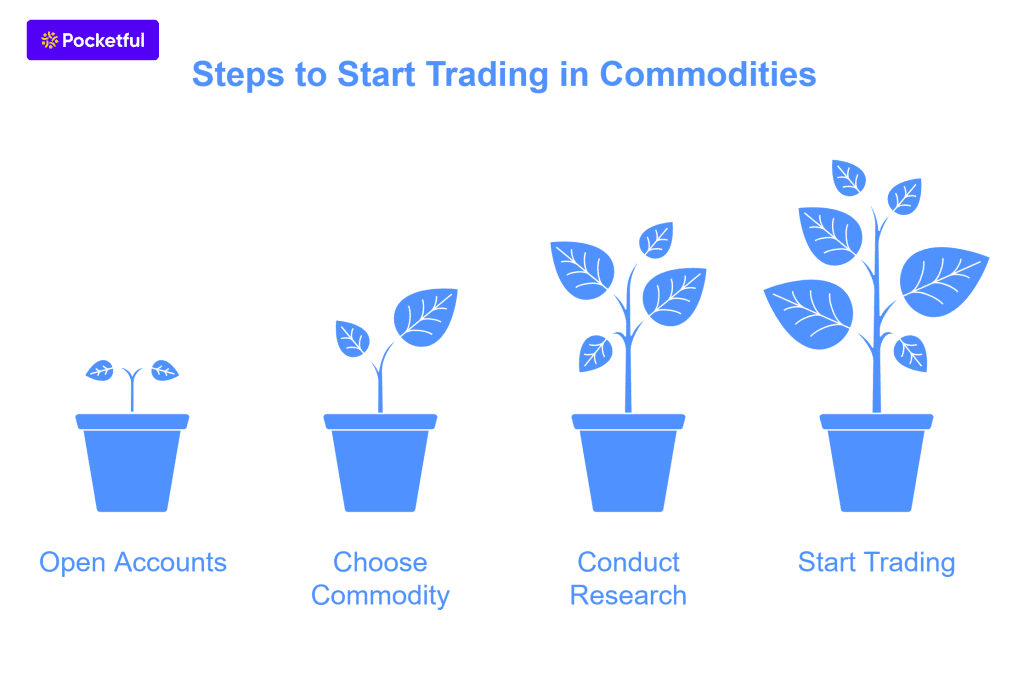

Steps to Start Trading in the Commodity Market

You don’t need a fortune to get started. Here’s how:

1. Open a Demat and Trading Account

Find a broker. They’re your entry ticket to the commodity market. You’ll need to Open a Demat and Trading Account with a reputable firm. Make sure they’re authorized for commodities and offer user-friendly platforms.

2. Pick Your Commodity

Start simple. Gold and crude oil are popular choices for beginners. They’re easier to track and less unpredictable than, say, soybeans or coffee.

3. Do Your Homework

Research is everything. Check historical price patterns, follow the news, and use trading apps to stay updated.

4. Start Small

Don’t throw your life savings into your first trade. Begin with an amount you’re okay losing. The goal is to learn the ropes, not strike gold on Day 1.

With these steps, you’re not just learning how to invest in the commodity market; you’re setting a foundation for long-term success.

Key Strategies for Commodity Trading

It is essential to have a robust strategy before investing in the commodity market. However, you must bear in mind that a strategy that works for one trader does not necessarily mean that it would work for all traders. So, it is crucial to have a plan depending on your risk appetite, knowledge, profit target and commodity types in the Indian market. Here are the key strategies to help you succeed in commodity trading in India.

Willing to Learn

It is important to have a complete understanding of the trading domain before you step into it. Similarly, you must get a better knowledge of commodity trading, futures and options while understanding how they trade. It is also crucial to understand the support and resistance level as well as margins to ensure a successful trading journey.

Treat Leverage Cautiously

Commodity trading, unlike stock trading, often involves high leverage. You must be wondering what is leverage. Leverage allows you to create a trading position worth much more than the funds deposited. The margin needed to place a trade ranges from 6% to 35% in India.

Investors looking to trade in commodity markets are often drawn to leverage and enter the market with the goal of making large gains with a small investment. However, leverage can be a double-edged sword if not used with caution. While leverage can multiply your earnings, it can also compound your losses (if the market moves in the opposite direction).

As a result, it is prudent to weigh the benefits and drawbacks of leverage before trading in the commodity market.

Choose the Best Broker

A broker plays an important part in deciding the benefits of commodity trading. For example, if the broker’s platform is slow, order execution may be delayed. Furthermore, if the brokerage fees are too high, your actual profit may be reduced.

Fortunately, many online brokers allow you to register a free account and trade at low fees. Furthermore, they offer an app for conducting online transactions on the go. Pocketful is one of the best commodity trading apps as it offers a fast and easy-to-use mobile application and a web platform at very low fees.

Make Volatility Your Best Friend

Volatility is an inherent characteristic of traders. Perhaps the finest commodities market trading ideas are those that help you comprehend and capitalize on volatility.

Some commodities are extremely volatile (such as copper or agricultural commodities), whereas others are less volatile (such as gold, crude oil, etc.). Low-volatile commodities tend to maintain a consistent trajectory within a larger long-term trend. For example, during the peak of the COVID-19 epidemic, oil prices fell precipitously and remained low for a long period. And, for an investor, such periods might be ideal for profiting from commodities market trading.

To make volatility your friend, you must first grasp the overall trend and price range of the commodity you intend to trade. In addition, while trading a commodity, you must select a lot size.

For novices, it is best to begin with low-volatile commodities before progressing to high-volatile commodities. Once you understand price movement, the commodities market suggestions you receive from your broker will make more sense to you.

These strategies aren’t just for experts. They’re practical tools anyone can use when learning how to trade in the commodity market.

Risks in Commodity Trading

Here’s the truth: trading commodities isn’t a walk in the park. Prices can swing wildly, and leverage (borrowing money to trade) can magnify losses.

The Big Risks

- Market Volatility: A geopolitical situation in the Middle East could send oil prices soaring. A bumper crop season could cause wheat prices to drop significantly.

- Liquidity Issues: Not every commodity has enough buyers and sellers, making it hard to trade at times.

- Emotional Decisions: Fear and greed are your worst enemies. They lead to impulsive trades and unnecessary losses.

The key? Keep emotions in check. Set stop-loss limits. And never trade more than you can afford to lose.

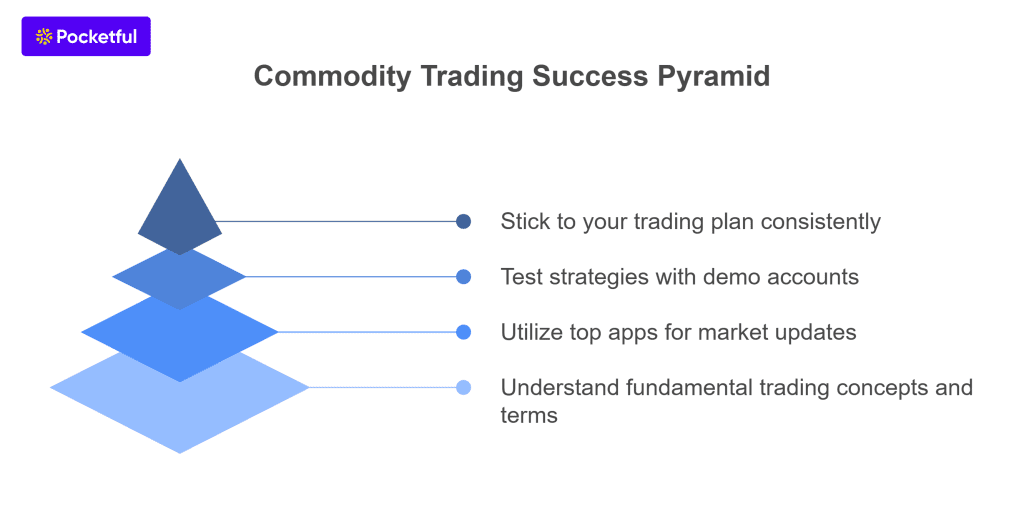

Tips for Beginners

Starting your journey in commodity trading can be exciting yet challenging, so here are some essential tips to help you navigate the market with confidence.

- Learn Before You Leap: Watch videos, read articles, and join forums. Knowing the basics makes a huge difference.

- Use the Best Commodity Trading App: A good app can provide real-time updates and analysis, making trades easier.

- Practice First: Many platforms offer demo accounts. Use them to test strategies without risking real money.

- Stay Disciplined: Set a plan for each trade—when to enter, when to exit, and how much to risk. Stick to it.

Remember, it’s okay to make mistakes. Every trader has lost money at some point. What matters is that you learn and keep going.

Conclusion

Commodity trading is part art, part science. It’s about timing, strategy, and a bit of gut instinct. Whether you’re figuring out how to invest in commodities in India or anywhere else, the process is the same: start small, stay informed, and grow step by step.

The rewards? They’re not just financial. It’s the thrill of making a call and being right. The satisfaction of understanding something most people don’t. And the sense that you’re playing a small but real role in the global economy. However, it is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What is the minimum amount required to start commodity trading?

There is no fixed minimum amount required to start commodity trading. However, you can start with as little as Rs 10,000, depending on the broker. Some commodities may require higher margins.

Can beginners trade in commodities successfully?

Yes. Start with less volatile commodities, educate yourself, and focus on small, consistent wins.

Are commodity markets open 24/7?

No. In India, commodity markets do not operate 24/7. These markets allow commodity trading from Monday to Saturday. There are fixed market hours, such as 10 am to 5 pm, which is the morning session. The evening session starts from 5 pm to 11.30 pm or 11:55 pm.

What is the minimum amount required to trade in commodities?

There is no fixed amount as it varies. The margin required depends on the commodity and your broker. ₹5,000 to ₹10,000 is common for smaller trades.

How do I calculate my profit or loss in commodity trading?

Subtract your buying price from the selling price, then multiply by the lot size. Don’t forget to account for brokerage and taxes.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.